The purpose of this form is to help the interviewer communicate his/her impression of a recent job applicant.

New York Applicant Appraisal Form - Questions

Description

How to fill out Applicant Appraisal Form - Questions?

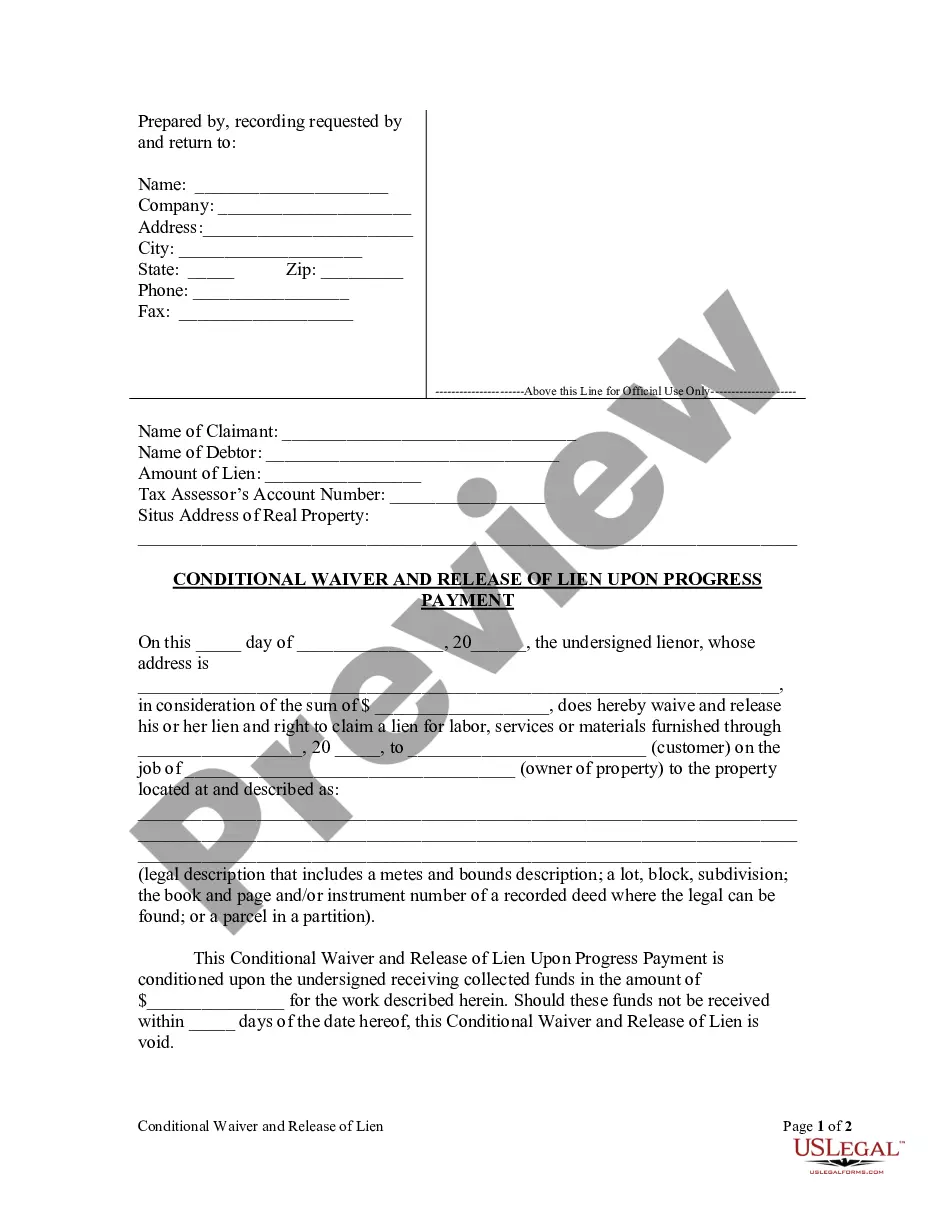

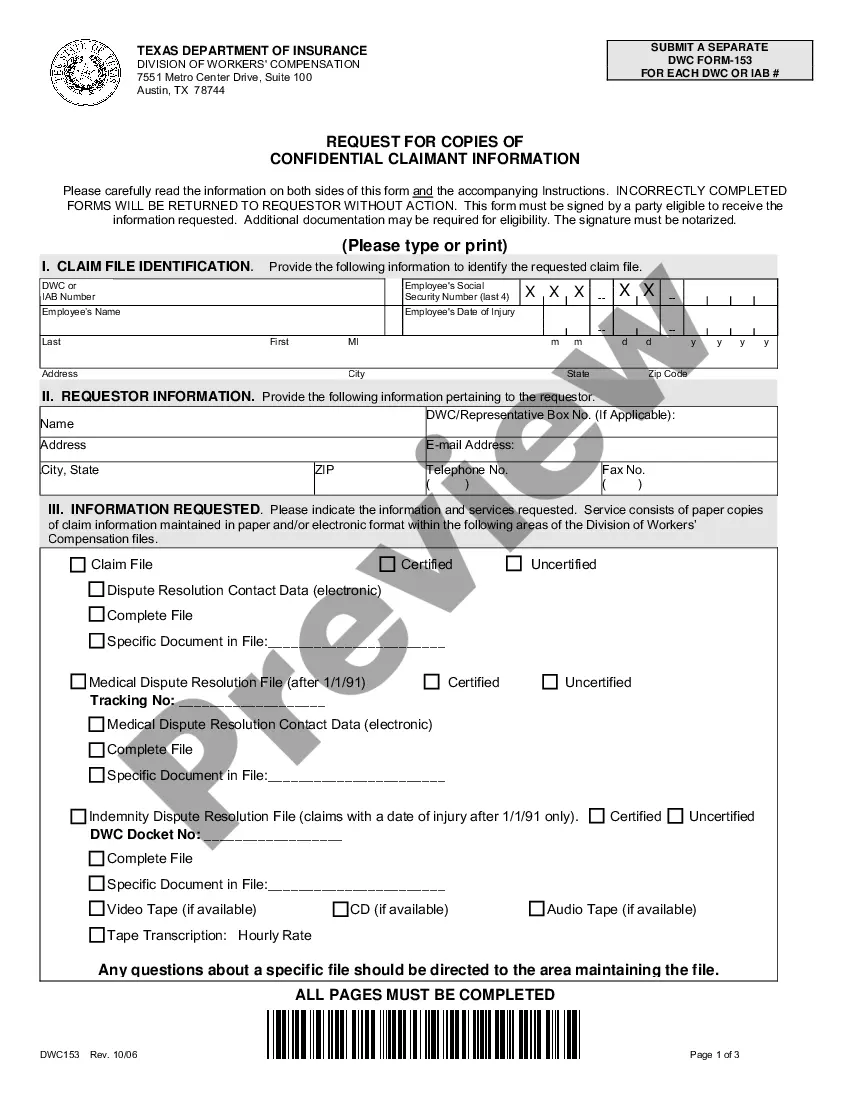

You can spend several hours online searching for the legal document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal documents that have been vetted by experts.

You can easily download or print the New York Applicant Appraisal Form - Questions from our service.

If available, use the Preview button to review the document template at the same time.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can fill out, edit, print, or sign the New York Applicant Appraisal Form - Questions.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

In an auditor appraiser interview, candidates might face inquiries regarding their experience with compliance and financial reporting. Interviewers may ask about your techniques in identifying discrepancies and valuing properties accurately. Also, be ready to discuss real-life auditing scenarios and how you ensure accuracy and fairness in your evaluations. These experiences directly relate to understanding the complexities within the New York Applicant Appraisal Form - Questions.

Yes, a residential appraiser can appraise a mixed-use property, provided they have the requisite knowledge and experience. However, the valuation may include both residential and commercial considerations, making it essential for the appraiser to understand the dynamics of both sectors. Such expertise ensures that all aspects are correctly evaluated for the New York Applicant Appraisal Form - Questions.

An appraisal interview often includes scenarios where the interviewer presents you with a specific property type and asks how you would approach its valuation. For example, you could be tasked with valuing a suburban office complex, and the interviewer would seek your thought process in determining its worth. These examples help highlight your problem-solving skills and understanding of the New York Applicant Appraisal Form - Questions.

In a property valuation interview, you may be asked about the property’s age, condition, and location. The interviewer might also inquire about recent improvements made to the property and its prior sale history. Additionally, they may ask about comparable properties in the area and any zoning regulations that could affect its value. Understanding these aspects will help clarify the New York Applicant Appraisal Form - Questions.

