When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

New York Disclaimer of Partnership

Description

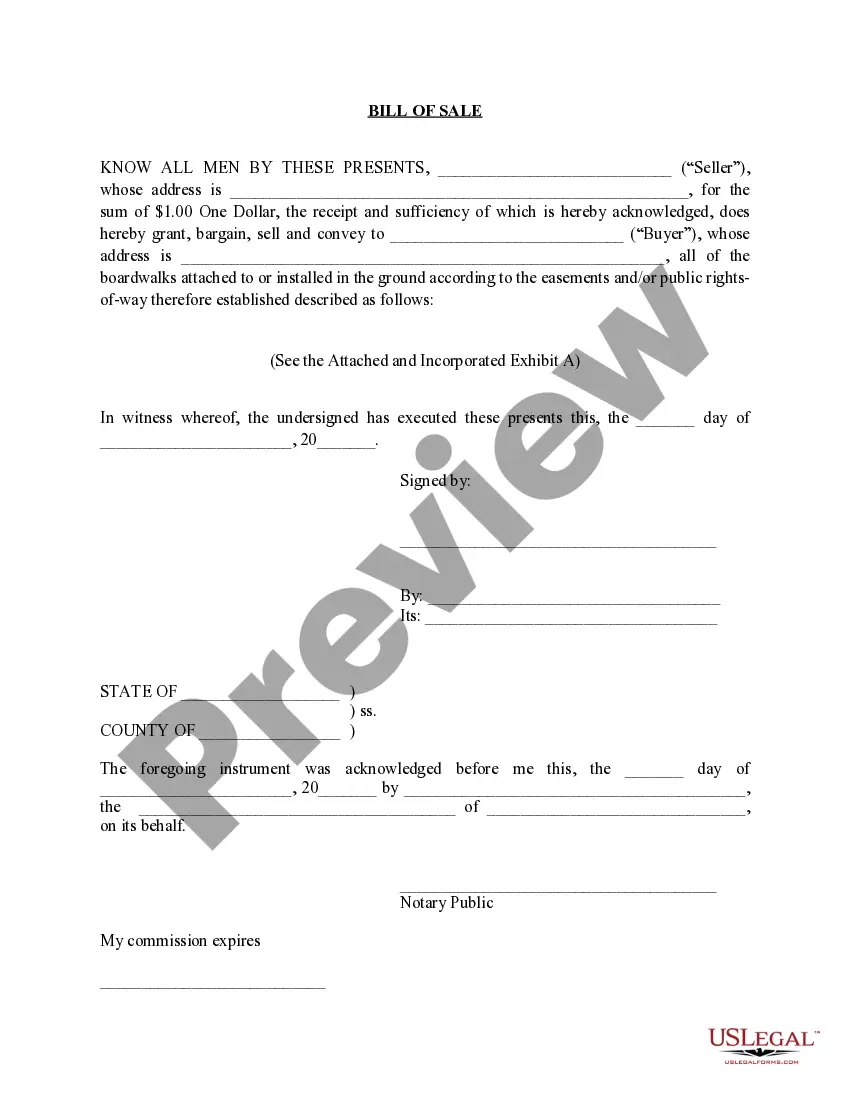

How to fill out Disclaimer Of Partnership?

You can use countless hours online trying to find the authentic document template that meets the federal and state standards you require.

US Legal Forms provides a vast array of valid forms that are reviewed by experts.

You can easily obtain or create the New York Disclaimer of Partnership from my service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and hit the Download button.

- Next, you can complete, edit, produce, or sign the New York Disclaimer of Partnership.

- Each valid document template you obtain is yours forever.

- To get another copy of a purchased form, navigate to the My documents tab and click on the relevant button.

- If it's your first time using the US Legal Forms website, adhere to the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Review the form details to make sure you have selected the right template.

Form popularity

FAQ

To get proof of partnership, you can request your domestic partnership certificate or any formal documents you've filed with the state. Be prepared to provide identification and pertinent details about your partnership. Using services like USLegalForms can streamline this process, ensuring you have the necessary proof to verify your New York Disclaimer of Partnership.

To obtain a marriage certificate copy in NYC, visit the City Clerk's office or request online via their official website. Ensure you have proper identification and details about the marriage, such as the date and location. This document can be crucial for proving your marital status, similar to a New York Disclaimer of Partnership.

In New York, a domestic partnership lasts until one party wishes to dissolve it, or until the parties legally marry. There is typically no fixed duration unless stated in a written agreement. Understanding your rights and responsibilities can help mitigate issues, and resources like USLegalForms can provide clarity on the implications of the New York Disclaimer of Partnership.

If you need a copy of your domestic partnership certificate in NYC, you can request it from the City Clerk's office, where your partnership was registered. Provide necessary identification and information about your partnership. This ensures that you receive the correct certified copy under the New York Disclaimer of Partnership.

To obtain domestic partnership papers in New York, you need to apply through your local city or county Clerk's office. Fill out the necessary forms and provide any required identification and documentation. Once the application is processed, you will receive the official partnership papers, which affirm your commitment under the New York Disclaimer of Partnership.

A New York certificate of status is important if you need to prove the existence of your business or partnership in New York. This document serves as an official confirmation that your partnership is in good standing with the state. If you are unsure about needing this certificate, it's helpful to consult an attorney or utilize services like USLegalForms to guide you through the process.

Your obligation to file NYC 204 depends on your business structure and income levels in New York City. If you participate in a partnership or other qualifying business entity, you may be required to file this form. For a clearer understanding of your filing requirements, consider using USLegalForms to access relevant tax advice and documents.

If the total value of your estate exceeds the New York estate tax exemption limit, you must file a New York estate tax return. This filing ensures compliance with state tax laws and provides an opportunity to settle any estate taxes due. For assistance in managing this process, explore the services available on USLegalForms.

New York 204 LL is required for limited liability companies (LLCs) that operate in New York City and have income or losses to report. This filing helps determine how much tax your LLC owes to the city. If you're part of an LLC and unsure about your obligations, consulting resources or experts via USLegalForms can provide valuable clarification.

Filing a New York biennial statement involves submitting your business information to the New York Secretary of State every two years. This requirement is critical for maintaining your business standing. You can simplify the process by using USLegalForms, which offers user-friendly tools and resources to ensure your filing is accurate and timely.