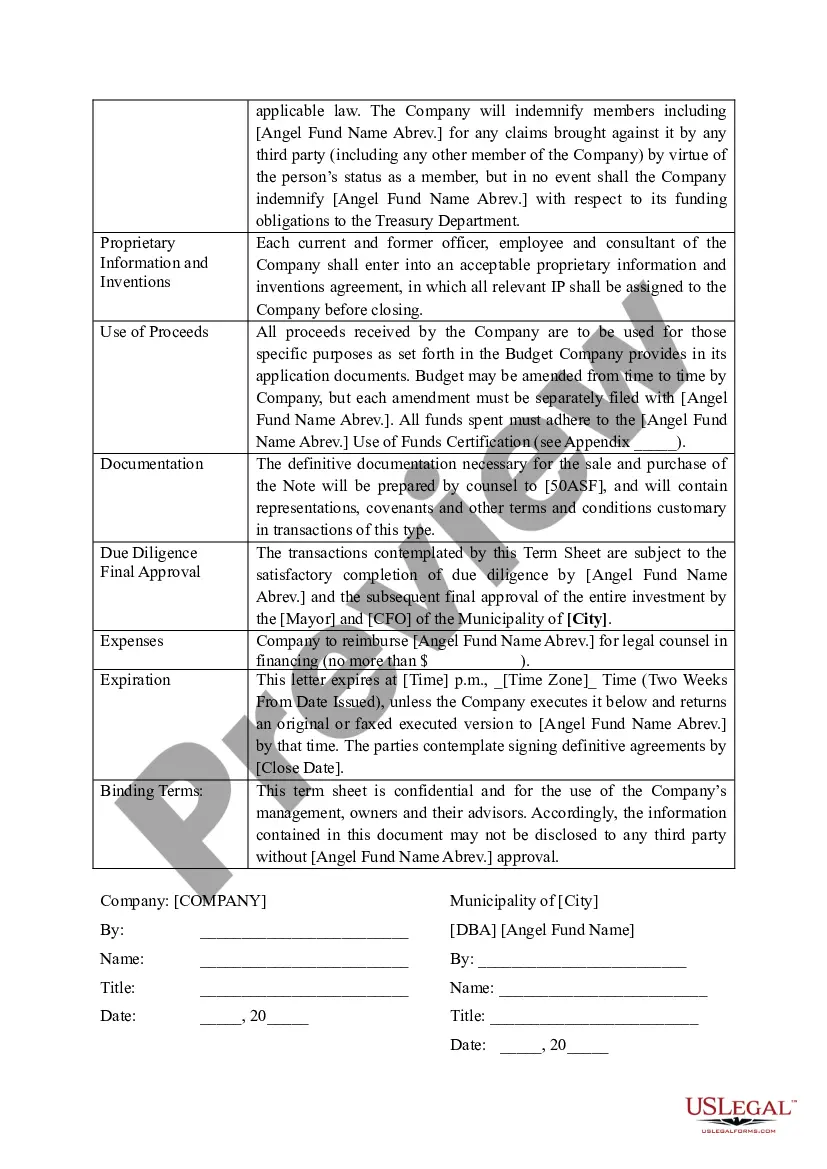

New York Angel Fund Promissory Note Term Sheet

Description

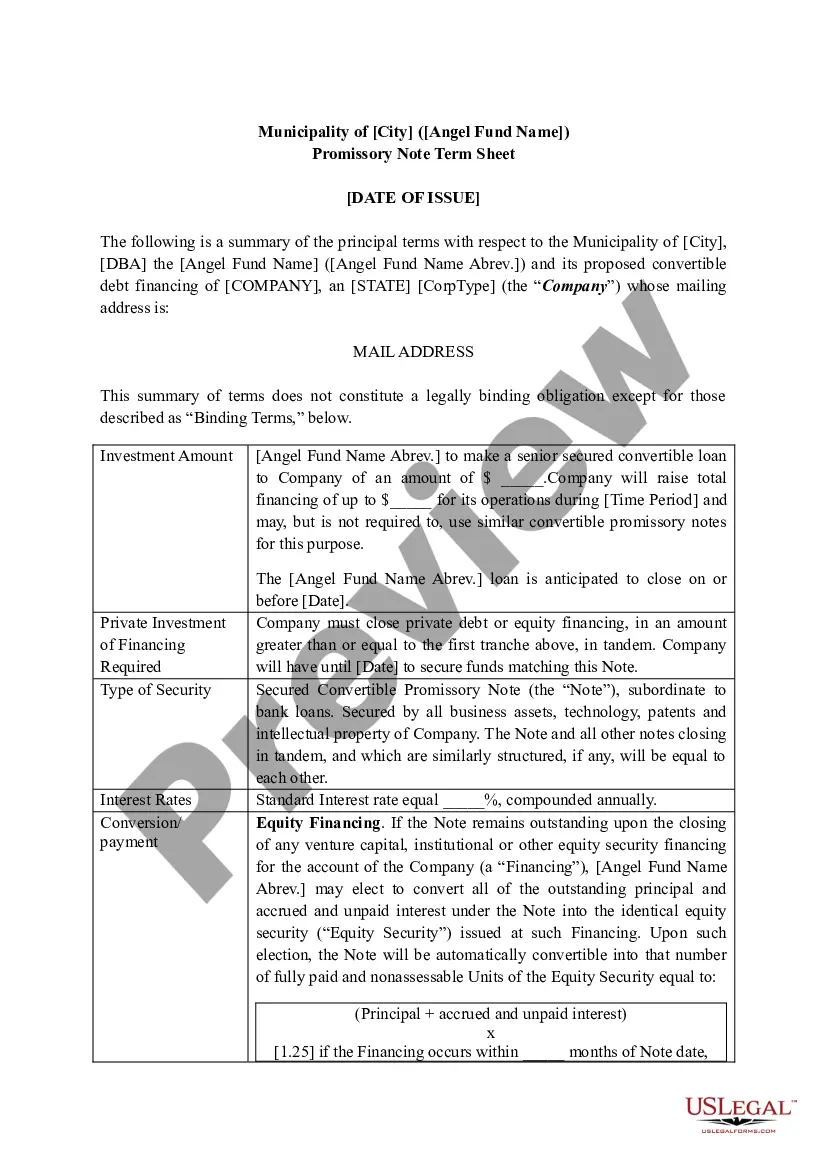

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

How to fill out Angel Fund Promissory Note Term Sheet?

If you want to full, acquire, or print out lawful papers layouts, use US Legal Forms, the biggest collection of lawful kinds, that can be found online. Take advantage of the site`s basic and handy lookup to get the documents you need. Numerous layouts for business and specific uses are sorted by groups and states, or keywords. Use US Legal Forms to get the New York Angel Fund Promissory Note Term Sheet with a handful of mouse clicks.

Should you be currently a US Legal Forms client, log in to your accounts and click on the Obtain option to have the New York Angel Fund Promissory Note Term Sheet. Also you can entry kinds you previously downloaded in the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, follow the instructions listed below:

