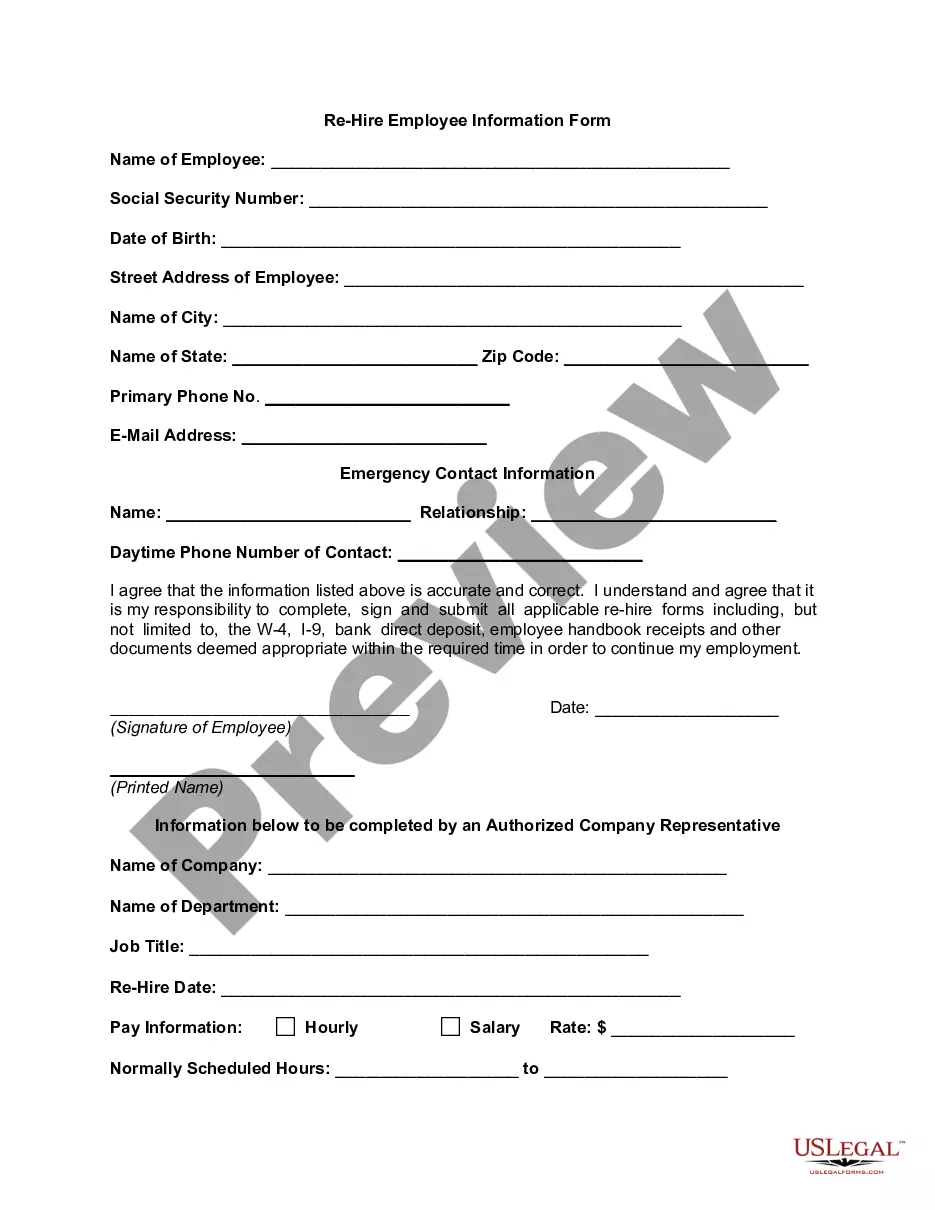

New York Re-Hire Employee Information Form

Description

How to fill out Re-Hire Employee Information Form?

