New York Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

Are you in a situation where you require documents for either professional or personal tasks almost every time.

There are numerous legitimate document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of form templates, such as the New York Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, designed to comply with federal and state regulations.

Once you find the appropriate form, click on Purchase now.

Select the pricing plan you want, enter the necessary information to set up your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you can download the New York Liquidation of Partnership with Authority, Rights and Obligations during Liquidation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

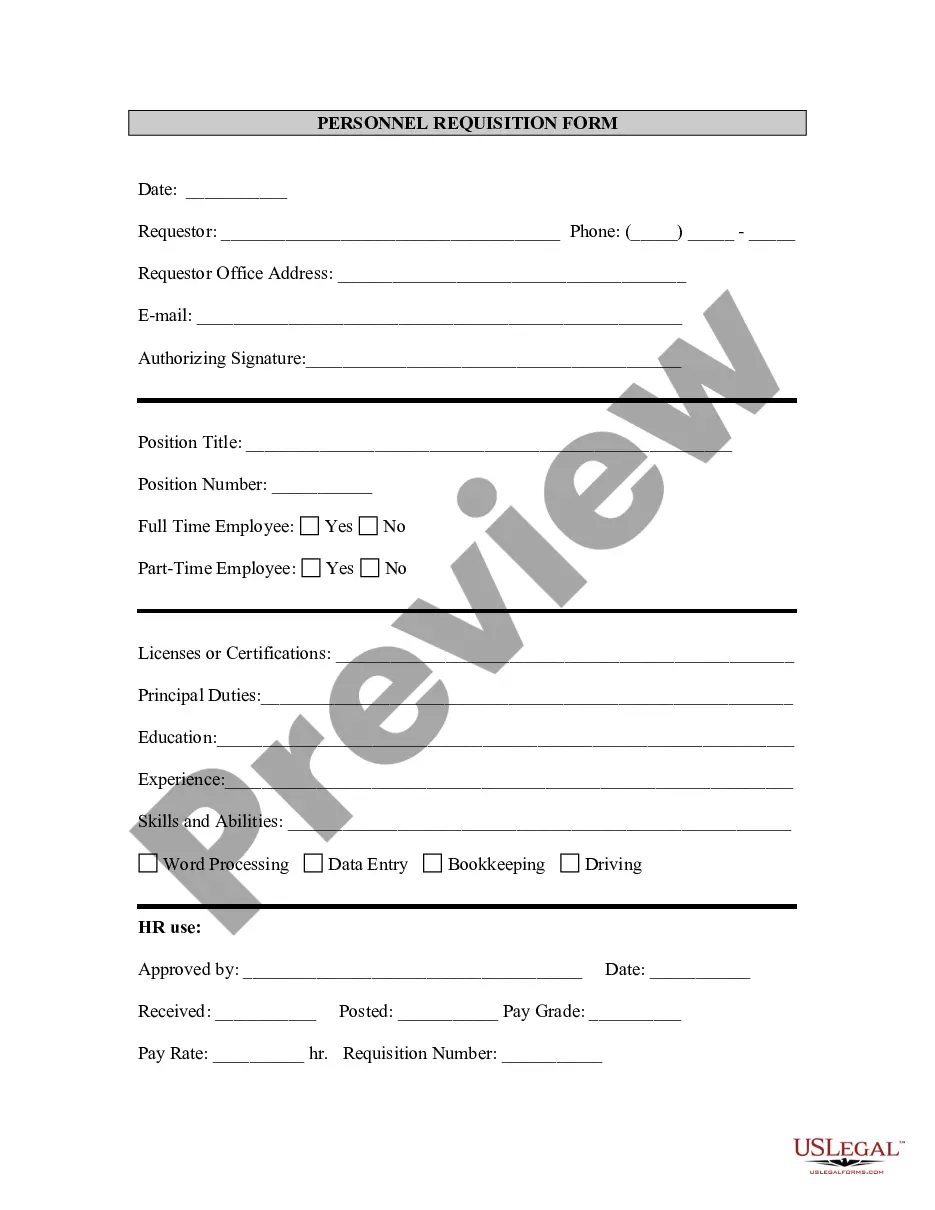

