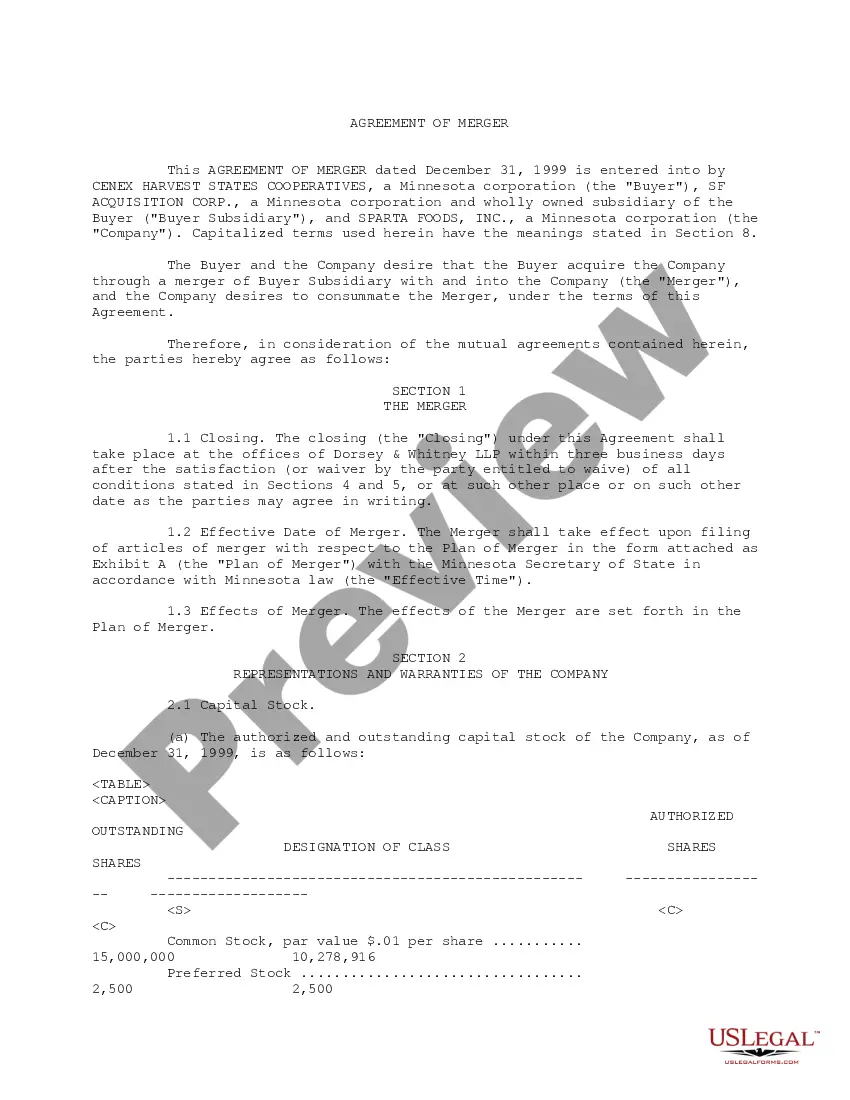

New York Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Finding the right authorized file format might be a battle. Obviously, there are tons of templates accessible on the Internet, but how would you get the authorized develop you want? Make use of the US Legal Forms internet site. The assistance provides thousands of templates, including the New York Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., which can be used for organization and personal demands. Every one of the varieties are examined by specialists and meet up with state and federal requirements.

Should you be currently listed, log in in your profile and click the Acquire key to find the New York Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Use your profile to look through the authorized varieties you possess purchased earlier. Go to the My Forms tab of the profile and have another copy from the file you want.

Should you be a new user of US Legal Forms, here are simple recommendations that you should comply with:

- Initial, make sure you have chosen the right develop for your personal city/area. You may examine the shape while using Preview key and browse the shape information to make sure this is basically the right one for you.

- In the event the develop fails to meet up with your preferences, use the Seach industry to discover the appropriate develop.

- When you are positive that the shape would work, click the Get now key to find the develop.

- Pick the costs program you desire and type in the needed information and facts. Create your profile and purchase your order making use of your PayPal profile or bank card.

- Pick the data file structure and obtain the authorized file format in your system.

- Total, change and produce and indicator the obtained New York Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

US Legal Forms is definitely the greatest catalogue of authorized varieties in which you will find a variety of file templates. Make use of the service to obtain skillfully-created papers that comply with state requirements.