Selecting the optimal legal document web template can be a significant challenge. Of course, there are numerous designs accessible online, but how do you find the legal document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the New York Re-Hire Employee Information Form, suitable for both business and personal purposes. All forms are reviewed by experts and comply with state and federal requirements.

If you are already a member, Log In to your account and click the Download button to receive the New York Re-Hire Employee Information Form. Use your account to view the legal forms you have previously ordered. Visit the My documents tab in your account to obtain another copy of the documents you need.

Complete, edit, and print the New York Re-Hire Employee Information Form you obtained. US Legal Forms boasts the largest collection of legal documents, allowing you to access a variety of document templates. Use this service to acquire professionally prepared documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

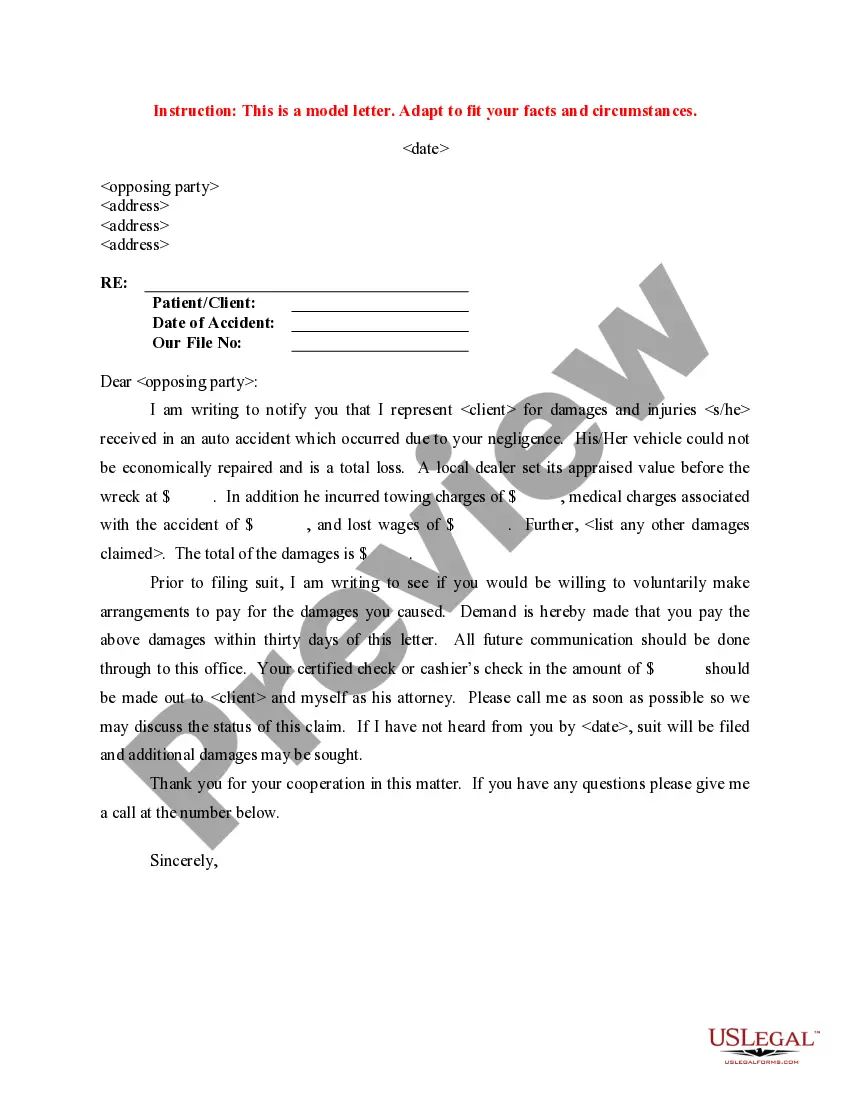

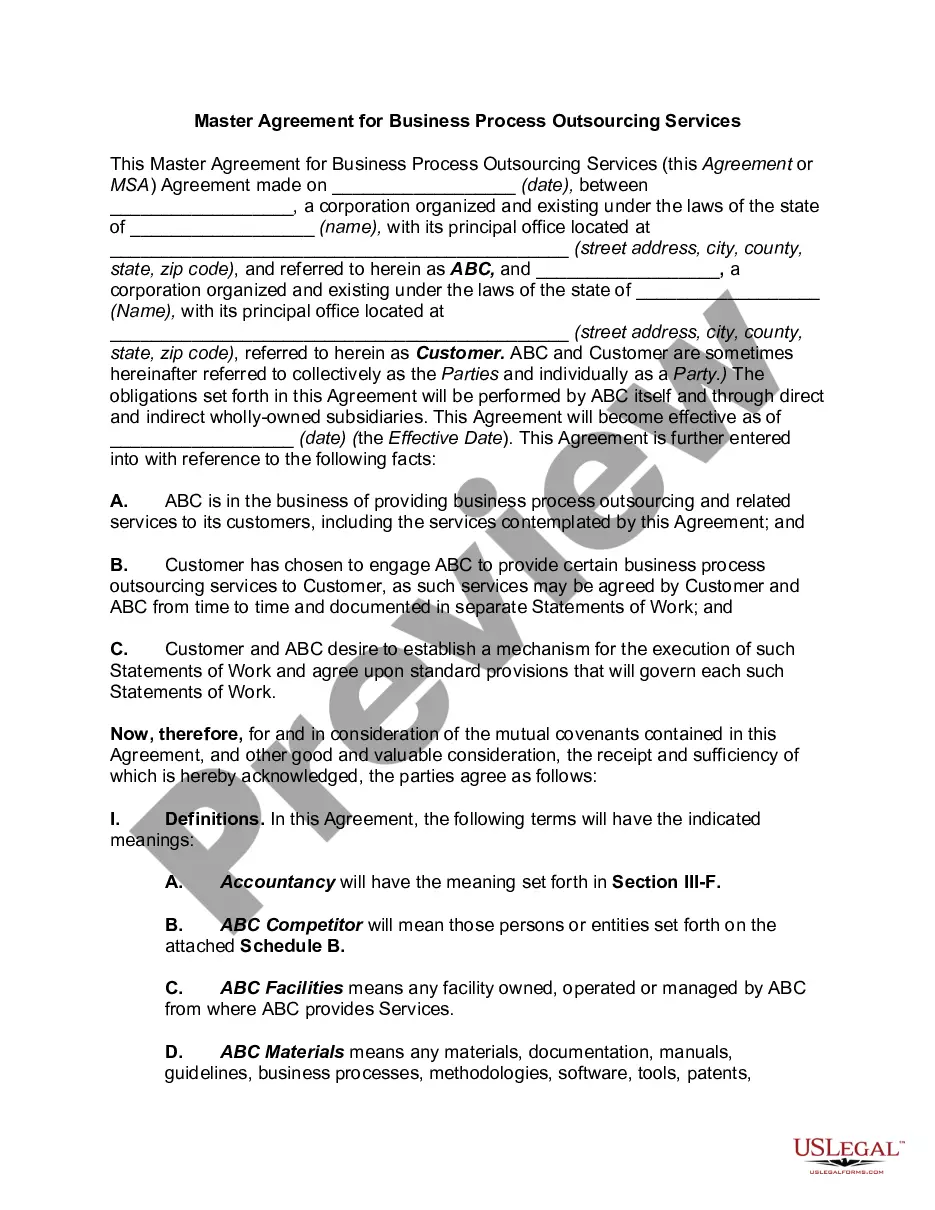

- First, ensure you have selected the appropriate form for your location/region. You can preview the form using the Review option and check the form description to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search bar to find the correct form.

- Once you are certain the form is suitable, choose the Purchase now button to acquire the form.

