New York Credit Card Application for Unsecured Open End Credit

Description

How to fill out Credit Card Application For Unsecured Open End Credit?

Are you currently inside a position where you require paperwork for either company or individual purposes nearly every time? There are plenty of lawful papers web templates accessible on the Internet, but finding kinds you can rely on isn`t straightforward. US Legal Forms offers thousands of develop web templates, much like the New York Credit Card Application for Unsecured Open End Credit, which can be created to satisfy federal and state demands.

In case you are previously familiar with US Legal Forms web site and have a free account, merely log in. After that, it is possible to acquire the New York Credit Card Application for Unsecured Open End Credit format.

If you do not come with an accounts and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for that proper town/area.

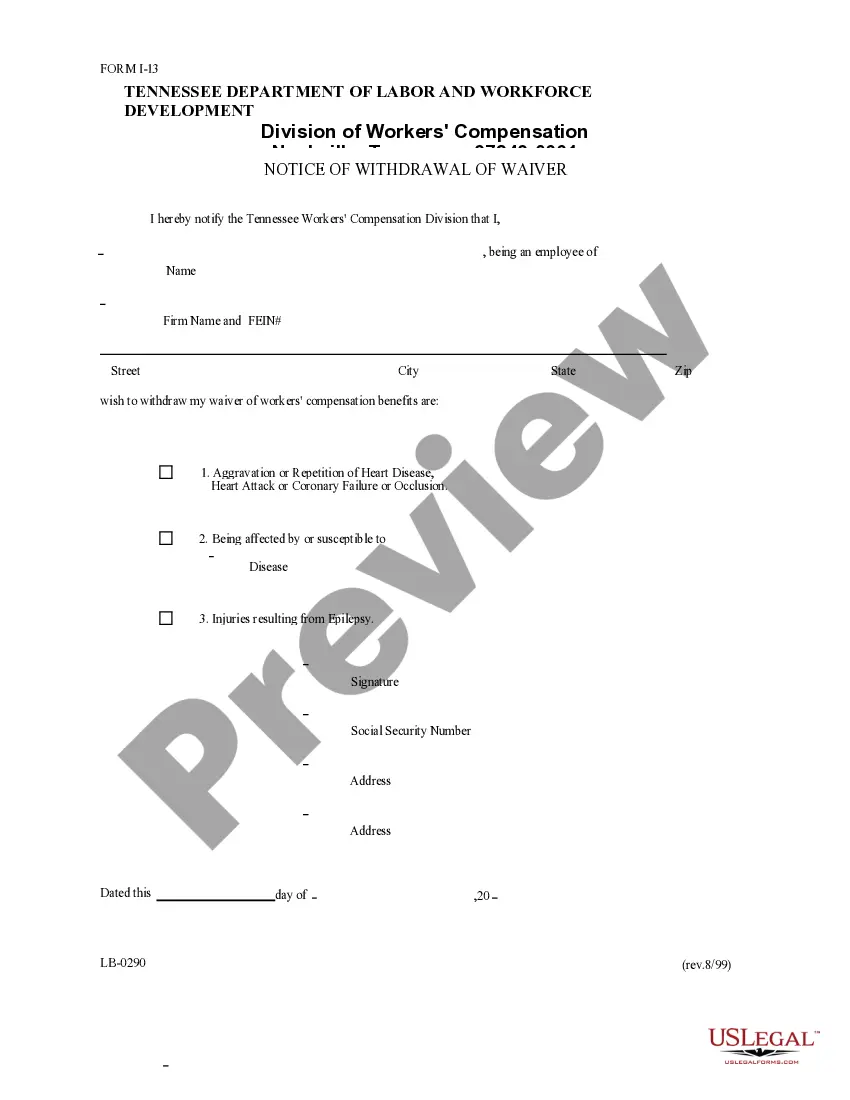

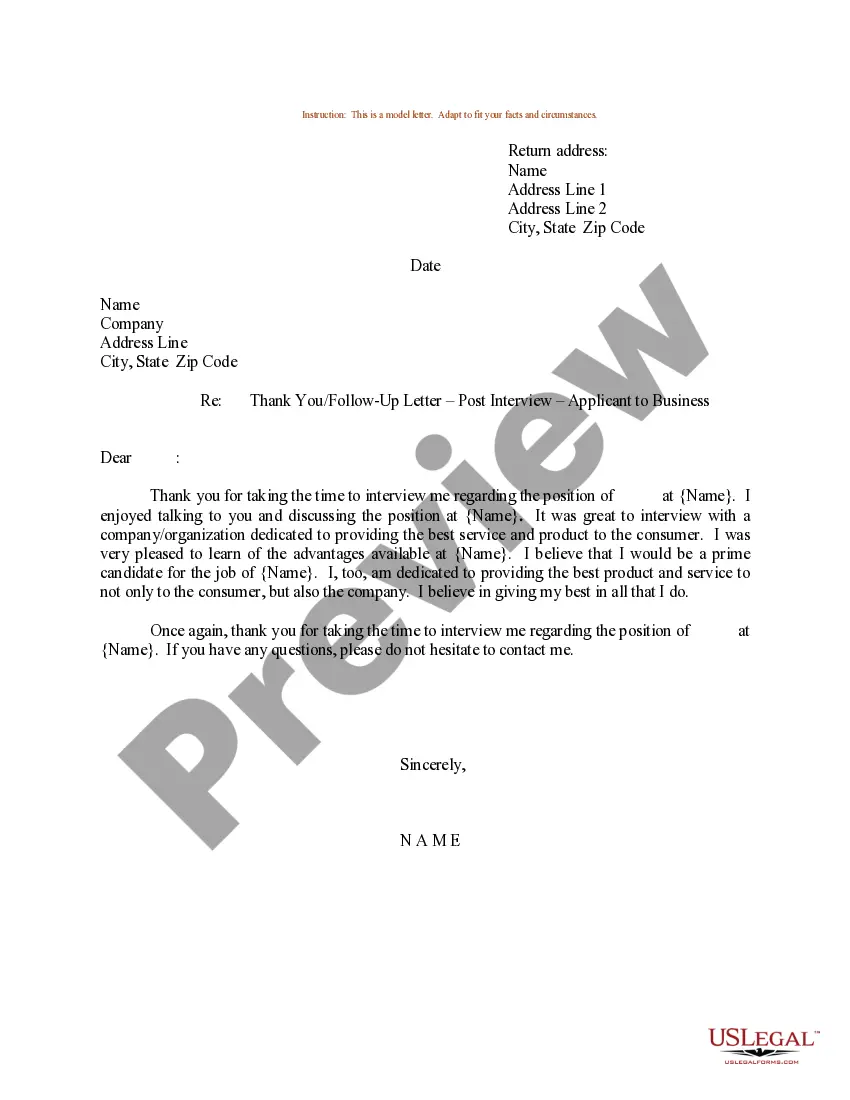

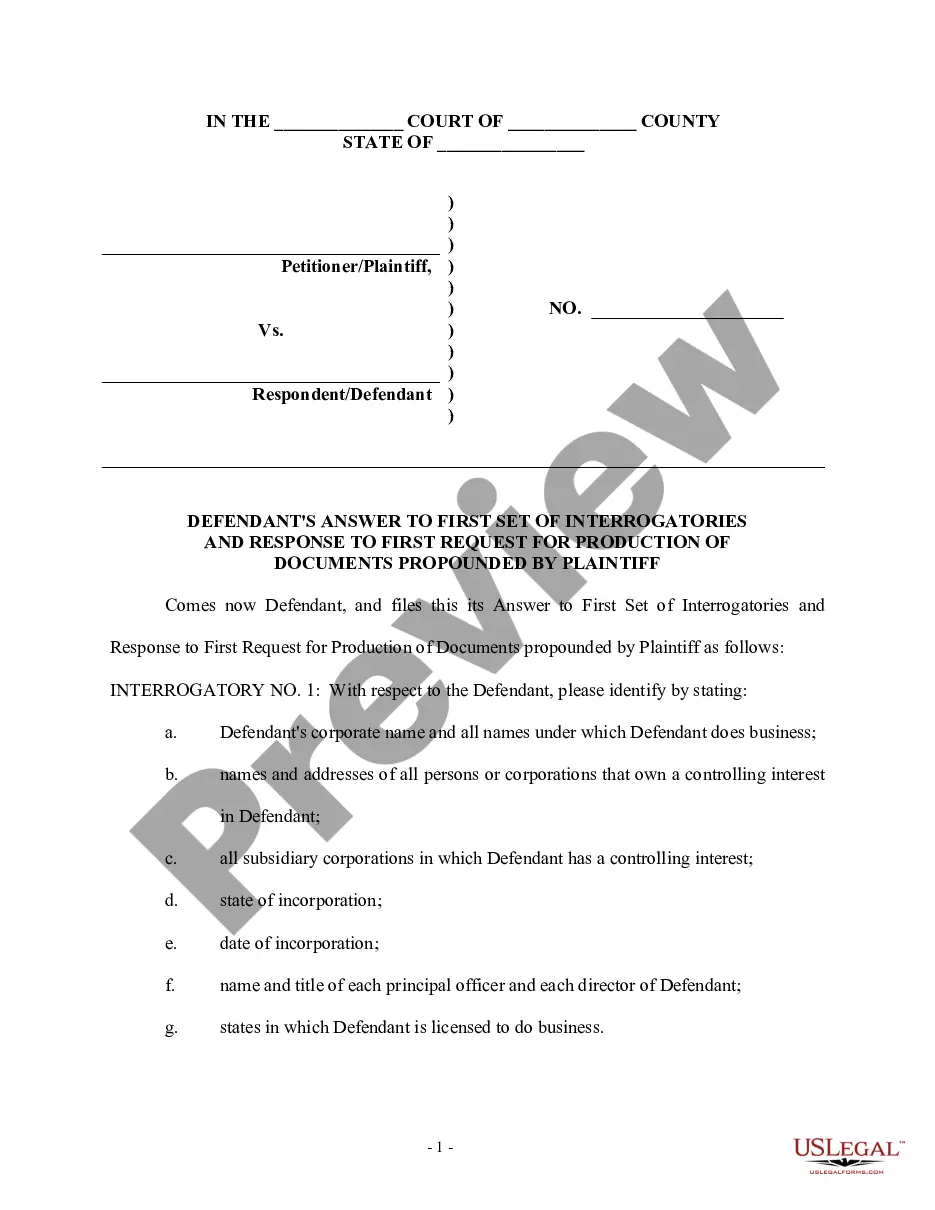

- Make use of the Preview button to examine the shape.

- Look at the explanation to actually have selected the proper develop.

- In the event the develop isn`t what you`re seeking, utilize the Look for discipline to get the develop that suits you and demands.

- When you discover the proper develop, click Acquire now.

- Opt for the prices strategy you would like, fill in the necessary details to produce your account, and buy an order using your PayPal or bank card.

- Pick a handy file file format and acquire your copy.

