New York Independent Developer or Contractor Agreement

Description

How to fill out Independent Developer Or Contractor Agreement?

Are you in a situation where you require documents for either business or personal reasons almost every day? There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the New York Independent Developer or Contractor Agreement, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the New York Independent Developer or Contractor Agreement template.

- Locate the form you need and ensure it is for the right location/state.

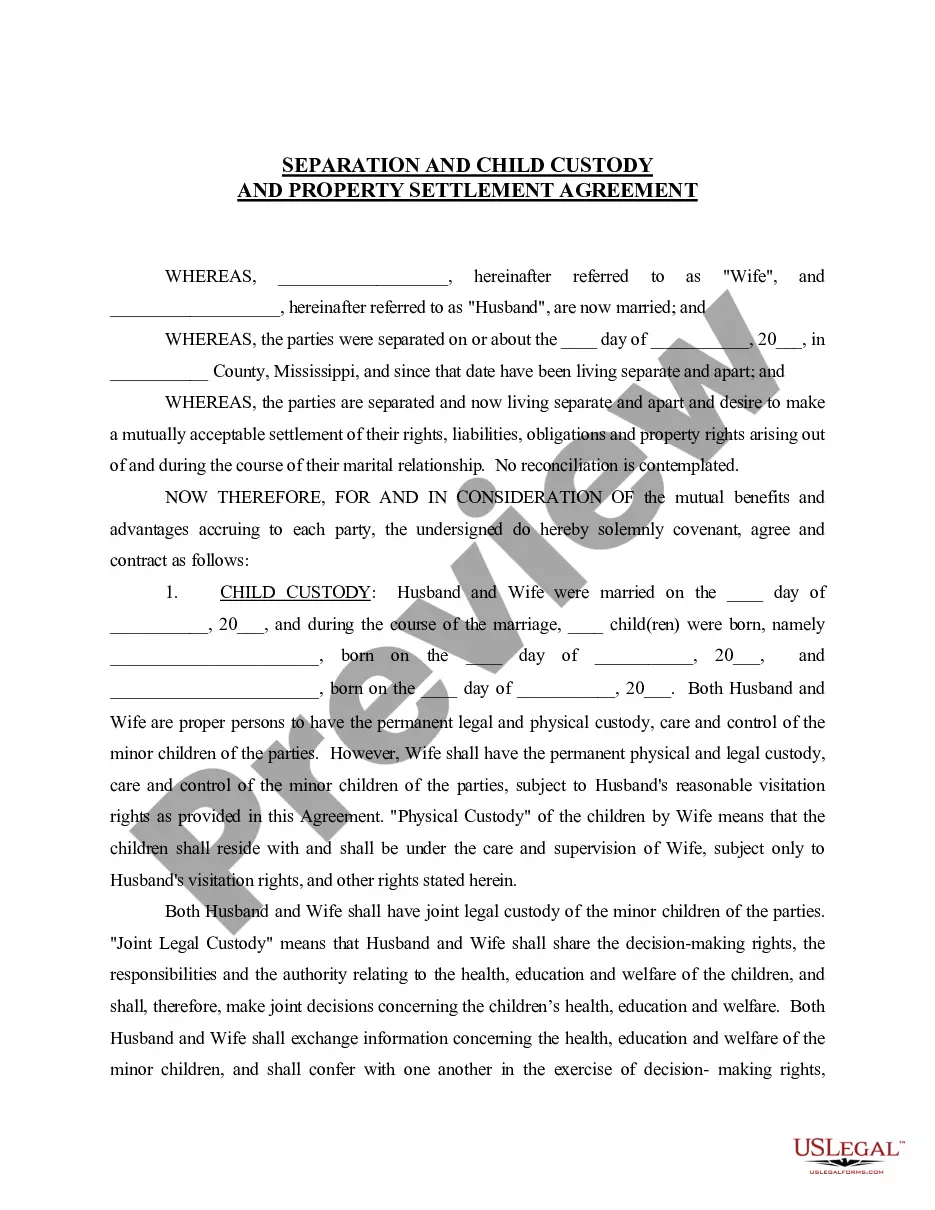

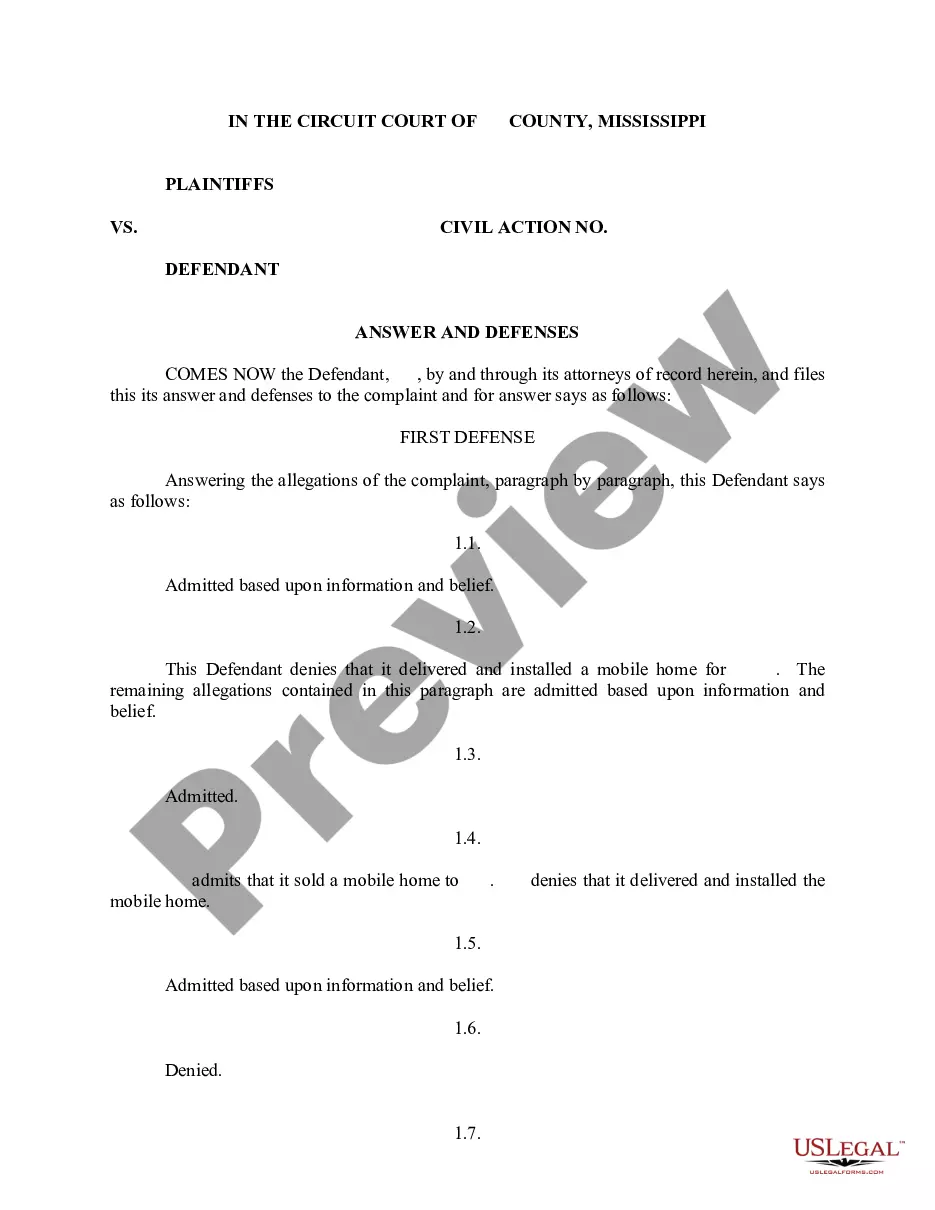

- Use the Preview option to review the document.

- Check the details to be sure you have chosen the correct form.

- If the document doesn't meet your needs, utilize the Lookup field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click on Buy now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using PayPal or credit card.

- Choose a convenient file format and download your version.

Form popularity

FAQ

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

It is important to understand that there is a massive difference between 1099 Independent Contractors and W-2 employment on contract basis, who we often refer to simply as contractors. Independent Contractors are truly independent. No one is paying the employer share of taxes such as Social Security and Medicare.

Herigstad says the tax responsibilities are a main reason for a contractor to get more pay than an employee typically 25% to 30% more.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?