New York Reclassification of Class B common stock into Class A common stock

Description

How to fill out Reclassification Of Class B Common Stock Into Class A Common Stock?

You are able to spend several hours on-line trying to find the lawful papers template that suits the state and federal needs you will need. US Legal Forms provides thousands of lawful kinds that are analyzed by professionals. It is simple to down load or printing the New York Reclassification of Class B common stock into Class A common stock from your assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Down load button. After that, you can total, modify, printing, or signal the New York Reclassification of Class B common stock into Class A common stock. Each lawful papers template you acquire is your own property eternally. To get another duplicate for any acquired type, go to the My Forms tab and then click the related button.

Should you use the US Legal Forms site for the first time, keep to the basic guidelines under:

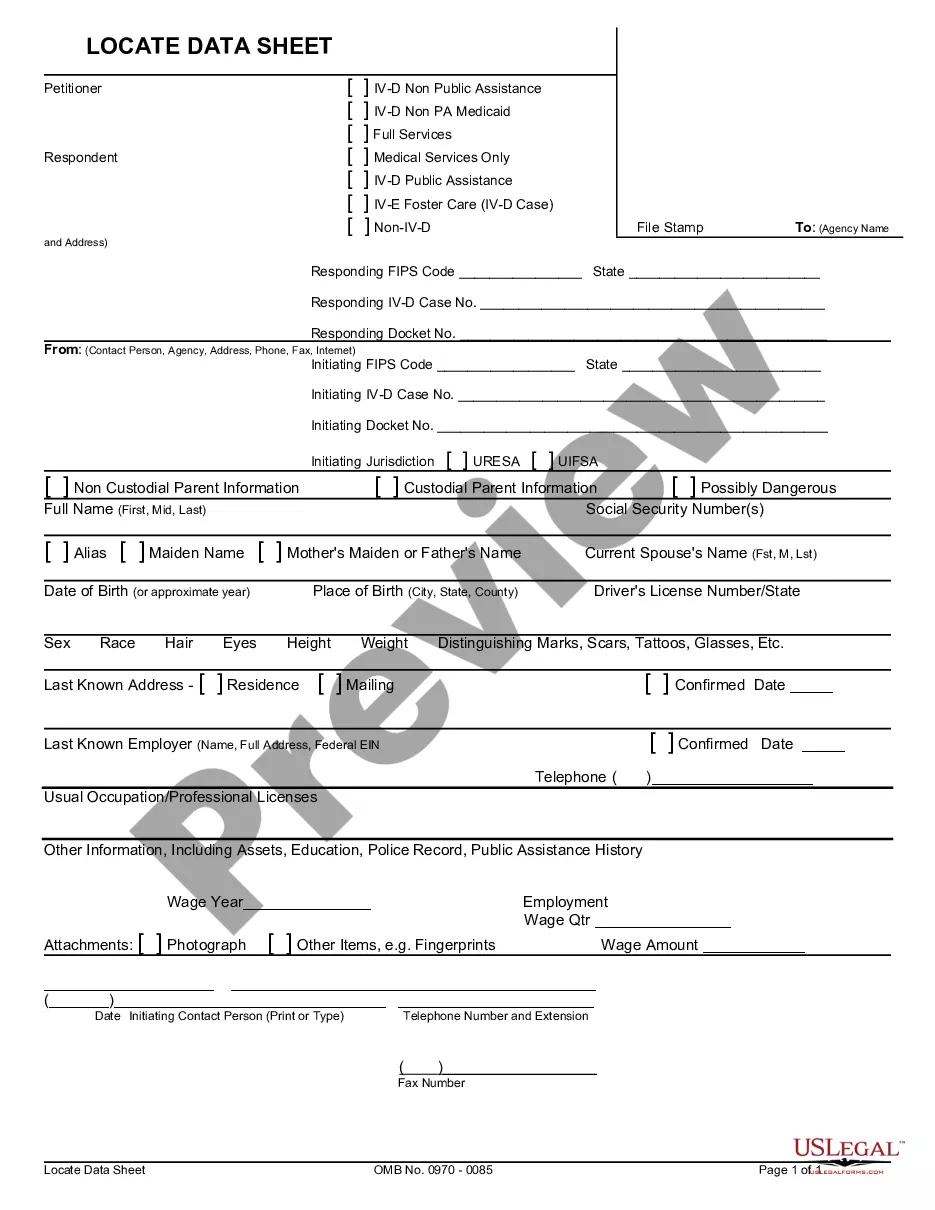

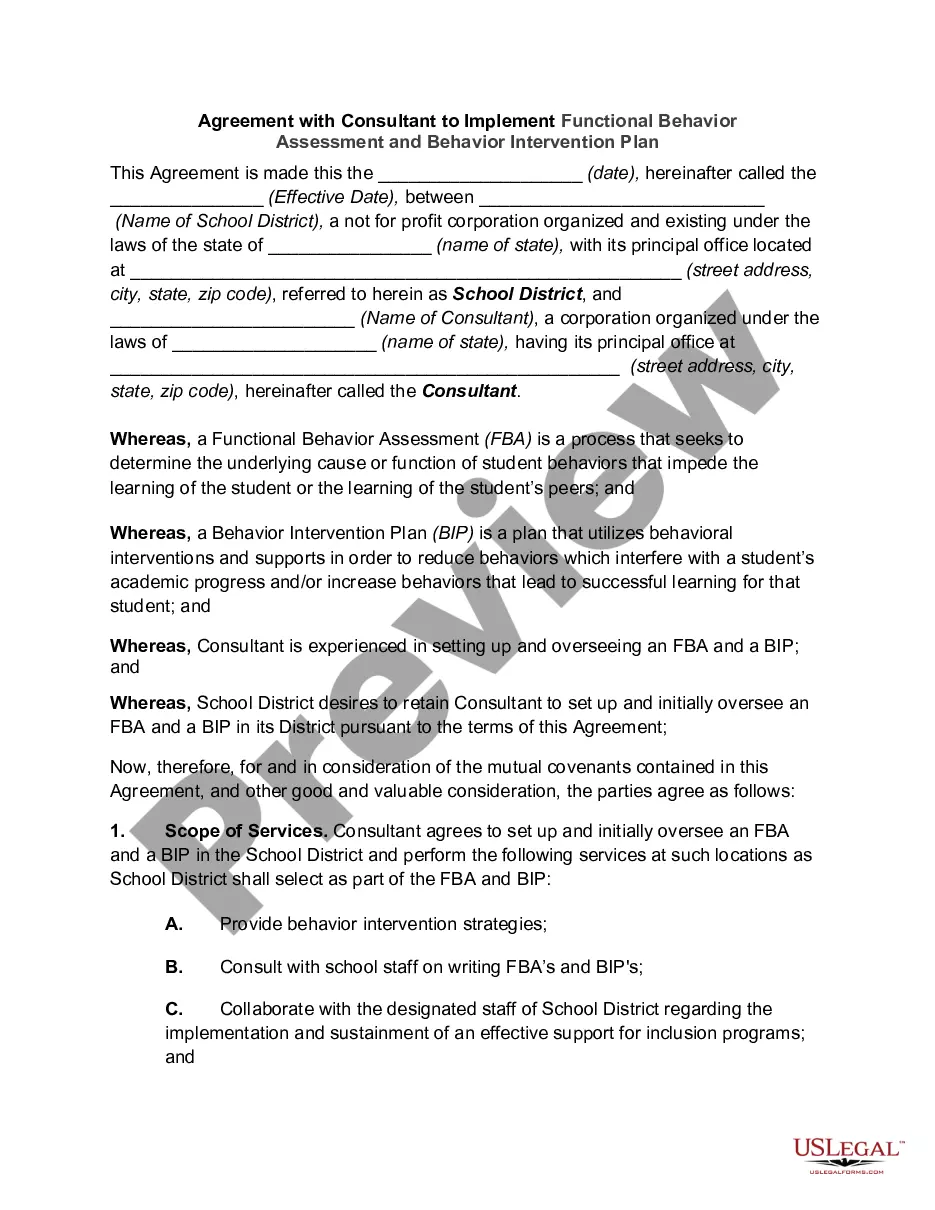

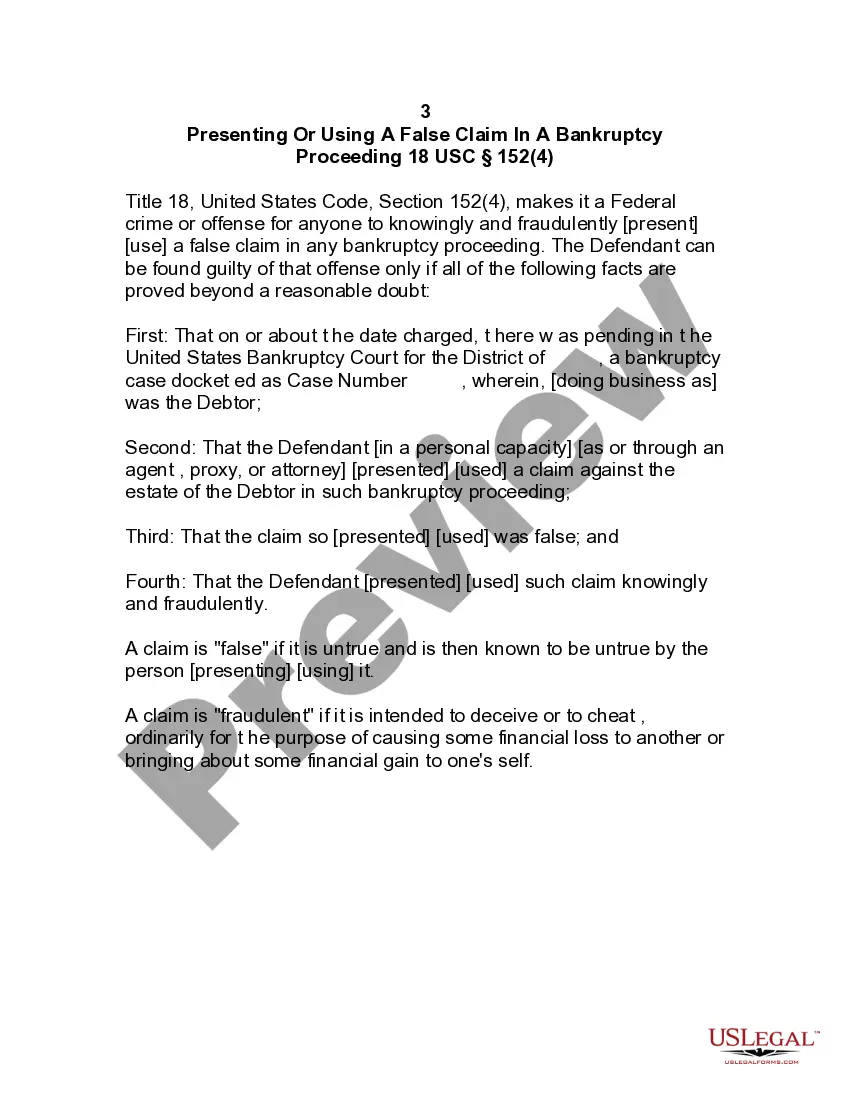

