New York Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you will gain access to thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the New York Assignment and Bill of Sale to Corporation in just a few moments.

Review the form description to confirm you have chosen the appropriate document.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already possess a membership, Log In and retrieve the New York Assignment and Bill of Sale to Corporation from the US Legal Forms repository.

- The Download button will appear on each form that you view.

- You have access to all previously saved forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your locality/state.

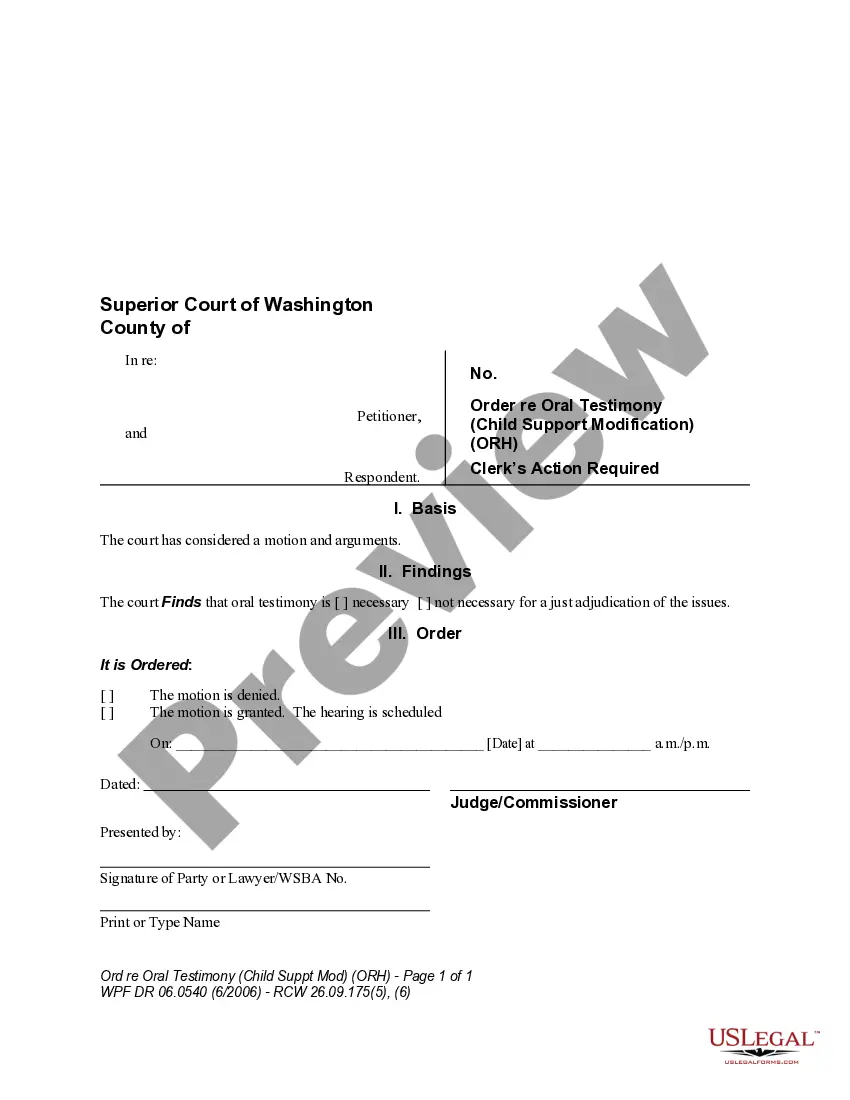

- Click the Preview button to review the content of the form.

Form popularity

FAQ

To form an S Corporation in New York, first select a unique name that adheres to state requirements. Then, file the Articles of Incorporation with the New York Department of State. After obtaining your EIN from the IRS, you can elect S Corporation status by filing Form 2553. For a smooth process, consider using the New York Assignment and Bill of Sale to Corporation to transfer ownership effectively and legally.

In selling, 'bulk' refers to large quantities of products sold at once. This term emphasizes the size of the order rather than individual transactions. Understanding this concept can be very helpful when executing the New York Assignment and Bill of Sale to Corporation, as it informs your approach to purchases and sales.

In New York, the seller is responsible for collecting and remitting the bulk sales tax. This tax applies to the total sale amount, regardless of whether the goods are sold individually or in bulk. If you are involved in the New York Assignment and Bill of Sale to Corporation, maintaining awareness of tax obligations will keep your business compliant.

Selling in bulk is commonly referred to as wholesale selling. This term highlights the nature of transactions involving large quantities of products sold at reduced prices. By understanding this concept, you can effectively navigate the New York Assignment and Bill of Sale to Corporation with improved financial strategies.

In New York, obtaining a certificate of authority typically takes around 1 to 2 weeks, assuming all paperwork is filled out correctly. This certificate is essential for any business planning to sell or lease goods in the state. If you are engaging in the New York Assignment and Bill of Sale to Corporation, be sure your authority is in place to proceed without delays.

In New York, it is challenging to obtain a title without a bill of sale since this document provides proof of ownership. While not legally required for all transactions, having a New York Assignment and Bill of Sale to Corporation strengthens your chances of securing a title efficiently. It shows that ownership has officially transferred, which is crucial for registration.

When selling a car in New York, you typically need the original title, a completed bill of sale, and a notice of transfer form. The bill of sale acts as a receipt for the transaction and can be part of a New York Assignment and Bill of Sale to Corporation if the buyer is an organization. Ensuring you have these documents helps create a smooth sale process.

Yes, you can handwrite a bill of sale in New York, and it is completely legal. However, it should contain all critical details regarding the transaction to avoid misunderstandings. Using a formal template, such as a New York Assignment and Bill of Sale to Corporation, can minimize mistakes and ensure all necessary information is clearly presented.

New York does not mandate a bill of sale for all transactions, but it is strongly advisable for documentation purposes. When transferring property, especially in business dealings with corporations, using a New York Assignment and Bill of Sale to Corporation ensures all parties are clear about the terms. This documentation also provides legal protection if issues arise later.

An assignment generally refers to the transfer of rights or interests in a specific agreement, while a bill of sale specifically documents the transfer of ownership for goods. In the context of a New York Assignment and Bill of Sale to Corporation, the assignment will address rights, while the bill of sale will formalize the ownership change. Understanding these differences can help simplify your transactions.