New York Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

If you require to aggregate, download, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's simple and efficient search feature to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and suggestions, or keywords.

Step 4. After you have found the form you need, click on the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the New York Demand for Payment of Account by Business to Debtor in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the New York Demand for Payment of Account by Business to Debtor.

- You can also find documents you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/region.

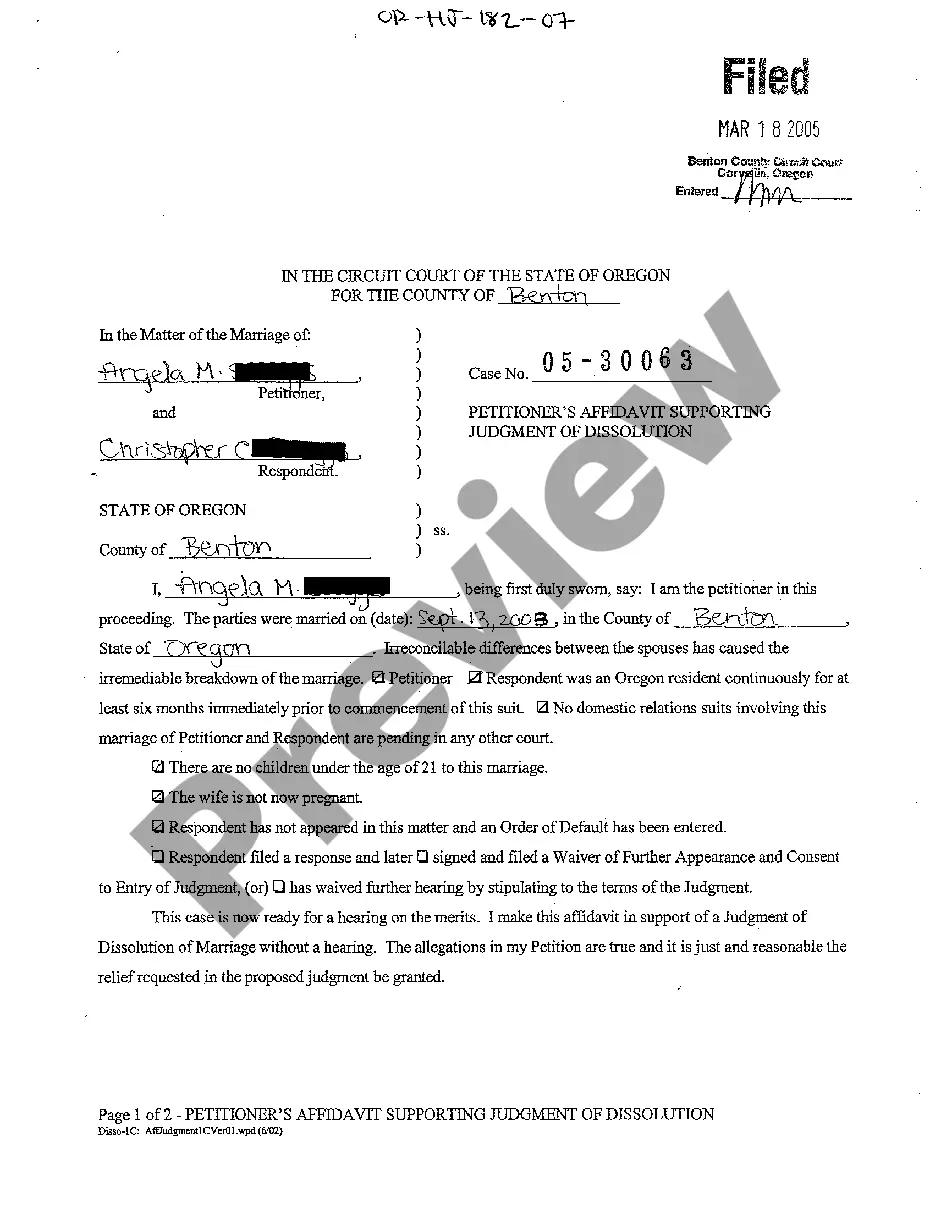

- Step 2. Use the Review option to review the document’s content. Don't forget to read the details.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Typically, the statute of limitations on consumer debt in NY has been six years. However, in November 2021, New York Gov. Kathy Hochul signed legislation to cut the statute of limitations on most debt from six years to three years.

Legal action for non payment is common in contract disputes.Legal Action for Non Payment.Determine Your Damages.Analyze the Other Party's Finances.Make a Formal Demand.Filing a Lawsuit.Obtaining Judgment.

Yes, u can sue your client. appropriate remedy for you is to file a suit for recovery. the case will be filed on the basis of your invoices, receipts and other documents available with you. the matter may take anything around 1.5-2 years.

In New York, the law that governs the statute of limitations states that a creditor has up to six years to seek repayment for a debt. After this time elapses, the creditor can't sue a debtor to collect the debt.

Remedies available under civil law:Order 37 of Civil Procedure Code: This order is a power given to the person who wants to recover his money. This order permits creditor to file a summary suit.Negotiable Instruments Act, 1881- This is act which deals with the non payment through cheque or bill of exchange etc.

10 Options When Your Clients Refuse To Pay YouResearch the client.Discuss before signing the contract.Send invoices right away.Send project completion summary from time to time.Invoice follow-ups.Document everything.Ask politely first.Charge Late Fees.More items...?

Statute of Limitations in New York Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system. The statute of limitations used to be six years.

Talk to a real lawyer about your legal issue. You may take legal recourse to recover the money for which firstly legal notice would be issued by your advocate and thereafter, a civil suit for recovery of due amount with interest would be filed on your behalf.

FILING AN INCOME EXECUTION The Creditor can file an Income Execution or wage garnishment to obtain a percentage of the Debtor's earnings to apply to the Judgment. The judgment creditor may contact the Sheriff's Civil Department for the procedure to file an income execution or wage garnishment.

Here are the steps to suing for non-payment of services:Send a Final Demand for Payment. Before taking any formal legal action, it's a good idea to send a final demand for payment to the client.Assess How Much You're Owed.Get Legal Advice.Consider Small Claims Court.Consider A Civil Lawsuit.