US Legal Forms - one of many most significant libraries of legal types in the USA - delivers a wide array of legal file layouts you can down load or printing. Utilizing the website, you will get a large number of types for organization and personal purposes, sorted by classes, states, or keywords and phrases.You can find the most up-to-date models of types like the New York Contest of Final Account and Proposed Distributions in a Probate Estate in seconds.

If you currently have a registration, log in and down load New York Contest of Final Account and Proposed Distributions in a Probate Estate in the US Legal Forms collection. The Download button will show up on each form you perspective. You get access to all earlier delivered electronically types from the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, listed below are basic guidelines to help you started:

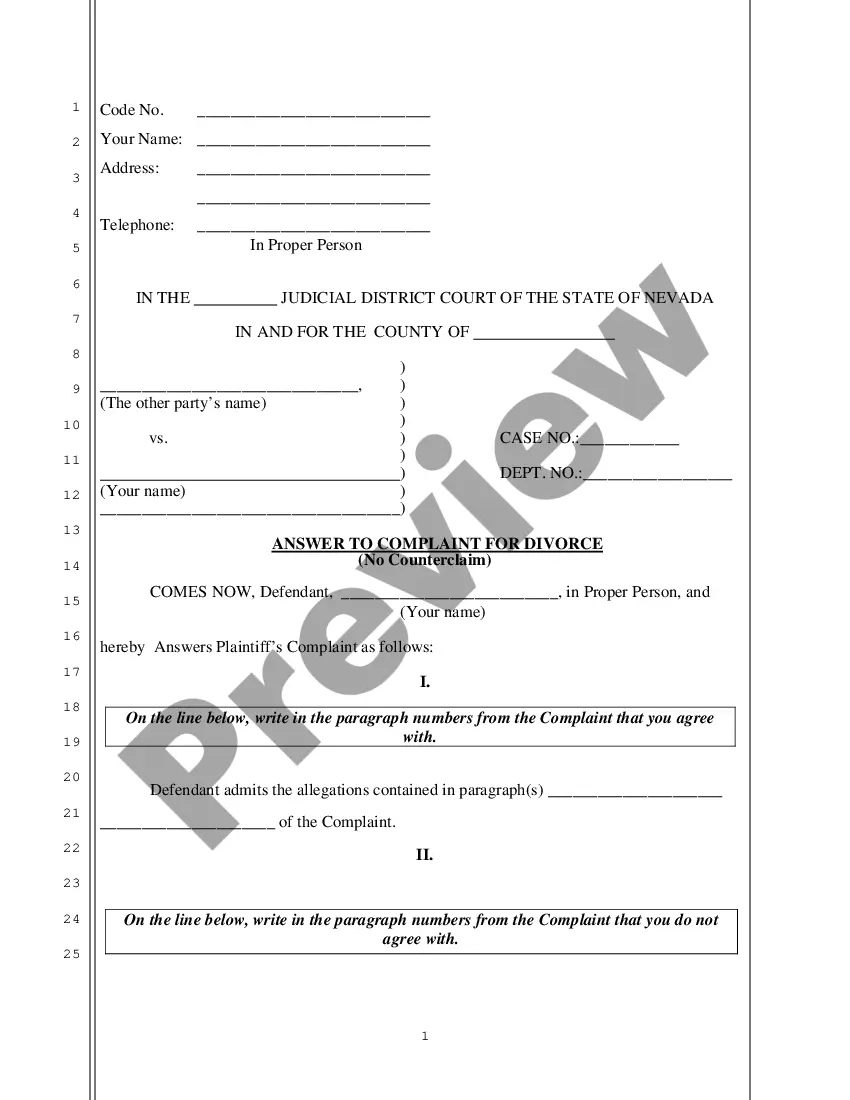

- Be sure you have picked the best form for the city/area. Go through the Preview button to analyze the form`s content. See the form explanation to ensure that you have selected the appropriate form.

- If the form does not suit your demands, utilize the Research discipline towards the top of the monitor to discover the one which does.

- When you are happy with the form, confirm your option by simply clicking the Buy now button. Then, opt for the pricing prepare you want and offer your qualifications to sign up for the profile.

- Procedure the transaction. Make use of your credit card or PayPal profile to accomplish the transaction.

- Find the formatting and down load the form on your system.

- Make adjustments. Fill out, edit and printing and sign the delivered electronically New York Contest of Final Account and Proposed Distributions in a Probate Estate.

Each design you put into your money lacks an expiry time and it is your own permanently. So, in order to down load or printing another backup, just visit the My Forms area and then click on the form you will need.

Gain access to the New York Contest of Final Account and Proposed Distributions in a Probate Estate with US Legal Forms, one of the most extensive collection of legal file layouts. Use a large number of specialist and state-particular layouts that fulfill your organization or personal needs and demands.