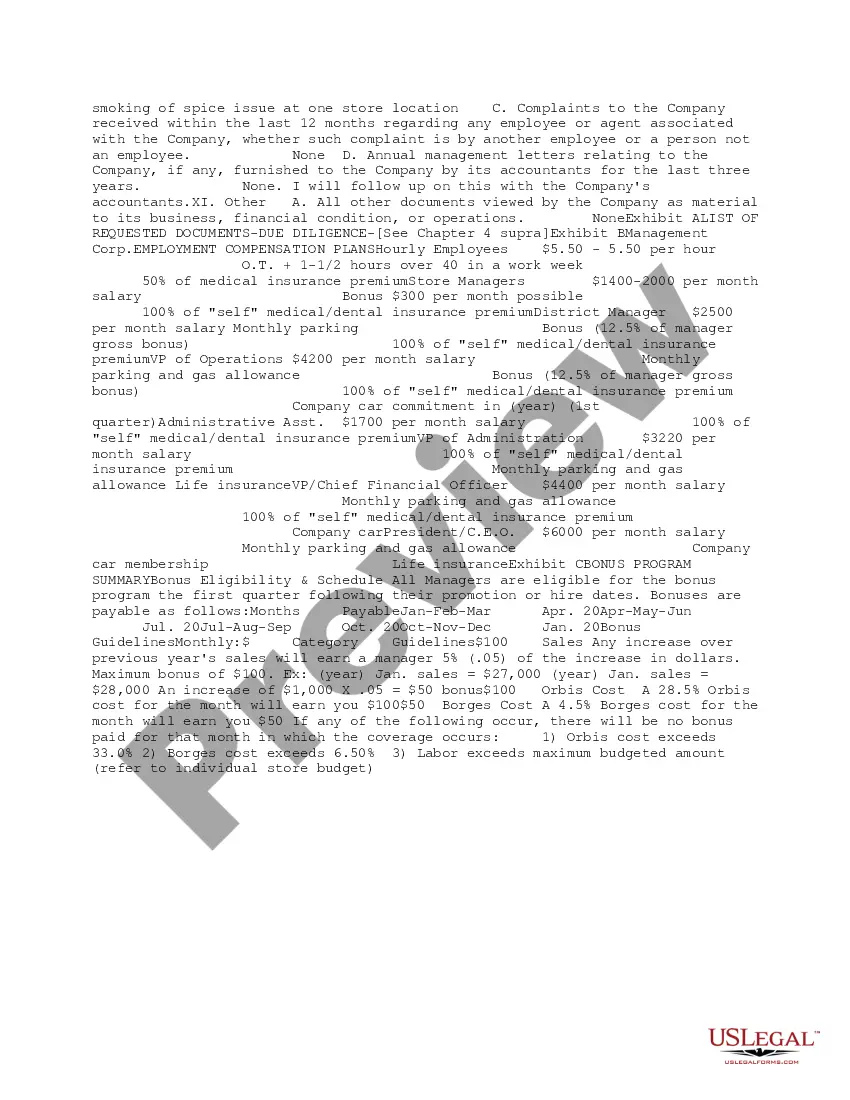

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

New York Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

Are you presently in a circumstance where you require documents for either business or particular operations almost every day.

There are numerous official document templates accessible online, but locating versions you can trust isn't easy.

US Legal Forms provides thousands of form templates, like the New York Summary Initial Review of Response to Due Diligence Request, designed to meet state and federal requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the New York Summary Initial Review of Response to Due Diligence Request template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the details to ensure you have selected the proper form.

- If the form isn't what you're looking for, use the Research field to find the form that suits your requirements.

Form popularity

FAQ

The time frame for obtaining a title report in New York can vary based on several factors, usually ranging from a few days to a couple of weeks. Factors influencing this timeline include the complexity of the property and the workload of the title company. You can expedite this process by using US Legal Forms, as our resources can enhance efficiency, especially during the New York Summary Initial Review of Response to Due Diligence Request.

A due diligence report can be issued by a variety of professionals who possess the required expertise, including licensed attorneys, certified public accountants, or specialized due diligence firms. These professionals ensure that the report meets legal standards and aligns with industry best practices. If you're seeking a comprehensive report in New York, considering the New York Summary Initial Review of Response to Due Diligence Request will guide you toward credible issuers.

Typically, a due diligence report is prepared by professionals such as attorneys, real estate agents, or specialized firms that focus on compliance and risk assessment. These experts gather and analyze information pertinent to your specific needs, ensuring all aspects are covered. By choosing US Legal Forms, you can access templates and resources that foster accurate preparation, especially for New York Summary Initial Review of Response to Due Diligence Request.

To obtain a due diligence report, you can start by contacting a reliable provider who specializes in this area. They will guide you through the necessary steps, which typically involve submitting a formal request along with relevant information. The process can also include engaging with platforms like US Legal Forms that streamline obtaining such reports. Remember to ask how the New York Summary Initial Review of Response to Due Diligence Request fits into the broader consultation about due diligence.

A due diligence review is a comprehensive examination of the financial, legal, and operational aspects of a business or investment. It focuses on uncovering potential liabilities and assessing overall value. Often included in this review is a New York Summary Initial Review of Response to Due Diligence Request, which helps stakeholders gauge the responsiveness of a party to their inquiries. Engaging with uslegalforms can simplify this process and ensure thoroughness.

An initial due diligence report serves as a preliminary overview of essential findings regarding a potential investment or transaction. It outlines key risks, compliance issues, and other important factors that could affect the deal. The report often includes a New York Summary Initial Review of Response to Due Diligence Request to provide insights on what further steps should be taken. This document is vital for making informed decisions.

The due diligence process involves several key steps. Initially, you gather all relevant documentation related to the transaction, followed by a detailed analysis of the information. After that, you validate the findings and assess any identified risks. Finally, you will compile a New York Summary Initial Review of Response to Due Diligence Request to summarize your observations and recommendations.

In New York State, the dormancy period for unclaimed property generally lasts for three years. This period begins when there is no owner activity associated with the property. Being proactive in managing your assets can prevent them from becoming unclaimed. The New York Summary Initial Review of Response to Due Diligence Request provides a helpful framework for monitoring and responding to potential dormant assets, ultimately ensuring your property remains within your control.

Receiving a letter from the NYS comptroller usually pertains to financial matters, such as discrepancies in tax filings or inquiries regarding your business operations. This correspondence serves as a notification that requires your prompt attention and response. Utilizing the New York Summary Initial Review of Response to Due Diligence Request can aid in preparing an accurate reply and ensure you meet any requirements outlined in the letter. Addressing these letters quickly can help maintain good standing with state authorities.

When conducting due diligence on a new client, you should gather essential information about their business, including financial statements, credit history, and relevant legal documentation. You should thoroughly review this data to ensure compliance with regulations and mitigate risks. Utilizing the New York Summary Initial Review of Response to Due Diligence Request can help streamline this process, providing you with a structured approach to assess the client's background. Always maintain clear records of your findings to facilitate future reference.