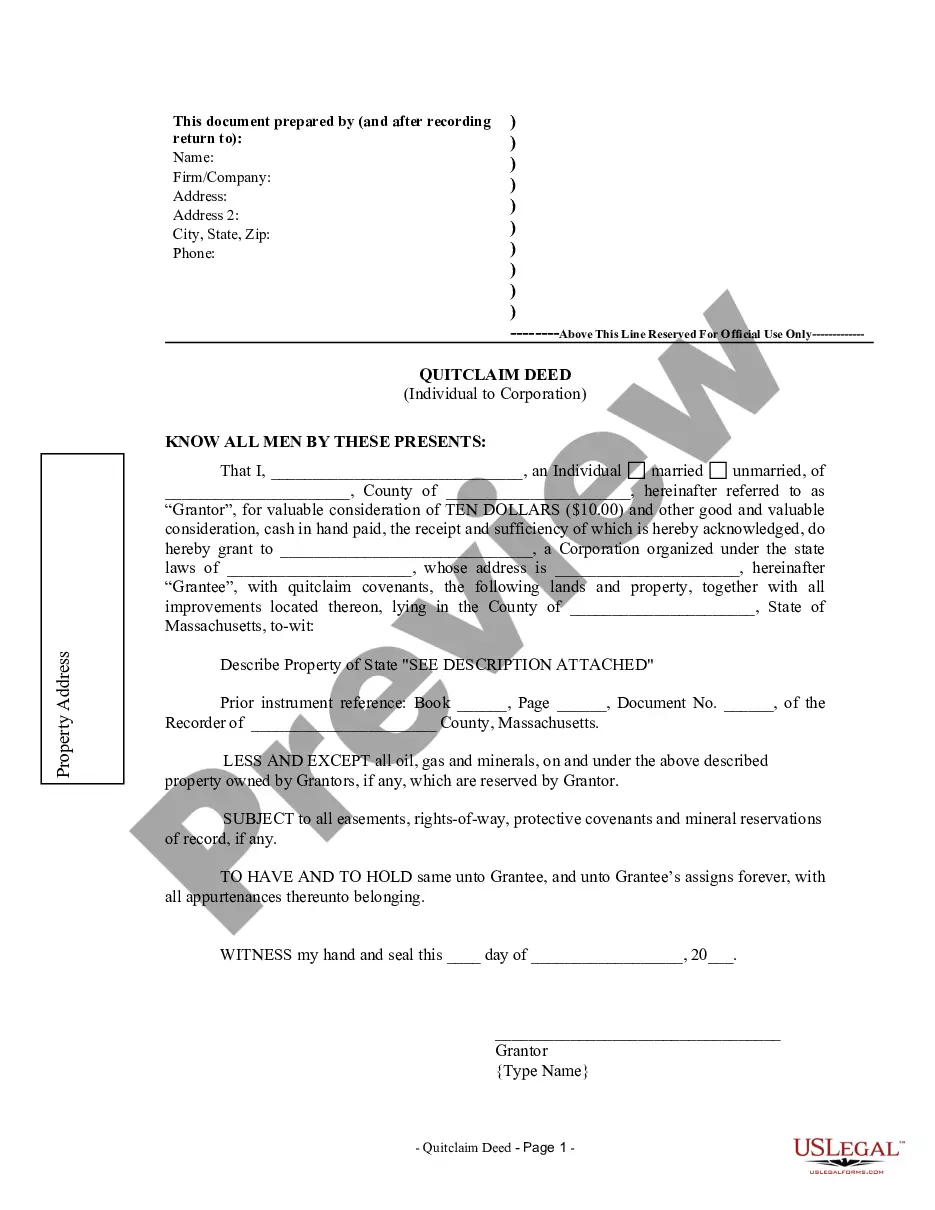

New York Loan Agreement for Property

Description

How to fill out Loan Agreement For Property?

US Legal Forms - one of many biggest libraries of lawful varieties in the United States - delivers a wide array of lawful document templates it is possible to obtain or print out. Using the website, you may get a huge number of varieties for company and individual uses, categorized by categories, says, or keywords and phrases.You will find the newest types of varieties like the New York Loan Agreement for Property in seconds.

If you currently have a membership, log in and obtain New York Loan Agreement for Property from the US Legal Forms collection. The Down load switch will show up on each and every develop you look at. You have accessibility to all in the past saved varieties within the My Forms tab of your own profile.

In order to use US Legal Forms the first time, listed below are simple recommendations to help you get began:

- Make sure you have chosen the correct develop for your personal metropolis/region. Go through the Review switch to review the form`s content material. Browse the develop description to actually have selected the appropriate develop.

- In the event the develop does not match your needs, take advantage of the Research field near the top of the screen to get the the one that does.

- In case you are happy with the shape, affirm your selection by visiting the Acquire now switch. Then, opt for the costs prepare you want and supply your credentials to register for the profile.

- Process the purchase. Make use of your credit card or PayPal profile to finish the purchase.

- Choose the format and obtain the shape on your own gadget.

- Make adjustments. Fill up, change and print out and signal the saved New York Loan Agreement for Property.

Every single web template you added to your money lacks an expiry time and is also your own property for a long time. So, if you would like obtain or print out another duplicate, just visit the My Forms area and then click in the develop you want.

Get access to the New York Loan Agreement for Property with US Legal Forms, one of the most extensive collection of lawful document templates. Use a huge number of professional and express-distinct templates that fulfill your organization or individual requires and needs.

Form popularity

FAQ

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

New York defines a building loan contract as a construction loan agreement where the lender, ?in consideration of the express promise of an owner to make an improvement upon real property, agrees to make [building loan] advances ? secured by a [building loan] mortgage on such real property?.

A mortgage loan agreement is a legal document between a borrower and lender that outlines their mortgage loan terms. Mortgage loan agreements are different from standard loan agreements in that the collateral or what's used to secure the loan is personal property and real estate.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.