New York Guaranty with Pledged Collateral

Description

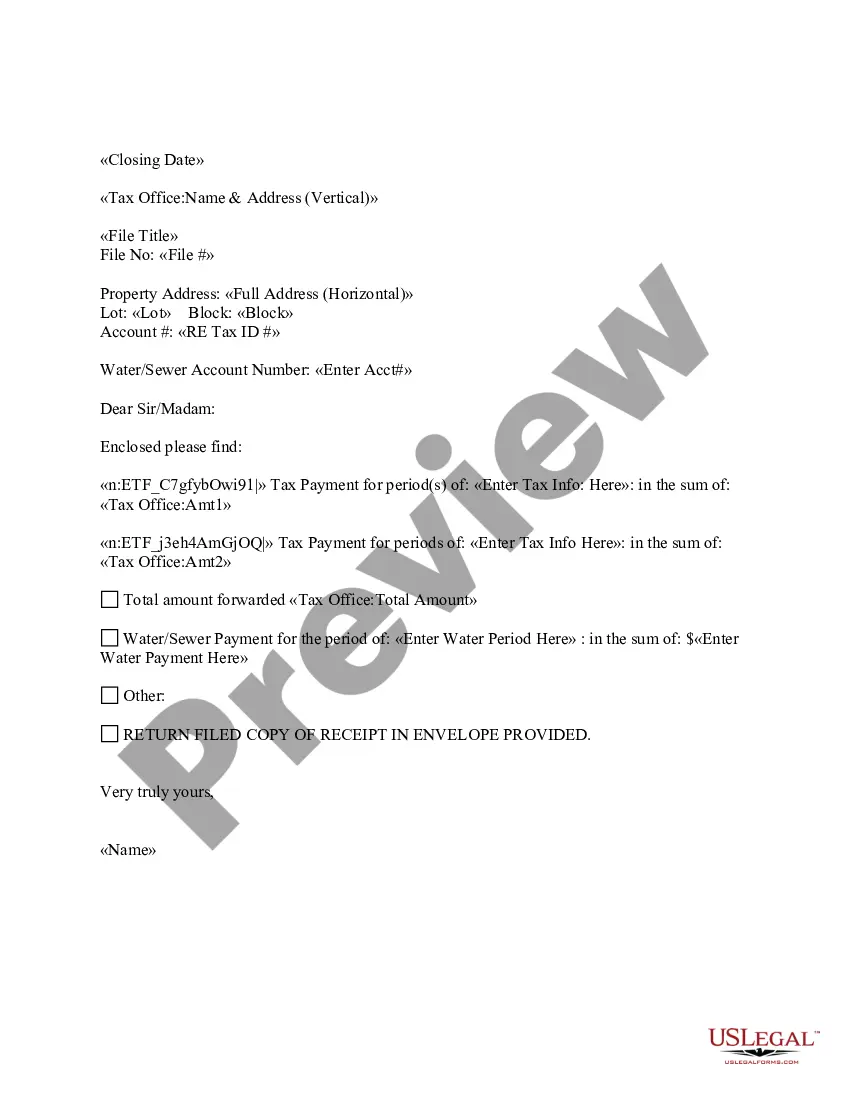

How to fill out Guaranty With Pledged Collateral?

Are you currently in a scenario where you require documents for either business or personal uses almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, such as the New York Guaranty with Pledged Collateral, designed to comply with federal and state requirements.

Once you locate the suitable form, click on Get now.

Choose the pricing plan you prefer, provide the necessary information to process your payment, and complete the transaction using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. Access all the document templates you have purchased from the My documents section. You can obtain an additional copy of the New York Guaranty with Pledged Collateral anytime, if needed. Simply select the desired form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New York Guaranty with Pledged Collateral template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/county.

- Utilize the Preview feature to review the form.

- Verify the details to confirm you have selected the correct form.

- If the form does not meet your requirements, make use of the Search bar to find the form that suits your needs.

Form popularity

FAQ

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

More Definitions of Collateral Guarantee Collateral Guarantee means a guarantee and indemnity to be executed by the Collateral Guarantor in favour of the Lender in form and substance acceptable to the Lender in all respects.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

A secured line of credit is guaranteed by collateral, such as a home. An unsecured line of credit is not guaranteed by any asset; one example is a credit card.

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

Banks must pledge securities when they borrow from the Federal Reserve's discount window. The discount window is a central bank lending facility meant to help commercial banks manage short-term liquidity needs.