You can become an appraiser relatively quickly, depending on your dedication to completing the required education and obtaining hours of experience. If you focus on your studies and find a mentor for practical hours, it’s possible to start working as an appraiser in under a year. Additionally, familiarizing yourself with the New York Applicant Appraisal Form - Questions streamlines your progression towards becoming a certified appraiser.

The income for an appraiser per house varies significantly based on location, experience, and the complexity of the property. On average, appraisers can earn between $300 to $500 per residential appraisal. Understanding the local market and building a solid portfolio can enhance your earning potential. The New York Applicant Appraisal Form - Questions may also provide insights on how to maximize your appraising career.

Becoming an appraiser in New York online is possible through various accredited institutions that offer online courses. You can complete required education remotely, allowing for flexibility in scheduling. After finishing the courses, you still need to gain practical experience and submit the New York Applicant Appraisal Form. This digital approach offers convenience while you pursue your appraisal career.

The timeline to become an appraiser in New York varies based on the level of certification you seek. Generally, it can take anywhere from six months to several years to fulfill educational and experience requirements. Completing courses quickly speeds up the process, but practical experience is crucial. Understanding the New York Applicant Appraisal Form - Questions can help clarify the specific steps you need to take.

To become a property appraiser in New York, you must complete specific educational requirements and gain practical experience. Start by completing a pre-licensing course that covers appraisal principles and practices. After obtaining the necessary hours of experience and passing the exam, you can apply for the New York Applicant Appraisal Form. This form is essential for your licensing process.

You can challenge an appraisal if you believe it is inaccurate. To do so, provide a well-documented case with supporting evidence, such as recent sales data, to your lender or the appraisal company. Familiarize yourself with the New York Applicant Appraisal Form - Questions to ensure you cover all relevant points when presenting your challenge. Utilizing platforms like uslegalforms can guide you through this process efficiently.