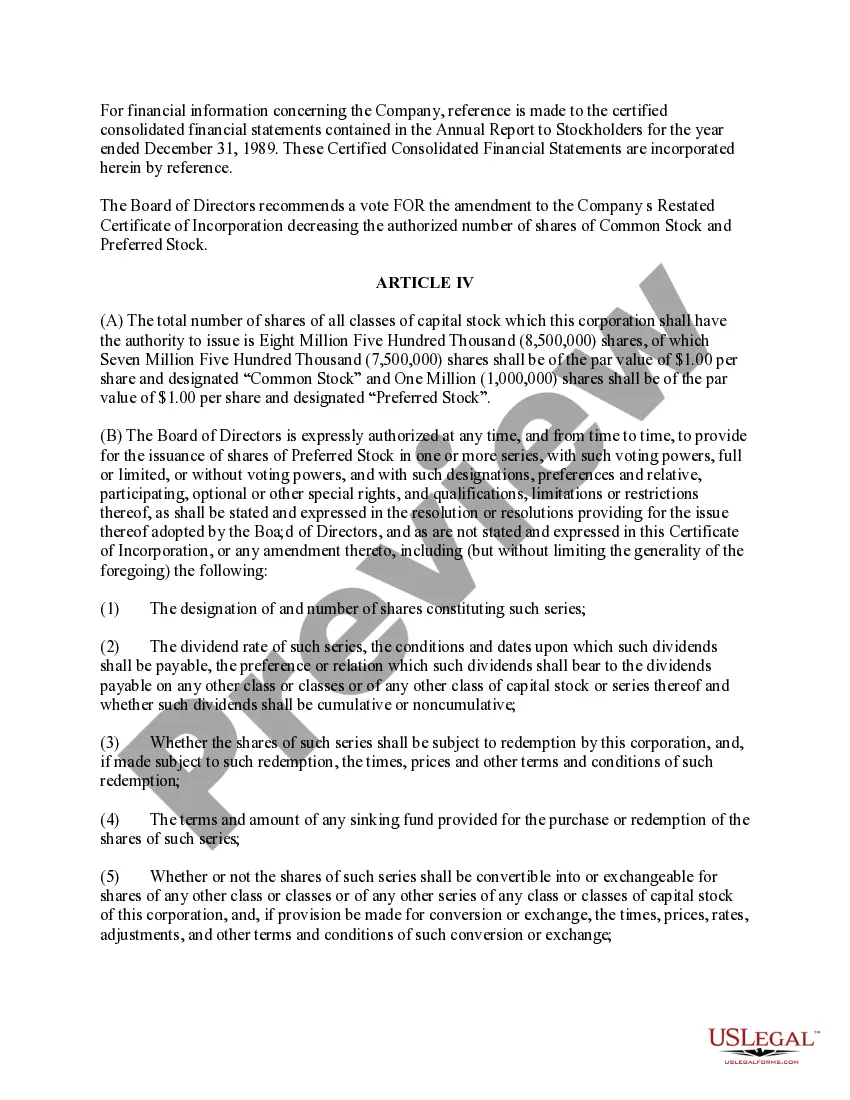

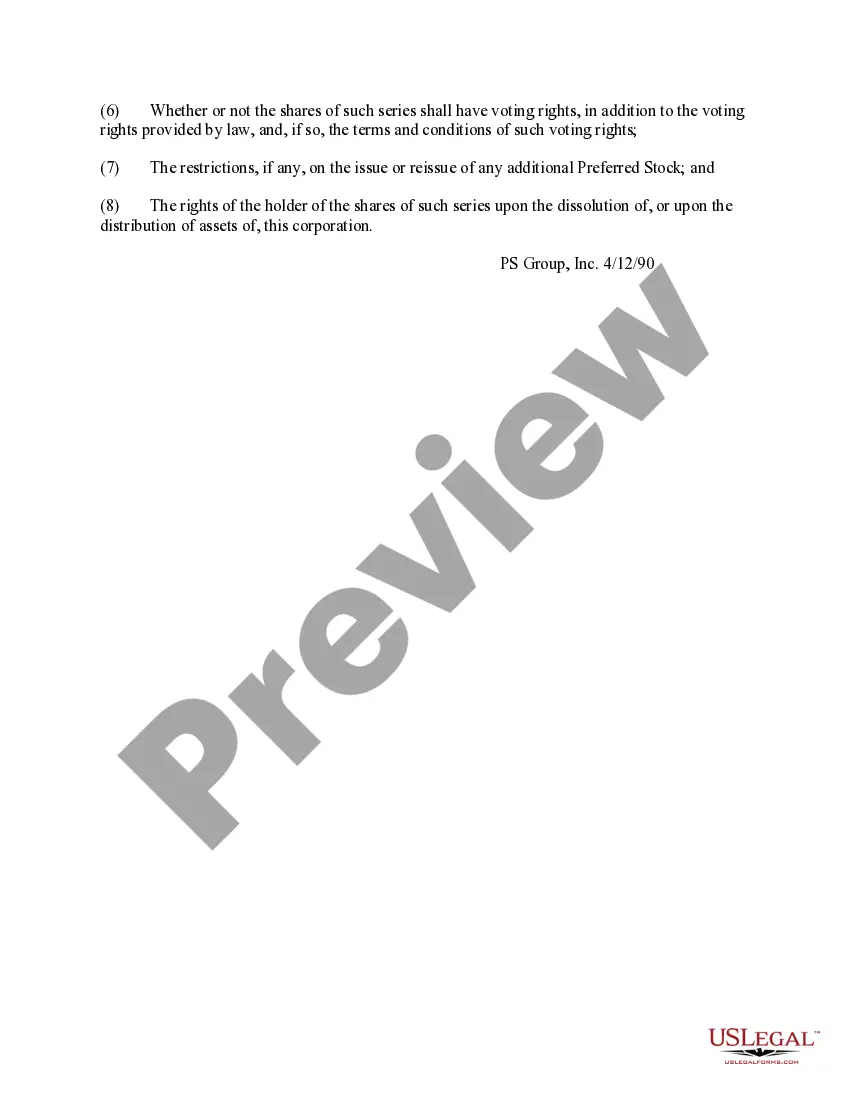

New York Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

Choosing the right lawful record web template could be a struggle. Needless to say, there are a lot of templates accessible on the Internet, but how would you find the lawful develop you require? Make use of the US Legal Forms site. The service gives a large number of templates, like the New York Proposal to decrease authorized common and preferred stock, which can be used for business and personal requires. Every one of the forms are inspected by experts and fulfill state and federal specifications.

Should you be previously registered, log in to the profile and click the Acquire button to have the New York Proposal to decrease authorized common and preferred stock. Make use of your profile to search through the lawful forms you possess acquired earlier. Visit the My Forms tab of your respective profile and have yet another copy in the record you require.

Should you be a brand new end user of US Legal Forms, listed below are simple recommendations so that you can comply with:

- Initially, make sure you have chosen the proper develop to your area/county. You are able to look through the shape while using Review button and study the shape information to make sure this is the right one for you.

- When the develop fails to fulfill your needs, use the Seach area to find the appropriate develop.

- Once you are certain the shape would work, go through the Purchase now button to have the develop.

- Select the pricing prepare you would like and enter the needed info. Create your profile and purchase the order using your PayPal profile or bank card.

- Opt for the submit format and obtain the lawful record web template to the product.

- Complete, edit and printing and indicator the received New York Proposal to decrease authorized common and preferred stock.

US Legal Forms is the biggest catalogue of lawful forms where you can discover various record templates. Make use of the company to obtain skillfully-created papers that comply with condition specifications.

Form popularity

FAQ

Preferred stock is equity. Just like common stock, its shares represent an ownership stake in a company. However, preferred stock normally has a fixed dividend payout as well. That's why some call preferred stock a stock that acts like a bond.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Journal Entries DateParticulars(ii) For allotment of sharesPreference Share Application A/cTo Preference Share Capital A/c(Being transfer of the application money to share capital account)(iii) For making the allotment money (second installment) duePreference Share Allotment A/c26 more rows

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock. ? Cash is an asset account that is increasing.