Form popularity

FAQ

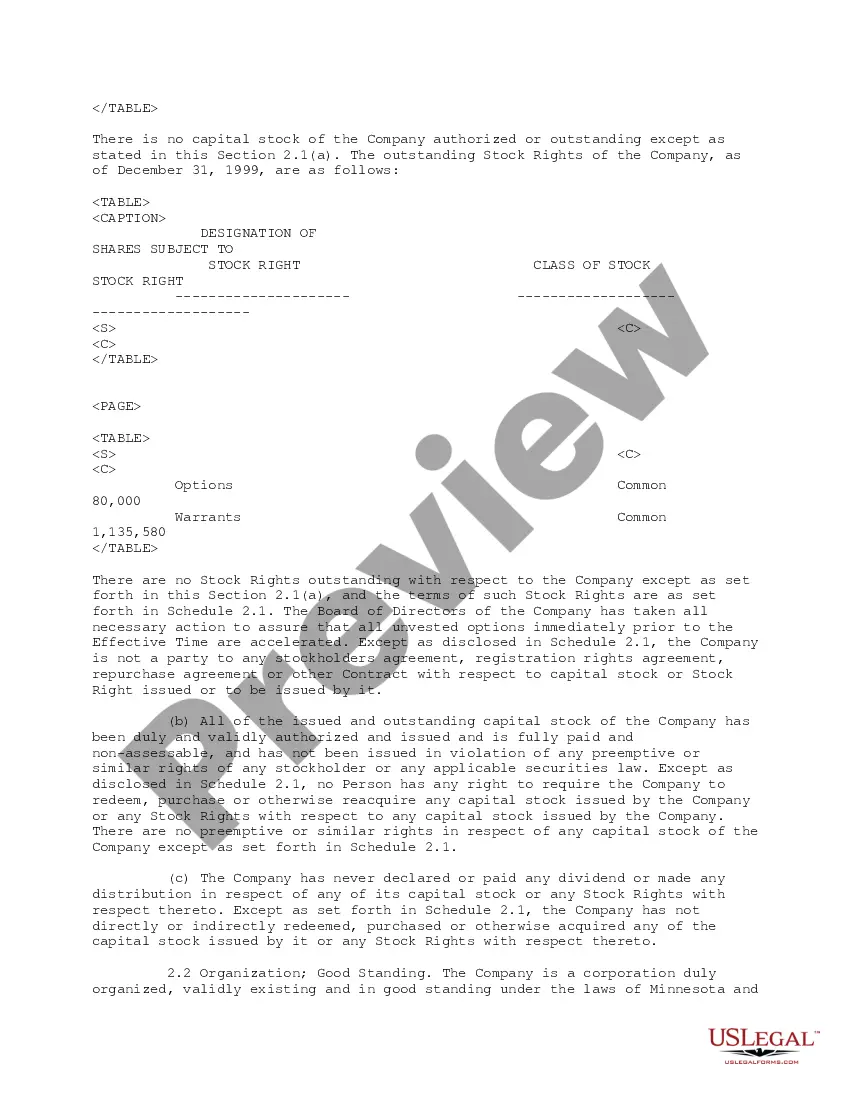

Target shareholder approval is required The target board of directors initially approves the merger and it subsequently goes to a shareholder vote. Most of the time a majority shareholder vote is sufficient, although some targets require a supermajority vote per their incorporation documents or applicable state laws.

Most statutes provide that a majority vote is needed to approve a merger, consolidation, or share exchange, unless otherwise provided in the articles of incorporation. After shareholder approval has been obtained, articles of merger, consolidation, or share exchange must be filed with the appropriate state official.

If the necessary majority of the corporation's shareholders approve a merger or consolidation, it will advance, and the shareholders will receive compensation. However, no shareholder who votes against the transaction is required to accept shares in the surviving or successor corporation.

Most notably, shareholders must approve the issuance of common stock, exceeding 1% of the total number of shares or 1% of the outstanding voting power, to related parties. Related parties include directors, officers, 5% or greater shareholders, subsidiaries, and other persons with a substantial interest in the company.

Most statutes provide that a majority vote is needed to approve a merger, consolidation, or share exchange, unless otherwise provided in the articles of incorporation. After shareholder approval has been obtained, articles of merger, consolidation, or share exchange must be filed with the appropriate state official.

Merger means that two companies have joined hands and decided to proceed as one firm. It indicates that the CEOs of both companies have mutually agreed to ally. The structure of mergers depends on the relationship between two parties, but they include vertical, horizontal, conglomerate, and rollup mergers.