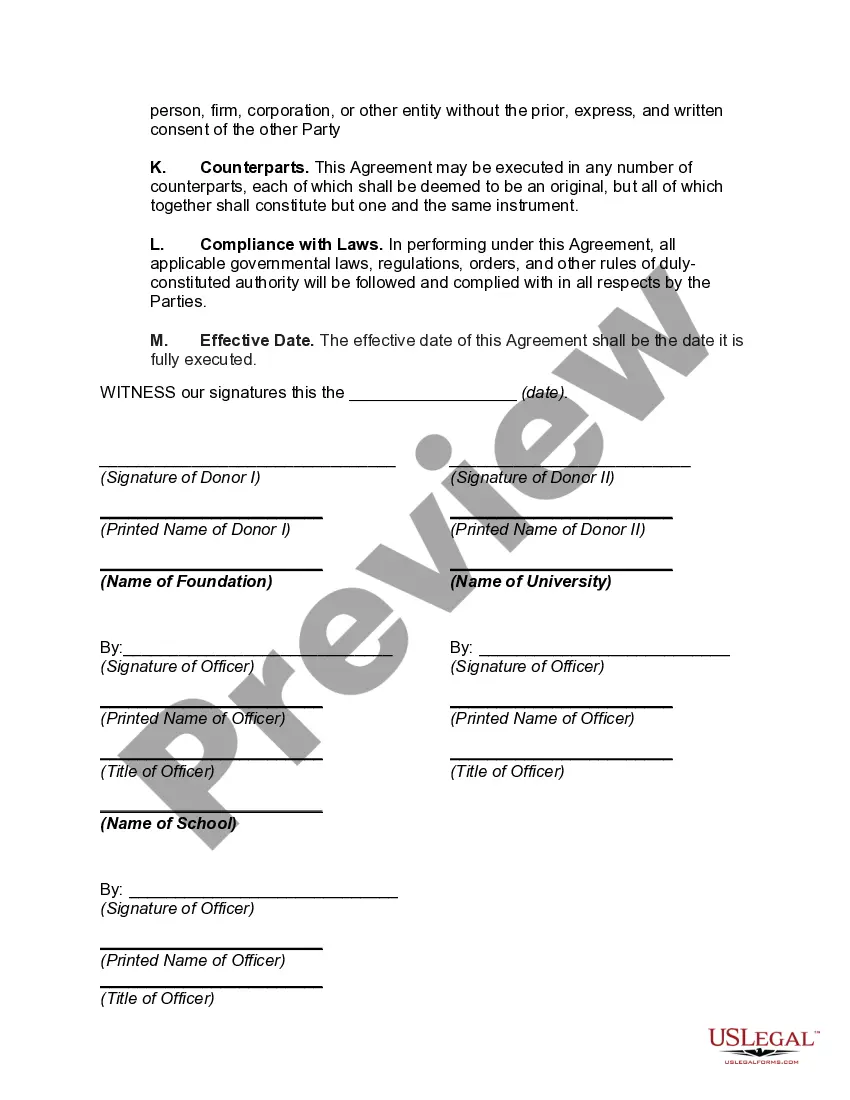

New York Gift Agreement Between Donors and University Foundation with Purpose of Gift to Construct Building to be Named after Donors

Description

How to fill out Gift Agreement Between Donors And University Foundation With Purpose Of Gift To Construct Building To Be Named After Donors?

You can spend significant time online trying to locate the valid document template that fulfills the state and federal requirements you have.

US Legal Forms provides a vast selection of valid forms that are evaluated by experts.

You can readily obtain or print the New York Gift Agreement Between Donors and University Foundation with Purpose of Gift to Construct Building to be Named after Donors through my assistance.

You can browse numerous document templates through the US Legal Forms site, which offers the largest variety of valid forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire option.

- After that, you can complete, modify, print, or sign the New York Gift Agreement Between Donors and University Foundation with Purpose of Gift to Construct Building to be Named after Donors.

- Every valid document template you receive is your property indefinitely.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choosing.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

To write the perfect donation request letter, follow these simple steps:Start with a greeting.Explain your mission.Describe the current project/campaign/event.Include why this project is in need and what you hope to accomplish.Make your donation ask with a specific amount correlated with that amount's impact.

Include a note with your donation that identifies the person for whom you are making the donation, including contact information. This allows the charity to send a card or certificate to that person, letting him know that someone has made a donation on his behalf.

Letter templateDear Donor's Preferred Name, I can't tell you how much all of us at nonprofit name appreciate your contribution to our cause. Thanks to your donation of amount, we'll be able to list out specific goals, objectives, etc..

