New York General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

Have you ever found yourself in a situation where you require documentation for various organizational or personal reasons almost every workday.

There are countless legal document templates accessible online, but finding ones you can rely on is challenging.

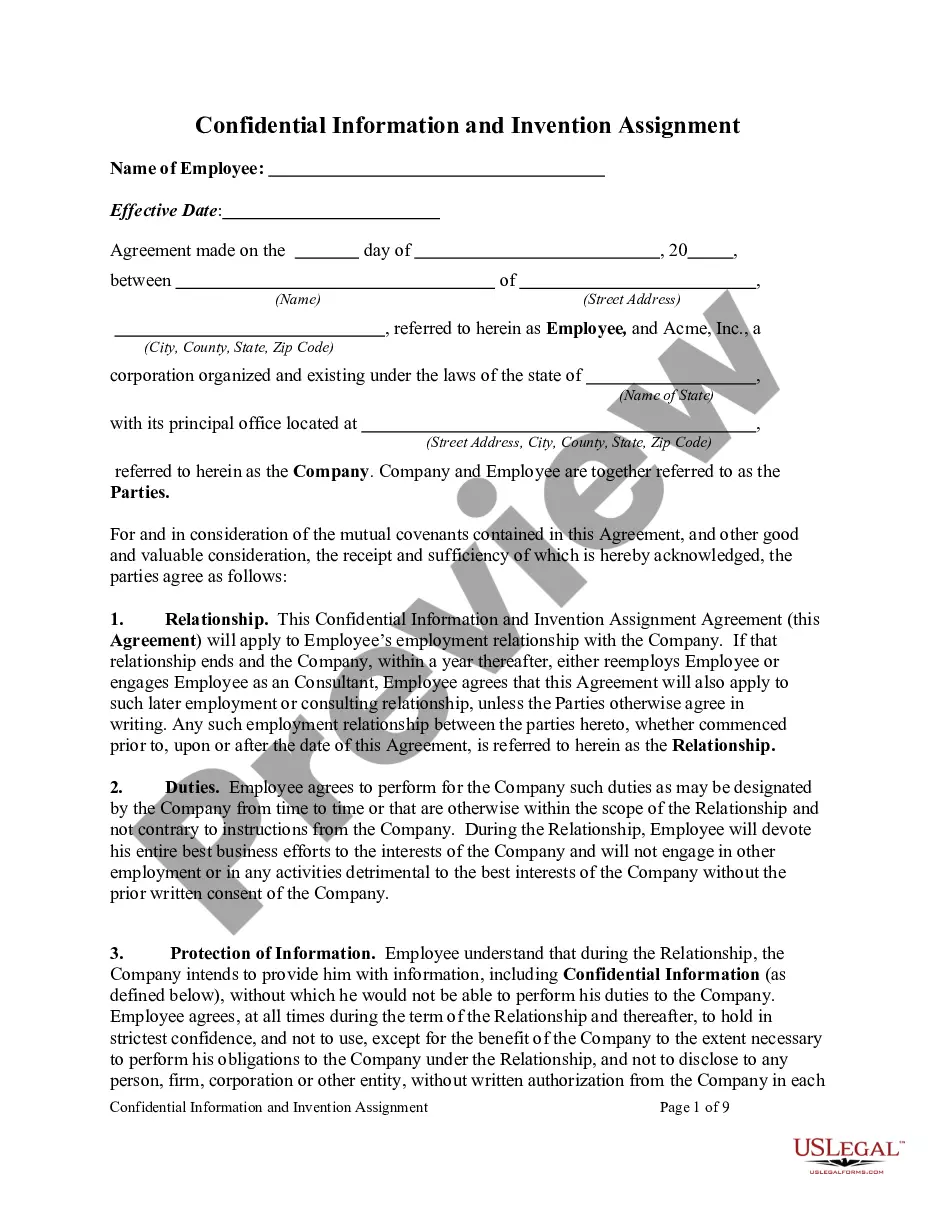

US Legal Forms offers a vast array of template documents, such as the New York General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, which can be tailored to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and verify it is for the correct state/region.

- Use the Review button to examine the document.

- Check the details to ensure you have selected the correct template.

- If the template is not what you are looking for, utilize the Search field to find the document that meets your requirements.

- When you locate the appropriate template, click Acquire now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or Visa or MasterCard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New York General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion whenever needed. Simply click on the desired template to download or print the document.

- Utilize US Legal Forms, which has one of the largest collections of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create a free account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

WASHINGTON -- If you give any one person gifts valued at more than $10,000 in a year, it is necessary to report the total gift to the Internal Revenue Service. You may even have to pay tax on the gift. The person who receives your gift does not have to report the gift to the IRS or pay gift or income tax on its value.

While NYS does not impose a gift tax, it does apply a 3 year clawback rule where any lifetime gifts made within 3 years of death are clawed back to the decedent's estate for purposes of determining NYS estate tax.

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

For 2020 the annual gift tax exclusion remains at $15,000. This means that an individual can give away $15,000 to any person in a calendar year ($30,000 for a married couple) without having to file a federal gift tax return.

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).

Was the trust a revocable trust or an irrevocable trust? Transferring assets to your revocable trust is not a giftbecause you still have total control over the assets in a revocable trust (and can therefore revoke it at any time), the funding is not considered a completed gift as you did not really give it away.

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.