New York Subscription Agreement

Description

How to fill out Subscription Agreement?

If you have to complete, down load, or printing legal file web templates, use US Legal Forms, the largest assortment of legal types, that can be found on-line. Utilize the site`s simple and hassle-free research to discover the files you require. Various web templates for organization and specific reasons are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to discover the New York Subscription Agreement in a handful of mouse clicks.

Should you be presently a US Legal Forms client, log in in your profile and then click the Down load switch to find the New York Subscription Agreement. Also you can access types you earlier downloaded within the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the appropriate town/country.

- Step 2. Make use of the Preview choice to look through the form`s content material. Never overlook to read the explanation.

- Step 3. Should you be unhappy using the type, make use of the Search field on top of the display screen to get other models in the legal type web template.

- Step 4. Once you have identified the form you require, go through the Purchase now switch. Pick the costs program you prefer and add your qualifications to register to have an profile.

- Step 5. Procedure the transaction. You should use your bank card or PayPal profile to perform the transaction.

- Step 6. Select the structure in the legal type and down load it on your gadget.

- Step 7. Comprehensive, modify and printing or indicator the New York Subscription Agreement.

Each legal file web template you get is the one you have eternally. You might have acces to each type you downloaded with your acccount. Click the My Forms portion and decide on a type to printing or down load once more.

Remain competitive and down load, and printing the New York Subscription Agreement with US Legal Forms. There are millions of professional and state-certain types you may use to your organization or specific requires.

Form popularity

FAQ

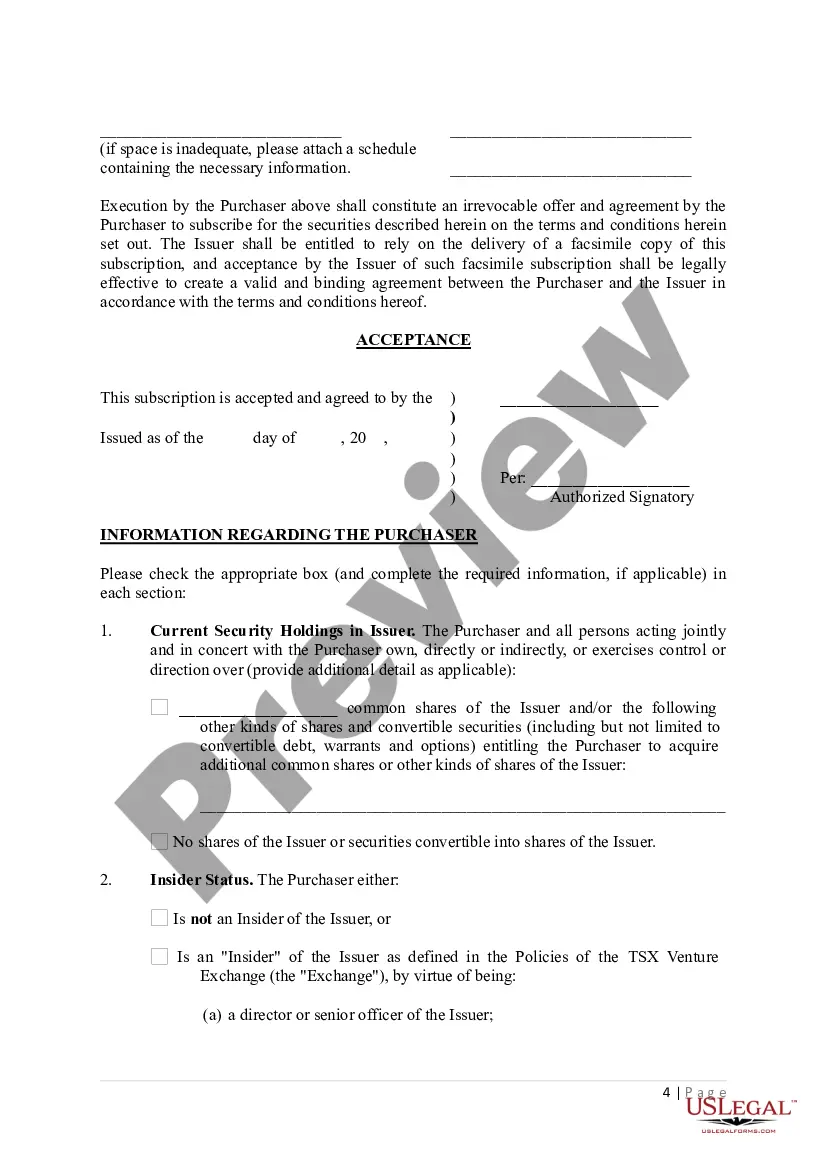

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

Subscription agreements are legal contracts that allow an investor to buy shares, bonds, or units of a company as a subscriber and shareholder with limited partnerships (LP) or private placement rights. Share subscription agreements are a type of subscription agreement that involves purchasing shares specifically.

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.