New York Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership

Description

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

Discovering the right authorized papers format could be a battle. Naturally, there are plenty of templates available on the net, but how would you obtain the authorized develop you want? Use the US Legal Forms internet site. The support provides a huge number of templates, for example the New York Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership, which can be used for organization and private requirements. All of the kinds are inspected by experts and meet state and federal demands.

Should you be currently authorized, log in in your profile and click the Download option to have the New York Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership. Make use of your profile to check from the authorized kinds you may have ordered formerly. Visit the My Forms tab of the profile and acquire another copy in the papers you want.

Should you be a new user of US Legal Forms, allow me to share simple directions that you can follow:

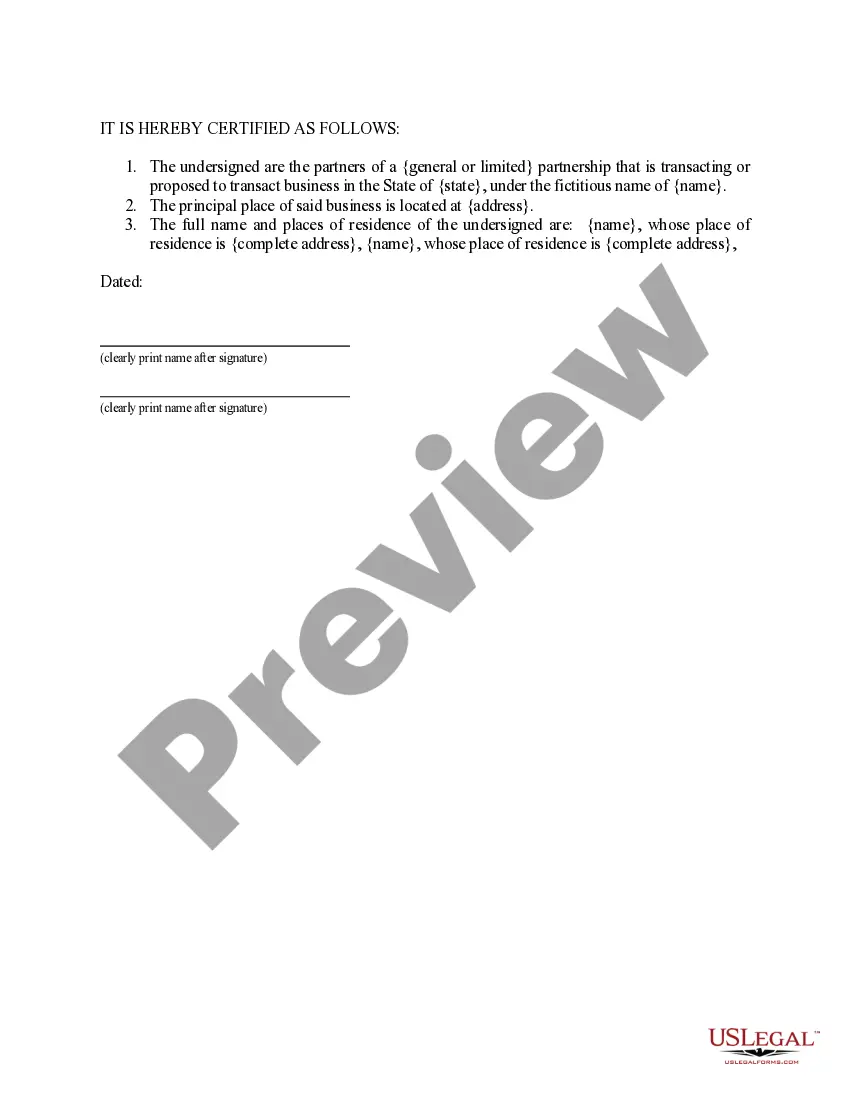

- Initially, make certain you have selected the right develop for your metropolis/state. You may look over the shape using the Review option and study the shape description to make certain it is the right one for you.

- In case the develop does not meet your expectations, take advantage of the Seach field to obtain the appropriate develop.

- When you are positive that the shape is suitable, go through the Get now option to have the develop.

- Choose the pricing program you need and type in the needed information and facts. Make your profile and purchase the order with your PayPal profile or credit card.

- Choose the document structure and acquire the authorized papers format in your system.

- Full, edit and print out and indicator the obtained New York Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership.

US Legal Forms will be the largest local library of authorized kinds where you can discover different papers templates. Use the service to acquire appropriately-produced documents that follow express demands.

Form popularity

FAQ

State State, Department of. Businesses that conduct business under a name that is not their legal name need a Certificate of Assumed Name. This certificate is also called the "doing business as (DBA) certificate." Businesses must file the certificate with the New York State Department of State (NYSDOS).

How Do I Change My DBA in New York? To make changes to your certificate of assumed name, you must complete and submit the Certificate of Amendment of Certificate of Assumed Name form. For most changes, visit the County Clerk's office to complete an amendment form and pay a filing fee.

There is really no way to ?convert? DBA to LLC, since DBA issued to a sole proprietor is just an alias, and the EIN is issued to the sole proprietorship. What you could do is simply register a new NY LLC, and obtain a new EIN for it.

How much does a DBA filing cost in New York? For sole proprietors, the filing fee for a DBA in New York is $100. Certified copies of the business certificate are an additional $10 each. Sole proprietors file a DBA with the county clerk they plan on doing business with.

An assumed business name, also called a DBA (doing business as) name, is used by an entity that is conducting business under a name that is not its legal name.

You may fax the Certificate of Assumed Name with the Credit Card/Debit Card Authorization Form and your written request for a certified copy, if requested, to the Division of Corporations at (518) 474-1418.

In New York State, DBAs have no expiration date and renewals aren't necessary. You do, however, need to file a Certificate of Discontinuance if you're no longer conducting business.

A fictitious business name statement usually must be filed within 40 days of starting the business. Along with the original, the county or city may require several copies of the statement for filing. The clerk or recorder will certify and return all copies to the registrant, keeping the original.