New York Purchasing Cost Estimate

Description

How to fill out Purchasing Cost Estimate?

Are you currently in a situation where you require documentation for either business or personal needs nearly every day? There are numerous legal document templates accessible online, but finding reliable ones can be challenging. US Legal Forms offers thousands of form templates, including the New York Purchasing Cost Estimate, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New York Purchasing Cost Estimate template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/state.

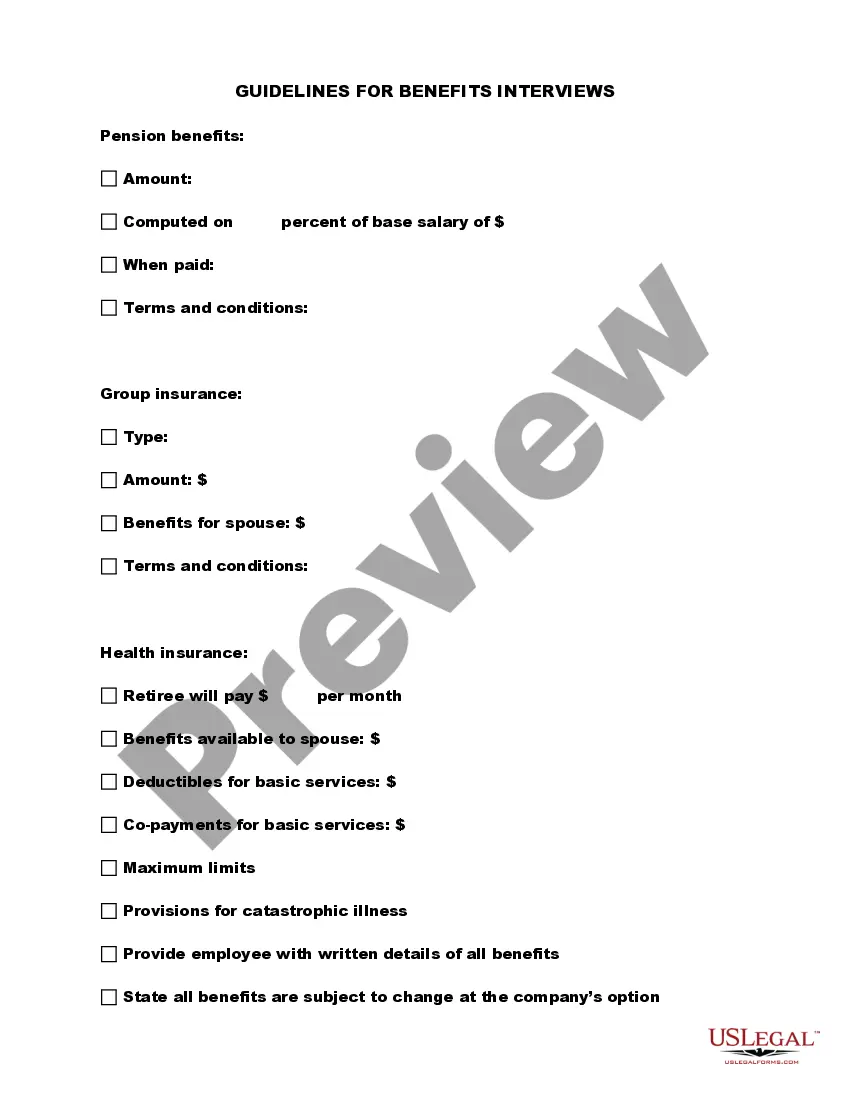

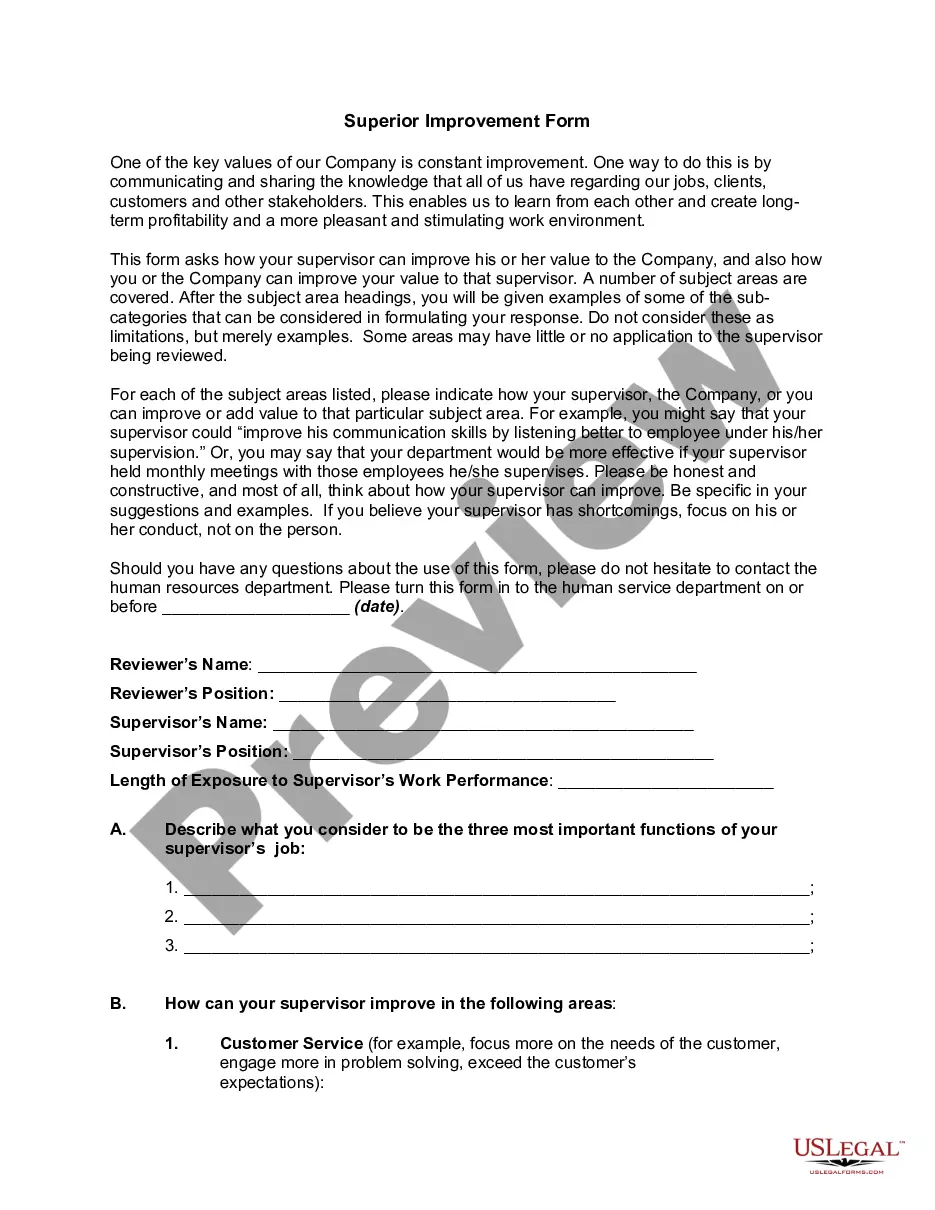

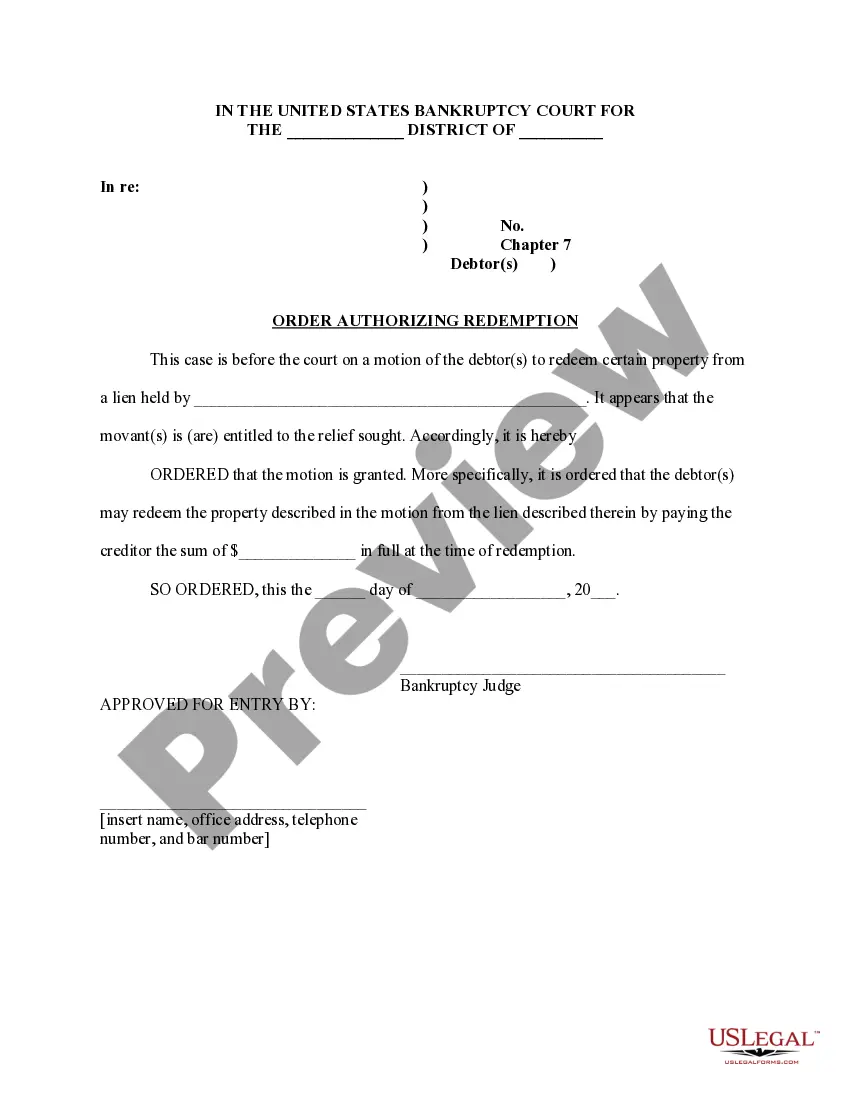

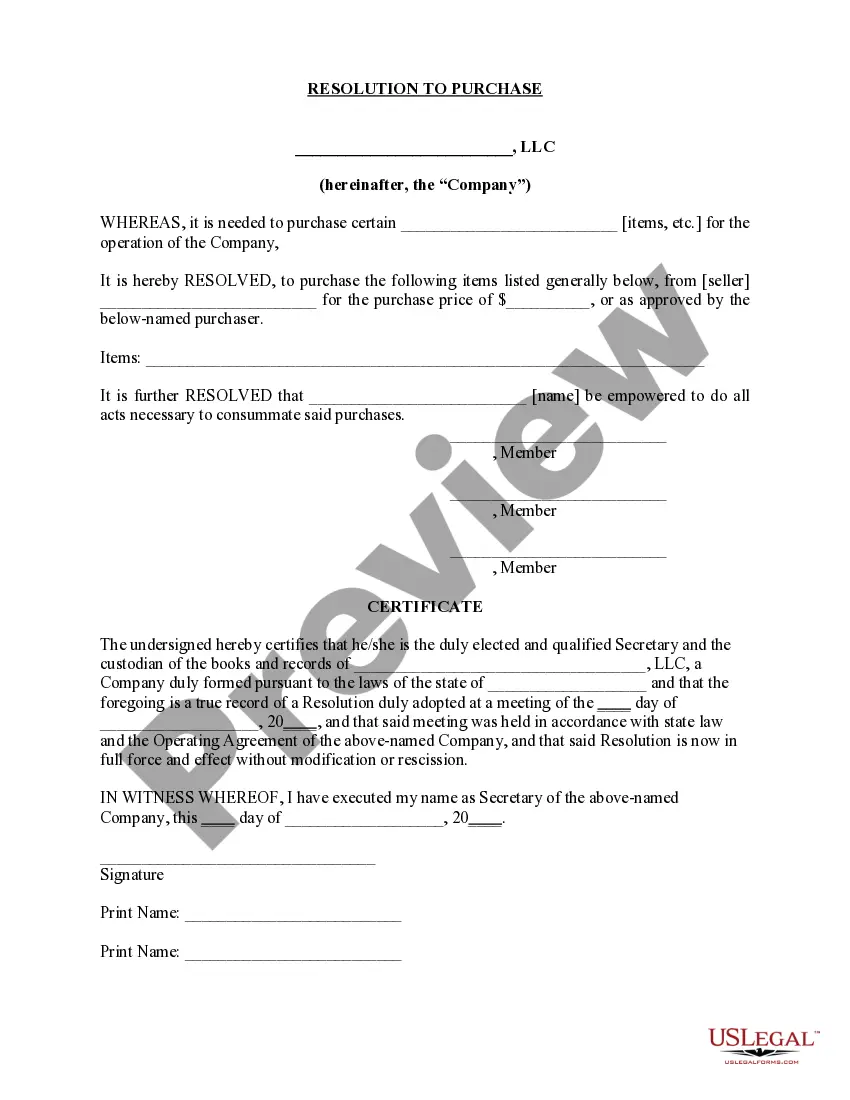

- Use the Preview feature to review the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search bar to find the form that fits your needs and criteria.

