New York Specific Guaranty

Description

How to fill out Specific Guaranty?

Finding the appropriate format for legal documents can be challenging.

Indeed, there are numerous templates accessible online, yet how do you secure the legal document you need.

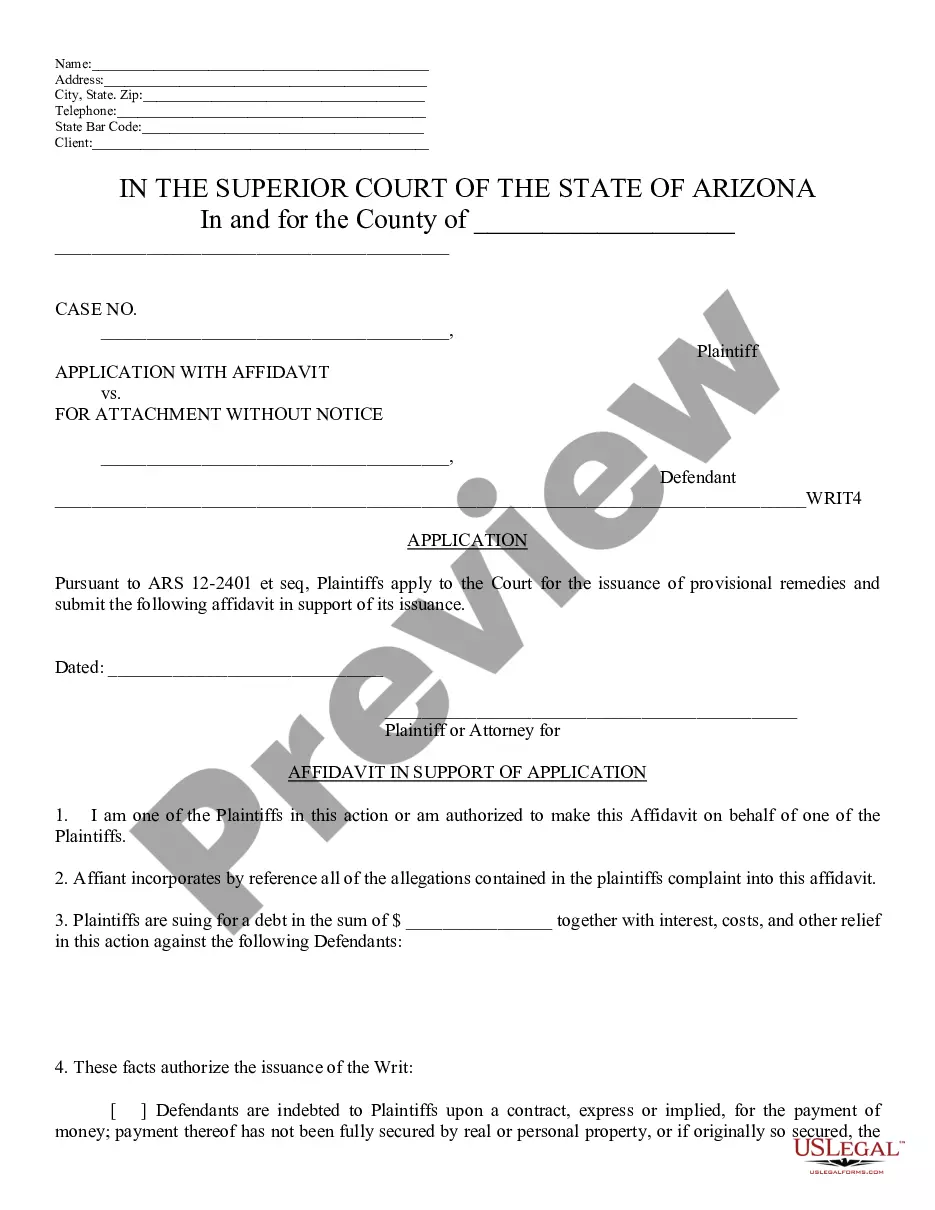

Utilize the US Legal Forms website. The platform offers a vast collection of templates, including the New York Specific Guaranty, suitable for business and personal purposes.

You can preview the form using the Preview option and read the form description to confirm it is the correct one for your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and select the Acquire button to access the New York Specific Guaranty.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your area.

Form popularity

FAQ

To serve an insurance company in New York, you generally follow specific legal procedures to ensure the company receives your documents properly. This often involves delivering the documents directly to the company’s designated agent as stipulated in the New York Specific Guaranty provisions. It’s essential to comply with these protocols to avoid any complications in your legal matters. If you need assistance with this process, our platform offers detailed information and templates that simplify serving legal notices to insurance companies.

Section 4119 of the New York Insurance Law establishes the New York Specific Guaranty, which ensures the protection of policyholders in the event of an insurance company's insolvency. This section outlines the requirements and provisions that insurance companies must adhere to in order to provide a safety net for their clients. By understanding this section, you can better appreciate how New York's legal framework safeguards your interests. For those seeking guidance, our platform provides comprehensive resources about insurance regulations in New York.