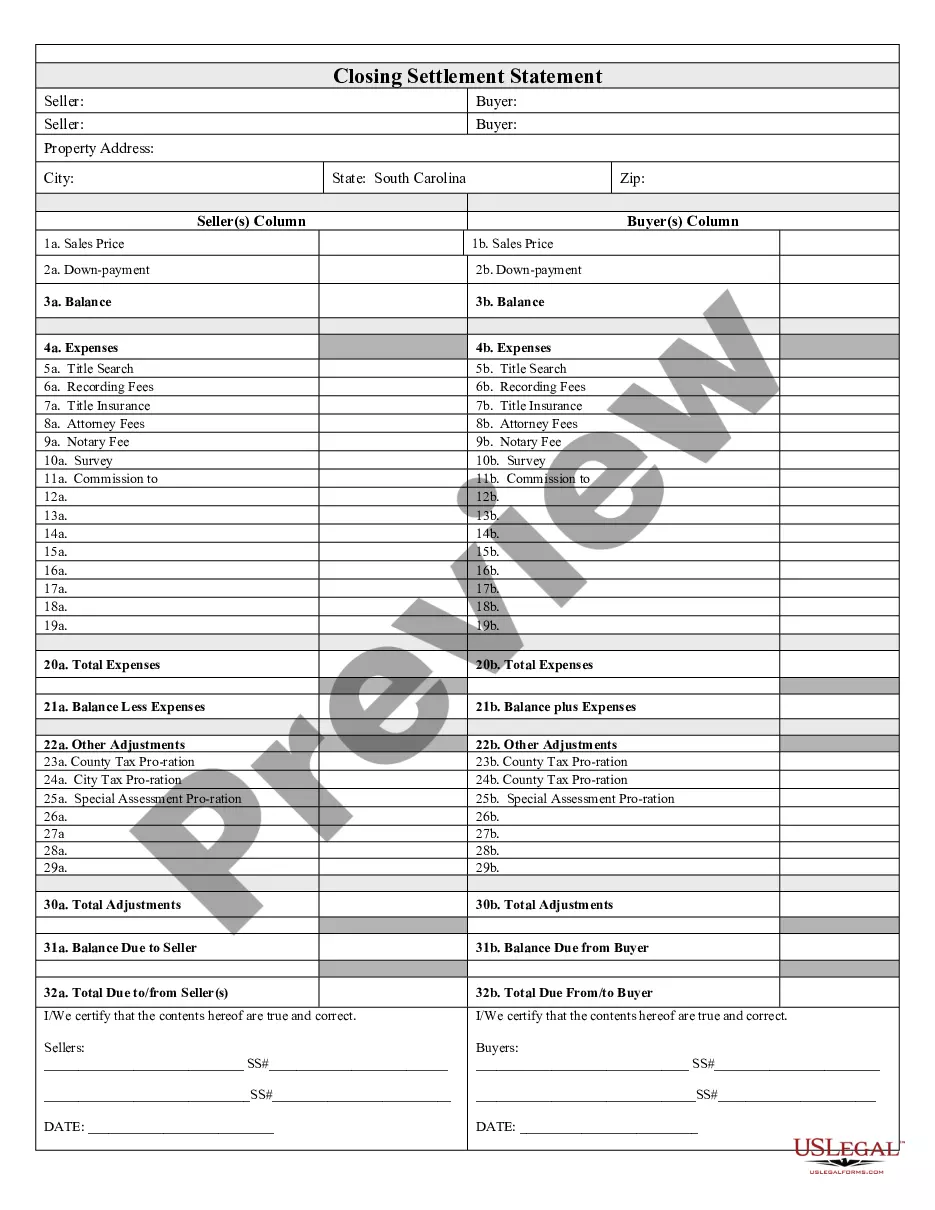

You must issue preferred stock certificates to each individual or institution that purchases your shares. You must enter each sale into your stock certificate ledger. At a minimum, you need to record the sale date, the name and address of the buyer, the number of shares sold and the price per share.

Issuing preferred shares allows companies to diversify their capital structure, access additional funding sources and cater to investors with specific preferences for steady income and reduced risk. That tends to be a different group of investors than those who gravitate toward common shares.

A company issues common stock to raise money, so the debit will always be to cash. There will always be a credit to common stock for the # of shares issued x the par value. Additional paid-in capital (APIC) is the plug.

Issuance of Preferred Stock: When a company issues preferred stock, it debits (increases) the cash account on the balance sheet for the total value received and credits (increases) the ?preferred stock? account in the equity section of the balance sheet.