New York Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

US Legal Forms - one of many biggest libraries of lawful varieties in America - delivers an array of lawful file web templates it is possible to obtain or printing. Utilizing the web site, you can get a huge number of varieties for organization and person functions, sorted by groups, claims, or key phrases.You can get the latest models of varieties like the New York Special Meeting Minutes of Shareholders within minutes.

If you currently have a subscription, log in and obtain New York Special Meeting Minutes of Shareholders in the US Legal Forms catalogue. The Acquire button will show up on each kind you see. You have accessibility to all earlier saved varieties from the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share easy recommendations to help you began:

- Ensure you have chosen the best kind for your personal area/county. Go through the Review button to examine the form`s content. Look at the kind information to actually have selected the correct kind.

- If the kind doesn`t fit your requirements, utilize the Research field near the top of the screen to discover the one which does.

- If you are satisfied with the form, affirm your selection by clicking the Purchase now button. Then, opt for the prices prepare you favor and provide your references to register for an account.

- Approach the purchase. Make use of charge card or PayPal account to finish the purchase.

- Find the file format and obtain the form on your product.

- Make adjustments. Load, edit and printing and signal the saved New York Special Meeting Minutes of Shareholders.

Each template you included in your bank account does not have an expiry date and is also the one you have permanently. So, in order to obtain or printing another duplicate, just visit the My Forms area and then click in the kind you need.

Get access to the New York Special Meeting Minutes of Shareholders with US Legal Forms, by far the most comprehensive catalogue of lawful file web templates. Use a huge number of specialist and state-specific web templates that satisfy your company or person demands and requirements.

Form popularity

FAQ

The people who may convene an SGM are: the chairperson of the owners corporation; or. the secretary of the owners corporation; or. a lot owner nominated by lot owners whose lot entitlements total at least 25% of all lot entitlements for the land affected by the owners corporation; or.