- Select the pricing plan you wish to use and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

From a best practice perspective, the following documents should be included: employment documents including a job description, letter of offer, employment contract, copy of the business' employee handbook and Fair Work Information Statement; Tax File Declaration form; superannuation nomination form; and.

You can register by:applying online through New York Business Express (see Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Business Employer (NYS 100), or.calling the Department of Labor at 1 888 899-8810 or (518) 457-4179.

4 form (or 9 for contractors) I9 Employment Eligibility Verification form. State Tax ithholding form. Direct Deposit form....An employment contract should include:Job information (job title, department)ork schedule.Length of employment.Compensation and benefits.Employee responsibilities.Termination conditions.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4. See Employee Withholding Forms. Employers in certain industries must obtain statements from new hires.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

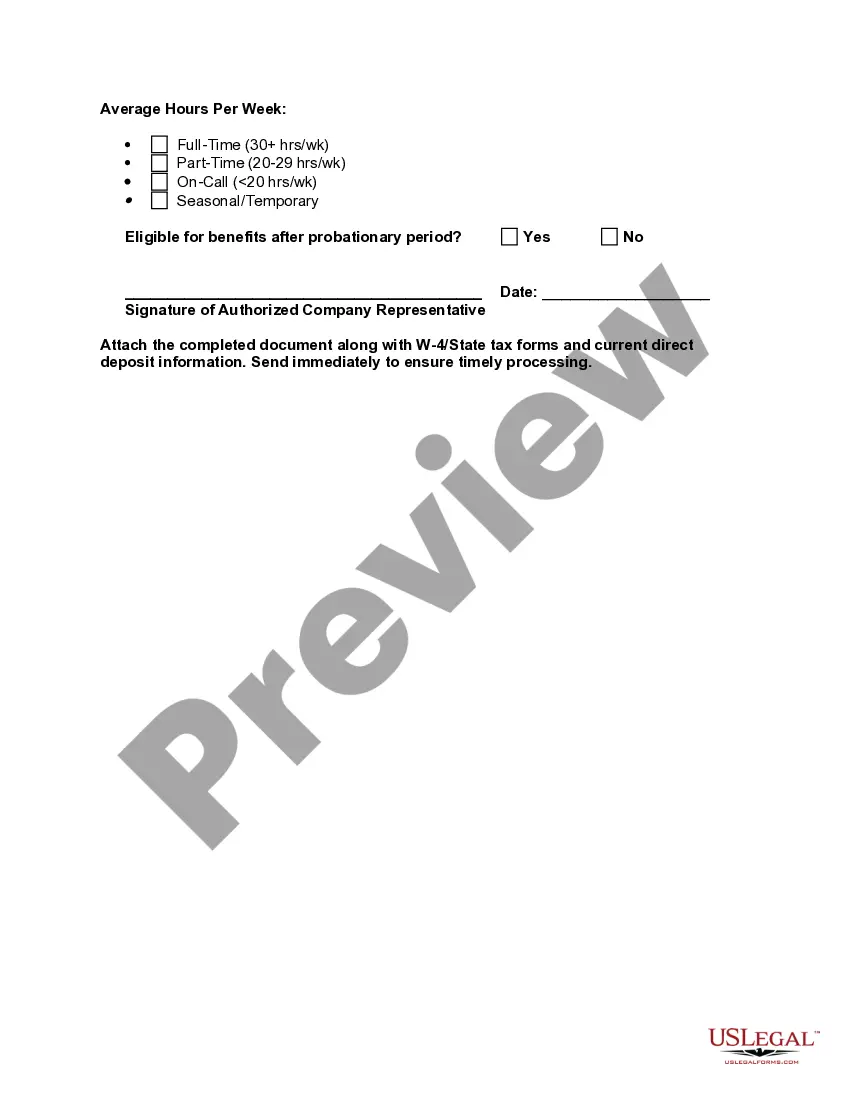

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. The hiring date is the first day the employee: performs any services for which they will be paid wages, tips, commissions, or any other type of compensation.