New York Returned Items Report

Description

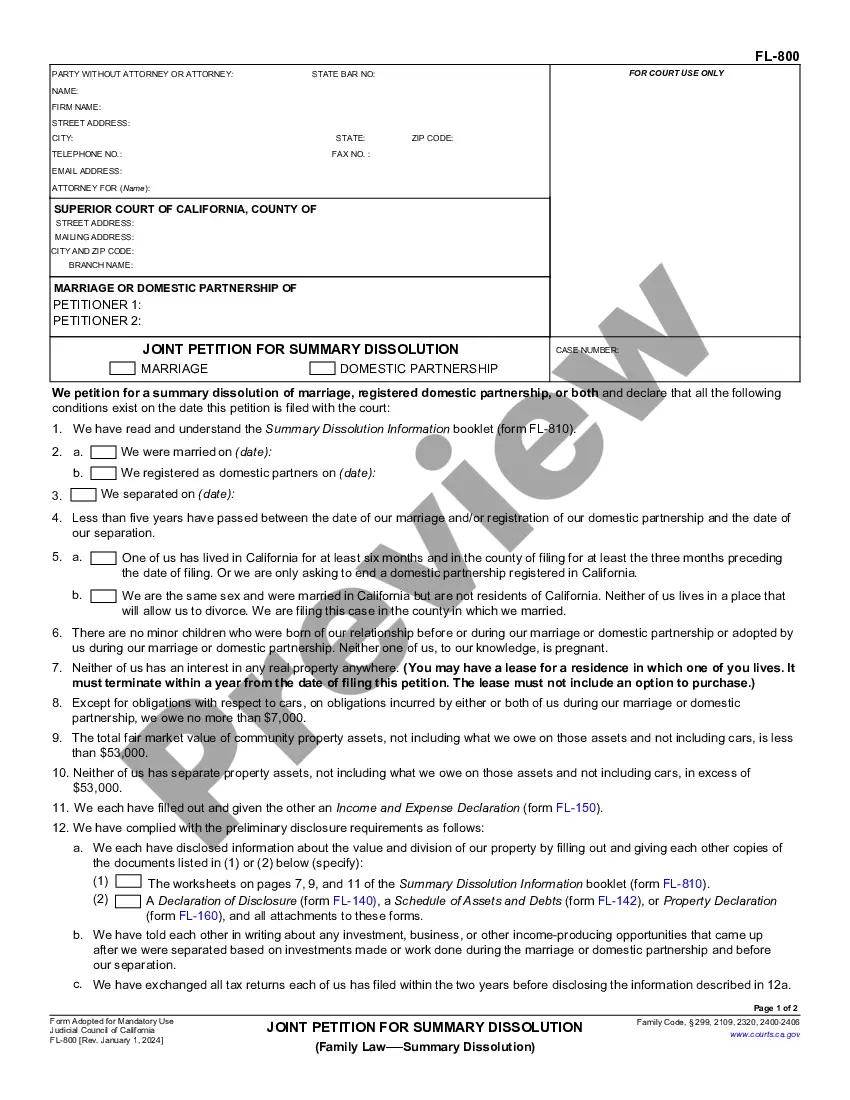

How to fill out Returned Items Report?

Have you found yourself in a situation where you need to obtain documents for both business or personal reasons almost every workday? There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the New York Returned Items Report, that are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the New York Returned Items Report template.

- Acquire the form you need and ensure it is for the appropriate city/region.

- Utilize the Review button to evaluate the document.

- Examine the description to confirm that you have selected the correct form.

- If the document is not what you are seeking, use the Search field to find the template that suits your needs and requirements.

- Once you find the correct template, click Buy now.

- Select the pricing plan you prefer, fill out the required information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms. TaxSlayer will handle most of this automatically.

That have resident partners Submit a Form IT-204-IP for each Article 22 resident partner (you do not have to submit Form IT-204-IP for nonresident partners) and for each partner that is a partnership or LLC. Submit a Form IT-204-CP for each corporate partner that is taxable under Article 9-A.

Complete Form IT-558 and submit it with your return to report any New York State addition and subtraction adjustments required to recompute federal amounts using the rules in place prior to any changes made to the IRC after March 1, 2020.

New York's fiscal 2021 budget decoupled the state's personal income tax from any amendments made to the IRC after March 1, 20202 including changes under the Coronavirus Aid, Relief, and Economic Security Act (P.L. 116-36) and any other federal amendments to the IRC.

Yes, the NY Form IT-558 is required to report any New York State addition and subtraction adjustments required to re-compute federal amounts using the rules in place prior to any changes made to the Internal Revenue Code after March 1, 2020.

General information. Complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return.

Form IT-225 is used for New York additions and/or subtractions that do not have a separate line on your return.

New York State Charitable Gifts Trust Fund Starting in 2018, donating taxpayers may claim a deduction on their New York State income tax returns equaling the full donation amount of any contribution for the tax year in which the donation is made.

If you received a W-2 for a job which you worked some days in New York and some days outside of New York, you must complete NY IT-203B Schedule A - Allocation of wage and salary income to New York State to adjust the State wage amounts.

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.