New York Simple Agreement for Future Equity

Description

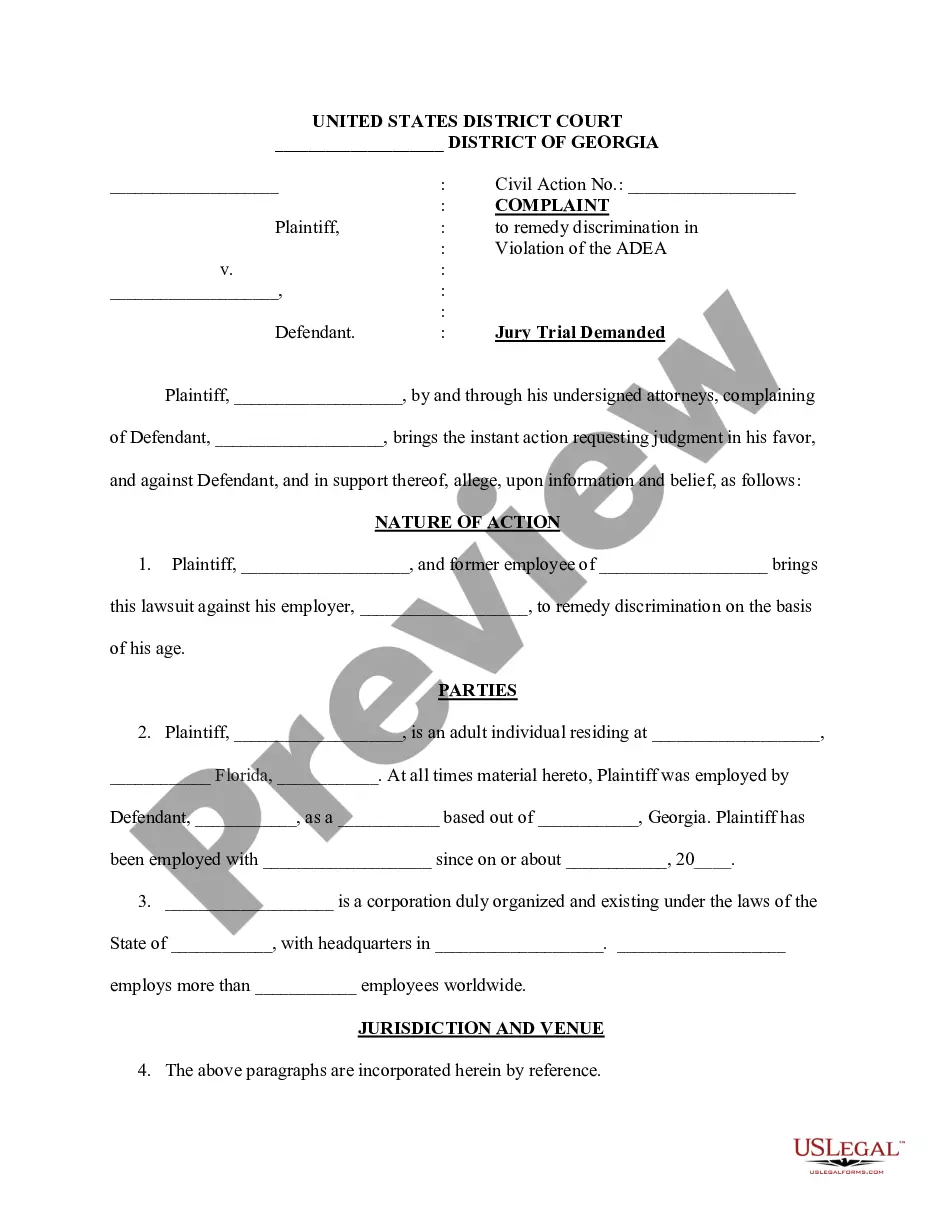

How to fill out Simple Agreement For Future Equity?

You can spend hours on the Internet trying to find the legitimate papers format that suits the federal and state requirements you want. US Legal Forms provides a large number of legitimate varieties which can be reviewed by experts. You can easily down load or print out the New York Simple Agreement for Future Equity from my assistance.

If you currently have a US Legal Forms profile, you can log in and then click the Down load key. After that, you can full, change, print out, or sign the New York Simple Agreement for Future Equity. Every single legitimate papers format you purchase is yours forever. To acquire another copy associated with a acquired develop, proceed to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the first time, stick to the straightforward directions beneath:

- Initial, make sure that you have selected the correct papers format for your state/city of your choice. Browse the develop explanation to ensure you have picked out the proper develop. If offered, utilize the Preview key to appear with the papers format also.

- If you wish to locate another variation of your develop, utilize the Lookup area to get the format that suits you and requirements.

- When you have located the format you need, just click Acquire now to continue.

- Select the rates program you need, type in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal profile to purchase the legitimate develop.

- Select the formatting of your papers and down load it for your device.

- Make adjustments for your papers if needed. You can full, change and sign and print out New York Simple Agreement for Future Equity.

Down load and print out a large number of papers templates using the US Legal Forms website, which provides the greatest collection of legitimate varieties. Use specialist and state-distinct templates to take on your small business or person requires.

Form popularity

FAQ

A simple agreement for future equity (SAFE) is a contract between an investor and a company that provides rights to the venture capital investor for equity down the road. Interested clients need to know that, concerning taxes, this relatively new and quick form of raising venture capital is not simple, advisors say.

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.

SAFEs are generally considered taxable at the time of the triggering event, when the SAFE converts into equity (i.e. stock in the company).

SAFTs typically provide that the intended tax treatment of the SAFT is as a forward contract. If this treatment is respected, then taxation of the purchase amount should be deferred until delivery of the s to the SAFT holder.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.

While debt is taxed once, equity funding is taxed twice: once at the business level, and once at the shareholder level through dividend and capital gains taxes. Successfully classifying funding as debt as opposed to equity produces tax advantages for the corporation.