An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York General Form of Irrevocable Trust Agreement

Description

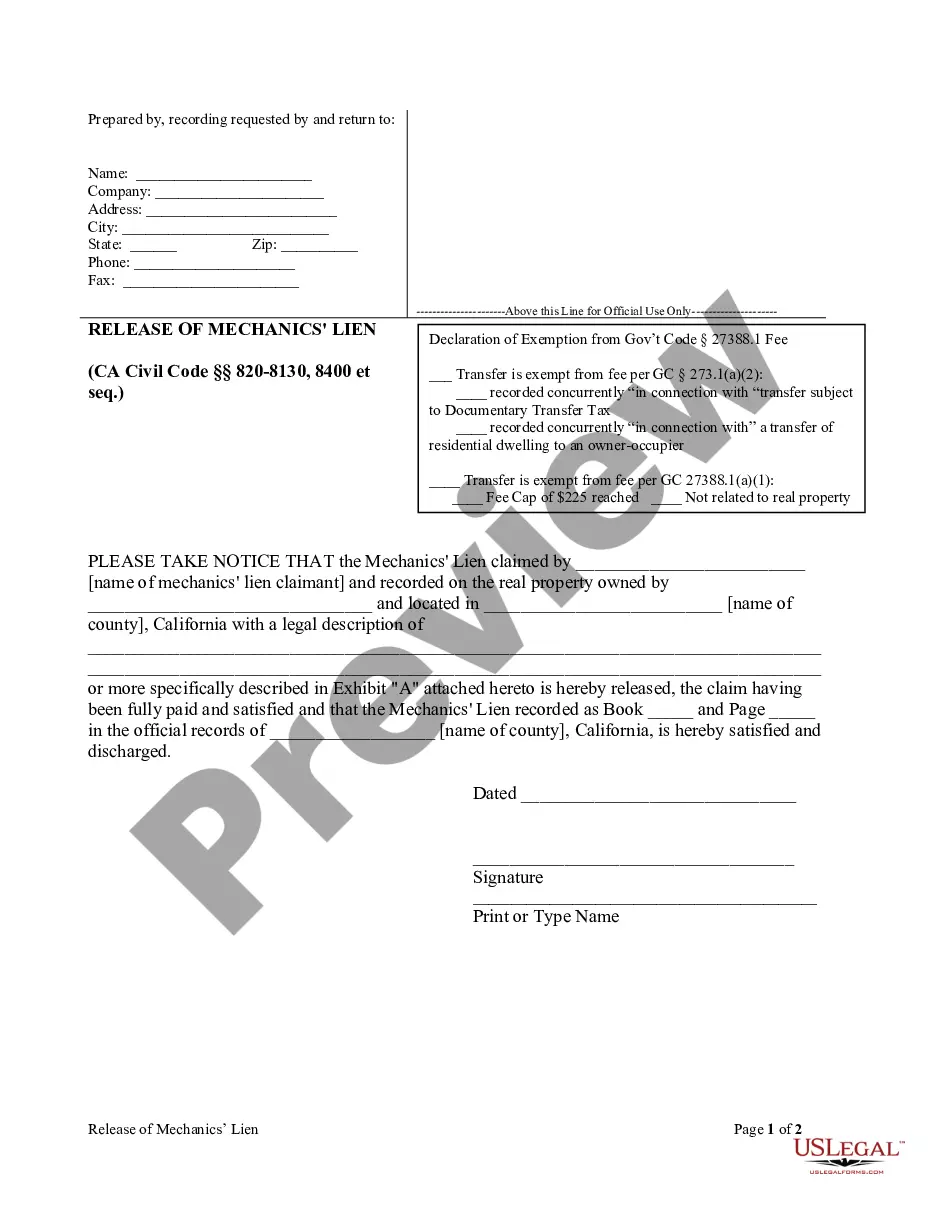

How to fill out General Form Of Irrevocable Trust Agreement?

Are you currently in a situation where you need documents for business or specific reasons frequently? There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, including the New York General Form of Irrevocable Trust Agreement, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New York General Form of Irrevocable Trust Agreement template.

- Locate the form you need and ensure it is for the correct area/region.

- Utilize the Review button to preview the form.

- Read the description to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and preferences.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you desire, complete the required information to create your account, and purchase the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

An irrevocable trust works by transferring ownership of your assets to a trust that you cannot modify or revoke. In New York, this kind of trust becomes its own legal entity, allowing you to designate a trustee to manage the assets according to your wishes. By utilizing the New York General Form of Irrevocable Trust Agreement, you can clearly define the terms and conditions. This arrangement offers benefits like asset protection and potential tax advantages while ensuring your beneficiaries receive support according to your plan.

One significant downside of an irrevocable trust is that you relinquish control over the assets transferred into the trust. Once established, you cannot easily change or terminate the trust without consent from beneficiaries. This lack of flexibility can be challenging, especially if your financial situation or goals change. Nevertheless, using the New York General Form of Irrevocable Trust Agreement can help ensure that your intentions are clearly outlined, providing protection and stability.

The 5-year rule for irrevocable trusts in New York typically refers to Medicaid eligibility. If you transfer assets into an irrevocable trust, they may be subject to a 5-year look-back period when applying for Medicaid benefits. This means that any assets transferred within the last five years may disqualify you from receiving benefits. This rule underscores the importance of using the New York General Form of Irrevocable Trust Agreement wisely, especially for long-term care planning.

In New York, the irrevocable trust law establishes that once a trust is created and assets are transferred into it, the grantor cannot alter or revoke the trust. This legal framework is crucial for individuals seeking to protect their assets or minimize estate taxes. The New York General Form of Irrevocable Trust Agreement provides a structured way to set up such a trust, ensuring compliance with New York laws. Understanding this law can help you secure your financial future.

Filling out a trust agreement requires careful attention to detail, including specifying the grantor, trustee, and beneficiaries in the document. You will need to define the terms and conditions governing the trust assets clearly. Uslegalforms can assist you with templates and guidance to ensure that your trust agreement, including the New York General Form of Irrevocable Trust Agreement, is completed properly and meets all legal requirements.

Filling out an irrevocable trust, such as the New York General Form of Irrevocable Trust Agreement, involves several steps, starting with identifying the grantor, trustee, and beneficiaries. You must also clearly outline the terms of the trust, including asset distribution and management strategies. Using a platform like uslegalforms can streamline the process, ensuring you cover all necessary details accurately.

Determining whether your parents should put their assets in a trust, like the New York General Form of Irrevocable Trust Agreement, depends on their specific financial and personal circumstances. Trusts can effectively manage assets, avoid probate, and provide tax benefits. Encouraging an open discussion with a financial advisor can help your parents make an informed decision.

The biggest mistake parents often make when setting up a trust fund, such as the New York General Form of Irrevocable Trust Agreement, is failing to clearly define the terms and conditions for its use. Without explicit guidelines, beneficiaries may have differing interpretations that can lead to conflict or mismanagement. It's critical to articulate your wishes thoroughly to avoid confusion later.

A family trust, including the New York General Form of Irrevocable Trust Agreement, might have limitations regarding tax benefits that can arise from something like a revocable trust. Moreover, family trusts can sometimes lead to disputes among beneficiaries if expectations are unclear or if family dynamics are complicated. It is essential to communicate the trust's purpose and details to all family members.

One potential downfall of having a trust, such as the New York General Form of Irrevocable Trust Agreement, is the loss of control over the assets you place into it. Once the trust is established, the assets belong to the trust itself, and as the grantor, you can't easily reclaim them. Additionally, trusts can involve complex setup and maintenance costs, which may not be ideal for everyone.