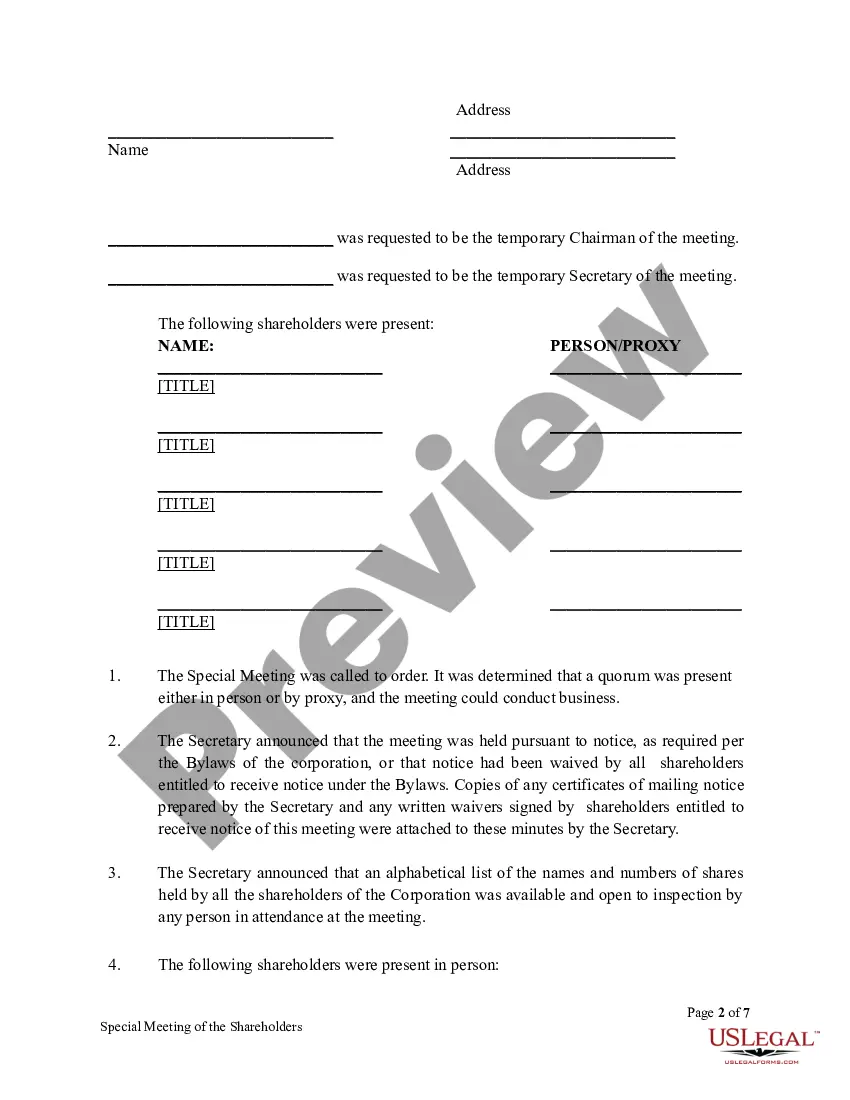

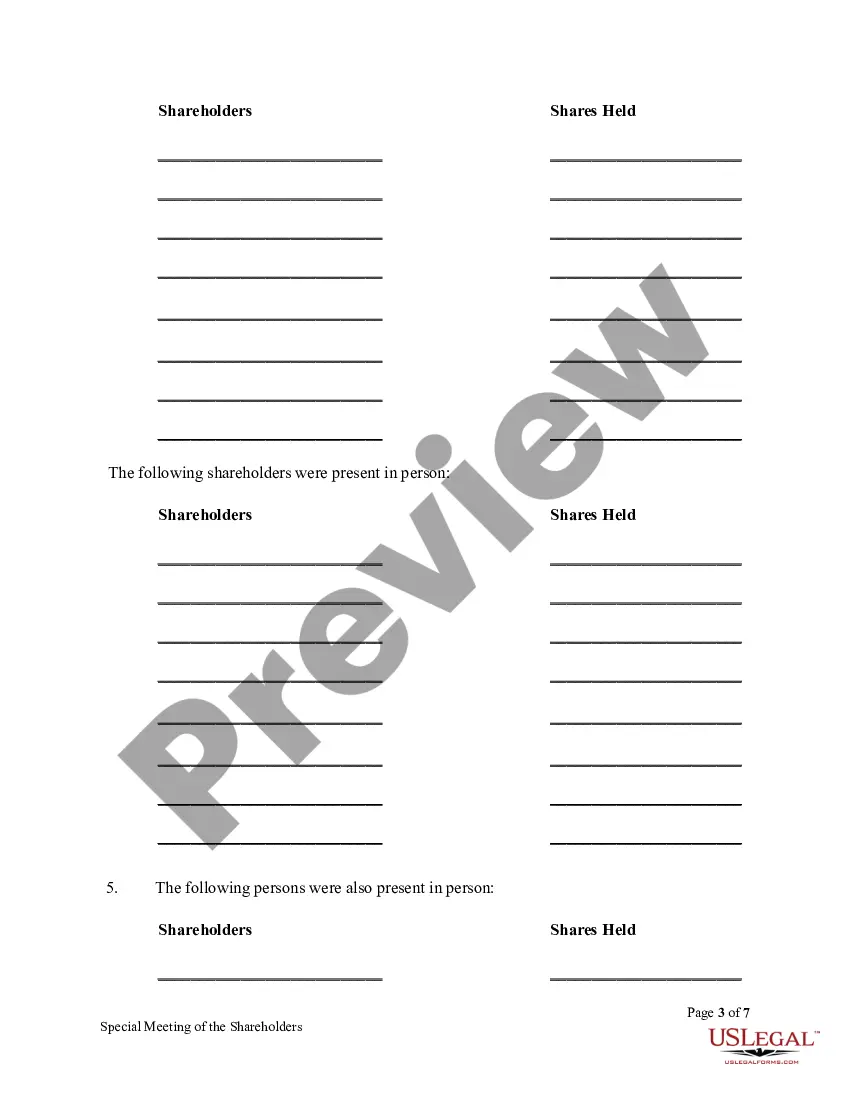

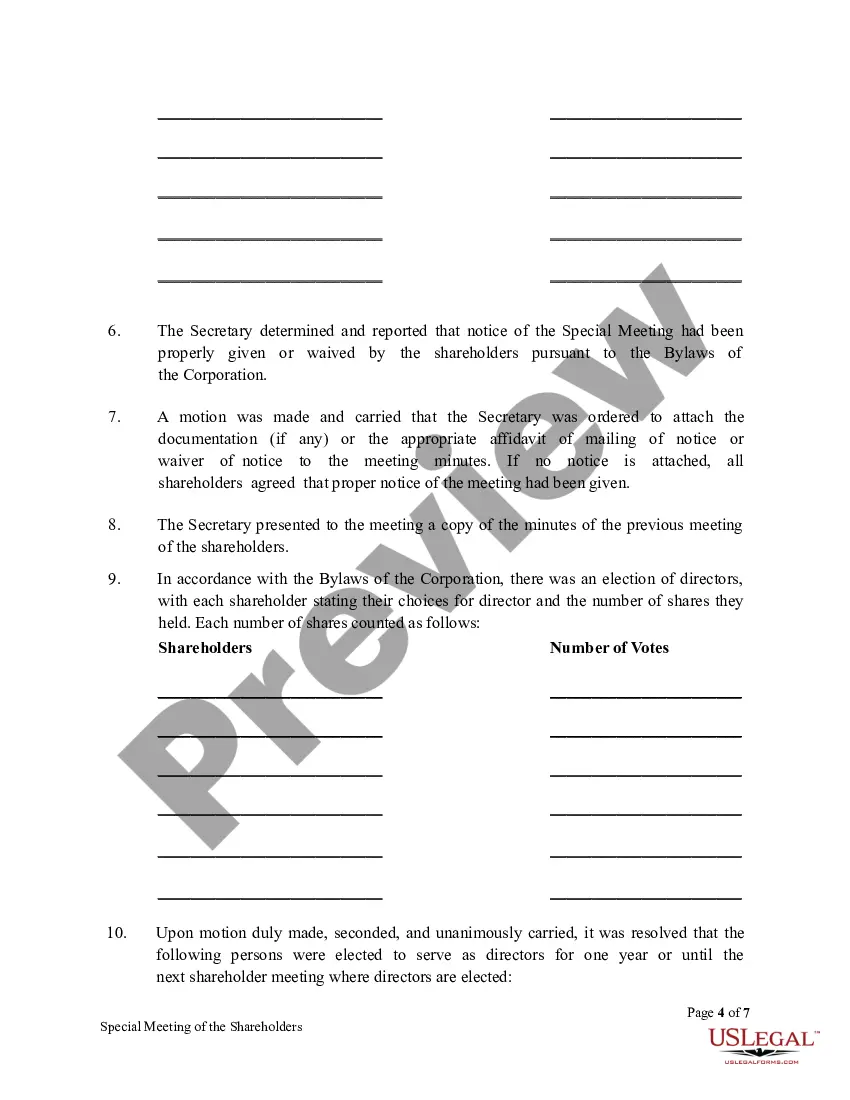

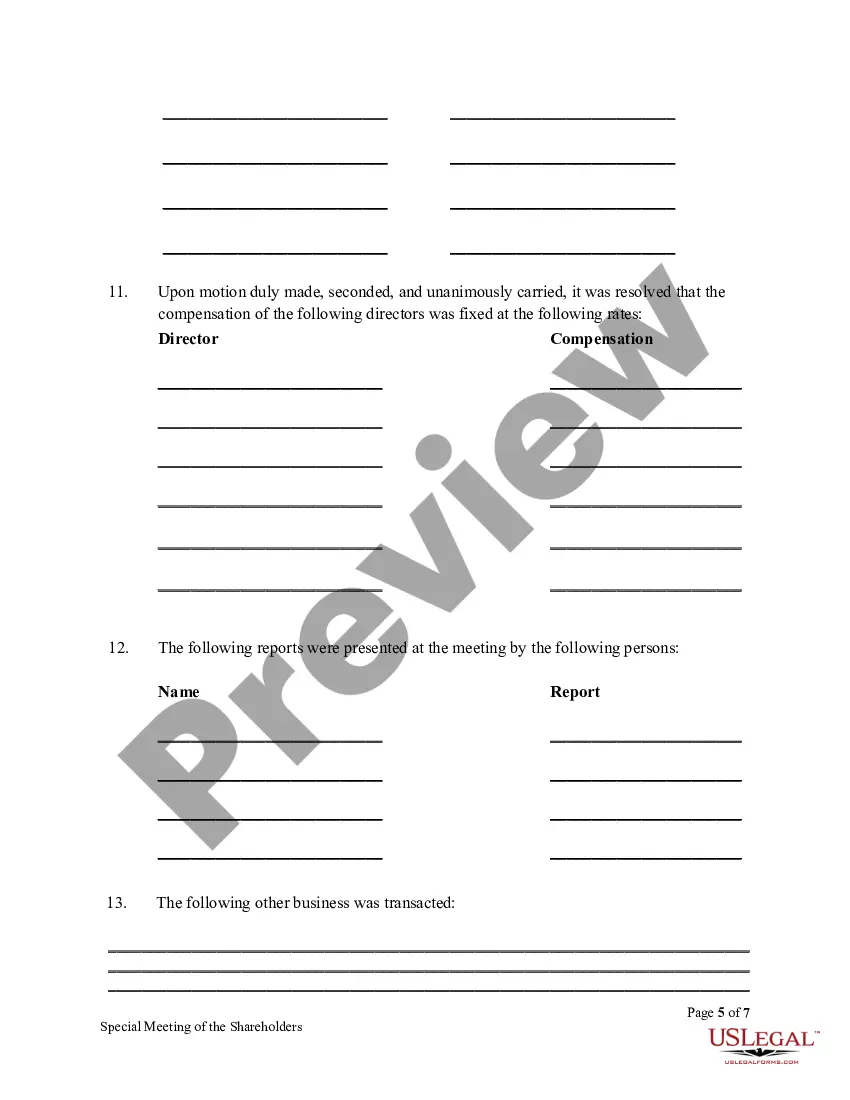

What should be recorded in meeting minutes? The minutes should include corporation details like the name of the corporation and the names of the chairperson and secretary of the meeting. The meeting place and time should also be found somewhere in the minutes, along with the names of the shareholders.

The ?call to meeting? needs to include all the necessary details, obviously ? time, date, and location. But you must also say generally what topics will be discussed, including a clear indication of what's open for discussion and what's not (see #3 below). You don't have to state the precise motions that will be made.

In general, companies require a letter or similar notification from investors having a sufficient number of shares, demanding a special meeting and stating the purpose for that meeting. The company can then set the date for the meeting, typically within a 30 to 90 day time period after receipt of the demand.

Our meeting experts compiled 7 best practices that apply to all sorts of teams and scenarios. 1 Date and time of the meeting. ... 2 Names of the participants. ... 3 Purpose of the meeting. ... 4 Agenda items and topics discussed. ... 5 Key decisions and action items. ... 6 Next meeting date and place. ... 7 Documents to be included in the report.

A general meeting can be called (ie initiated) either by the company directors or requested by the company shareholders. Different periods of notice are required depending on how a general meeting is being called, the type of company calling it, and whether or not the meeting is an AGM.

The directors must call an annual meeting no later than 18 months after the date of incorporation (or date of amalgamation) and no later than 15 months after the date of the last annual meeting.

Minutes of general meeting Agenda item 1: Welcome, attendees and apologies. ... Agenda item 2: Proxy appointments. ... Agenda item 3: Minutes of previous meeting and matters arising. ... Agenda item 4: Business of the meeting. ... Agenda item 7: Special resolution/s (if relevant) ... Agenda item 9: Any other business.