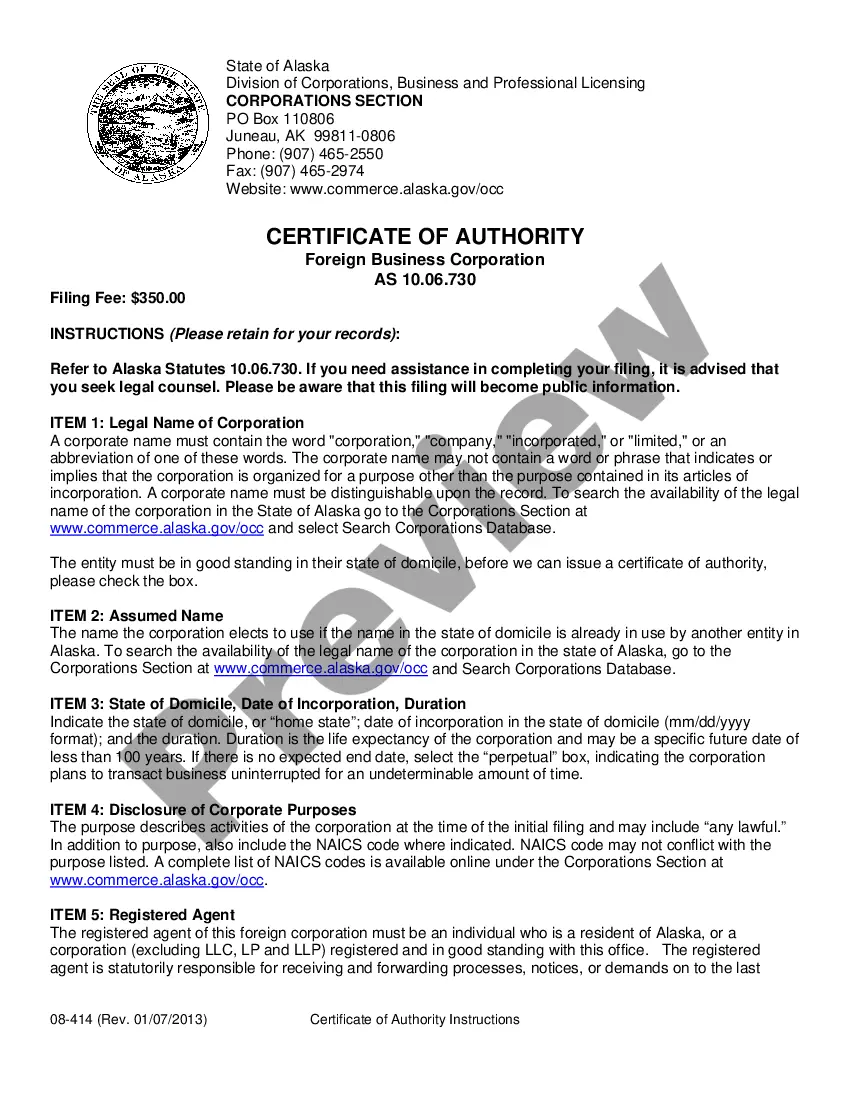

- Step 1. Be sure you have chosen the form to the appropriate metropolis/nation.

- Step 2. Utilize the Review solution to examine the form`s information. Do not forget about to learn the explanation.

- Step 3. Should you be unhappy using the form, utilize the Research area towards the top of the display to locate other versions of the lawful form design.

- Step 4. After you have located the form you need, click on the Buy now option. Select the prices strategy you prefer and put your references to register for an accounts.

- Step 5. Approach the purchase. You may use your charge card or PayPal accounts to complete the purchase.

- Step 6. Choose the formatting of the lawful form and acquire it in your device.

- Step 7. Full, modify and print out or indication the New York Angel Fund Promissory Note Term Sheet.

Each and every lawful papers design you buy is the one you have eternally. You might have acces to each form you downloaded within your acccount. Select the My Forms area and select a form to print out or acquire again.

Be competitive and acquire, and print out the New York Angel Fund Promissory Note Term Sheet with US Legal Forms. There are thousands of expert and status-specific kinds you may use for your business or specific needs.

Form popularity

FAQ

Fund Tenure/term: Venture capital funds typically have long tenures, beginning the first closing and running for 8-10 years. Fund managers usually seek pre-determined extension periods (2-3 years for example) to allow them for a smooth exit from all investments.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

