New York Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

US Legal Forms - one of the most extensive collections of authentic documents in the United States - offers an array of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can receive the latest forms such as the New York Business Management Consulting or Consultant Services Agreement - Self-Employed in a matter of minutes.

Read the form description to ensure you have chosen the right form.

If the form does not meet your needs, utilize the Search area at the top of the screen to find the one that does.

- If you have a subscription, Log In and download New York Business Management Consulting or Consultant Services Agreement - Self-Employed from the US Legal Forms catalog.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

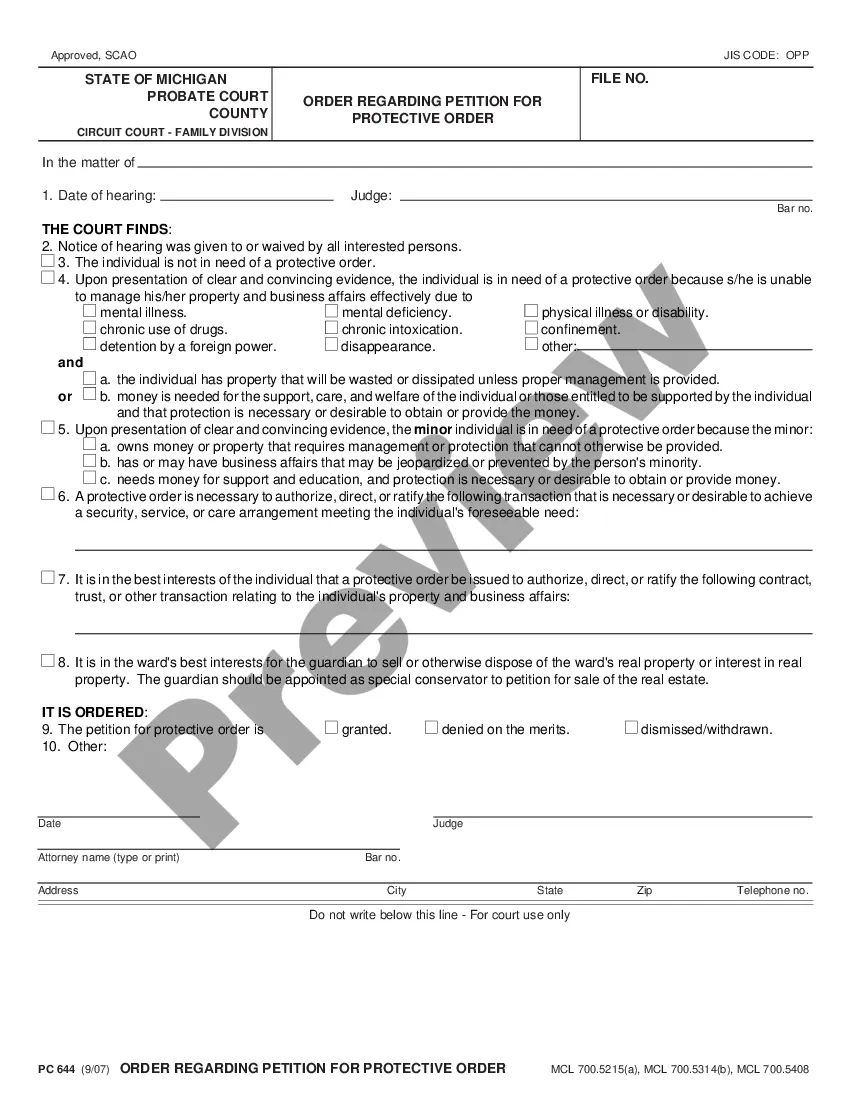

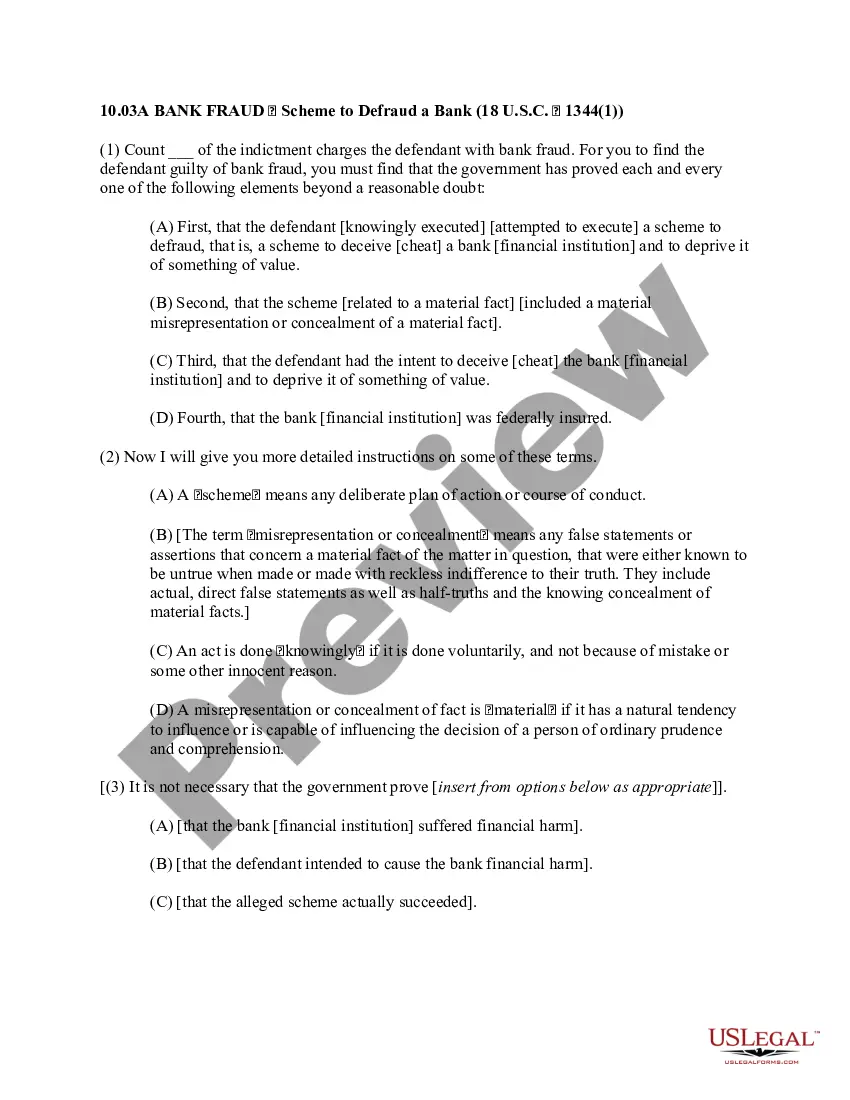

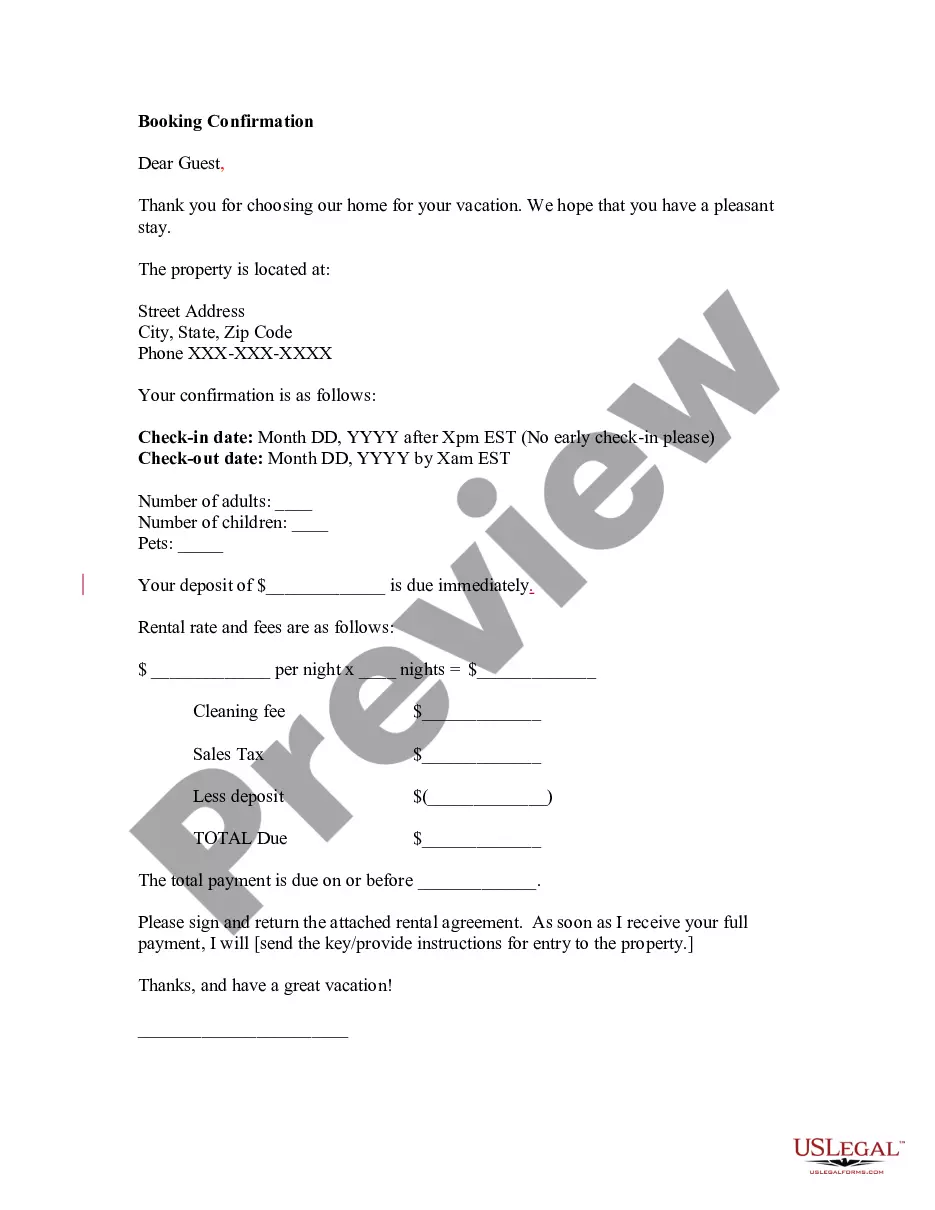

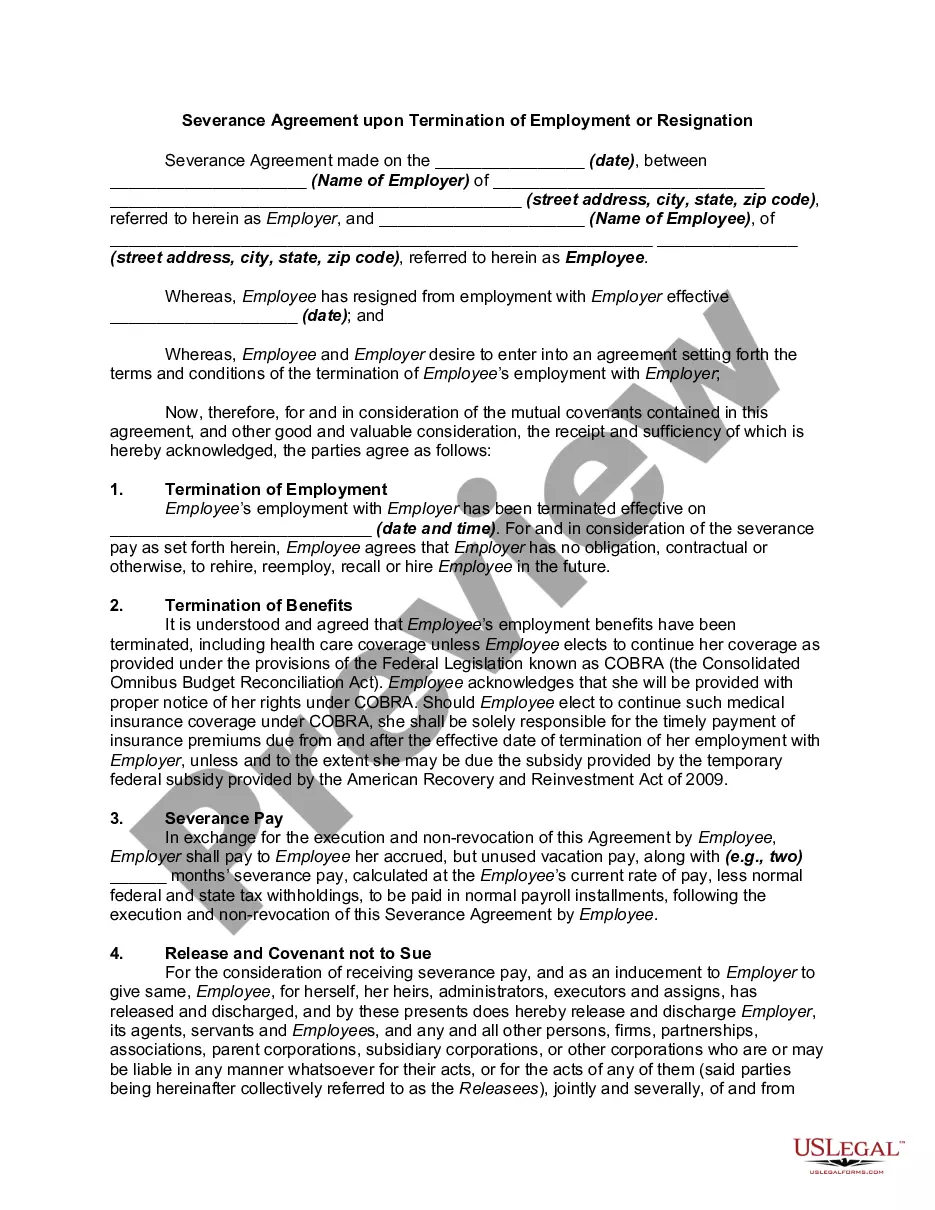

- Click the Preview button to review the form's content.

