New York LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Are you presently in a circumstance where you frequently require documents for personal or business purposes.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers a wide array of form templates, including the New York LLC Operating Agreement for S Corp, that comply with federal and state regulations.

When you find the appropriate form, click on Get it now.

Choose the payment plan that suits you, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Once logged in, you can download the New York LLC Operating Agreement for S Corp template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and confirm it is intended for the correct city/county.

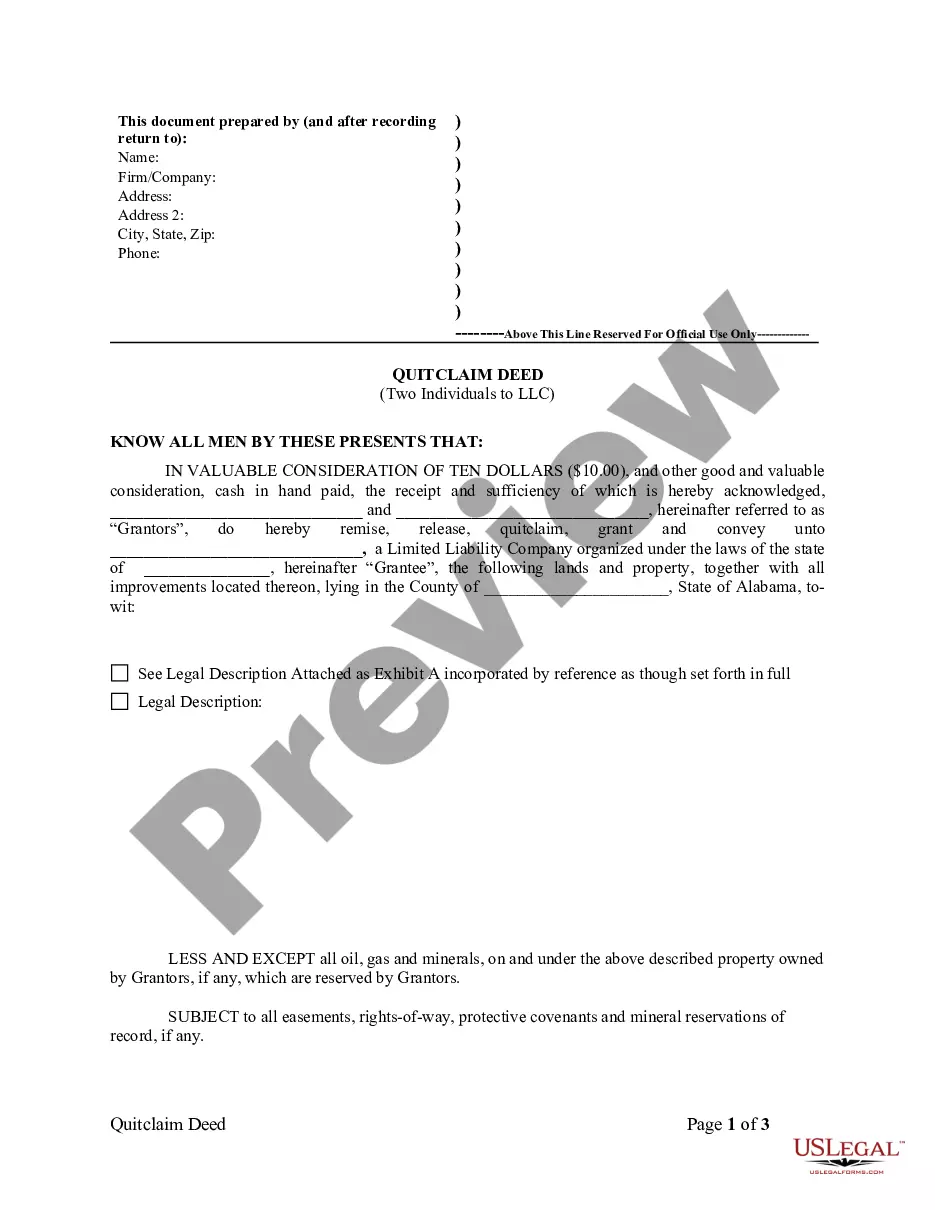

- Utilize the Preview option to examine the form.

- Review the details to ensure you have chosen the correct form.

- If the form does not meet your needs, use the Search field to find the form that matches your requirements.

Form popularity

FAQ

An SMLLC operating agreement offers various benefits, such as: providing rules that will supercede the default provisions of your state's LLC Act. serving as an additional document to show potential lenders regarding the organization of your business.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Do I need a registered agent in New York? Every U.S. state, with the exception of New York, requires all corporations and limited liability companies (LLCs) to have a registered agent.

An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made (or if it is a mandated New York S corporation).

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

How to Form an LLC in New York (7 steps)Step 1 Agent for Service of Process.Step 2 Choose LLC Type.Step 3 Filing Fee.Step 4 Publish the Articles.Step 5 Certificate of Publication.Step 6 Operating Agreement.Step 7 Employer Identification Number (EIN)