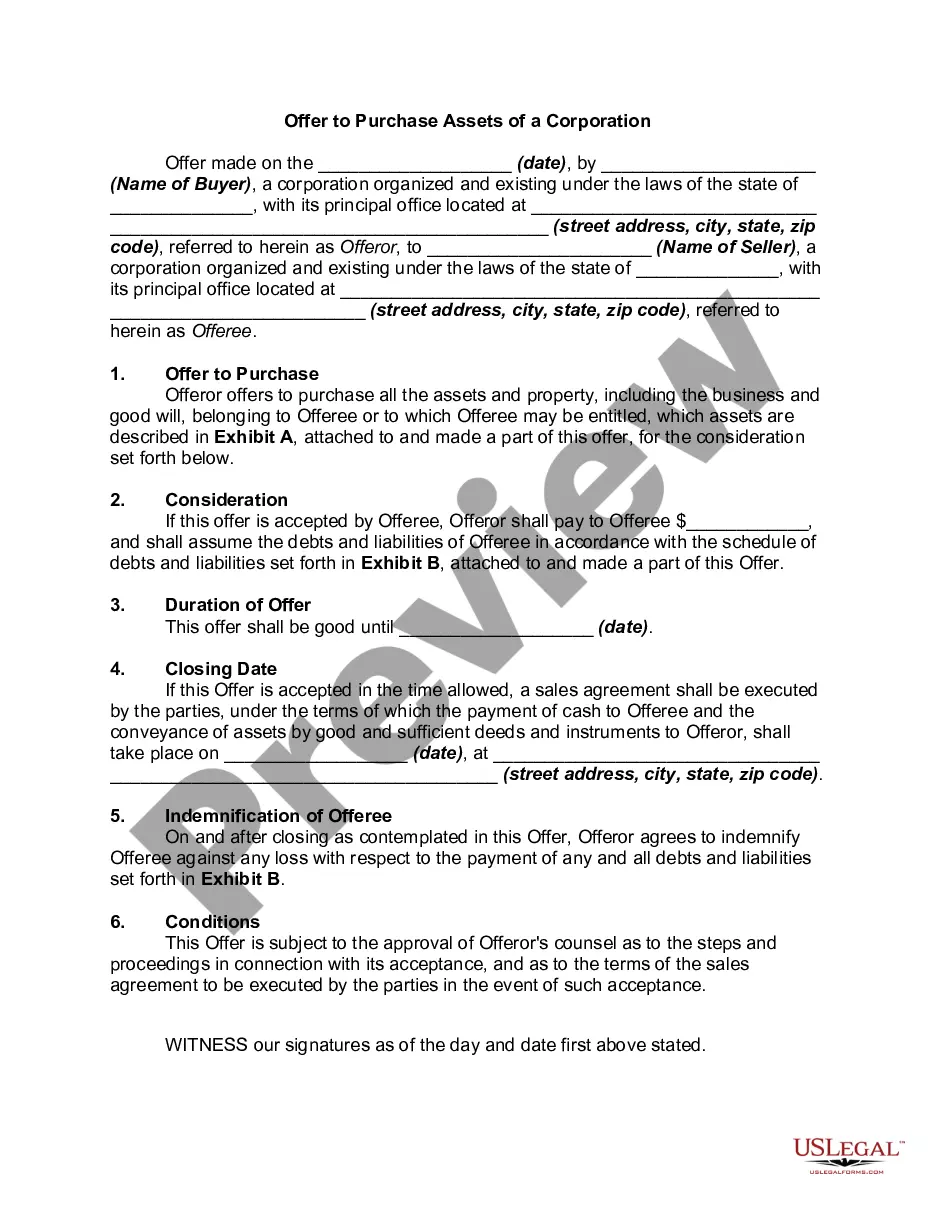

New York Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

Discovering the right legal record template could be a struggle. Of course, there are plenty of web templates available on the Internet, but how would you obtain the legal kind you require? Make use of the US Legal Forms web site. The service provides a large number of web templates, such as the New York Offer to Purchase Assets of a Corporation, which can be used for business and personal needs. Each of the kinds are checked out by experts and fulfill federal and state needs.

Should you be already authorized, log in to the account and click the Download switch to have the New York Offer to Purchase Assets of a Corporation. Make use of account to appear throughout the legal kinds you possess bought previously. Check out the My Forms tab of your respective account and acquire yet another backup in the record you require.

Should you be a new customer of US Legal Forms, listed below are easy directions for you to comply with:

- Initial, be sure you have chosen the proper kind for your metropolis/area. You are able to look through the shape using the Review switch and browse the shape outline to make sure it will be the best for you.

- If the kind fails to fulfill your requirements, make use of the Seach industry to discover the right kind.

- Once you are certain that the shape is suitable, go through the Get now switch to have the kind.

- Opt for the prices program you would like and enter the necessary information and facts. Create your account and pay money for an order with your PayPal account or charge card.

- Choose the submit file format and down load the legal record template to the product.

- Comprehensive, modify and print out and signal the acquired New York Offer to Purchase Assets of a Corporation.

US Legal Forms will be the greatest collection of legal kinds for which you can find various record web templates. Make use of the company to down load expertly-made documents that comply with state needs.

Form popularity

FAQ

If purchasing a business entity, you are purchasing all the corporation's shares or if a limited liability company, its membership interest. In contrast, if purchasing the business' assets, you are buying all the assets, contracts, debts, and anything else registered under the business' name.

Assets like stocks, bonds, and real estate can be used to create a steady stream of cash flow that can help fund other investments or be put towards expansion efforts. Additionally, investing in assets helps businesses diversify their portfolios and reduce their risk of loss due to market fluctuations.

The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale. Typically, for reasons having to do with tax benefits, buyers prefer asset sales, whereas sellers prefer stock sales.

Any purchases made with credit can be referred to as ?purchased on account.? A business that owes another entity for goods or services rendered will record the total amount as a credit entry to increase accounts payable. The outstanding balance remains until cash is paid, in full, to the entity owed.

Purchasing Assets The buyer is taking ownership of the company when he or she buys up the shares, and all the company's assets and liabilities become the property of the shareholder who takes ownership. Only certain company assets can be purchased, not the liabilities as a way to reduce the potential risk.

Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.