New York Superior Improvement Form

Description

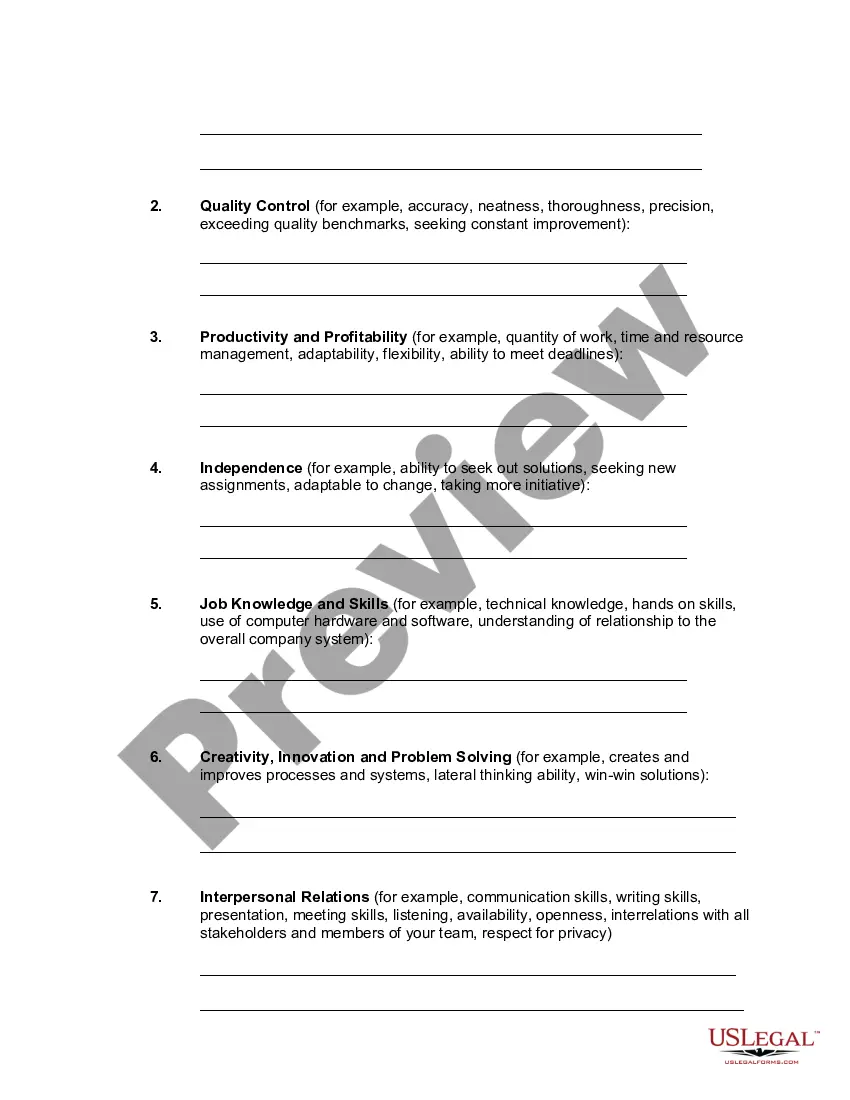

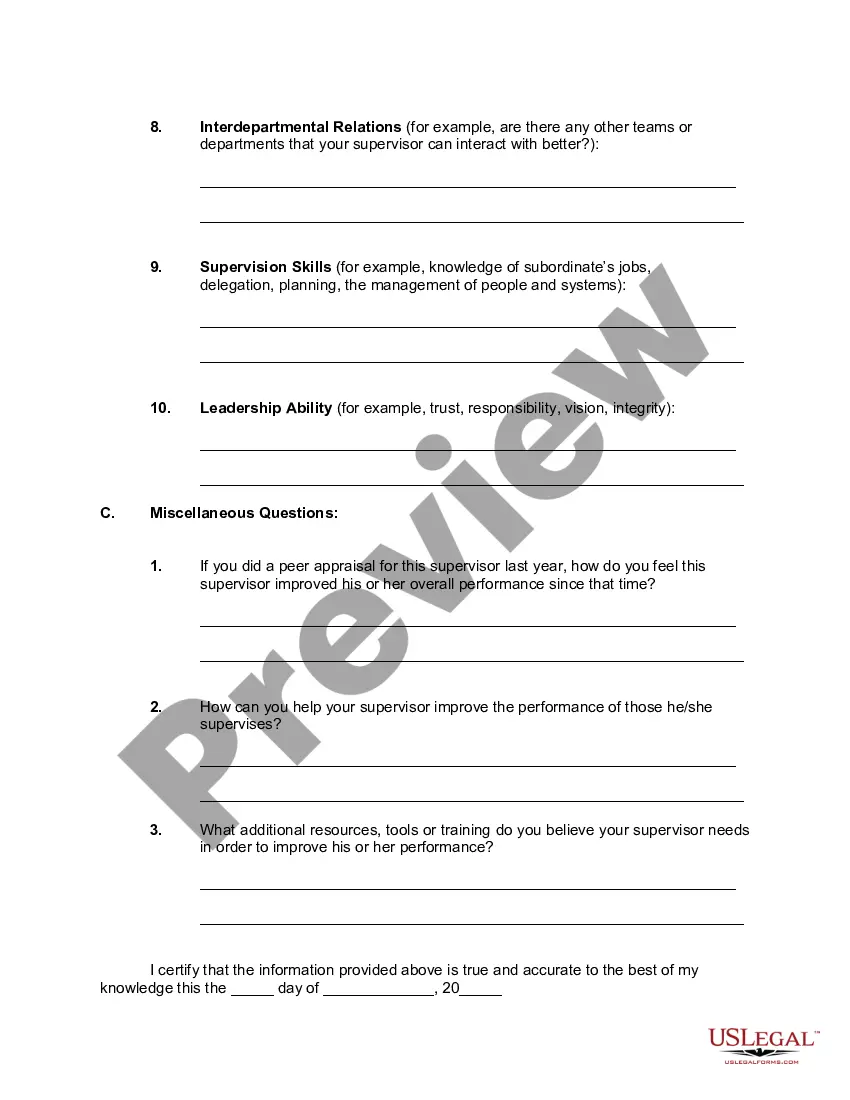

How to fill out Superior Improvement Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast assortment of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms such as the New York Superior Improvement Form in just seconds.

If you already hold a subscription, Log In and retrieve the New York Superior Improvement Form from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Edit as needed. Fill out, modify, print, and sign the downloaded New York Superior Improvement Form. Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the New York Superior Improvement Form through US Legal Forms, the most extensive collection of legal document templates. Utilize countless professional and state-specific templates tailored to fulfill your business or personal requirements.

- Ensure you have chosen the correct form for your locality.

- Click the Preview button to review the content of the form.

- Check the form details to confirm that you have selected the correct one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Form NYC-202 is required for certain businesses operating in New York City that meet specific revenue thresholds. If your business receives income from services, sales, or other operations within the city, you may need to file this form along with your New York Superior Improvement Form. It’s essential to review your obligations, as proper filing can prevent unnecessary penalties or issues with compliance.

The New York form IT-225, also referred to as the New York Superior Improvement Form, is used to claim tax credits for certain improvements made to real property. This form allows property owners to seek benefits tied to investments in their properties, potentially reducing their tax burden. Understanding how to fill out this form accurately can lead to significant savings, especially for those who have made eligible enhancements to their properties.

Repairs that enhance the value or extend the life of your property qualify as capital improvements. Examples include renovations like adding a new roof, upgrading plumbing systems, or expanding living spaces. When completing the New York Superior Improvement Form, it’s important to include these types of work. Understanding what counts as a capital improvement can help you maximize your potential tax savings.

