New York New Employee Survey

Description

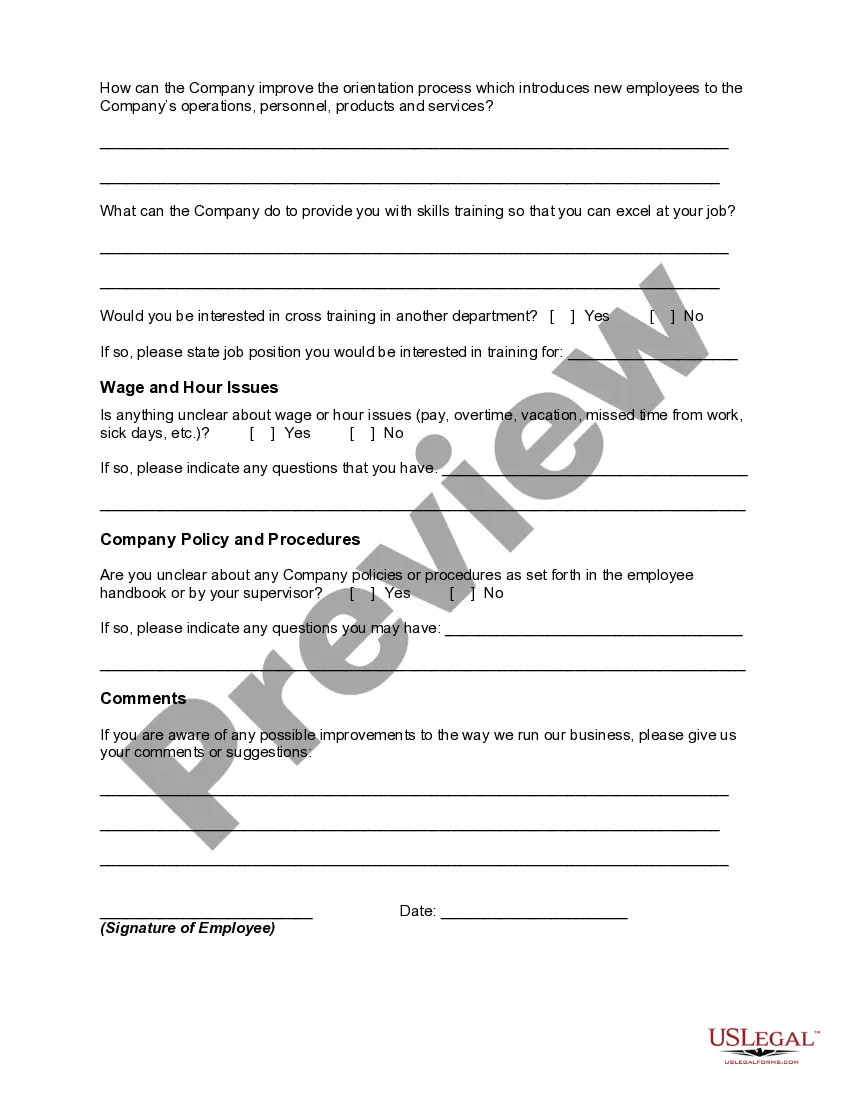

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

It is feasible to spend hours on the internet searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can download or print the New York New Employee Survey from my account.

If available, utilize the Review button to view the document template as well. If you wish to explore another version of the form, use the Search section to find the template that meets your needs and requirements. Once you have located the format you want, click Obtain now to proceed. Select the pricing plan you prefer, enter your information, and register for a free account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the New York New Employee Survey. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Afterwards, you can complete, modify, print, or sign the New York New Employee Survey.

- Every legal form you procure is your property permanently.

- To get another copy of a purchased document, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the state/city of your choice.

- Read the form description to confirm you have selected the right form.

Form popularity

FAQ

For new hire reporting in New York, employers must submit the completed NYS-100 form, as well as the I-9 form. These submissions are essential for state tracking and compliance with labor laws. Accurate reporting helps to avoid penalties and ensures that new employees are recognized in the system.

NYC Checklist for REQUIRED EMPLOYMENT. DOCUMENTATION and POSTERS for RESTAURANTS and BARS.New Hires.Paperwork to Complete.25a1 Employment application (signed and.2022 Do not accept photo.25a1 IRS Form W-4 (Employee's Withholding Allowance.Certificate) (signed and dated)25a1 NYS Department of Taxation and Finance Form.More items...

The best way to answer this question is by being as honest as possible about the problem while providing concrete examples of how it affects your work. For example, if you're not able to meet productivity goals because you're constantly working through technical issues, this is a great time to mention that.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

New York employers should provide each new employee with a New York State Form IT-2104, Employee's Withholding Allowance Certificate, as well as a federal Form W-4. See Employee Withholding Forms. Employers in certain industries must obtain statements from new hires.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

You must report newly hired or rehired employees who will be employed in New York State within 20 calendar days from the hiring date. The hiring date is the first day the employee: performs any services for which they will be paid wages, tips, commissions, or any other type of compensation.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.