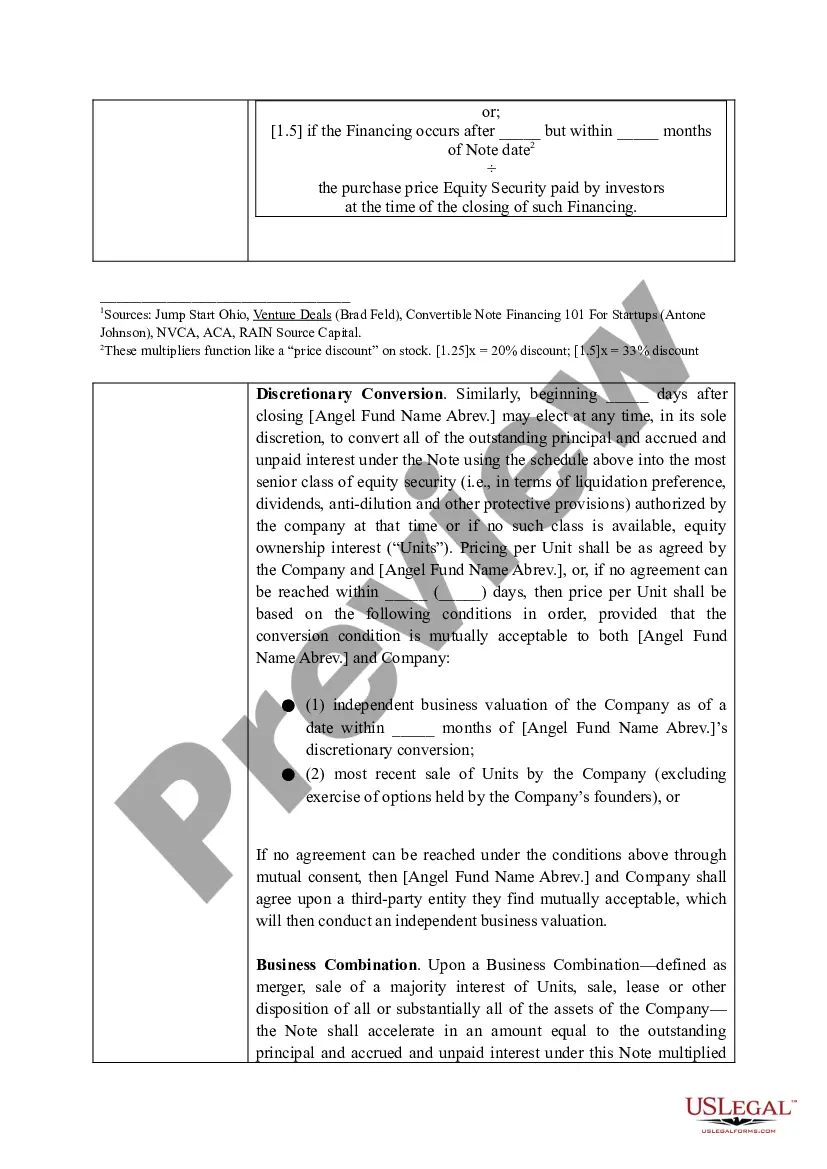

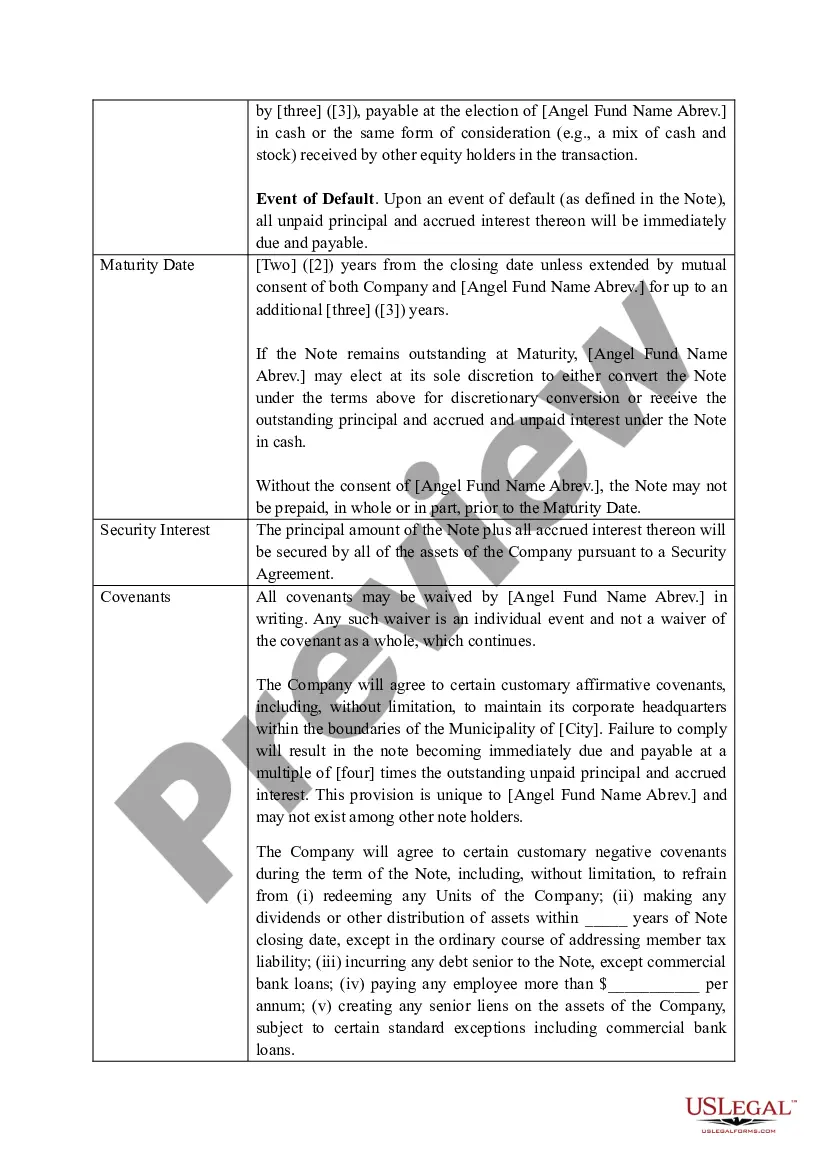

