New York Co-Employee Applicant Appraisal Form

Description

How to fill out Co-Employee Applicant Appraisal Form?

If you need thorough, obtain, or create authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms available online.

Leverage the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by type and state, or keywords.

Employ US Legal Forms to quickly find the New York Co-Employee Applicant Appraisal Form in just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access all forms you acquired in your account. Click on the My documents section and select a form to print or download again.

Engage and acquire, and print the New York Co-Employee Applicant Appraisal Form with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the New York Co-Employee Applicant Appraisal Form.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

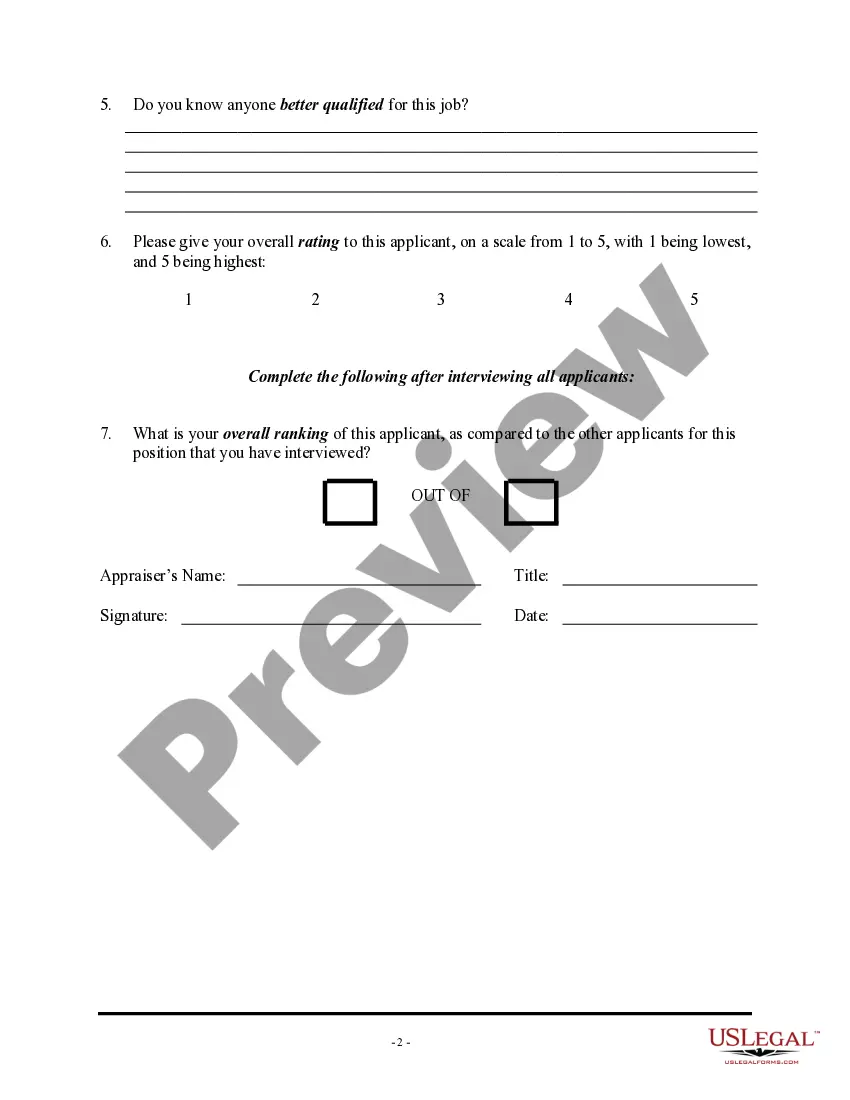

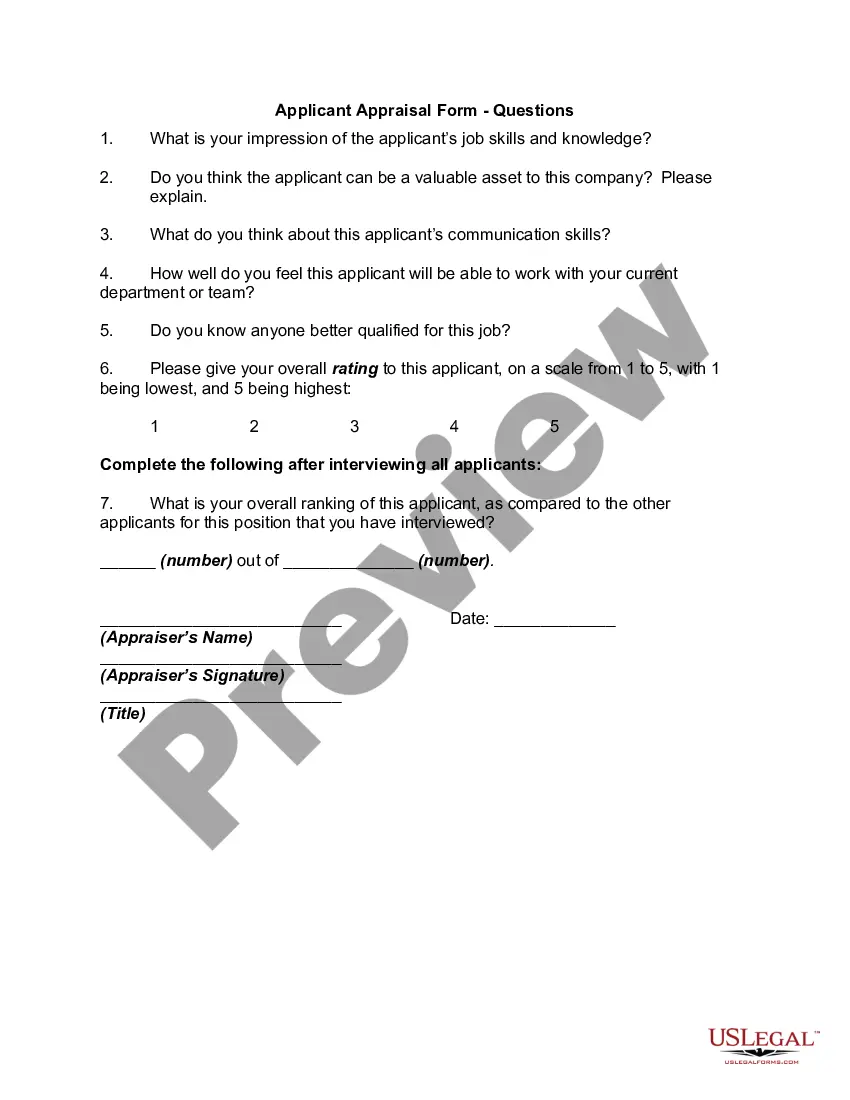

- Step 2. Use the Preview option to review the form's contents. Remember to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to explore other variations in the form design.

- Step 4. Once you have located the form you need, click the Buy now button. Choose a pricing plan that suits you and input your information to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Download the form from the legal document and save it to your device.

- Step 7. Fill out, modify, and print or sign the New York Co-Employee Applicant Appraisal Form.

Form popularity

FAQ

The New York Corrections Law Article 23-A prohibits an employer from unfairly discriminating against a person previously convicted of one or more criminal offenses. Article 23-A requires employers to evaluate qualified job seekers and current employees with conviction histories fairly and on a case-by-case basis.

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4. See Employee Withholding Forms. Employers in certain industries must obtain statements from new hires.

NYC Checklist for REQUIRED EMPLOYMENT. DOCUMENTATION and POSTERS for RESTAURANTS and BARS.New Hires.Paperwork to Complete.25a1 Employment application (signed and.2022 Do not accept photo.25a1 IRS Form W-4 (Employee's Withholding Allowance.Certificate) (signed and dated)25a1 NYS Department of Taxation and Finance Form.More items...

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

An employer may typically disclose a current or former employee's job title, the period of employment, salary amount, responsibilities, job performance, and whether they resigned or were terminated. There are no federal laws restricting what an employer can or cannot disclose, however, state laws may differ.

Employers are not prohibited by law from disclosing to a potential employer - who calls for a reference about a former employee - the reasons that the employee left, as long as the information they share is truthful.

If the company inquires further about salary, HR can give out that information as well, but it has the right to ask for express consent from the applicant. You do not have to give out any information whatsoever, including employment verification data and salary information.

Job title or position with the company. The reason the employee left the company. Salary information. Job performance.

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. The hiring date is the first day the employee: performs any services for which they will be paid wages, tips, commissions, or any other type of compensation.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.