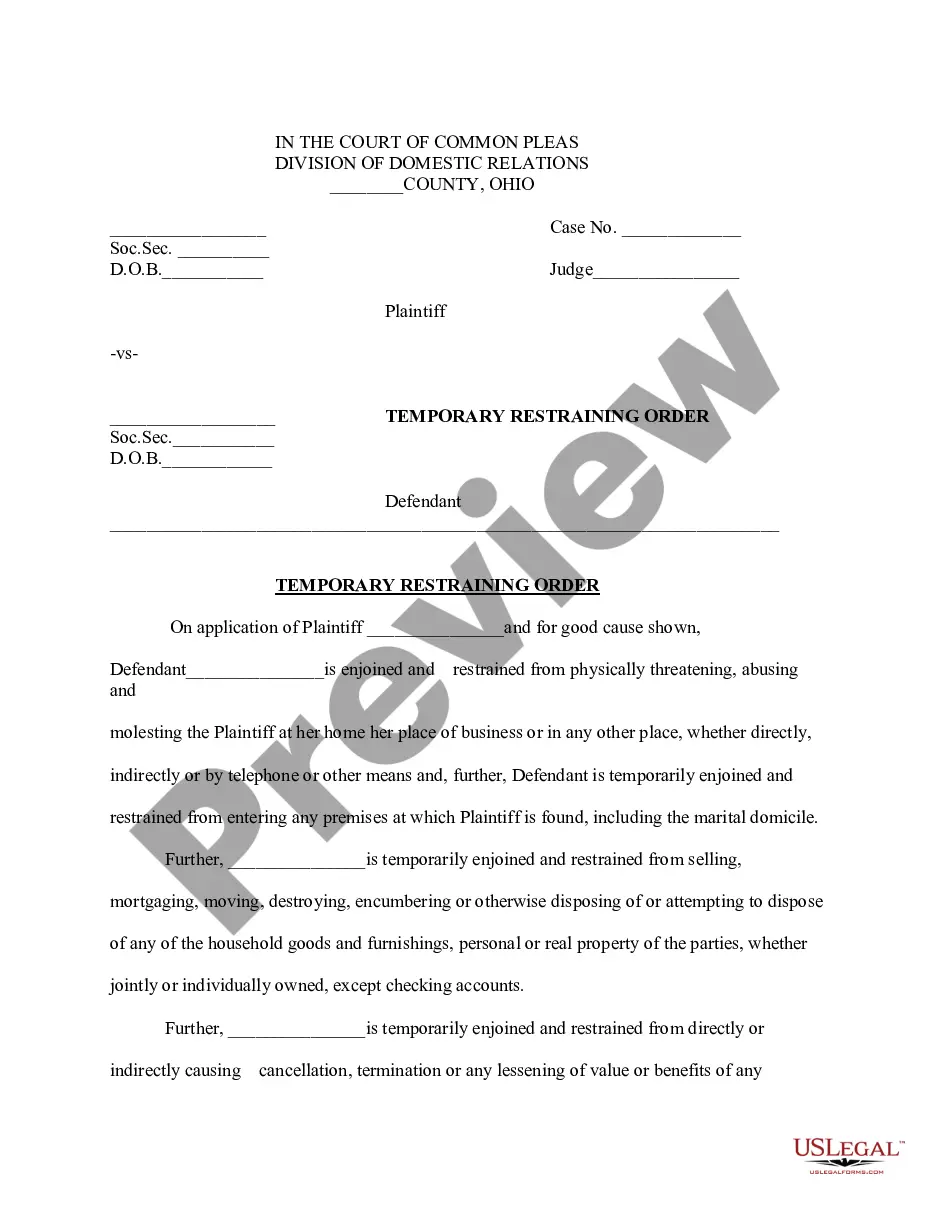

The guaranty of a lease is an assurance that one party, the guarantor, will fulfill the lease obligations if the tenant does not. This guaranty often provides landlords with a safety net, especially if the tenant has a limited credit history. When you leverage a New York Specific Guaranty, it creates a more secure rental arrangement, benefiting both tenants and landlords.

The New York coverage for all bill is a legal mechanism that provides consumers protection against non-payment or bankruptcies related to various debts. This coverage assures individuals that funds will be available even in dire financial situations. When considering agreements like the New York Specific Guaranty, it's important to ensure that your financial obligations are covered under this kind of protective law.

Section 312 of the New York insurance law outlines the requirements for guaranty associations in New York. This section mandates that insurance companies maintain certain financial standards to protect policyholders. Understanding this law is critical for anyone involved in New York Specific Guaranty agreements, as it affects the stability and reliability of insurance products.

A landlord's lease guarantees certain rights and obligations under the New York Specific Guaranty framework. It ensures the landlord will receive timely rent payments and allows them to enforce terms if a tenant breaches the lease. Both parties benefit from clarity in these guarantees, as they help to set expectations and provide legal recourse if issues arise.

The guaranty law in New York City pertains to agreements that ensure financial responsibility for obligations under a lease. This law protects landlords by allowing them to seek compensation from the guarantor if the tenant fails to meet their lease terms. Understanding the New York Specific Guaranty helps tenants and landlords navigate these agreements more effectively.

The financial guaranty law in New York outlines the responsibilities and limitations of financial guarantors when it comes to securing debts or obligations. This law ensures clarity in how financial guarantees function, providing protection for all parties involved. By grasping the implications of the New York Specific Guaranty, individuals can better navigate their financial agreements. Uslegalforms can provide the necessary documentation to ensure compliance with these laws.

To get a guarantor in New York City, you typically need to approach a person with good credit history who is willing to back your financial commitments. Many landlords and financial institutions will require a guarantor to co-sign leases or loans as a reassurance of timely payments. Understanding the legal elements of a New York Specific Guaranty can help both parties know their rights and obligations. For forms and guidance on establishing this relationship, uslegalforms is a useful resource.

The new law in New York regarding car insurance focuses on enhancing consumer protection and adjusting the minimum coverage requirements. This legislation aims to ensure that drivers carry adequate coverage and understand their financial responsibilities after an accident. By being aware of the New York Specific Guaranty, drivers can better protect themselves and their assets. For further clarification and to find forms that comply with these new laws, visit uslegalforms.