New York Loan Agreement

Description

How to fill out Loan Agreement?

Are you presently in a situation where you need to have files for either business or individual purposes almost every working day? There are tons of authorized papers layouts available on the net, but finding types you can rely on isn`t easy. US Legal Forms gives a huge number of form layouts, such as the New York Loan Agreement, which are written in order to meet state and federal demands.

Should you be presently acquainted with US Legal Forms website and also have your account, simply log in. Following that, you are able to download the New York Loan Agreement format.

If you do not have an accounts and would like to start using US Legal Forms, follow these steps:

- Find the form you need and make sure it is to the right metropolis/area.

- Utilize the Preview option to examine the shape.

- Browse the information to ensure that you have selected the correct form.

- When the form isn`t what you`re trying to find, use the Research discipline to find the form that suits you and demands.

- When you discover the right form, click Purchase now.

- Select the rates strategy you would like, submit the necessary information to generate your money, and purchase your order utilizing your PayPal or charge card.

- Decide on a handy paper formatting and download your version.

Find all the papers layouts you might have purchased in the My Forms menus. You may get a extra version of New York Loan Agreement anytime, if necessary. Just go through the necessary form to download or print out the papers format.

Use US Legal Forms, probably the most substantial collection of authorized types, to conserve some time and prevent errors. The support gives skillfully made authorized papers layouts which can be used for a selection of purposes. Create your account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

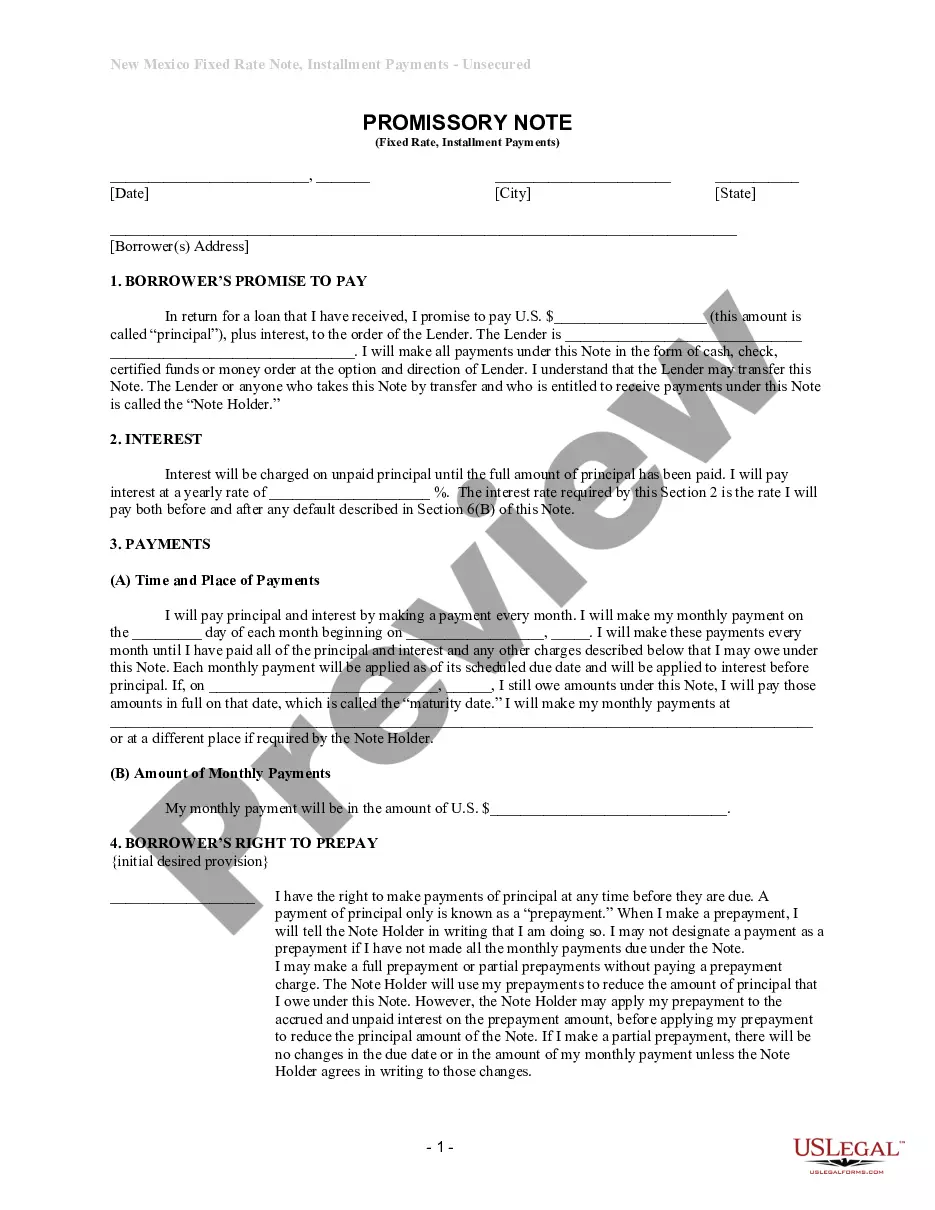

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

About. This license allows lenders to charge interest rates above those permitted by law. State law prohibits businesses from making loans of $25,000 or less to individuals or $50,000 or less to businesses with an interest rate above 16%. Higher interest rates may only be given by licensed lenders.