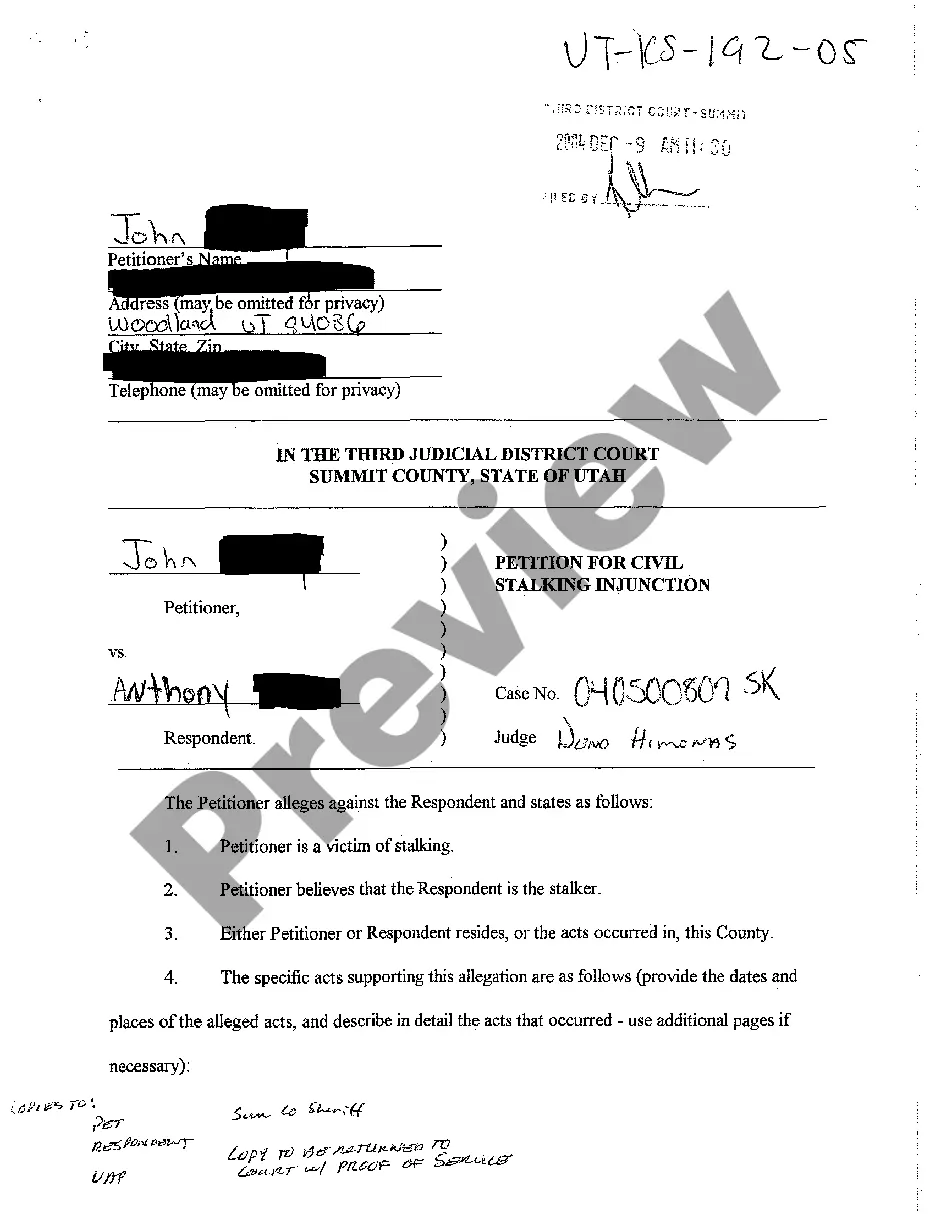

New York Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

You can dedicate time online trying to find the legal document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been evaluated by experts.

You can acquire or print the New York Miller Trust Forms for Medicaid from our service.

If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the New York Miller Trust Forms for Medicaid.

- Every legal document format you purchase is yours indefinitely.

- To get an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for your chosen state/city.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

The documents needed for Medicaid in New York include proof of income, asset verification, and valid identification. If your income is above the allowable limits, New York Miller Trust Forms for Medicaid will also be required to help establish eligibility. Having these documents organized can facilitate a quicker approval process.

When applying for Medicaid, the paperwork required includes income verification, asset documentation, and identification proof. Additionally, if your income surpasses the Medicaid threshold, you will need to complete and submit New York Miller Trust Forms for Medicaid. Ensuring you have all necessary documents ready can simplify your application process.

In New York, the income limit for Medicaid qualification varies based on family size and specific needs. Generally, for individuals seeking long-term care, the monthly income limit is around $1,500. If your income exceeds this amount, New York Miller Trust Forms for Medicaid can help you meet eligibility requirements.

To apply for Medicaid in New York, you must submit various documents. These include proof of identity, income statements, asset information, and, importantly, New York Miller Trust Forms for Medicaid if your income exceeds the Medicaid limits. It's essential to gather all required paperwork to ensure a smooth application process.

In New York, certain assets are exempt from Medicaid consideration, allowing individuals to preserve some property while applying for benefits. Primary residences, personal belongings, and some household goods may fall under these exemptions. Understanding how the New York Miller Trust Forms for Medicaid can aid in protecting assets is beneficial. Consulting with a professional can provide clarity on which assets you can retain.

Yes, a Miller trust can be a valuable tool for qualifying for Medicaid. By setting up a Miller trust, you can legally allocate excess income while remaining eligible for Medicaid assistance. When utilizing the New York Miller Trust Forms for Medicaid, you ensure that your trust adheres to state guidelines. Working with a qualified attorney can help you navigate this process effectively.

To apply for Medicaid in New York, you typically need several key documents. These include proof of income, bank statements, and records of your assets, along with completed New York Miller Trust Forms for Medicaid if applicable. Having these documents organized can streamline the application process and avoid unnecessary delays. It’s always advisable to check specific requirements before proceeding.

To protect your assets from Medicaid in New York, consider establishing an irrevocable trust. This allows you to hold and manage your assets while making them unavailable for Medicaid consideration. Utilizing the New York Miller Trust Forms for Medicaid can also be an effective way to ensure your assets remain safeguarded. Consulting with an expert can help customize a strategy that fits your needs.

Avoiding the Medicaid 5 year lookback period involves strategic planning. You can transfer assets under certain exemptions or utilize the New York Miller Trust Forms for Medicaid to create a trust structure that meets the requirements. Additionally, planning well in advance and understanding the rules can help in minimizing penalties during the lookback period. Professional guidance can be critical in this area.

Yes, placing your home in an irrevocable trust can protect it from Medicaid. When you transfer your home into such a trust, it often means that you no longer own the home, which helps in qualifying for Medicaid benefits. To effectively use this strategy, it is essential to complete the New York Miller Trust Forms for Medicaid correctly. Consult with a legal expert to ensure that this process is done properly.