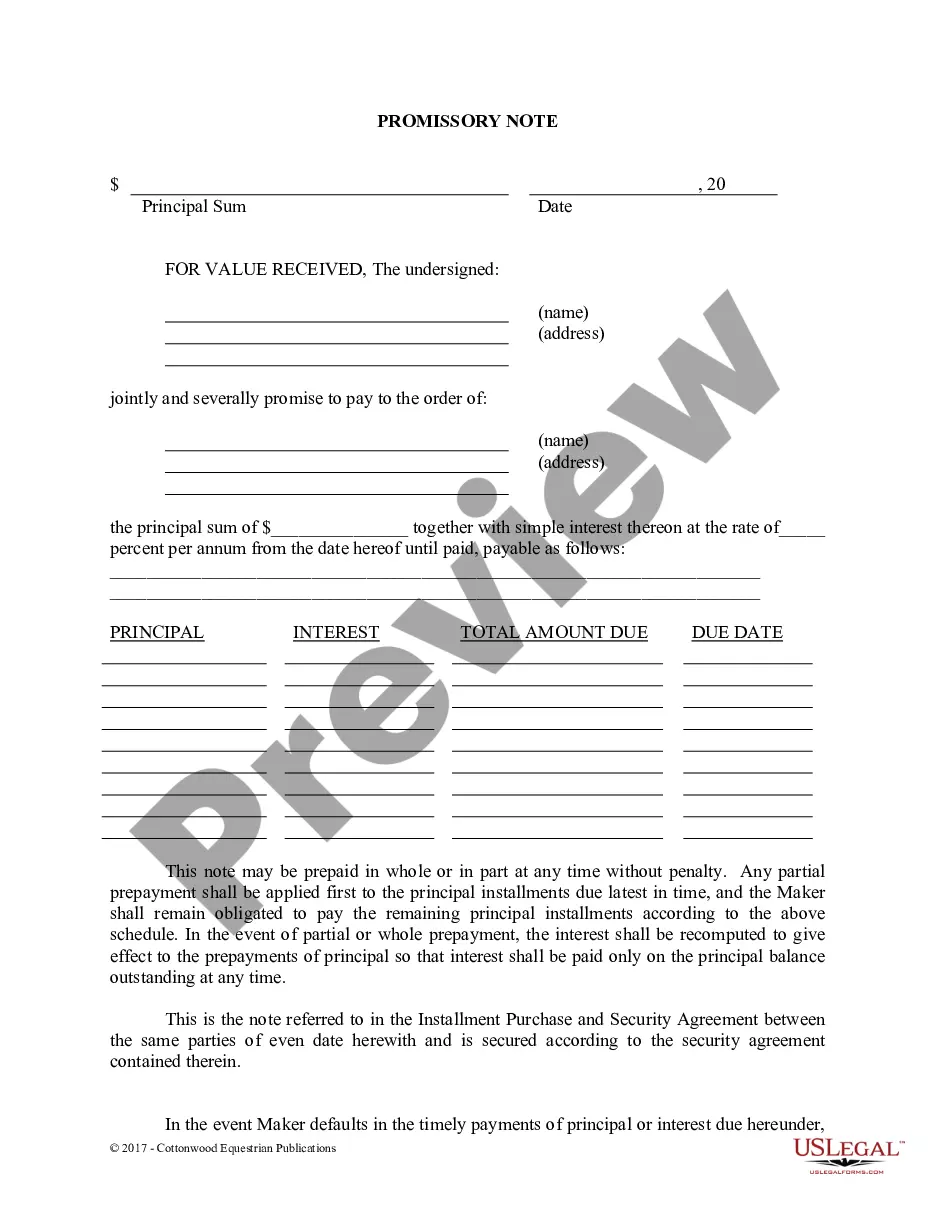

This form is a due diligence checklist that outlines information pertinent to five percent shareholders in a business transaction.

New York Five Percent Shareholder Checklist

Description

How to fill out Five Percent Shareholder Checklist?

US Legal Forms - one of the largest collections of legal documents in the country - provides a variety of legal document templates that you can download or print.

By utilizing the website, you will acquire thousands of documents for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of documents such as the New York Five Percent Shareholder Checklist within moments.

View the document description to confirm that you have the correct document.

If the form does not meet your requirements, use the Search field at the top of the screen to locate one that does.

- If you have a subscription, Log Into your account and download the New York Five Percent Shareholder Checklist from the US Legal Forms collection.

- The Download button will show on every document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple steps to help you get started.

- Make sure you've selected the correct document for your location.

- Click the Preview button to review the form's content.

Form popularity

FAQ

To file your taxes in New York, you will typically need W-2 forms, 1099 forms, and proof of any income or deductions. It's also crucial to gather forms that support any credits you are claiming, like the NY form IT-225. When preparing your filing as a five percent shareholder, consulting the New York Five Percent Shareholder Checklist can help ensure that you have all required documents in order, making your filing process smoother.

NY form IT-225 is a New York State tax form that provides a detailed report of the various credits and adjustments available to taxpayers. This form is essential for those who wish to claim certain credits against their New York income tax. By adhering to the provisions of the New York Five Percent Shareholder Checklist, you can easily determine if you qualify for any deductions or credits associated with this form.

The DTF 5 form, also known as the New York State Sales Tax Exempt Form, serves as a document for exempt organizations to claim their tax-exempt status. Completing this form is essential for entities making purchases without paying sales tax. If you are a five percent shareholder, understanding the requirements of the New York Five Percent Shareholder Checklist can help guide you in filling out the DTF 5 form correctly, ensuring compliance with New York tax laws.

The 10 minute rule for the NYSE, similar to its trading counterpart, implies traders should wait ten minutes for market reaction before executing trades. This pause enables traders to better gauge market sentiment and reduces the likelihood of making hasty decisions. Knowledge of these protocols is beneficial for anyone looking to uphold the standards set by the New York Five Percent Shareholder Checklist.

The 20 issuance rule on the NYSE requires that a listed company must maintain a minimum number of publicly held shares, typically at least 1.1 million shares. This rule helps ensure that there is sufficient trading activity to support the company’s stock. Investors must be aware of these statutory requirements while using the New York Five Percent Shareholder Checklist to manage their stakes effectively.

Yes, you can file an S Corporation on your own, but it requires attention to detail and understanding of the process. The New York Five Percent Shareholder Checklist can help clarify the information you need to submit. While it's possible to handle the filing, many find using a platform like uslegalforms beneficial for ensuring compliance and accuracy. Having a resource can help prevent mistakes that could lead to complications down the road.

To write a check to New York State for income tax, start by making the check out to 'New York State Income Tax.' Include your Social Security number or EIN on the memo line for proper identification. Ensure you write the correct amount and date on the check. For assistance, the New York Five Percent Shareholder Checklist can provide guidance on necessary payments and how to submit them efficiently.

Individuals who own at least five percent of a corporation must file the New York Five Percent Shareholder Checklist as part of their tax obligations. This checklist is crucial for ensuring compliance with New York State regulations. Not filing could result in penalties, so it’s important to determine if you meet the threshold. Utilizing platforms like uslegalforms can simplify the process, helping you stay organized.

To fill out the NYS withholding form, gather necessary employee information such as Social Security number and filing status. Follow the instructions carefully for estimating withholding amounts based on expected income and deductions. Using the New York Five Percent Shareholder Checklist can help you navigate this process smoothly and ensure compliance.

The apportionment factor in New York calculates how much of your business income is taxable in the state. This factor usually considers sales, property, and payroll proportions within New York compared to your total. The New York Five Percent Shareholder Checklist provides key insights on ensuring accurate calculations for your apportionment.