New York FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule

Description

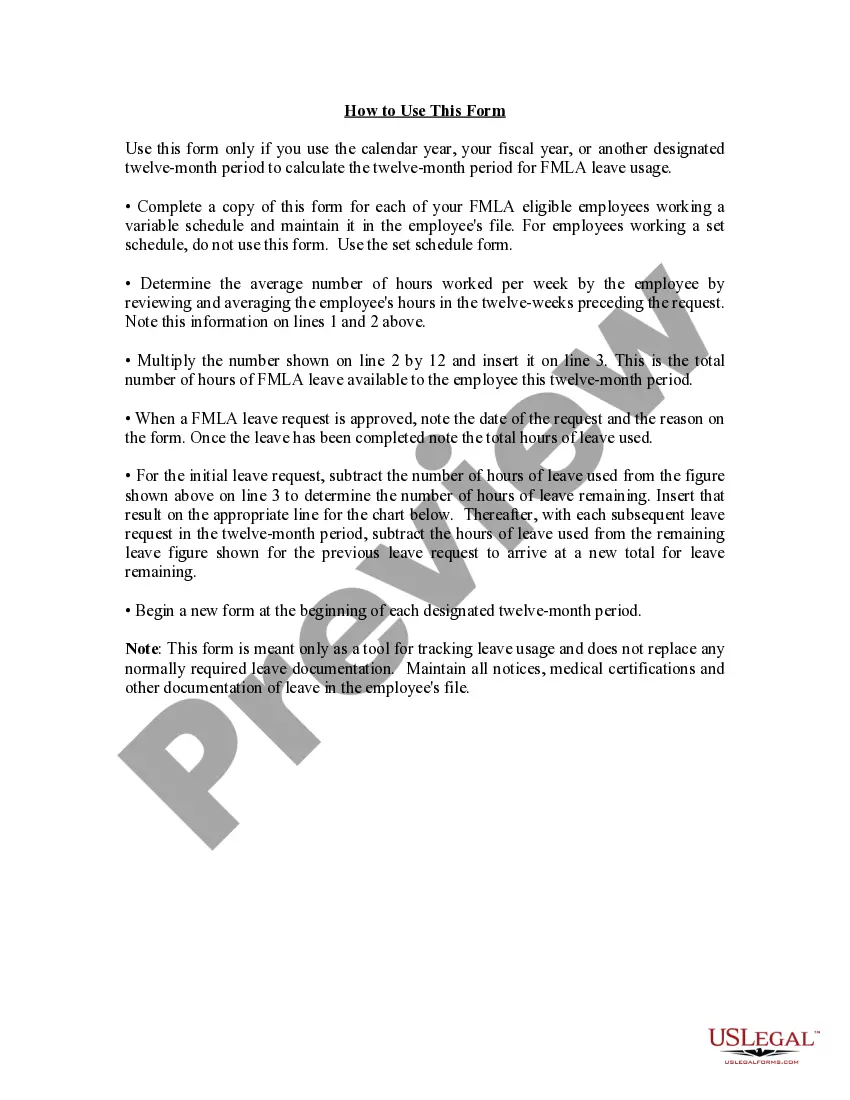

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Variable Schedule?

You might devote numerous hours online attempting to locate the legal document template that satisfies the federal and state requirements you desire. US Legal Forms offers countless legal templates that have been reviewed by experts.

It is easy to download or print the New York FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule from your account.

If you possess a US Legal Forms account, you can Log In and click the Acquire button. After that, you can fill out, modify, print, or sign the New York FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule. Every legal document template you purchase is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to your document as needed. You may fill out, revise, sign, and print the New York FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Variable Schedule. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal templates. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/region of your preference. Review the document description to confirm you have chosen the right template.

- If available, utilize the Review button to preview the document template as well.

- To find another version of the form, utilize the Search field to locate the template that fits your needs and requirements.

- Once you have located the template you require, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your information, and register for an account on US Legal Forms.

