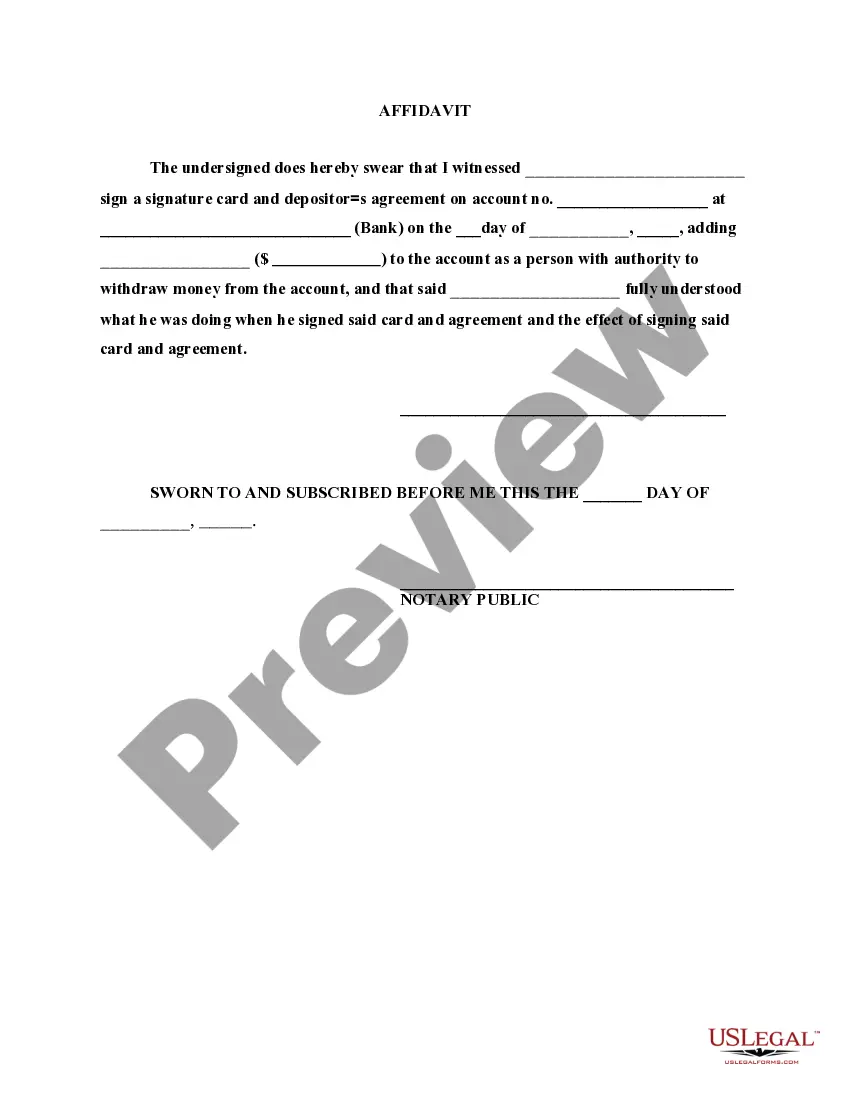

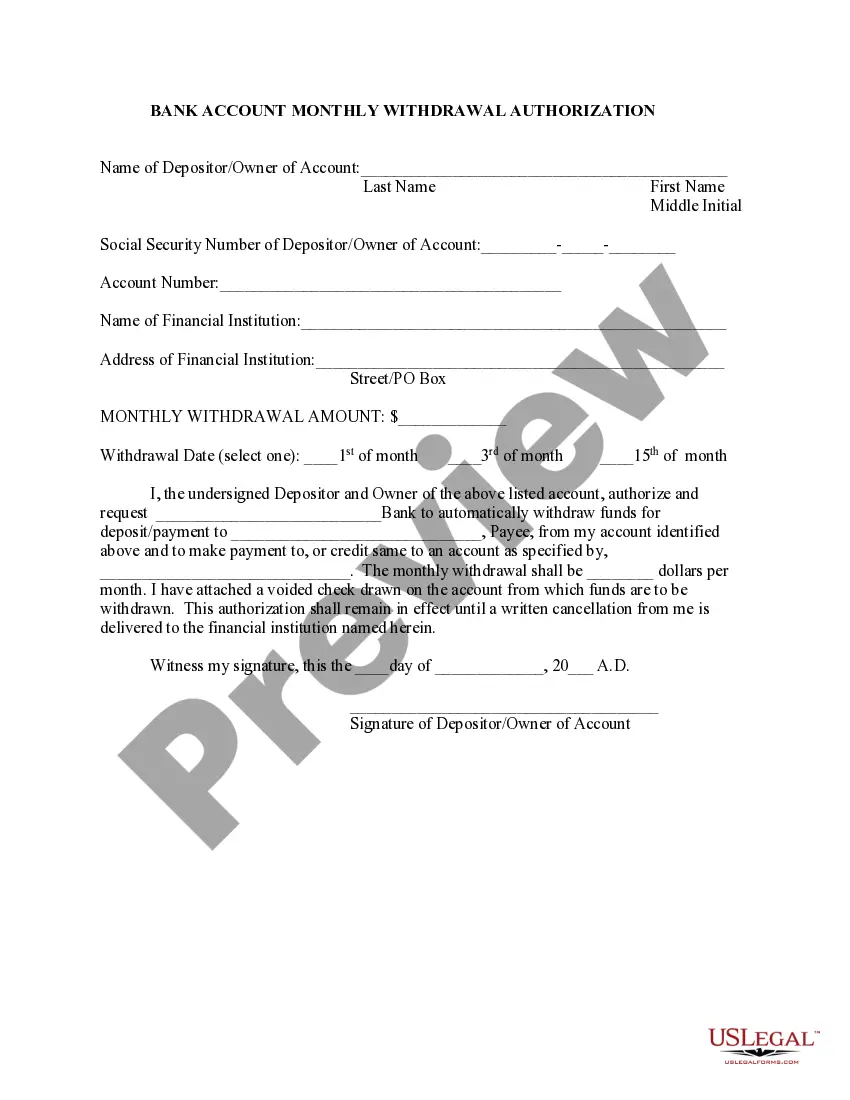

New York Bank Account Monthly Withdrawal Authorization

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

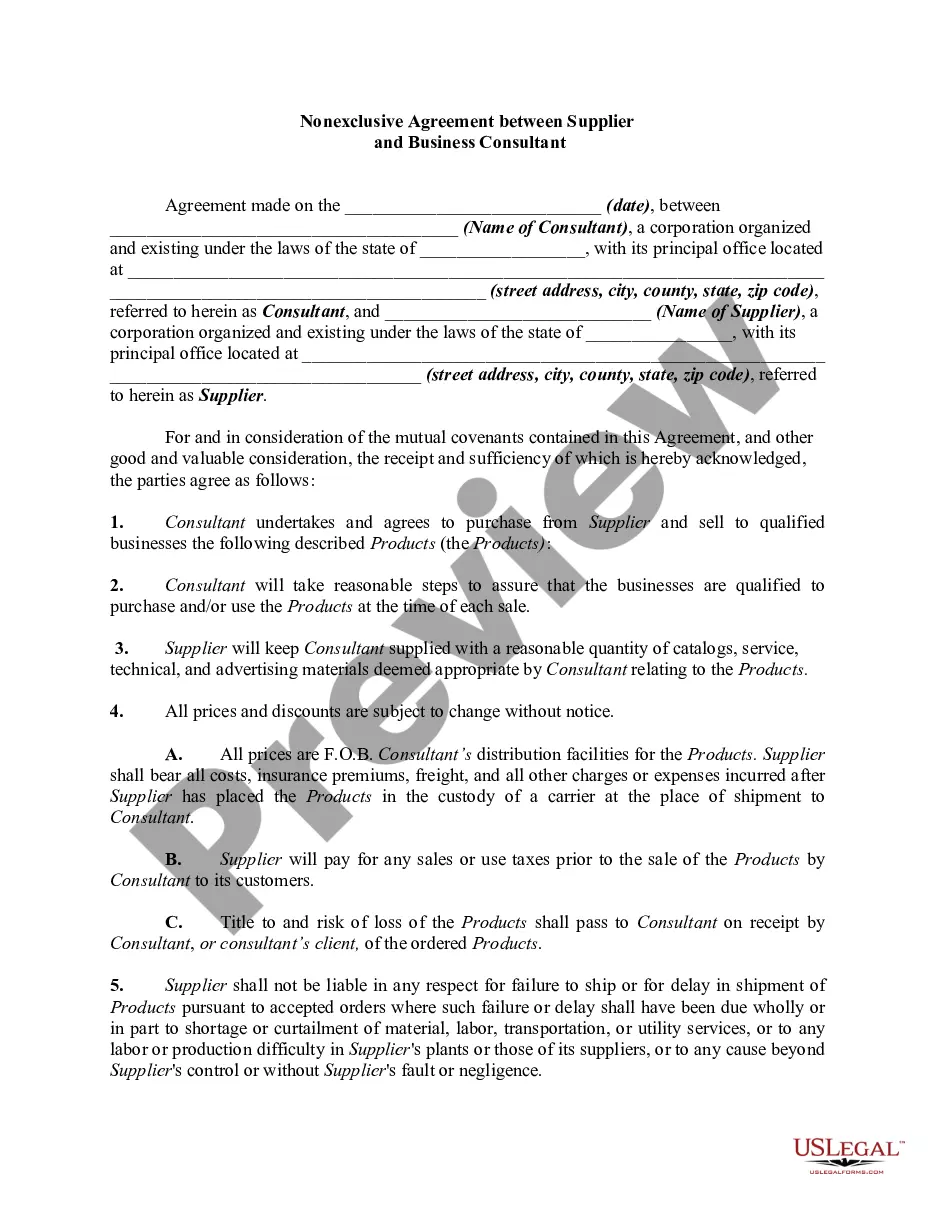

Finding the right legal file design might be a battle. Needless to say, there are plenty of web templates available on the Internet, but how do you get the legal type you want? Take advantage of the US Legal Forms web site. The assistance offers a large number of web templates, such as the New York Bank Account Monthly Withdrawal Authorization, that you can use for enterprise and personal requires. All of the kinds are inspected by professionals and satisfy federal and state demands.

