New York Checklist - Certificate of Status as an Accredited Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

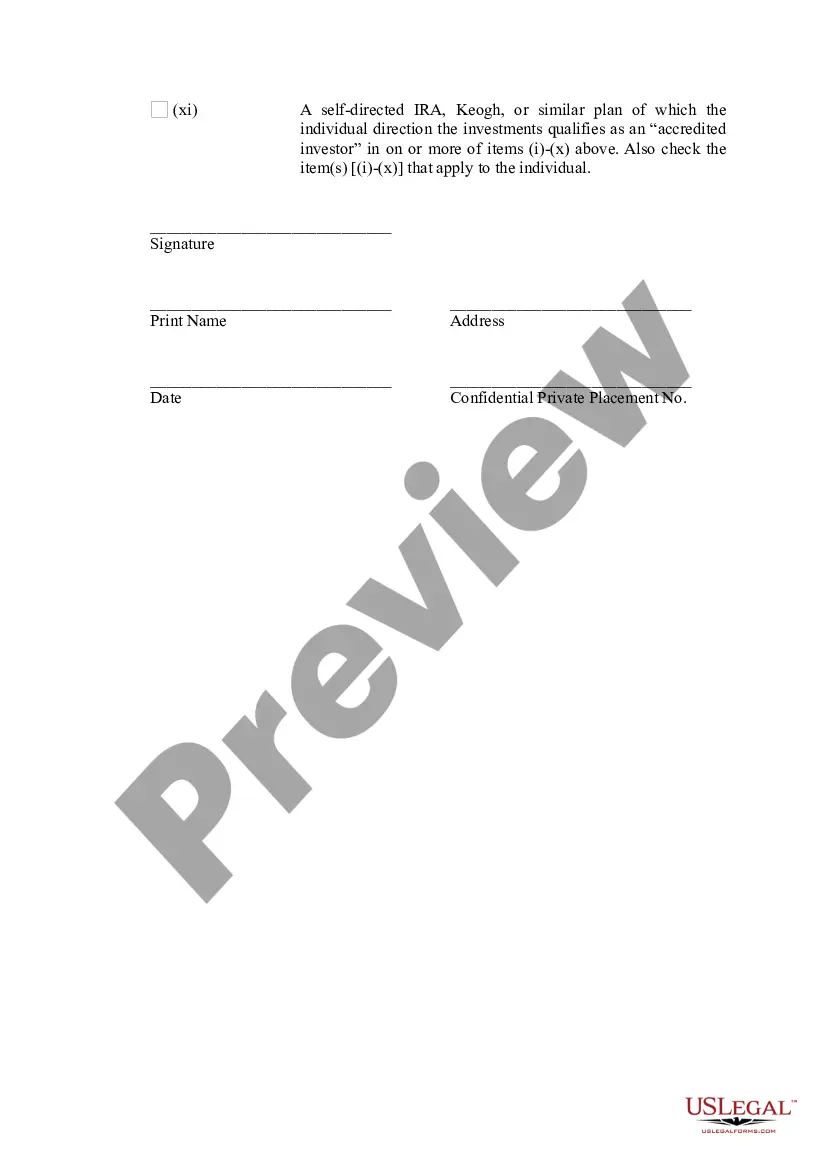

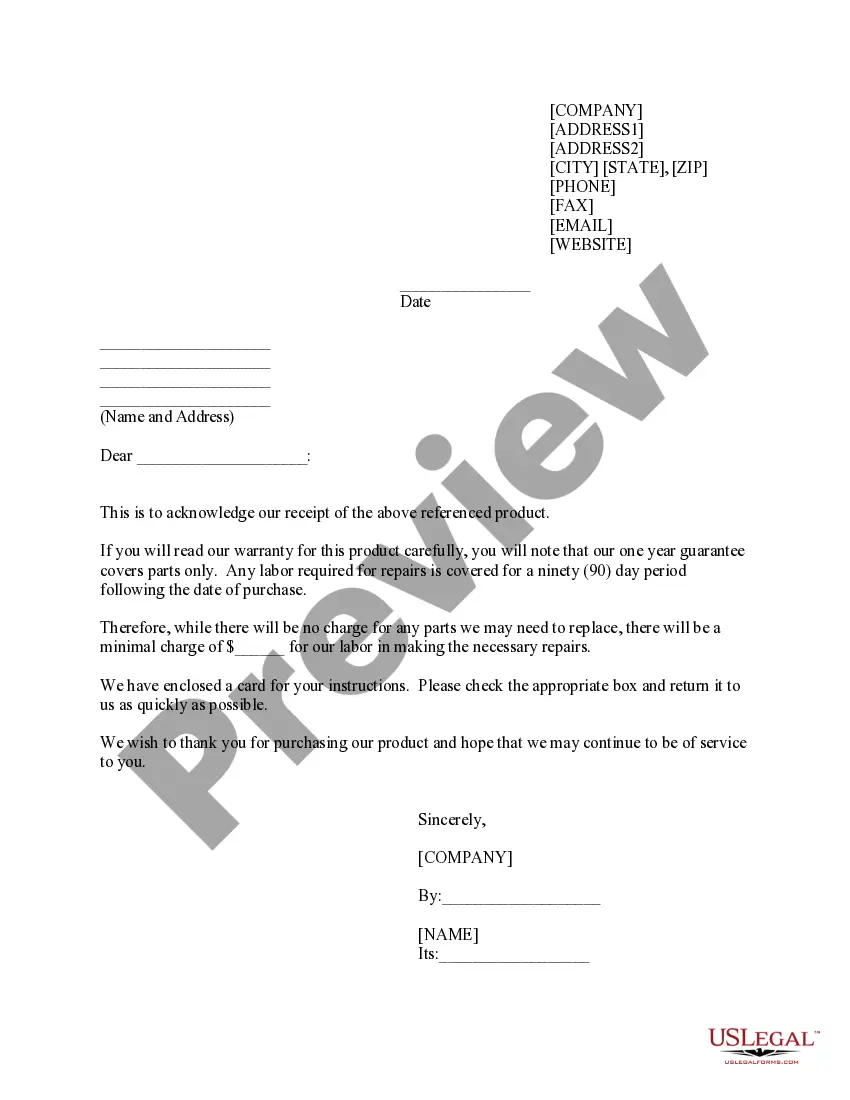

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Checklist - Certificate Of Status As An Accredited Investor?

Are you currently in the position the place you will need papers for either business or person reasons nearly every time? There are a lot of legal document templates available online, but finding types you can rely on is not effortless. US Legal Forms delivers a huge number of develop templates, just like the New York Checklist - Certificate of Status as an Accredited Investor, that are created to meet federal and state specifications.

When you are already acquainted with US Legal Forms website and get a merchant account, just log in. After that, it is possible to obtain the New York Checklist - Certificate of Status as an Accredited Investor design.

Should you not have an bank account and would like to start using US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for the appropriate city/region.

- Use the Preview button to examine the form.

- See the outline to ensure that you have selected the proper develop.

- If the develop is not what you`re trying to find, make use of the Look for discipline to obtain the develop that meets your requirements and specifications.

- If you find the appropriate develop, just click Buy now.

- Opt for the rates program you would like, submit the specified details to make your bank account, and pay money for an order utilizing your PayPal or bank card.

- Select a convenient data file formatting and obtain your duplicate.

Locate every one of the document templates you may have bought in the My Forms food list. You can aquire a more duplicate of New York Checklist - Certificate of Status as an Accredited Investor anytime, if necessary. Just go through the needed develop to obtain or print out the document design.

Use US Legal Forms, one of the most extensive selection of legal varieties, to save efforts and prevent errors. The service delivers appropriately made legal document templates which can be used for a selection of reasons. Make a merchant account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Can an LLC become an accredited investor? Yes, a Limited Liability Company (LLC) could potentially qualify as an accredited investor if it has total assets of at least $5,000,000 and the LLC was not created for the specific purpose of acquiring the securities.

For those seeking a career in investing, consider one of the following certifications: Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Chartered Alternative Investment Analyst (CAIA), or Financial Risk Manager (FRM). Each of these certifications can help one pursue a career in investing.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.