New York Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

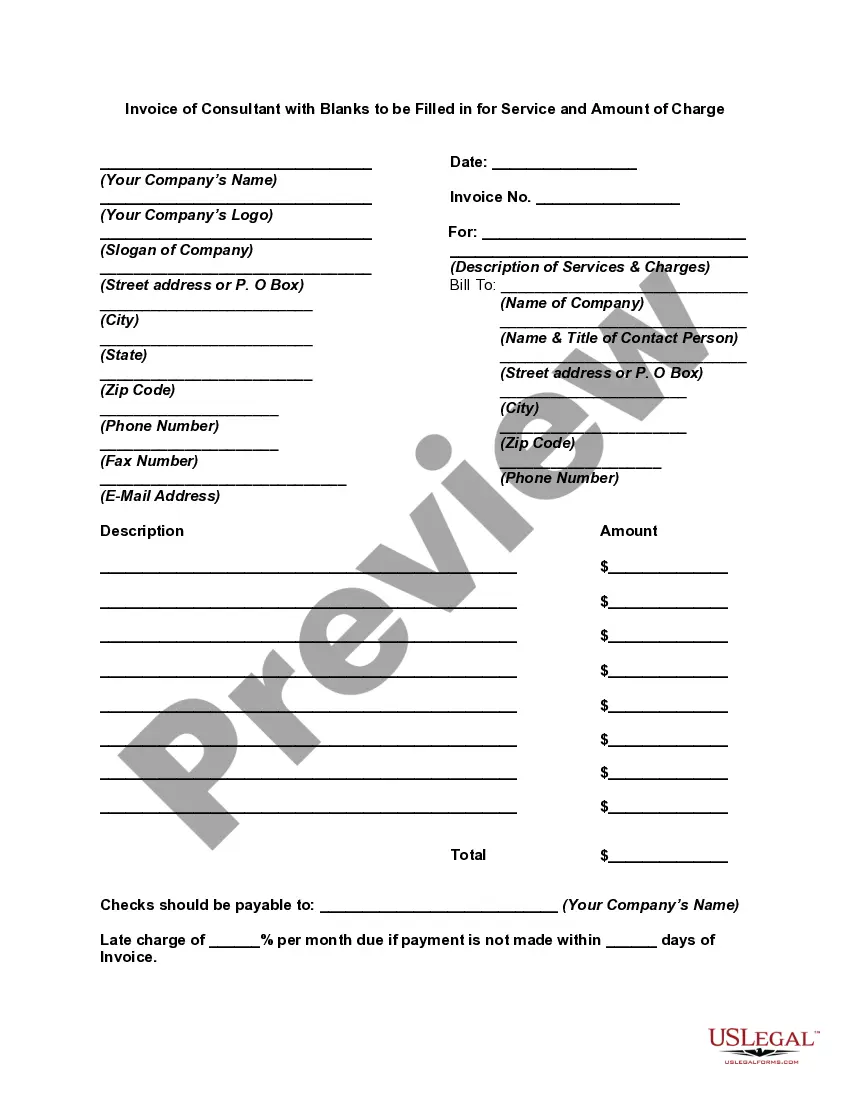

You may invest time on the Internet attempting to find the legal papers design that fits the state and federal demands you need. US Legal Forms supplies 1000s of legal forms which can be examined by experts. You can actually obtain or produce the New York Trust Agreement for Pension Plan with Corporate Trustee from my assistance.

If you currently have a US Legal Forms profile, you may log in and then click the Acquire button. Next, you may full, revise, produce, or indicator the New York Trust Agreement for Pension Plan with Corporate Trustee. Every legal papers design you purchase is your own for a long time. To get yet another version for any acquired develop, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site initially, keep to the easy guidelines listed below:

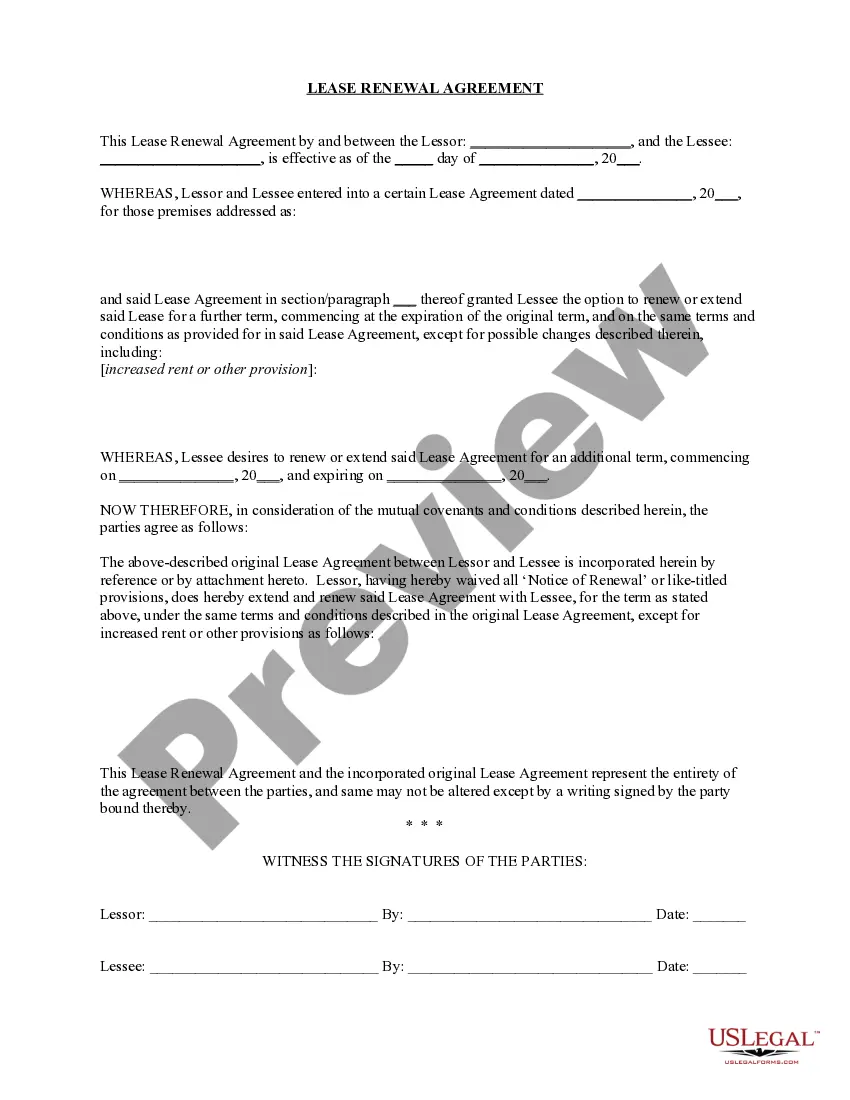

- Initial, ensure that you have chosen the right papers design for that area/metropolis of your choosing. See the develop information to ensure you have picked the correct develop. If accessible, use the Review button to search through the papers design also.

- If you would like get yet another edition in the develop, use the Research industry to get the design that meets your requirements and demands.

- When you have located the design you would like, simply click Buy now to move forward.

- Find the costs prepare you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal profile to purchase the legal develop.

- Find the file format in the papers and obtain it in your system.

- Make adjustments in your papers if necessary. You may full, revise and indicator and produce New York Trust Agreement for Pension Plan with Corporate Trustee.

Acquire and produce 1000s of papers themes making use of the US Legal Forms web site, that provides the greatest collection of legal forms. Use skilled and state-distinct themes to deal with your business or person demands.

Form popularity

FAQ

Corporate trust services can provide assistance with both the issuance and administration of corporate debt. Corporate trusts might distribute the interest payments from the corporation to the bondholders and ensure that the issuer is adhering to the covenants of the bond agreement.

A trust is a relationship where one person or company (the trustee) holds assets for the benefit of another (the beneficiary). When contracting on behalf of the beneficiaries, a trustee typically wishes to limit its liabilities to the extent to which it is indemnified out of the trust assets.

A trustee is responsible for managing and maintaining trust property while the custodian is only the entity that holds the assets. When you open a trust, you must appoint a trustee to oversee the trust's activities, which includes managing, selling, and distributing trust property to beneficiaries.

A pension trustee is someone who technically holds an occupational pension scheme's assets for the beneficiaries. They act separately from the employer for the benefit of scheme members and their powers are written in the trust deed and the scheme's rules.

The trustee's role is to administer and distribute the assets in the trust according to your wishes, as expressed in the trust document. Trustees have the fiduciary duty, legal authority, and responsibility to manage your assets held in trust and handle day-to-day financial matters on your behalf.

A trust is a legal agreement that transfers legal title of an asset to a trustee, who then manages the asset for the benefit of the grantor or another beneficiary. The trustee will hold, manage, and distribute the assets to a beneficiary as directed by the trust agreement.

What Is a 401(k) Trustee? The trustee (or trustees) of a plan is the individual that has the primary fiduciary responsibility to ensure the plan assets are being managed in the best interest of the participants and in line with the plan document. The trustee can be held personally liable for the misuse of plan asset.

Even if you are capable of managing your own trust, a corporate trustee can be a wise choice. You may not have the time, desire, or investment experience to manage your trust yourself, or perhaps you just feel that someone with more time and experience could do a better job than you.

A trust agreement is a legal document that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries. Trust agreements are created for many reasons: Allow your trustees to avoid probate. Wealth management. Tax advantages.

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.