When you are presently registered, log in to the accounts and click the Down load button to get the New York Bank Account Monthly Withdrawal Authorization. Use your accounts to check through the legal kinds you possess acquired earlier. Proceed to the My Forms tab of your own accounts and acquire yet another backup of the file you want.

When you are a fresh customer of US Legal Forms, listed below are simple directions so that you can stick to:

- Very first, make certain you have selected the proper type for your personal city/area. You are able to look through the shape utilizing the Preview button and browse the shape explanation to guarantee this is the right one for you.

- If the type does not satisfy your expectations, take advantage of the Seach area to find the proper type.

- Once you are certain the shape is proper, click the Get now button to get the type.

- Select the rates prepare you need and type in the required details. Make your accounts and pay money for your order using your PayPal accounts or Visa or Mastercard.

- Pick the file format and acquire the legal file design to the gadget.

- Full, edit and print out and indication the acquired New York Bank Account Monthly Withdrawal Authorization.

US Legal Forms is the most significant local library of legal kinds for which you can discover different file web templates. Take advantage of the company to acquire appropriately-made paperwork that stick to status demands.

Form popularity

FAQ

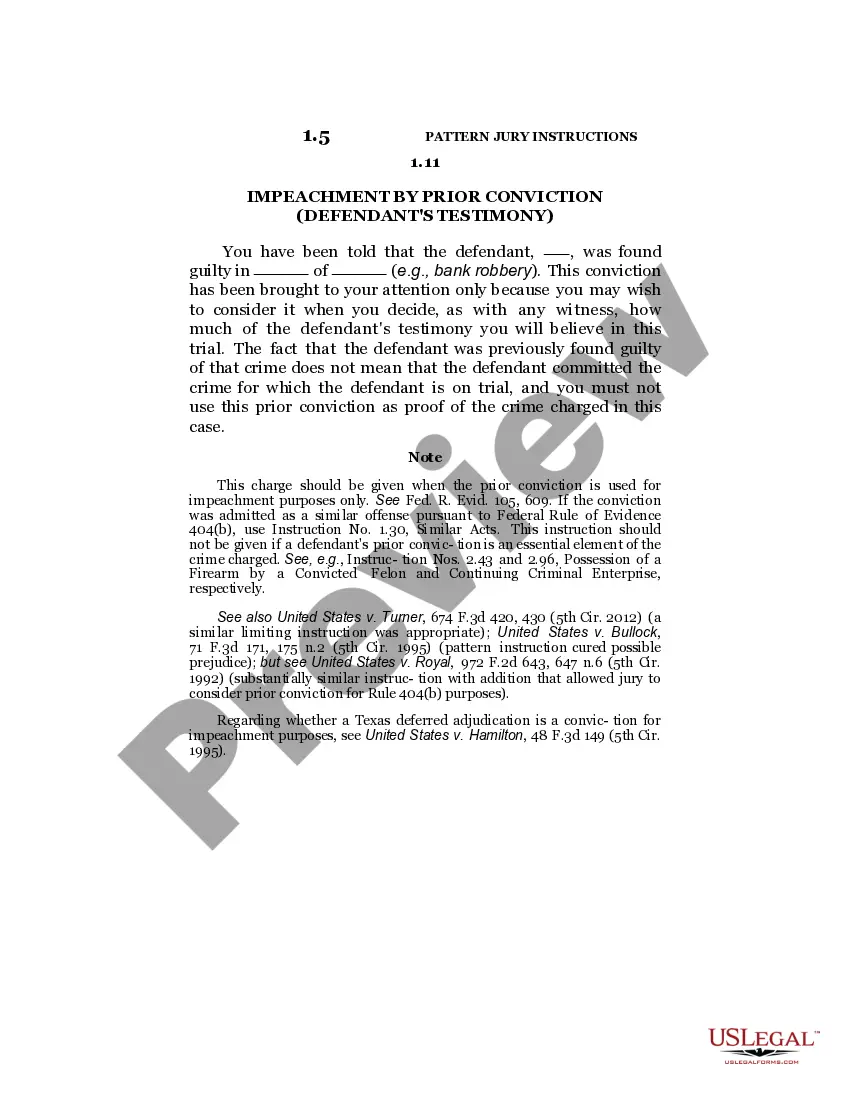

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used.

