New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

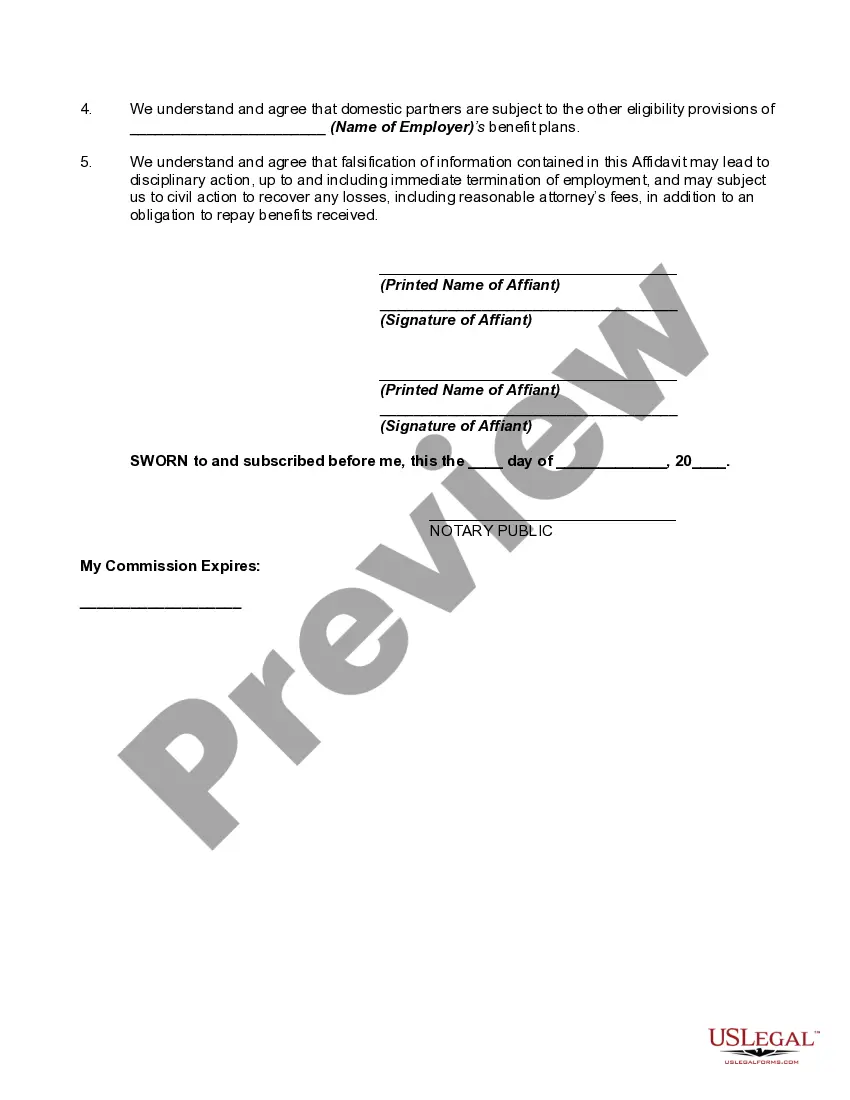

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

US Legal Forms - one of the largest collections of legal documents in the US - provides a vast selection of legal document templates that you can download or print.

By utilizing the site, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly locate the latest forms like the New York Affidavit of Both Domestic Partners to Employer to Receive Benefits.

If you already hold a membership, Log In to access the New York Affidavit of Both Domestic Partners to Employer to Receive Benefits within the US Legal Forms library. The Download button will be visible on each form you view. You can retrieve all previously downloaded forms from the My documents section of your account.

Afterward, make edits. Fill out, modify, and print and sign the downloaded New York Affidavit of Both Domestic Partners to Employer to Receive Benefits.

Each template you add to your account has no expiration date and belongs to you forever. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New York Affidavit of Both Domestic Partners to Employer to Receive Benefits with US Legal Forms, the most comprehensive collection of legal document templates. Take advantage of thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you begin.

- Ensure you have chosen the correct form for your city/county. Click on the Review button to assess the form's details. Check the form description to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, finalize your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

To prove your domestic partnership for insurance purposes, you will often need to provide documentation that verifies your relationship. This may include the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, along with other evidence such as joint leases, shared bank accounts, or beneficiaries on insurance policies. Preparing these documents ensures a smoother process when applying for health insurance benefits through your employer.

The affidavit of domestic partner relationship is a legal document that verifies and acknowledges the partnership between two individuals. This document often serves as the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits and outlines your mutual commitment to one another. By filing this affidavit, you gain access to various benefits, including health insurance and other employer-provided perks, which are typically available to married couples.

To add your domestic partner to your health insurance, first check with your employer or insurance provider regarding their specific requirements. You typically need to submit a New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, along with any necessary documentation proving your relationship. Follow the enrollment process and provide the required forms within the open enrollment period to ensure your partner receives coverage in a timely manner.

The primary difference between marriage and domestic partnership in New York lies in the legal recognition and rights associated with each. Marriage grants broader rights and protections, whereas domestic partnerships provide limited rights. The New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits is essential for registering your partnership and securing certain benefits, though it does not equate to all the privileges of marriage. It's crucial to understand these distinctions for legal and financial planning.

No, domestic partners cannot file income taxes jointly in New York. This limitation means you must file separately and acknowledge individual incomes. Utilizing the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can still aid in applying for certain benefits available to domestic partners. Stay informed about the best practices for tax filings based on your partnership status.

To prove domestic partnership for health insurance in New York, you typically need to provide documentation, such as a signed affidavit or evidence of shared expenses. Submitting the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can serve as strong proof of your partnership. Always consult with your employer or insurance provider for their specific requirements. Proper documentation will facilitate the benefits you seek.

In New York, domestic partnership rules require that both partners sign a registration form with the local government. You must share a domestic residence and meet specific eligibility criteria regarding age and financial status. Completing the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can further solidify your partnership status and allow access to necessary benefits. Be sure to check local laws for any additional requirements.

In New York, domestic partners are not generally responsible for each other's debts. This differs from married couples, who may share financial responsibilities in certain cases. However, having the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can clarify aspects of financial responsibility when dealing with shared expenses and benefits. It's always wise to review any agreements regarding debts.

No, if you are not married in New York, you cannot file taxes jointly. Domestic partners have different tax filing options compared to married couples, which is where the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can be useful. It can help establish your status and ensure you receive the correct benefits for health insurance and other financial matters. Filing separately may be your best option.

In New York, domestic partners cannot file taxes jointly like married couples can. However, you can still file separately while considering the benefits that come with the New York Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This affidavit may help in determining eligibility for certain deductions and credits. It is essential to understand tax implications based on your partnership status.