New York Terms of Class One Preferred Stock

Description

How to fill out Terms Of Class One Preferred Stock?

Are you inside a place that you will need paperwork for possibly enterprise or person functions just about every working day? There are a lot of legitimate document web templates available on the Internet, but getting ones you can depend on isn`t simple. US Legal Forms offers 1000s of form web templates, such as the New York Terms of Class One Preferred Stock, that happen to be written to satisfy state and federal needs.

When you are previously acquainted with US Legal Forms web site and get an account, simply log in. Afterward, it is possible to down load the New York Terms of Class One Preferred Stock web template.

Should you not come with an account and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you want and ensure it is for your appropriate metropolis/region.

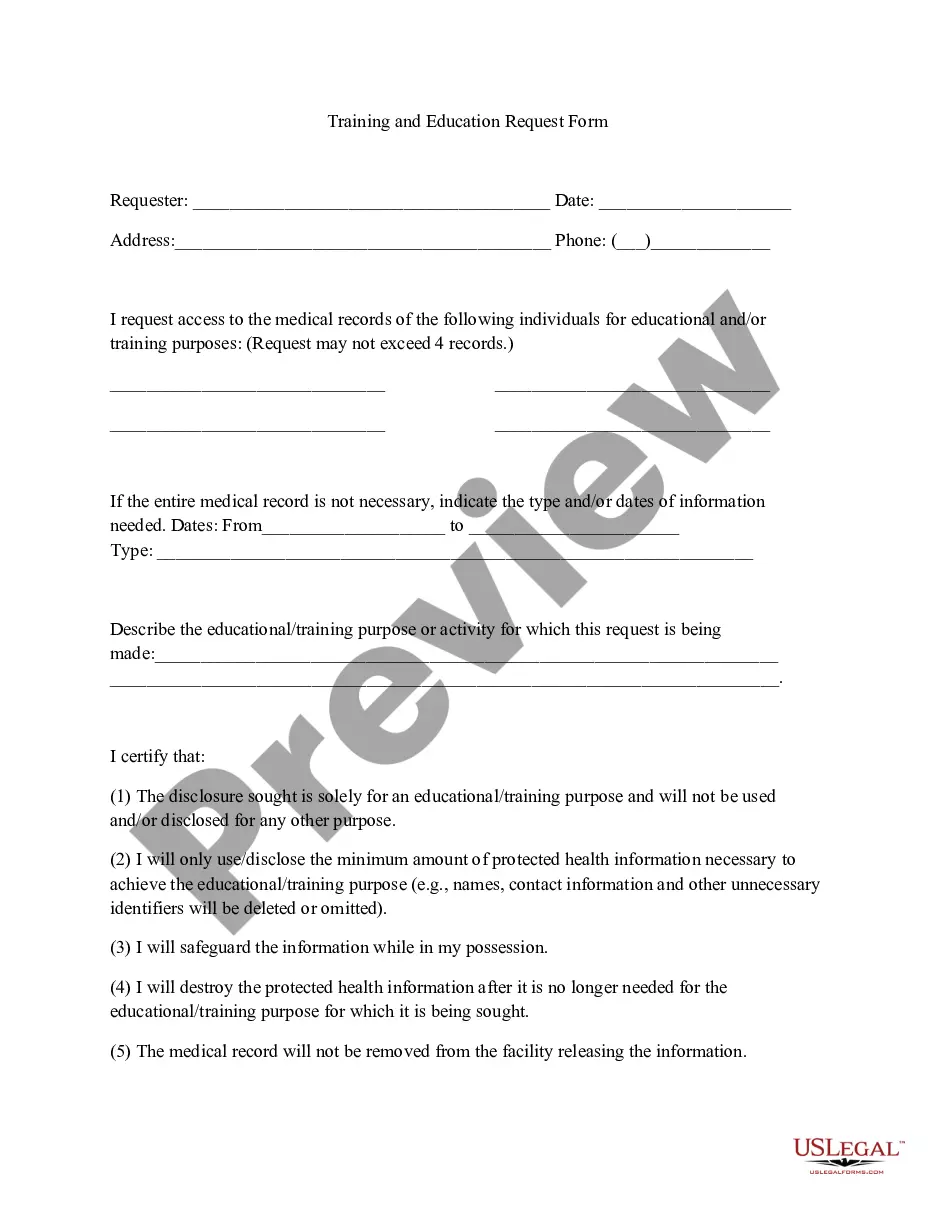

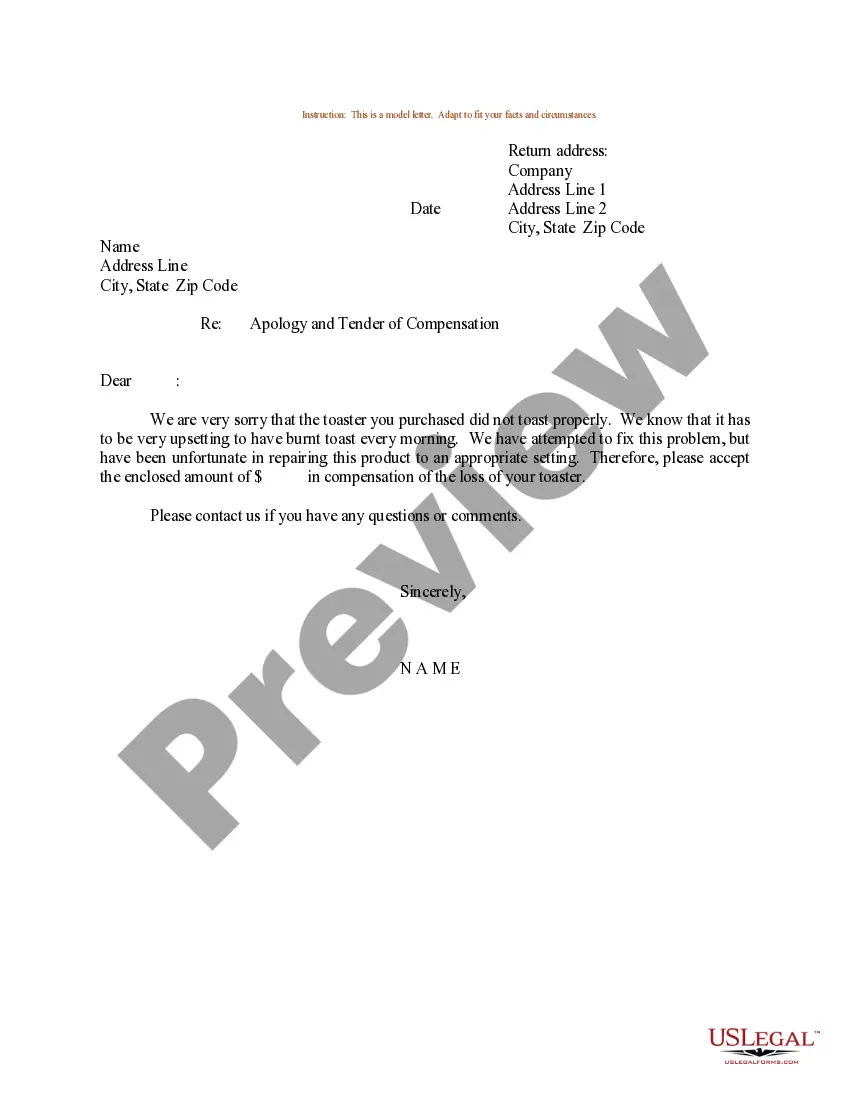

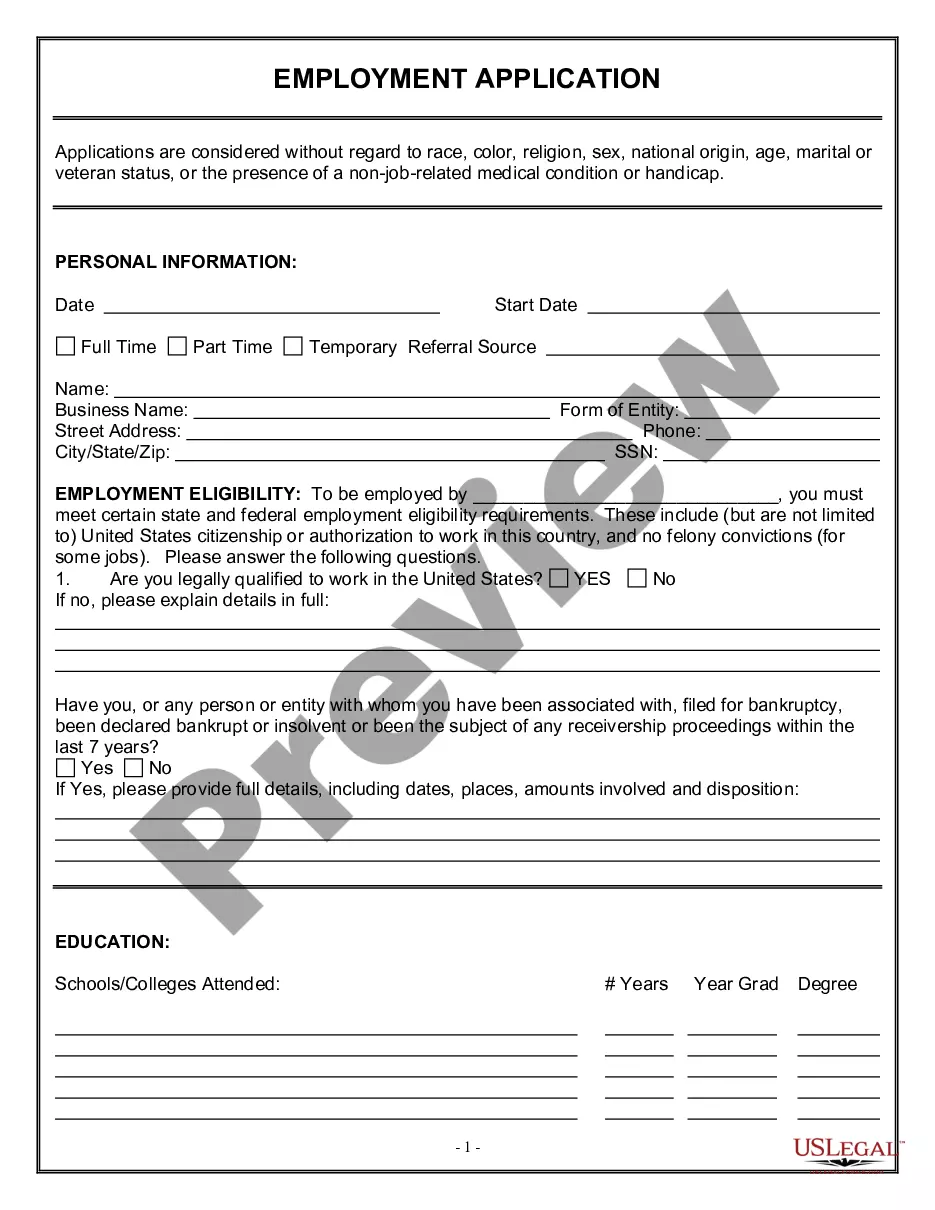

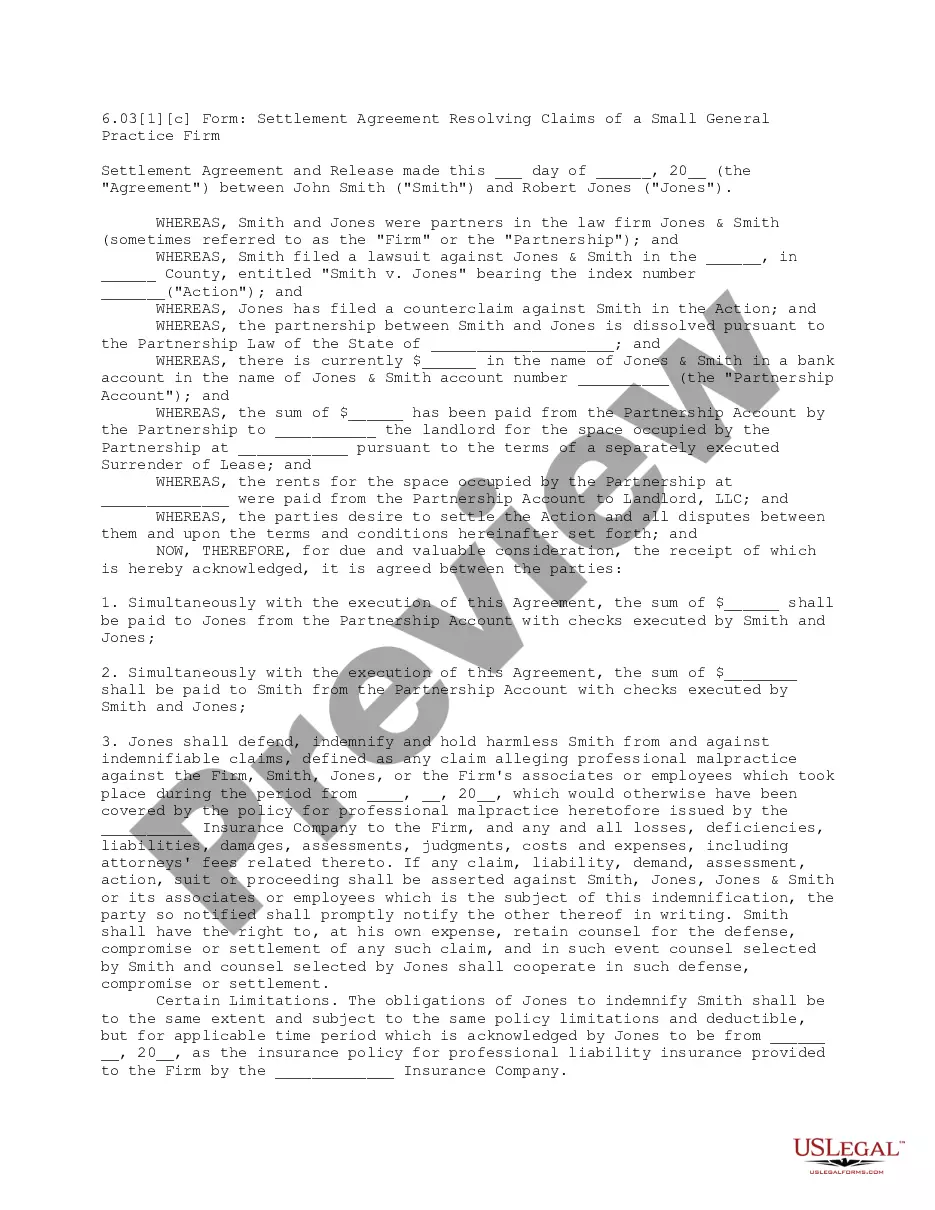

- Make use of the Preview switch to examine the form.

- Look at the explanation to actually have selected the appropriate form.

- When the form isn`t what you are trying to find, use the Search industry to get the form that fits your needs and needs.

- Once you discover the appropriate form, simply click Buy now.

- Opt for the rates plan you desire, complete the desired information and facts to produce your account, and pay for the transaction making use of your PayPal or credit card.

- Decide on a convenient paper formatting and down load your duplicate.

Find all the document web templates you might have purchased in the My Forms food list. You can aquire a more duplicate of New York Terms of Class One Preferred Stock whenever, if possible. Just click on the essential form to down load or print out the document web template.

Use US Legal Forms, one of the most substantial selection of legitimate types, in order to save some time and steer clear of errors. The service offers skillfully created legitimate document web templates that can be used for a variety of functions. Generate an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Series 1 Shares means the cumulative rate reset preference shares, series 1 issued by the Company "Series 3 Shares" means the cumulative rate reset preference shares, series 3 issued by the Company "Series 5 Shares" means the cumulative rate reset preference shares, series 5 issued by the Company.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

The four main types of preference shares are callable shares, convertible shares, cumulative shares, and participatory shares. Each type of preferred share has unique features that may benefit either the shareholder or the issuer.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

Class I shares are institutional shares that are made available to institutional investors and shareholders, and high net-worth investors. They can carry higher minimum investment amounts of $25,000 or more.