Form popularity

FAQ

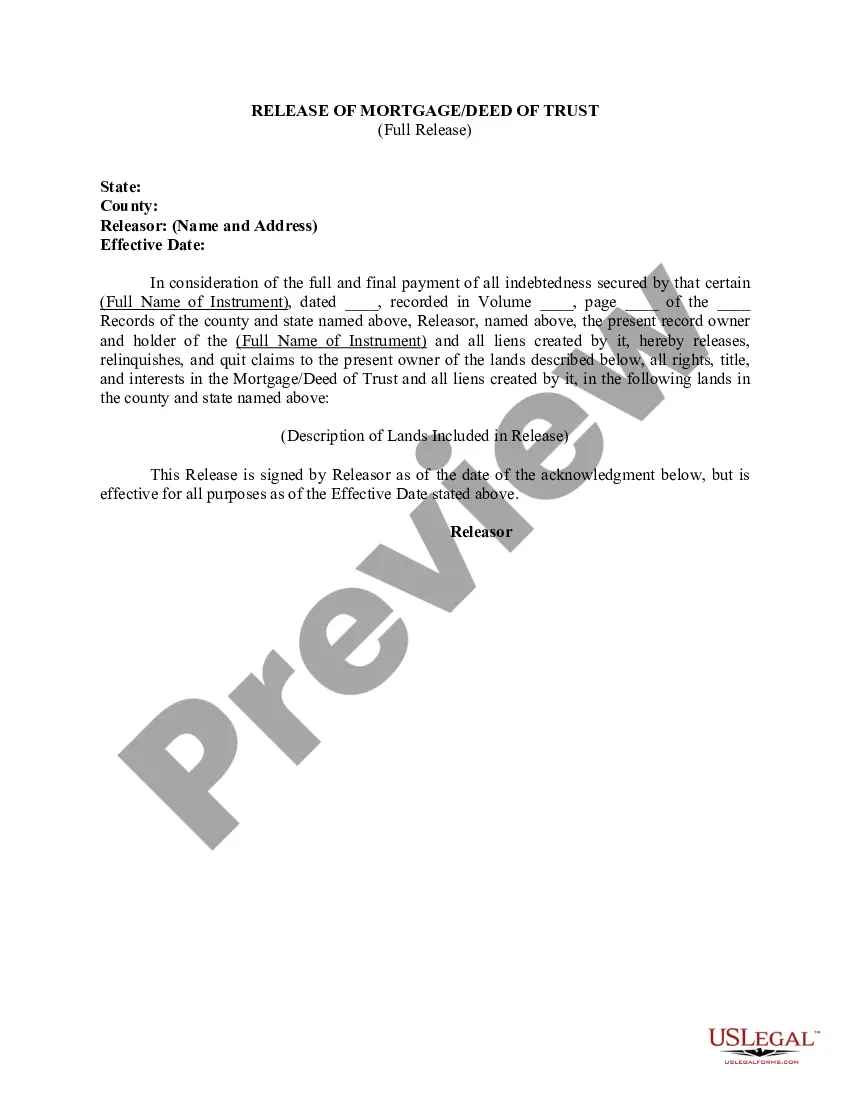

A service agreement outlines the terms of providing services, focusing on the deliverables, timelines, and payment structures. In contrast, a consultancy agreement emphasizes the relationship between the consultant and the client, detailing the scope of advice and expertise provided. When navigating New York Business Management Consulting or Consultant Services Agreement - Self-Employed, understanding these nuances can help in forming clear and effective contracts.

The main difference lies in the nature of the work. Consultants typically provide advice and strategies, while contractors often execute specific tasks or projects. Understanding this distinction is crucial when engaging with New York Business Management Consulting or Consultant Services Agreement - Self-Employed, as it helps businesses define their needs and select the right type of professional.

A consultant is typically someone with expertise in a specific field who provides professional advice to businesses or individuals. In the context of New York Business Management Consulting or Consultant Services Agreement - Self-Employed, consultants often have extensive knowledge and experience, allowing them to identify problems and suggest effective solutions for their clients.

Yes, an independent contractor can serve as a consultant. In the realm of New York Business Management Consulting or Consultant Services Agreement - Self-Employed, many consultants operate as independent contractors. This arrangement allows them to offer specialized advice and services to businesses while maintaining their own schedules and client relationships.

To protect yourself as a consultant, start by having a solid consulting agreement that clearly defines your responsibilities and limits liability. Additionally, consider obtaining professional liability insurance to safeguard against potential claims. Practicing transparency with clients during project discussions in New York Business Management Consulting or Consultant Services Agreement - Self-Employed also fosters trust. Finally, regularly reviewing your agreements can help adapt to any changing circumstances.