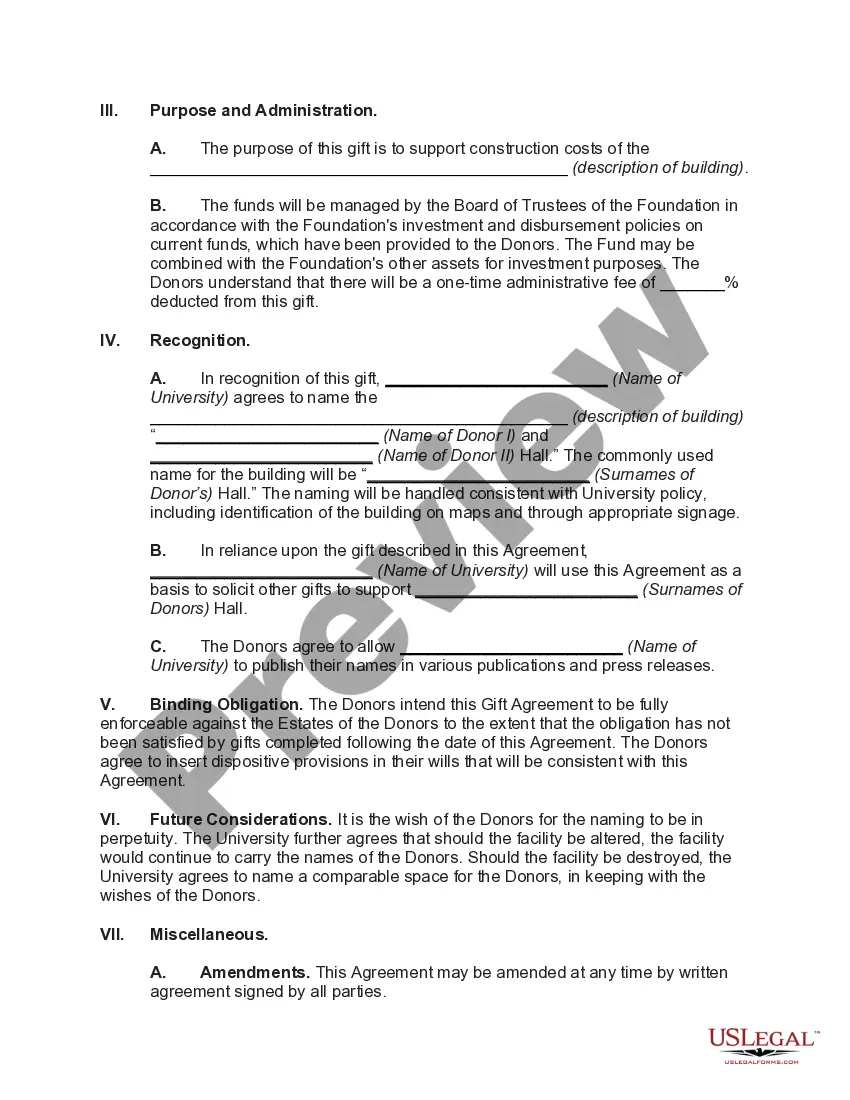

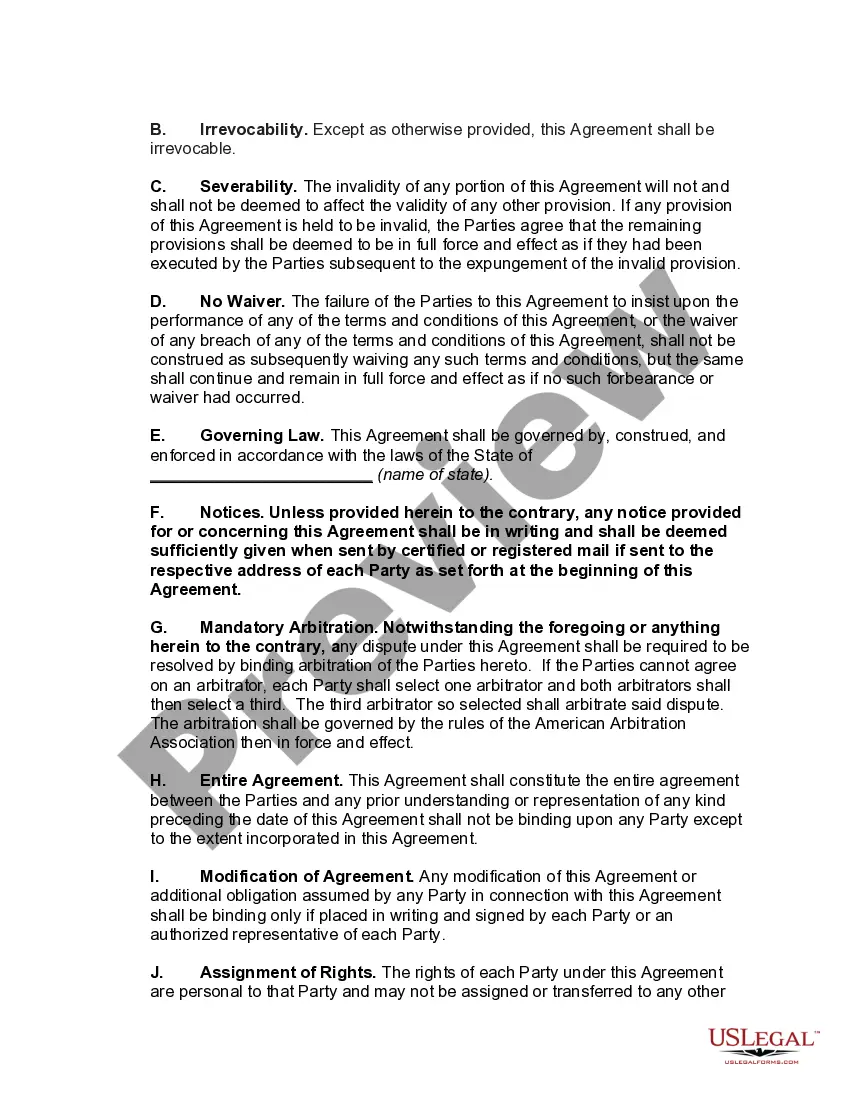

Elements of Gift InstrumentsDate of the agreement.Legal name of the NFP recipient.Legal name(s) of the donor(s).If more than one donor, an indication of the donors' intent to be obligated jointly, severally, or both jointly and severally.More items...

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.

In order to constitute a valid gift, the pivotal requirement is acceptance thereof. No particular mode of acceptance is required and the circumstances throw light on that aspect. A transaction of gift in order to be complete must be accepted by the donee during the lifetime of the donor.

There are the following five essentials of a valid gift:Transfer of ownership.Existing property.Transfer without consideration.Voluntary transfer with free consent.Acceptance of the gift.26-Aug-2020

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge. These are known as the three essential elements of a contract.