New York Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

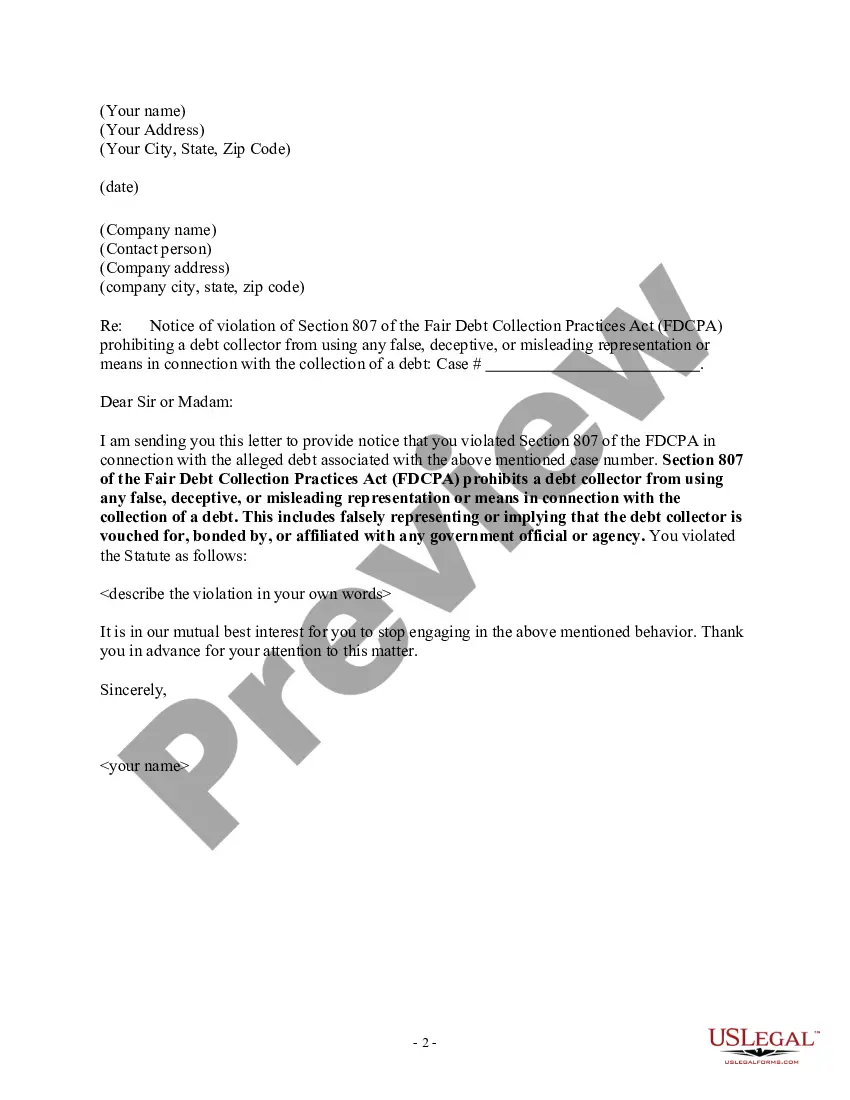

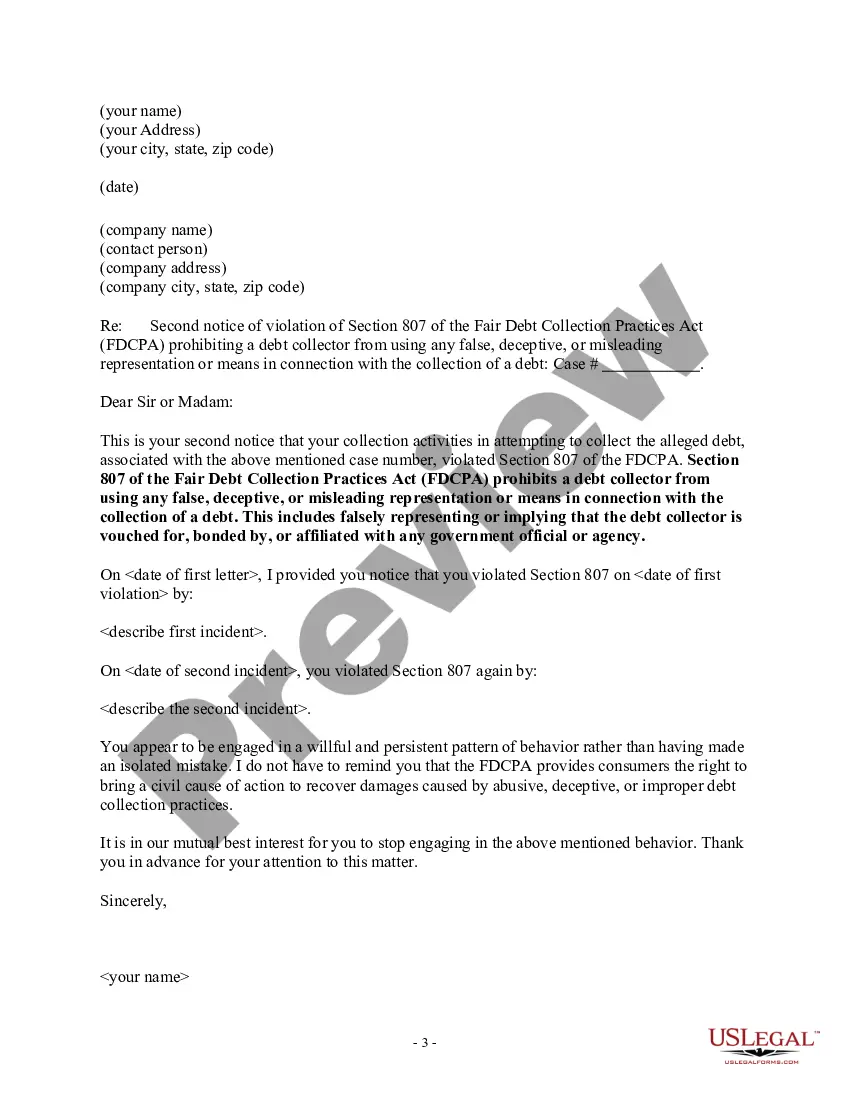

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

You have the ability to dedicate time online trying to locate the legal document template that fits the state and federal requirements you need.

US Legal Forms provides a wide array of legal forms that are reviewed by professionals.

You can download or print the New York Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself from their service.

If available, use the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and hit the Acquire button.

- After that, you can complete, edit, print, or sign the New York Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Every legal document template you receive is yours permanently.

- To obtain another copy of a purchased form, go to the My documents section and click on the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Under the new law, the statute of limitations can't be restarted if you make a payment or acknowledge the debt, which was allowed in the past. If you get sued for a time-barred debt, you still need to answer the lawsuit, but you can use the statute of limitations as a defense. Written by Attorney John Coble.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

In New York, the law that governs the statute of limitations states that a creditor has up to six years to seek repayment for a debt. After this time elapses, the creditor can't sue a debtor to collect the debt. However, some creditors may try to sue you after the expiration of the statute of limitations.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date.