New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan

Description

How to fill out Exhibit To UCC-1 Financing Statement Regarding A Fixture Filing For A Commercial Loan?

If you need to complete, acquire, or print out legal file templates, use US Legal Forms, the most important assortment of legal kinds, which can be found on the Internet. Make use of the site`s basic and practical research to discover the files you need. Various templates for organization and individual functions are categorized by types and suggests, or search phrases. Use US Legal Forms to discover the New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan in just a handful of mouse clicks.

Should you be already a US Legal Forms buyer, log in in your accounts and then click the Down load key to get the New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan. You may also gain access to kinds you earlier downloaded in the My Forms tab of your respective accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for the proper city/country.

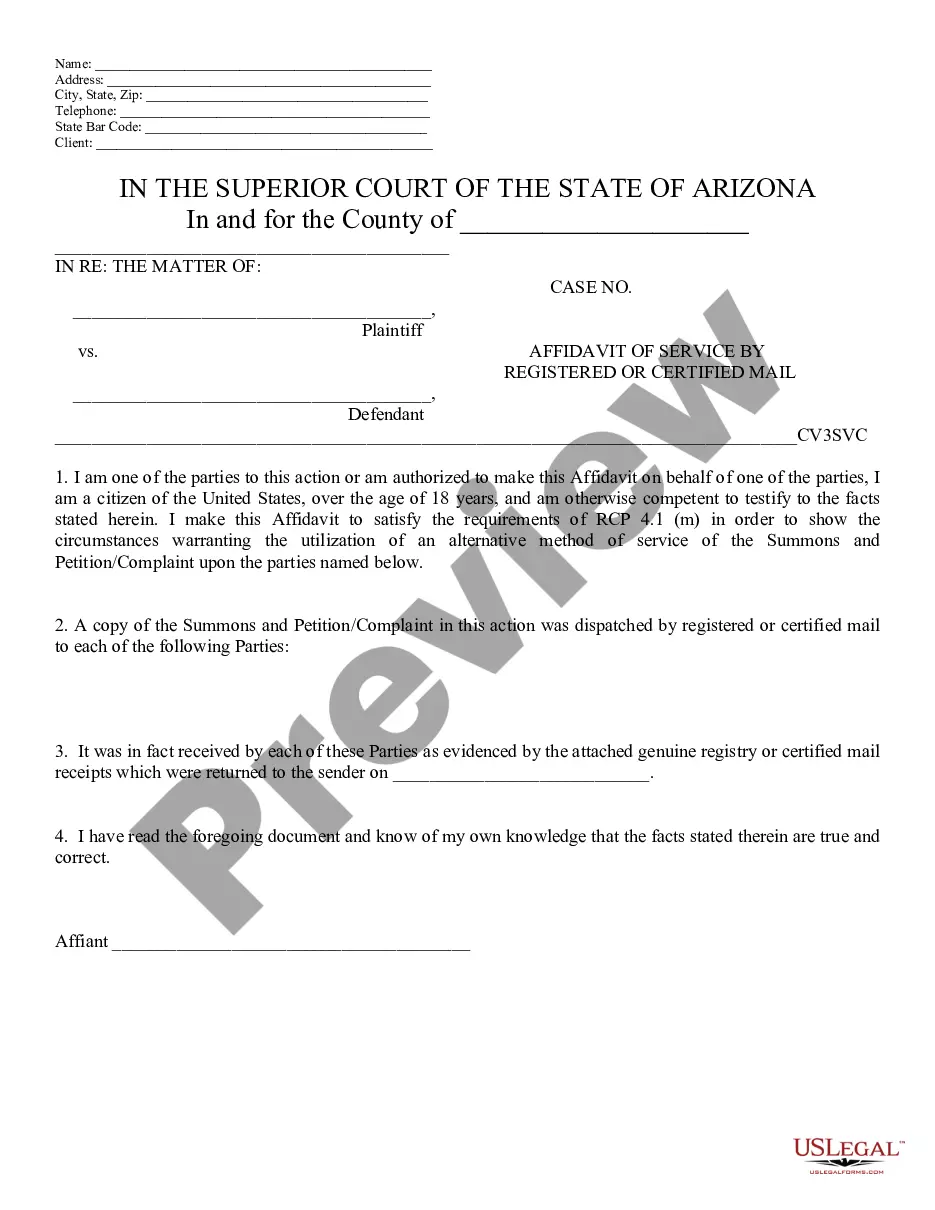

- Step 2. Make use of the Review solution to examine the form`s content. Do not forget about to see the description.

- Step 3. Should you be unhappy together with the form, utilize the Research industry towards the top of the display to find other versions from the legal form design.

- Step 4. When you have found the form you need, click the Buy now key. Select the prices strategy you choose and add your references to register for an accounts.

- Step 5. Process the purchase. You should use your bank card or PayPal accounts to finish the purchase.

- Step 6. Find the format from the legal form and acquire it in your product.

- Step 7. Total, revise and print out or signal the New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan.

Every legal file design you buy is yours permanently. You might have acces to every single form you downloaded with your acccount. Click the My Forms section and pick a form to print out or acquire again.

Be competitive and acquire, and print out the New York Exhibit to UCC-1 Financing Statement regarding a Fixture Filing for a Commercial Loan with US Legal Forms. There are thousands of professional and status-specific kinds you can utilize for your personal organization or individual requirements.

Form popularity

FAQ

By Mail: send the completed form with the processing fee of $40 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

New York State's Uniform Commercial Code (?UCC?) guides the sale of commercial business transactions, including the sale of goods between parties. Article 9 of the UCC governs transactions that combine a debt with a creditor's interest in a debtor's personal property.

(b) The office in which to file a financing statement to perfect a security interest in collateral, including fixtures, of a transmitting utility is the office of the Secretary of State.

What are the basic UCC fees? A UCC filing is $40 for a paper-based filing and $20 for an electronic filing (using XML transmission or e-File). The UCC search fee is $25. A separate Information Request (Form UCC-11) is required for each business or name to be searched.

New York State's Uniform Commercial Code (?UCC?) guides the sale of commercial business transactions, including the sale of goods between parties. Article 9 of the UCC governs transactions that combine a debt with a creditor's interest in a debtor's personal property.

(41) "Fixtures" means goods that have become so related to particular real property that an interest in them arises under real property law.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.

A fixture filing is a UCC-1 financing statement authorized and made in ance with the UCC adopted in the state in which the related real property is located. It covers property that is, or will be, affixed to improvements to such real property.