New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

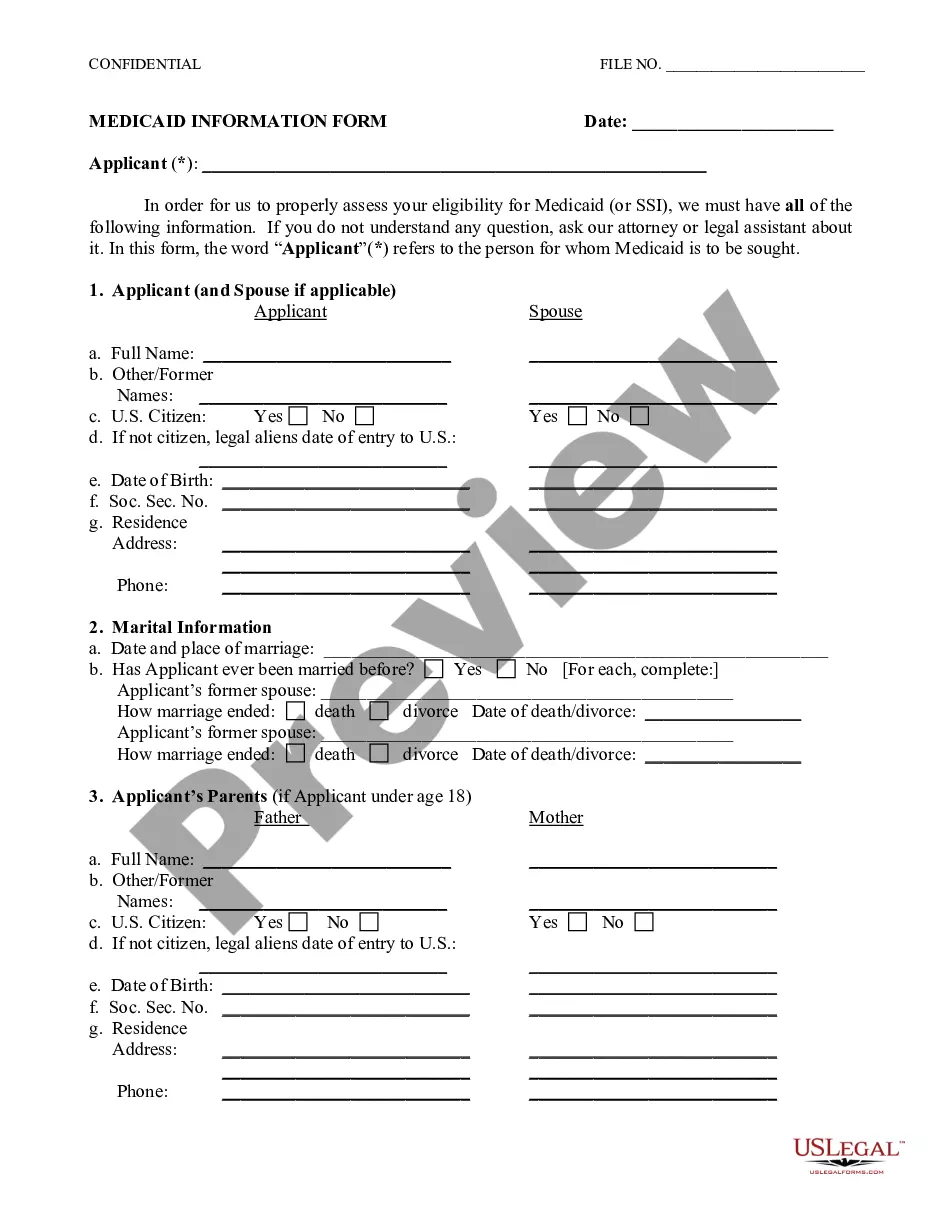

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Finding the correct legal document template can be quite a challenge.

Of course, there is a plethora of templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers numerous templates, including the New York Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation, which can be employed for both business and personal purposes.

You can preview the form using the Preview button and read through the form description to confirm this is the right one for you.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the New York Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation.

- Use your account to search for the legal forms you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the correct form for your region/state.

Form popularity

FAQ

Another common term for a buy-sell agreement is a buyout agreement. This term emphasizes the agreement's purpose of outlining the process for shareholders to buy each other’s shares during specific circumstances. It's crucial to consider the implications of a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation as it ensures a smooth transition and keeps business continuity in the event of a share transfer.

No, although both agreements relate to shareholders, they serve different purposes. A Shareholders Agreement outlines the general rules of shareholder conduct, while a buy-sell agreement focuses specifically on the process of buying and selling shares under certain conditions. Therefore, a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is more specialized in addressing share transfer scenarios.

While a buy-sell agreement offers many benefits, it can also have drawbacks. One potential disadvantage is the financial strain it may impose on shareholders when triggering events occur, such as a buyout. Additionally, a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation may require ongoing evaluation and updates, which can create complexity and potential conflicts over valuation.

A Shareholders Agreement establishes the rights and responsibilities of shareholders in a company. It governs how decisions are made and how shares are handled, ensuring that all shareholders are aware of their roles. When considering a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, this agreement acts as a foundation for managing relationships and expectations amongst shareholders.

The basics of a shareholder agreement include defining shareholder roles, rights, and obligations while outlining procedures for share transfers. It should highlight critical elements like voting rights and distribution of profits. These are essential factors in a comprehensive New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, facilitating a clear understanding of each shareholder’s position.

To write a shareholder agreement, outline the essential components, such as the company’s purpose, share allocation, and shareholder rights. It’s vital to incorporate specific clauses that align with a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation for clarity on share transfers. Utilizing tools like US Legal Forms can streamline this process, providing you with a solid foundation.

structured shareholder agreement should include the number of shares held, voting rights, profit distribution, and the procedures for selling shares. Additionally, it should encompass buysell provisions, especially if you consider a New York BuySell Agreement between Two Shareholders of Closely Held Corporation. Each element plays a crucial role in maintaining transparency and protecting shareholders' rights.

An agreement for the sale of shares to another shareholder facilitates the transfer of shares from one shareholder to another in a straightforward manner. It ensures that the selling shareholder has the right to sell their shares and that the purchasing shareholder understands their responsibilities. This concept is a critical component of a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, as it helps prevent future disputes.

To write a shareholder agreement, start by defining the governance structure, including how decisions are made and how shares can be sold or transferred. You should also include provisions related to dispute resolution and buy-sell clauses found in a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. For a comprehensive approach, you might consider using platforms like US Legal Forms for customizable templates.

A shareholder agreement outlines the relationship among shareholders, detailing responsibilities, rights, and decision-making processes. On the other hand, a New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation specifically governs the transfer of shares under certain conditions. While both documents are essential for corporate governance, they serve distinct purposes in protecting shareholder interests.