- Once you find the right form, click Purchase now.

- Select the payment plan you prefer, fill in the required details for your payment, and complete your purchase using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Average closing costs in NY for the buyer are between 1.5% and 5% of the purchase price. How much are closing costs for the seller in NY? Unfortunately, they are slightly higher that the costs for buyers, ranging from 8% to 10% for sellers.

Are Buyer Closing Costs Tax Deductible? The short answer is no - most buyer closing costs are not tax deductible. Taxes such as the mansion tax and mortgage recording tax may be added to your cost basis and thus shield capital gains when you sell.

How Much Are Closing Costs in New York? Closing costs in New York average $8,256 for a home loan of $352,314, or 2.34 percent of the home loan, according to a 2021 report by ClosingCorp, which researches residential real estate data.

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.

So, in most cases, sellers pay as much and maybe more than buyers. Closing costs are paid in cash at the time of closing. You'll pay higher closing costs if you choose to buy discount points and also referred to as prepaid interest points or mortgage points, but the trade-off is a lower interest rate on your loan.

Average Closing Costs in NY for Buyer Average closing costs in NY for the buyer are between 1.5% and 5% of the purchase price. How much are closing costs for the seller in NY? Unfortunately, they are slightly higher that the costs for buyers, ranging from 8% to 10% for sellers.

The median price of homes currently listed on the market is a whopping $779,000, according to Zillow. The median asking price of Manhattan homes in November 2019 was $1.6 million, according to StreetEasy's Price Index metric; in Brooklyn, it was a little over $969,000.

Why are NYC condo closing costs higher? It's a double whammy, condos cost more in price terms and they also have higher real estate closing costs! The reason is that when you are purchasing a condo with a mortgage you a required to pay a mortgage recording tax and typically required to purchase title insurance.

Closing Costs in New York Costs can include lender fees, appraisals, inspection, attorney, credit check, title search, title insurance, homeowner's insurance, transfer taxes (in some cases), mansion tax (if over $1 mil.), prepaid property taxes, prepaid interest, and mortgage or discount points.

Closing costs typically range from 3%6% of the home's purchase price. 1 Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so it's important to pay close attention to these fees.