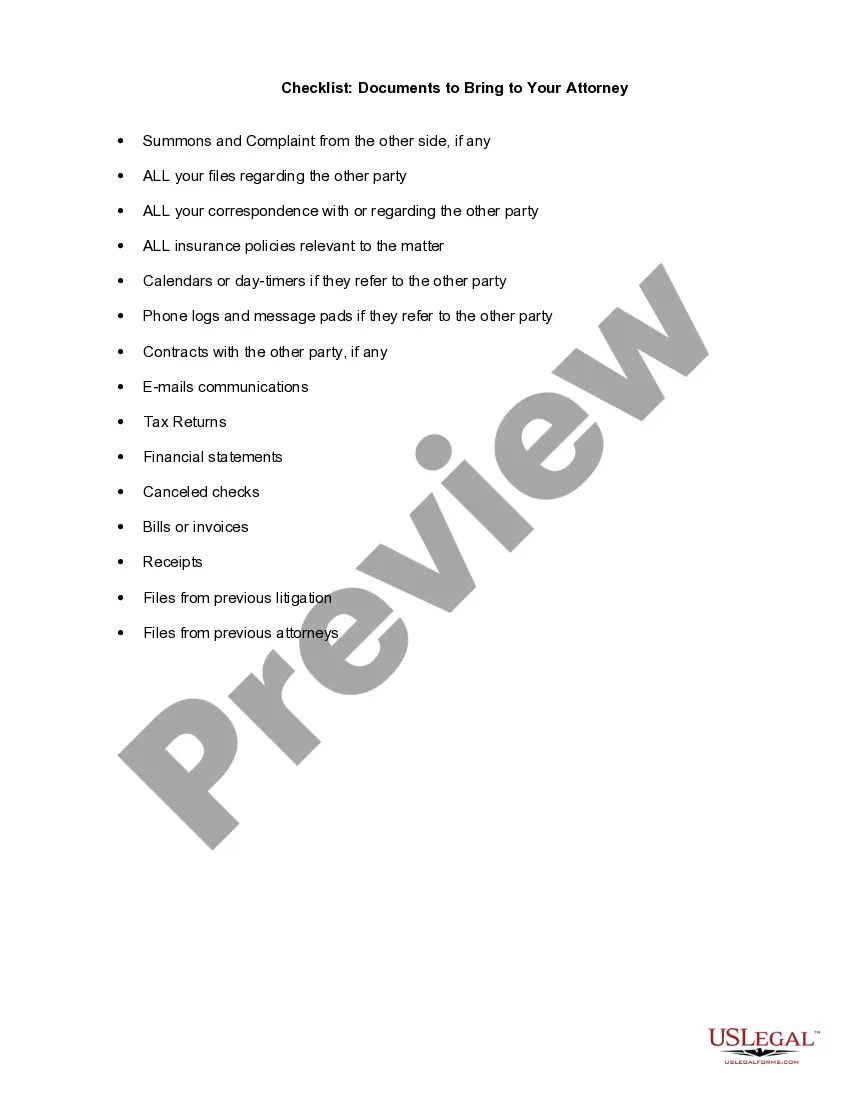

Consultants should have a comprehensive consulting agreement that outlines key elements of the working relationship, such as deliverables, payment terms, and termination conditions. This contract serves as a legal safeguard, detailing expectations in New York Business Management Consulting or Consultant Services Agreement - Self-Employed. Using a professional template or platform like uslegalforms can simplify the drafting process, ensuring you cover all essential aspects.

Setting up an LLC can be beneficial for consultants, offering personal liability protection and potential tax advantages. While it’s not mandatory, forming an LLC in New York Business Management Consulting or Consultant Services Agreement - Self-Employed can enhance your professionalism. It also reassures clients about your credibility. If you're uncertain, consulting a legal expert can guide you through the process effectively.

A consulting agreement is a written contract that outlines the terms between a consultant and a client. This document covers the scope of work, timelines, compensation, and confidentiality obligations, ensuring both parties understand their responsibilities. In the context of New York Business Management Consulting or Consultant Services Agreement - Self-Employed, a well-defined agreement protects your interests and establishes professional boundaries. It’s a vital tool for clarity and accountability.

Yes, a consultant is typically viewed as self-employed, as they often work independently rather than being on a company payroll. This self-employed status provides consultants with greater control over their projects and work-life balance. Operating under a New York Business Management Consulting or Consultant Services Agreement - Self-Employed helps in clarifying roles and responsibilities while solidifying client relationships.

You are considered self-employed if you run your own business and earn income without working for a traditional employer. This includes freelancers, consultants, and independent contractors. Your earnings and expenses from New York Business Management Consulting or Consultant Services Agreement - Self-Employed should be reported on your tax returns, reaffirming your status as a self-employed professional.