The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

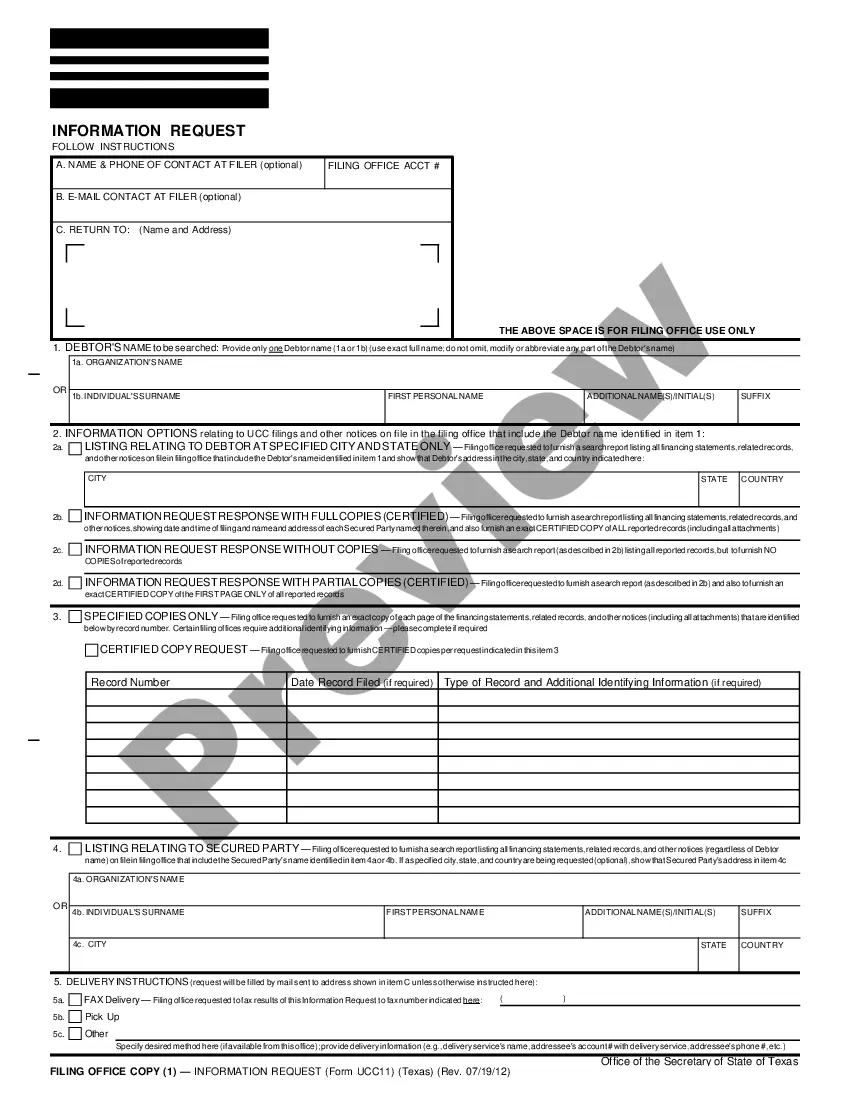

Form TR-579-IT must be completed to authorize an ERO to e-file a personal income tax return and to transmit bank account information for the electronic funds withdrawal.

PURPOSE - A completed Form NYC-579-EMP provides documentation that an ERO has been authorized to electronically file Form NYC-1127. The employee may designate the ERO to electronically sign the Form NYC-1127 by entering the employee?s personal identification number (PIN).

You must complete Schedule C and attach Form IT-203-B to your return if you are claiming the college tuition itemized deduction. Note: If a student is claimed as a dependent on another person's New York State tax return, only the person who claims the student as a dependent may claim the itemized deduction.

How does the e-signature option work? Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

A pension exclusion will calculate on Form IT-201, line 29 if you have an amount on line 9 or 10 that was not from a NYS or local government pension plan or federal government pension plan, and the taxpayer was 59 1/2 before January 1 of the current year.

For Tax Year 2022 Note that an electronic signature can be used as described in TSB-M-20(1)C, (2)I, E-File Authorizations (TR-579 forms) for Taxpayers Using a Paid Preparer for Electronically Filed Tax Returns. EROs and paid preparers must complete Part B prior to transmitting withholding returns.