The certificate of capital improvement serves as an official record that validates the completion of significant renovations. Its primary purpose is to secure tax benefits for property owners, especially when filing the New York Superior Improvement Form. By having this certificate, you can streamline the process of claiming exemptions. It plays a crucial role in ensuring you receive financial relief for your investment.

A certificate of capital improvement is essential for property owners who want to claim tax benefits on certain renovations. By submitting the New York Superior Improvement Form, you confirm that your improvements qualify for various tax exemptions. This certificate acts as proof to local tax authorities that the enhancements have been made. It enables property owners to take full advantage of available savings.

Capital improvements can increase the assessed value of your property, leading to higher property taxes. When you file the New York Superior Improvement Form, you can potentially benefit from tax exemptions related to these improvements. By accurately documenting your upgrades, you can ensure that your tax liabilities reflect the actual value added. Understanding this connection helps you manage your finances effectively.

You can obtain New York State tax forms by visiting the official New York State Department of Taxation and Finance website. They provide downloadable forms, including the necessary New York Superior Improvement Form. Additionally, you can also request physical copies by contacting their office directly if you prefer traditional mail.

To fill out the NY ST 120 form, begin by providing all required information about your property and the specific improvements made. Clearly list the costs associated with each improvement, as accurate figures are vital for your tax records. You can find guidance on completing the New York Superior Improvement Form through helpful resources offered by USLegalForms.

The requirements for capital improvements in New York include substantial expenditures that enhance the property’s functionality or extend its life. Additionally, documentation of the improvements and their costs is essential. Utilizing resources such as the New York Superior Improvement Form helps ensure compliance and maximizes your potential returns.

For tax purposes, a capital improvement must increase the property's value or adapt it for a different use. This may include significant repairs, installations of central air conditioning, or construction of new structures. Filling out the New York Superior Improvement Form accurately ensures you leverage any available tax benefits associated with these improvements.