New York Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Revocable Trust Agreement With Corporate Trustee?

Are you currently in a situation where you need documentation for either business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but locating reliable ones is challenging.

US Legal Forms offers thousands of form templates, such as the New York Revocable Trust Agreement with Corporate Trustee, designed to meet federal and state requirements.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Revocable Trust Agreement with Corporate Trustee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

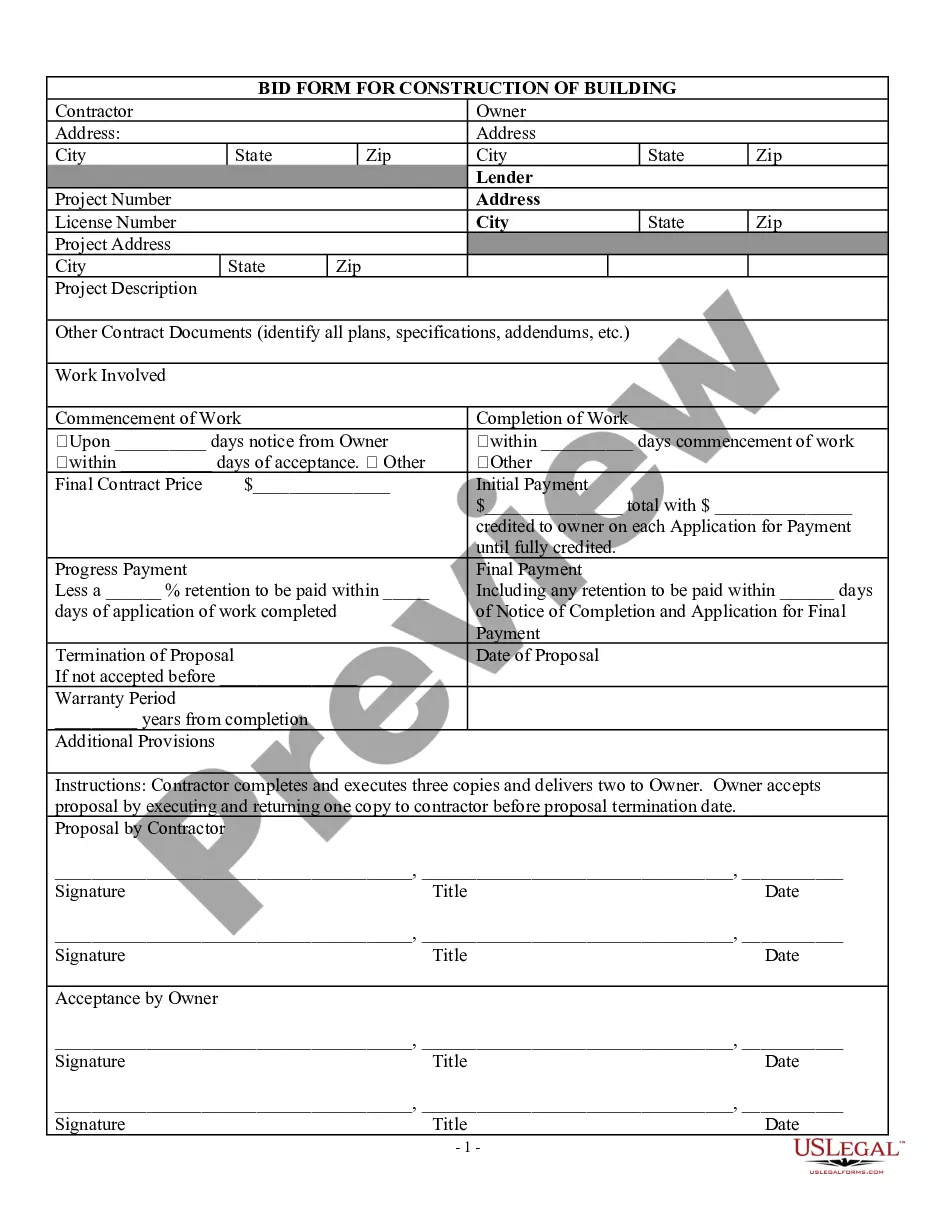

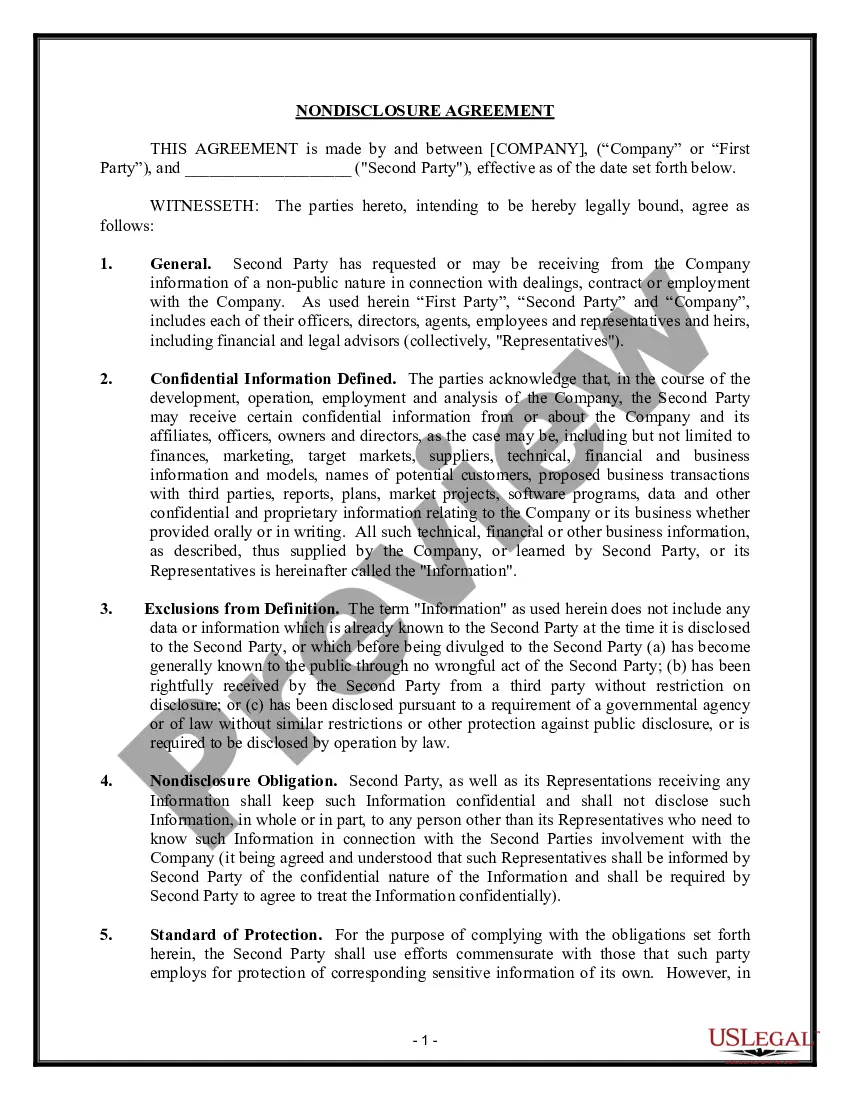

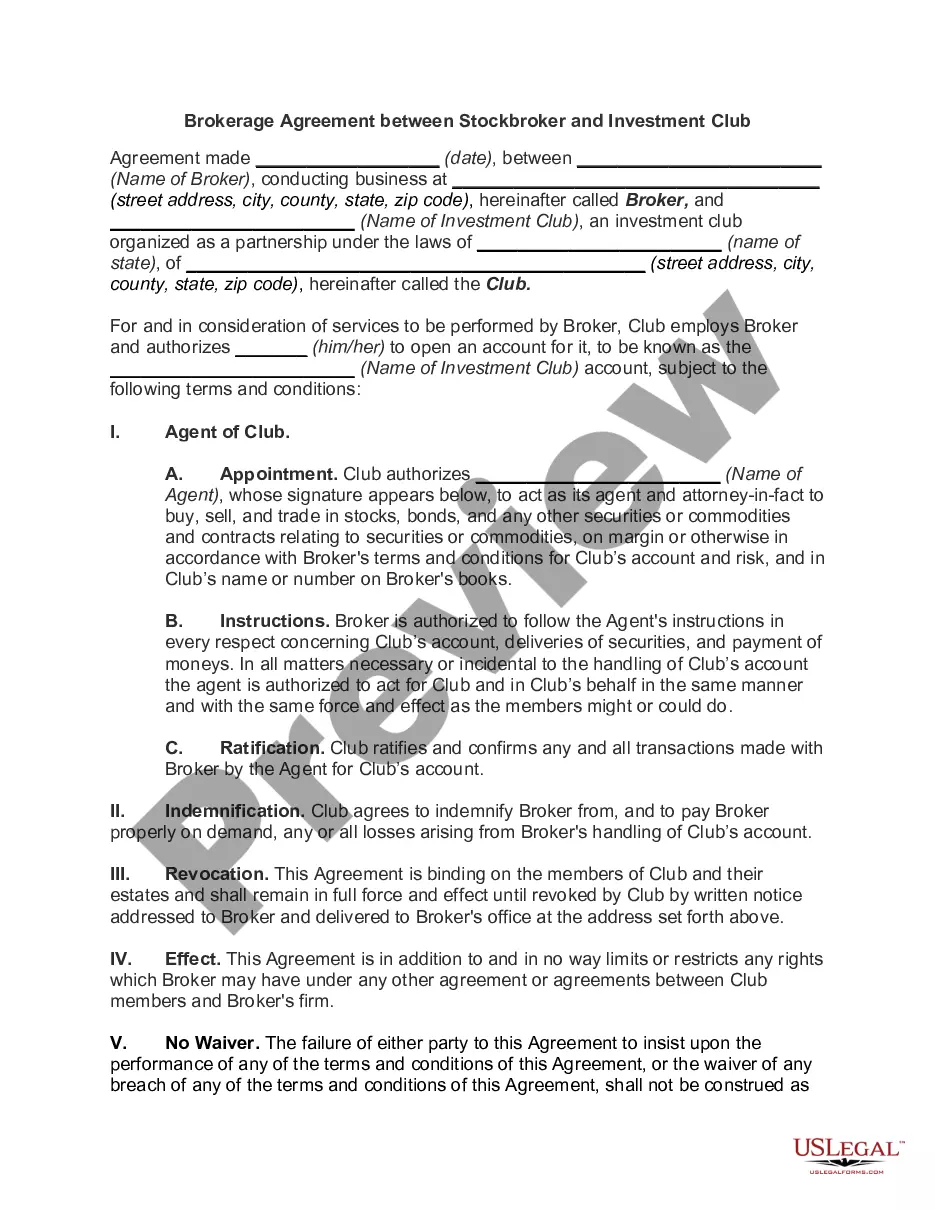

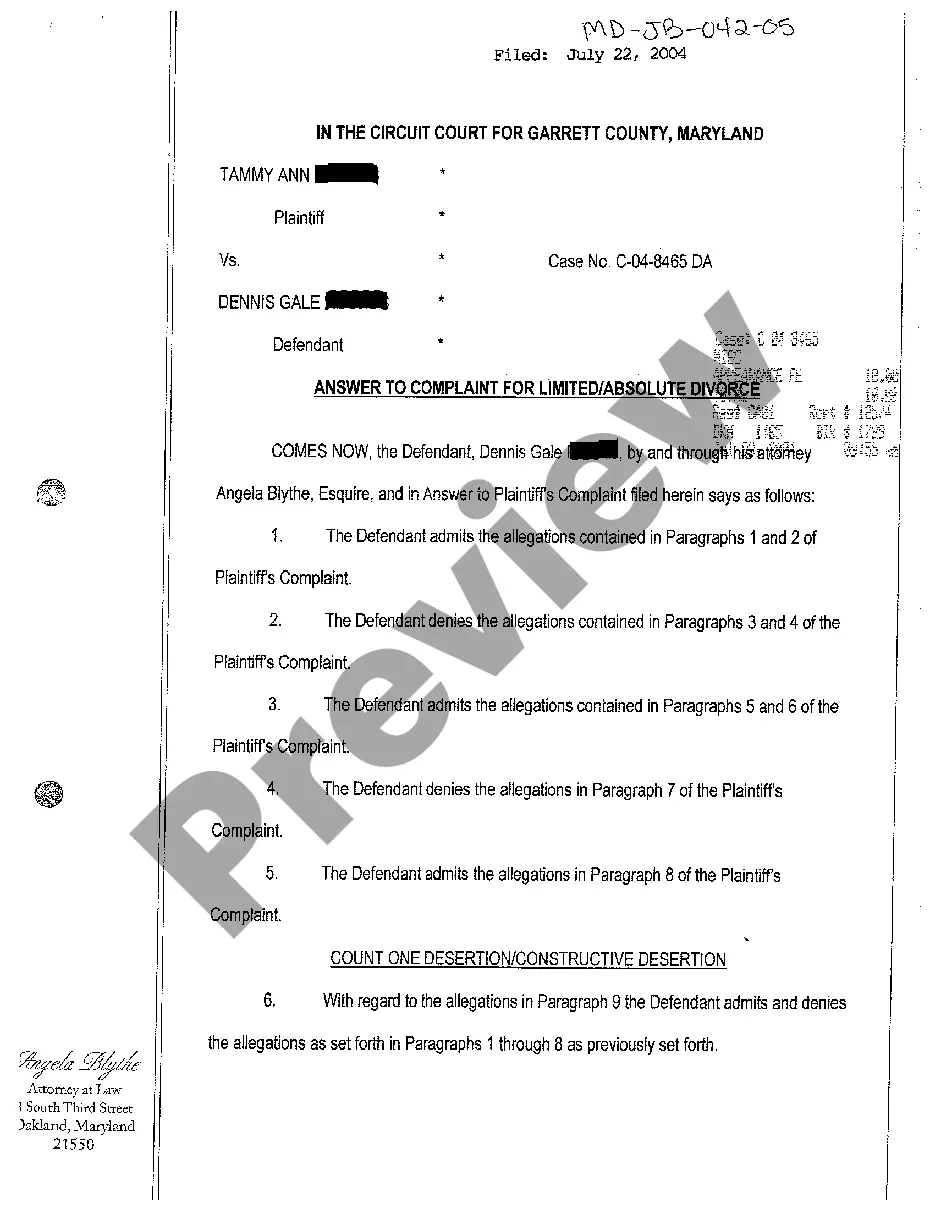