Form popularity

FAQ

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

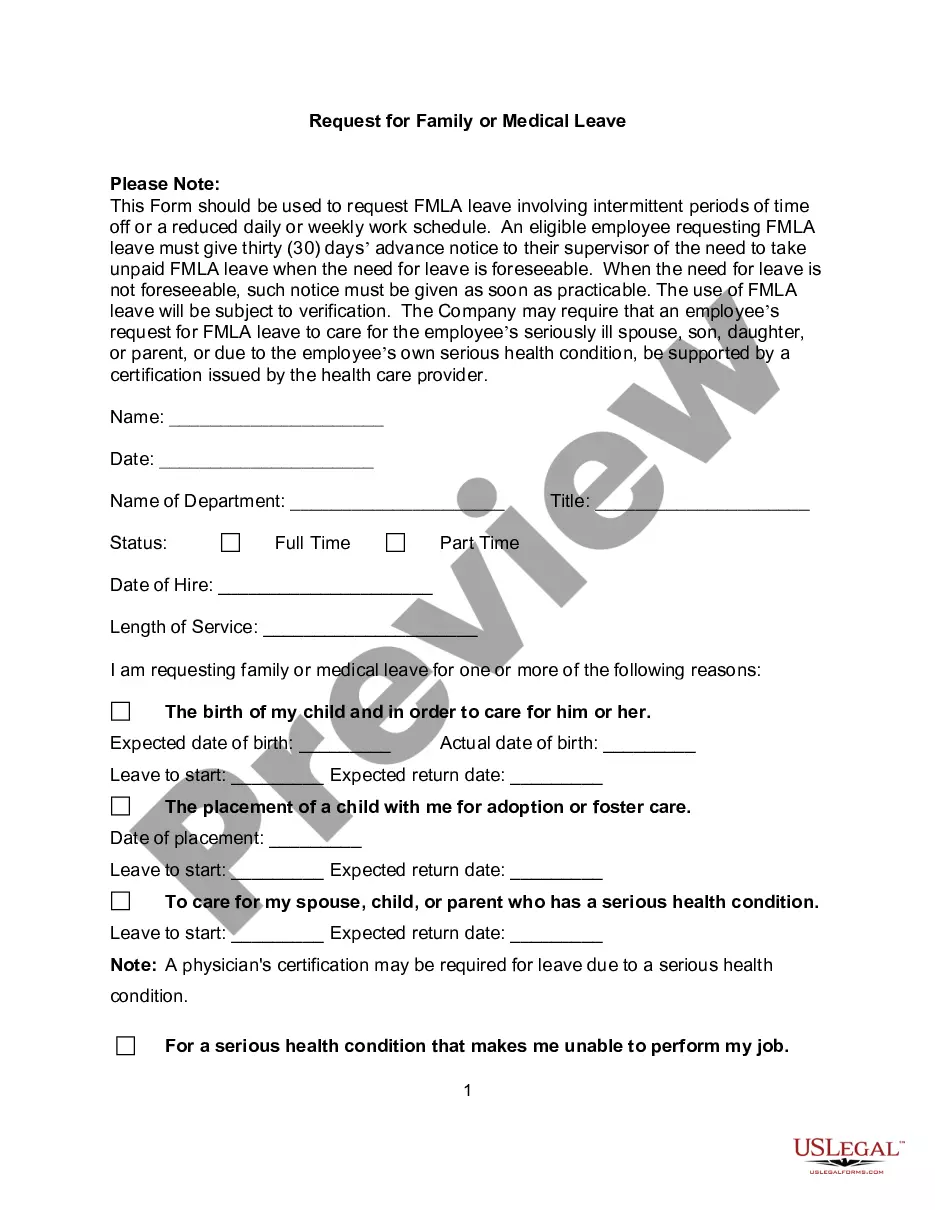

The FMLA, or Family and Medical Leave Act, is a federal law that allows certain employees working for covered employers to take up to 12 weeks of unpaid leave during each 12-month period. The 12-week allowance resets every 12 months, so in a sense, FMLA continues each year.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

Records pertaining to FMLA leave Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted.