New York Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

US Legal Forms - one of the largest collections of legal documents in the U.S. - offers a variety of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly find the most recent versions of forms like the New York Equipment Lease Checklist.

If you already have a subscription, Log In to download the New York Equipment Lease Checklist from the US Legal Forms library. The Download button will be available on each form you view. You can access all previously saved forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded New York Equipment Lease Checklist. Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New York Equipment Lease Checklist with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure to select the correct form for your city/region.

- Click the Review button to inspect the form’s content.

- Check the form details to ensure you have chosen the appropriate one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Setting up a lease to own agreement begins with drafting the agreement to specify payment terms, duration, and ownership transfer conditions. Next, both parties must review and sign the document to ensure a mutual understanding. For comprehensive information, consult the New York Equipment Lease Checklist to avoid missing any key components.

To set up an equipment lease in QuickBooks, first navigate to the 'Create Invoices' section and choose 'Equipment Lease' as your transaction type. Then, input your equipment details, leasing terms, and payment schedule. You can also refer to the New York Equipment Lease Checklist for guidance on what to include in your lease terms to maintain clarity and compliance.

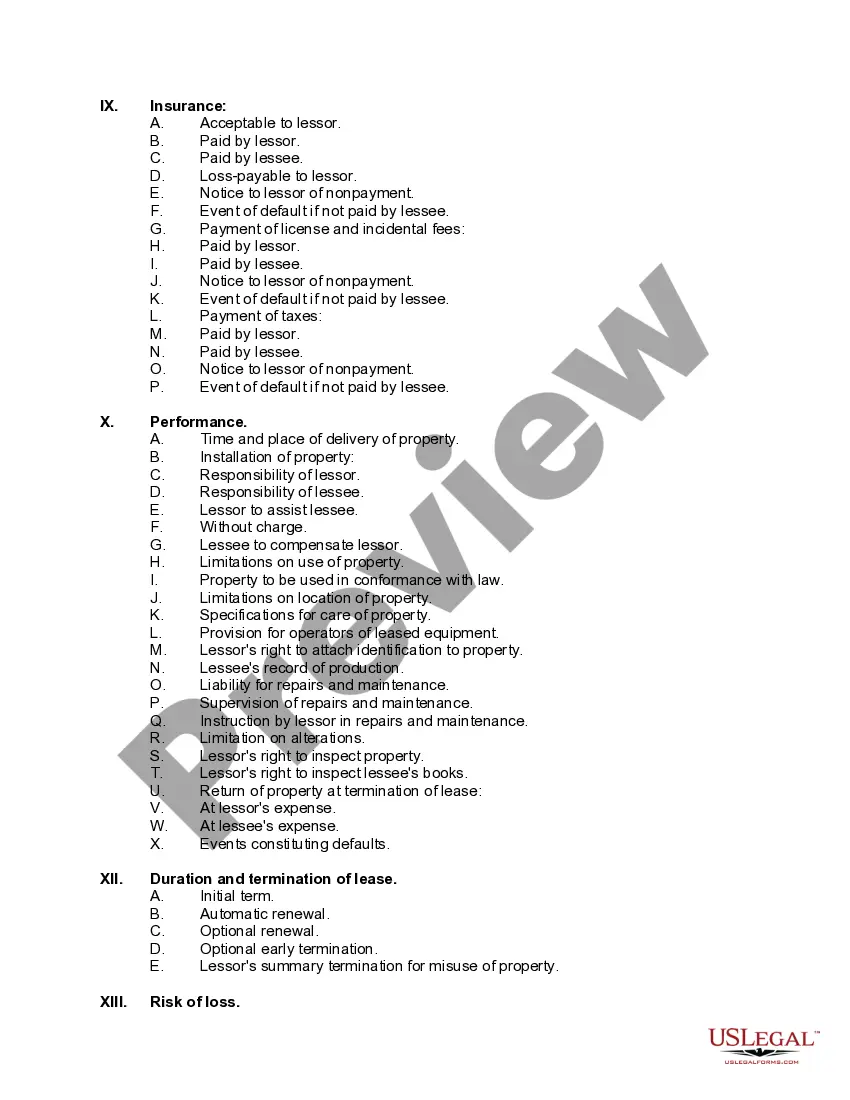

An equipment lease agreement outlines the terms under which you can use equipment owned by another party. This document includes details such as payment amounts, lease duration, and responsibilities for maintenance. Utilizing the New York Equipment Lease Checklist ensures that you include all necessary terms, protecting both parties involved.

A lease becomes a legal document when it meets specific criteria, such as being a written agreement signed by both parties. It should clearly define the assets involved, rental terms, and obligations of each party. Utilizing the New York Equipment Lease Checklist helps ensure your lease adheres to legal standards, enhancing its enforceability.

Setting up an equipment lease involves drafting a lease agreement that outlines the rights and responsibilities of both the lessor and lessee. Specify the equipment details, lease duration, payment terms, and any additional conditions. For a smooth setup process, the New York Equipment Lease Checklist can provide you with necessary guidelines and templates.

New York requires leases to be filed with the appropriate county clerk if the lease term is longer than a year. This filing helps protect the leased equipment from future claims. Using the New York Equipment Lease Checklist ensures you meet these recording requirements and safeguard your leasing interests effectively.

To record a lease in New York, the parties must execute a written agreement that specifies essential lease terms, including the duration and payment details. Additionally, the lease must be adequately signed and notarized. The New York Equipment Lease Checklist can guide you through these requirements, simplifying the process of lease documentation.

Yes, ASC 842 applies to equipment leases and requires lessees to recognize most leases on their balance sheets. This standard enhances financial transparency by providing a clearer picture of a company's leasing obligations. When using the New York Equipment Lease Checklist, you can ensure compliance with ASC 842, making it easier to manage your leases.

Yes, leased equipment can be capitalized under certain conditions, such as if the lease transfers ownership at the end or if the lease term covers a significant portion of the equipment's useful life. Capitalizing leased equipment means that it will appear on your balance sheet as an asset. Referencing the New York Equipment Lease Checklist will help you understand when capitalization is appropriate for your accounting needs.

In accounting, leased equipment should be recorded at the present value of future payments. This entry will show up as both an asset and a liability on your financial statements. Making sure these records align with the New York Equipment Lease Checklist will enhance your financial accuracy and transparency.