- Obtain the form you need and ensure it's for the correct city/state.

- Utilize the Review option to examine the form.

- Read the description to confirm that you have selected the correct template.

- If the form does not meet your needs, use the Search box to find a form that suits your requirements.

- Once you locate the right form, click on Get now.

- Select the pricing plan you prefer, provide the required information to create your account, and purchase your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New York Revocable Trust Agreement with Corporate Trustee anytime if needed. Just navigate to the necessary form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service provides expertly crafted legal document templates that can be used for various purposes.

- Create your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

In New York, co-executors usually need to act jointly for decisions concerning the estate. However, the will may grant specific powers that allow co-executors to take independent actions. It's crucial to review the will's stipulations to understand the extent of independence allowed. Engaging in a New York Revocable Trust Agreement with a Corporate Trustee can simplify governance and help avoid conflicts.

In New York, co-trustees generally have to work together to manage the trust effectively. However, they may act independently if the trust document permits it. This flexibility can provide efficiency in managing trust assets. If you're considering a New York Revocable Trust Agreement with a Corporate Trustee, ensure that the agreement clearly outlines the powers of each co-trustee.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property.

Yes, a corporate trustee can be the beneficiary of the trust - as long as you include the trustee's name and their capacity.

Among other benefits of revocable trusts, the execution or amendment of a revocable trust document is arguably more flexible than the execution of a will, as the execution of a New York trust usually requires two witnesses or notarization of the settlor's (testator's) signature and is not subject to the formal scrutiny

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

In New York, a trust does not have to be signed by two witnesses. But it could be. A trust does need to be signed by the person making the trust and by the trustee.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.