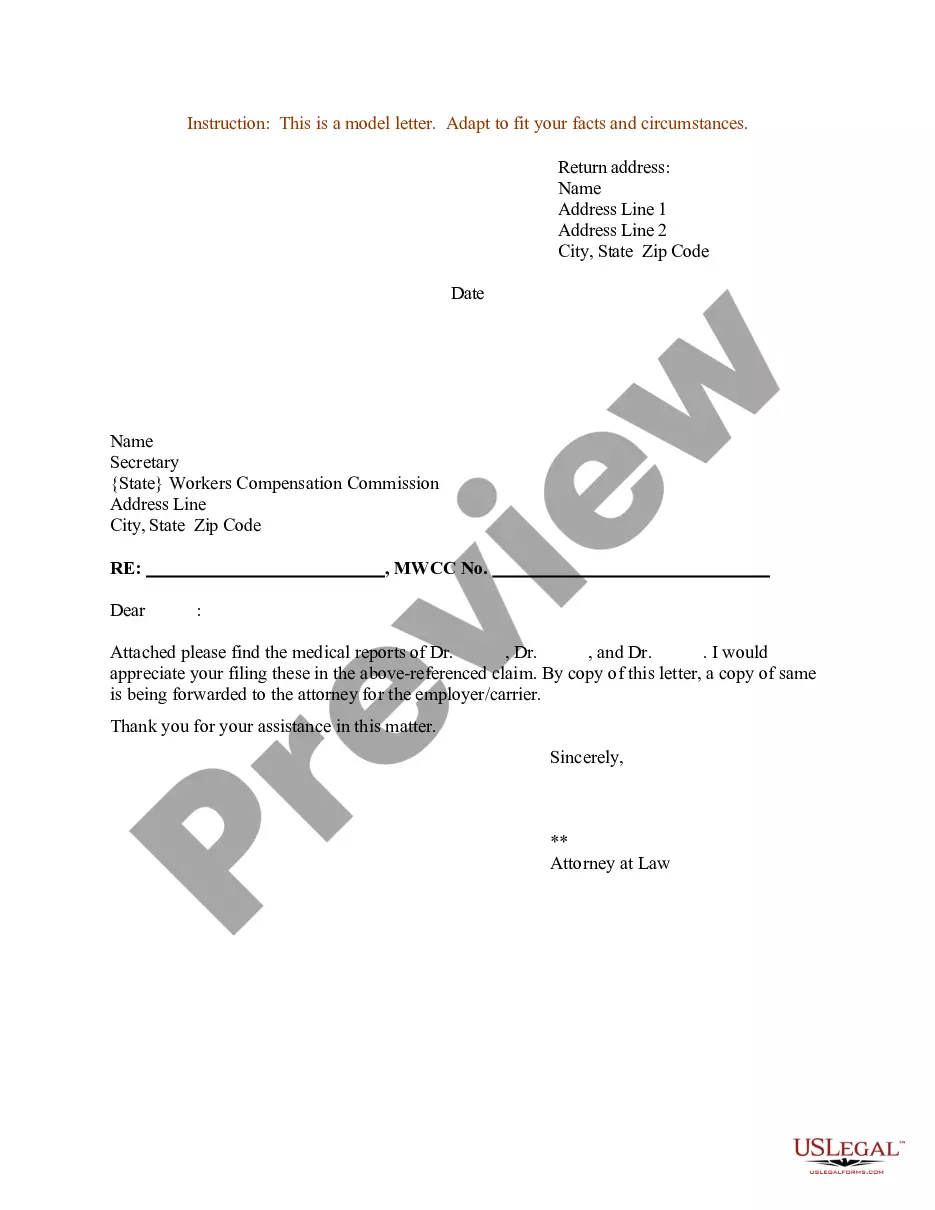

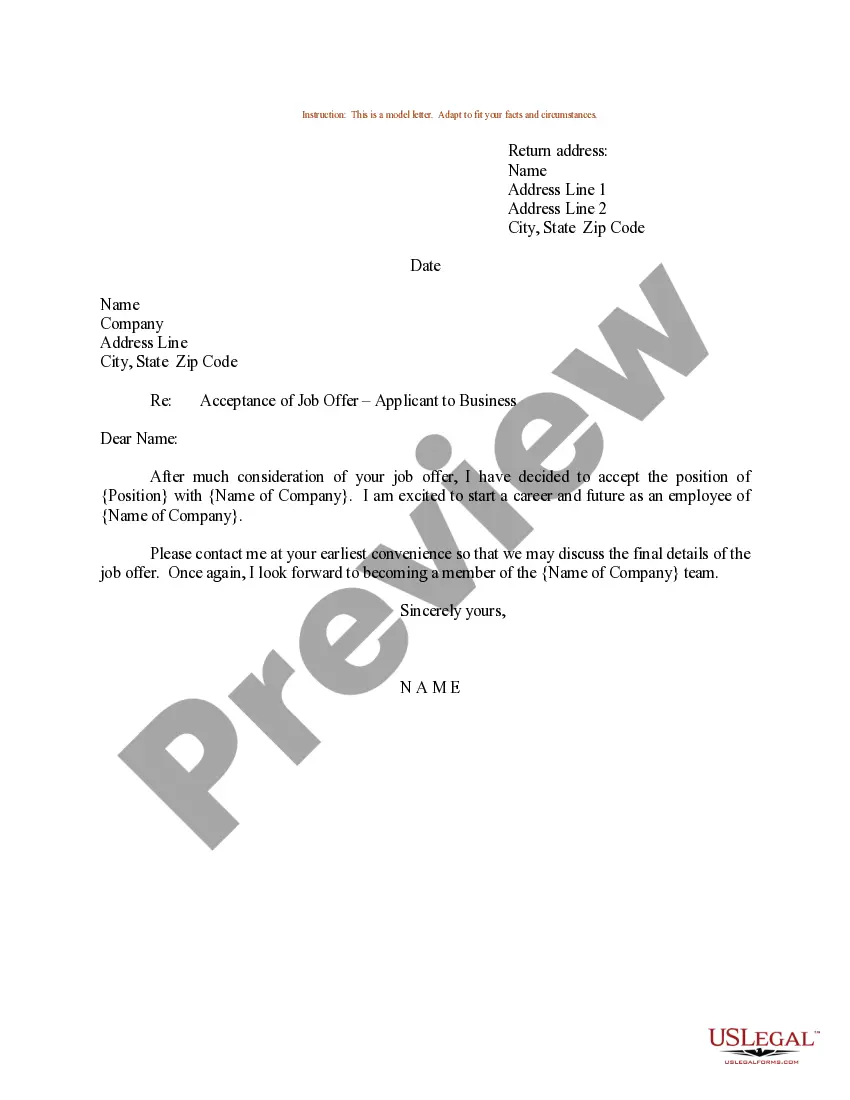

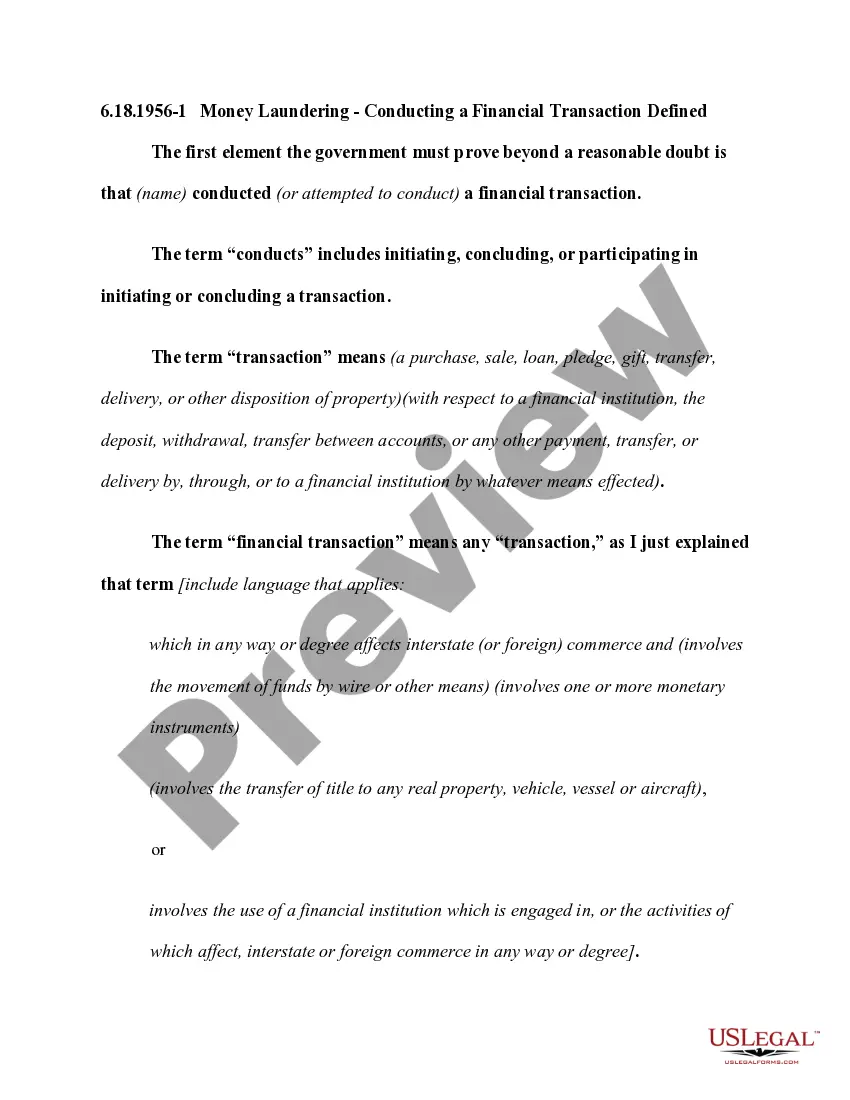

- Utilize the Review button to assess the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn't what you're seeking, use the Search field to find the form that satisfies your needs and requirements.

Form popularity

FAQ

Description. It is the creditor's responsibility to get a court order and provide any information that can assist MEP in securing payment. The creditor must respond to any changes in the court order that the debtor applies for and advise MEP of any changes in the creditor's address and phone numbers.

If the debtor company is in possession of goods belonging to a creditor, and the creditor can prove ownership, they have the right to make a claim for their return, or reimbursement via the liquidator. Unsecured creditors can claim interest on the debt up to the date of liquidation under certain circumstances.

Once a company goes into liquidation, creditors holding personal guarantees will pursue the directors to pay the outstanding company debt. The creditors that will almost always have a personal guarantee include, a financing bank, a landlord, and any major suppliers.

A liquidation marks the official ending of a partnership agreement. To end the partnership, the parties involved sell the property the business owns, and each partner receives a share of the remaining money.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

All creditors have the right to be heard with regard to liquidation of the debtor's nonexempt assets in Chapter 7 and with regard to the debtor's repayment plan under Chapter 13. All creditors are also entitled to challenge the debtor's right to a discharge. Not all creditors are treated equally in a bankruptcy case.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

Liquidation of a Partnership6.1 Introduction. Liquidation refers to the process of winding-up the operation of the business.6.2 The Partnership Liquidation Process. The liquidation process involves four steps.Payment of partnership Liabilities.Distribute the Remaining Cash to Partners.6.5 Summary.

(2) A secured creditor participating in the meetings of the creditors and voting in relation to the repayment plan shall forfeit his right to enforce the security during the period of the repayment plan in accordance with the terms of the repayment plan. (b) the estimated value of the unsecured part of the debt.