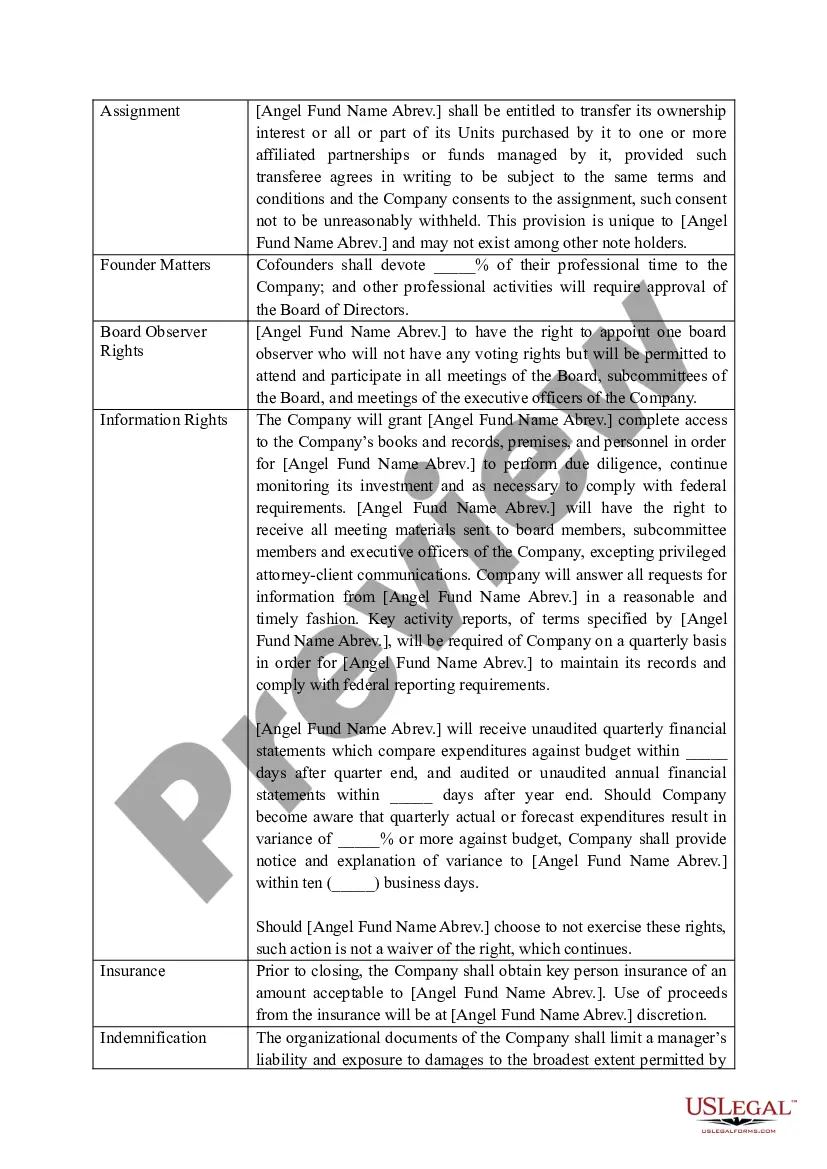

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

