New York Clubhouse Attendant Checklist

Description

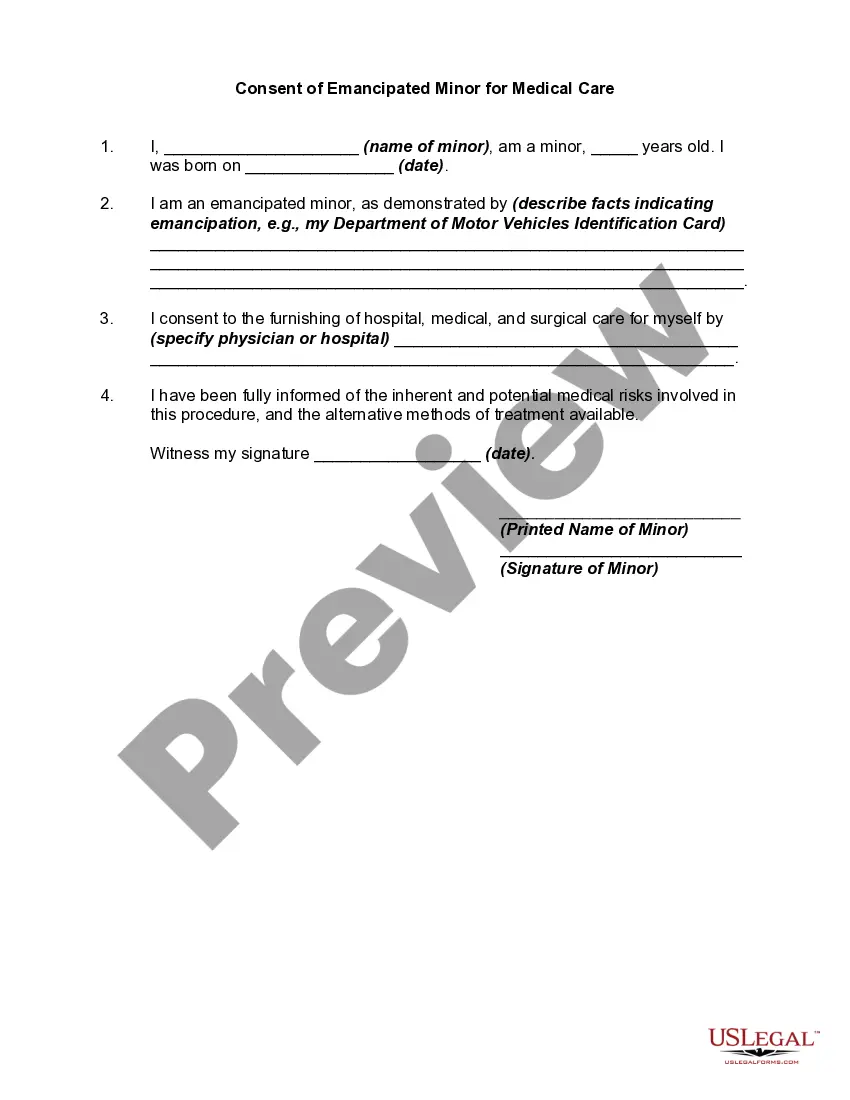

How to fill out Clubhouse Attendant Checklist?

Locating the appropriate legal document format can pose a challenge. Clearly, there is a multitude of templates accessible online, but how can you identify the specific legal form you require.

Utilize the US Legal Forms platform. The service offers thousands of templates, such as the New York Clubhouse Attendant Checklist, which can be applied for personal and business needs. All forms are vetted by experts and comply with federal and state regulations.

If you are currently registered, Log Into your account and then click the Obtain button to download the New York Clubhouse Attendant Checklist. Use your account to search for the legal documents you may have ordered previously. Navigate to the My documents tab in your account to retrieve another copy of the document you require.

Choose the document format and download the legal document format to your device. Fill out, modify, print, and sign the acquired New York Clubhouse Attendant Checklist. US Legal Forms boasts the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally-crafted documents that meet state requirements.

- To begin with, ensure you have chosen the correct form for your region/state.

- You can preview the form using the Review button and examine the form overview to make sure it is suitable for your needs.

- If the form does not meet your specifications, utilize the Search field to locate the appropriate form.

- Once you are confident that the form suits your needs, proceed by clicking the Buy now button to acquire the form.

- Select the pricing plan you require and fill in the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

The self-employment tax in NYC includes both Social Security and Medicare taxes, applied to your net earnings. This tax is typically around 15.3%, which comprises 12.4% for Social Security and 2.9% for Medicare. The New York Clubhouse Attendant Checklist can support you in calculating this tax accurately based on your earnings.