Get each of the papers web templates you have bought in the My Forms food list. You may get a extra copy of New York Credit Card Application for Unsecured Open End Credit anytime, if needed. Just go through the needed develop to acquire or produce the papers format.

Use US Legal Forms, one of the most considerable collection of lawful forms, in order to save efforts and stay away from faults. The assistance offers professionally created lawful papers web templates which can be used for a selection of purposes. Create a free account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

The best unsecured credit card to get with a 500 credit score is the Credit One Visa card. This card offers a $300 starting credit limit, the potential for automatic credit line increases, and an annual fee of $75 intro 1st yr, $99 after. Cardholders earn rewards on select purchases, too. Can I Get an Unsecured Credit Card with a 500 Credit Score? - WalletHub wallethub.com ? answers ? unsecured-credit-cards... wallethub.com ? answers ? unsecured-credit-cards...

Here's a Summary of The Best Credit Cards For Bad Credit U.S. Bank Cash+® Secured Visa® Card. Bank of America® Customized Cash Rewards Secured Credit Card. First Progress Platinum Prestige Mastercard® Secured Credit Card. Rates & Fees. ... Bank of America® Unlimited Cash Rewards Secured Credit Card. Best Credit Cards For Bad Credit Of November 2023 - Forbes forbes.com ? advisor ? best ? bad-credit forbes.com ? advisor ? best ? bad-credit

Most unsecured credit cards require credit in the good to excellent range (670-850). This range is where you'll become eligible for many different kinds of rewards and 0 percent intro APR cards.