- Initial, be sure that you have selected the best papers template for the county/town of your choice. Browse the type outline to ensure you have picked the appropriate type. If readily available, take advantage of the Review button to check through the papers template at the same time.

- If you want to find another variation of the type, take advantage of the Research industry to find the template that meets your needs and needs.

- Upon having discovered the template you need, click on Acquire now to proceed.

- Pick the prices program you need, type in your references, and sign up for an account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal accounts to cover the lawful type.

- Pick the structure of the papers and down load it for your system.

- Make changes for your papers if needed. You are able to total, modify and signal and printing New York Reclassification of Class B common stock into Class A common stock.

Down load and printing thousands of papers templates utilizing the US Legal Forms web site, that provides the greatest collection of lawful kinds. Use professional and state-particular templates to deal with your company or personal requires.

Form popularity

FAQ

Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof.

Class B shares typically have lower dividend priority than Class A shares and fewer voting rights. However, different classes do not usually affect an average investor's share of the profits or benefits from the company's overall success.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

share is one type of class of shares offered in a mutual fund that charges a sales load. The other common share classes are Ashares and Cshares. With Bshares, an investor pays a sales charge when they redeem from the fund, known as a backend sales load or a contingent deferred sales charge (CDSC).

B shares also have voting rights in the company, but their dividends are worked out based on a lower rate. C shareholders have the same rate of dividends as A shareholders, but have no voting rights at all.

share is a share class that charges a sales load in a mutual fund. This means investors pay a charge when they redeem from the fund. This is different from a frontloaded fund, which requires payment upon purchase.

Class C shares have a higher expense ratio compared to Class A shares. Class C shares can't be converted to Class A shares. There are no discounts at any investment level. Bear in mind the total cost of an investment in a mutual fund because that can affect your return.