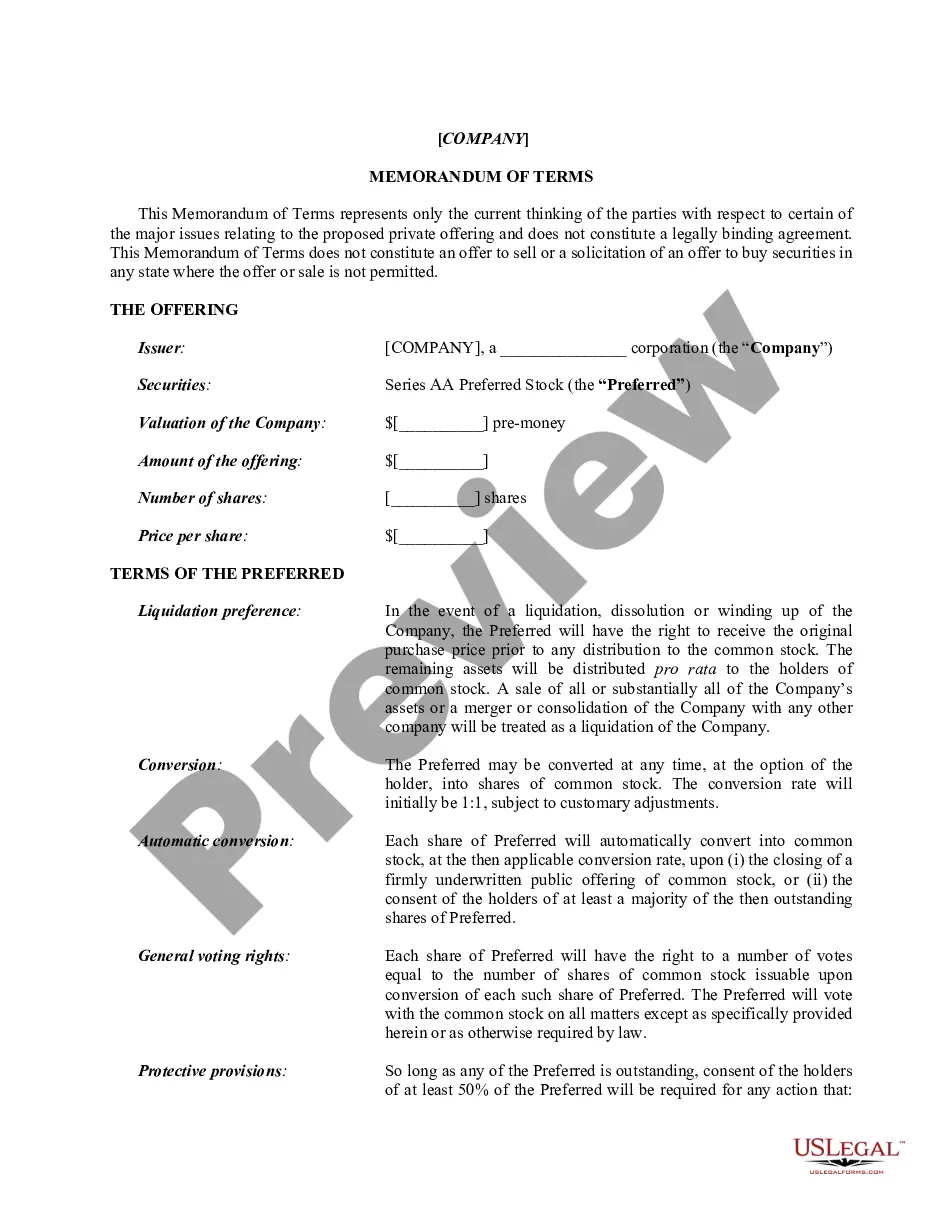

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.