Most Credit Cards Provide Same-Day Approval Milestone® Mastercard® 4.2 / 5.0. ... Fortiva® Mastercard® Credit Card. 4.7 / 5.0. ... Aspire® Cash Back Reward Card. 4.7 / 5.0. ... Surge® Platinum Mastercard® 4.5 / 5.0. ... Total Visa® Card. 4.5 / 5.0. ... First Progress Platinum Prestige Mastercard® Secured Credit Card. ... First Access Visa® Card.

While secured cards require some type of deposit or collateral, an unsecured card doesn't. However, it's important to know that unsecured cards accessible to those with poor credit?which FICO defines as under 580 and VantageScore as 600 or less?often come with other costs, like higher interest or fees.

670-850 Most unsecured credit cards require credit in the good to excellent range (670-850). This range is where you'll become eligible for many different kinds of rewards and 0 percent intro APR cards. What Is An Unsecured Credit Card? | Bankrate bankrate.com ? finance ? what-is-an-unsecu... bankrate.com ? finance ? what-is-an-unsecu...

Best unsecured credit cards for bad credit compared 2023 Unsecured credit cardBest forAnnual feeMission Lane Visa® Credit CardNo credit check$0First Access Visa CardBad credit$75 annual fee, followed by $8.25/mo after 1st yearMilestone® Mastercard®Short term use$35 - $95Avant Credit CardLimited credit$594 more rows

Easiest credit cards to get Best for no annual fee: Citi® Double Cash Card. Best for cash back: U.S. Bank Cash+® Visa® Secured Card. Best for students: Discover it® Student Cash Back. Best for no credit: Petal® 2 ?Cash Back, No Fees? Visa® Credit Card. Best secured card: Discover it® Secured Credit Card. 5 easiest credit cards to get approved for in November 2023 - CNBC cnbc.com ? select ? easiest-credit-cards-to-get cnbc.com ? select ? easiest-credit-cards-to-get