A bond placement is the process of selling a new bond issue often to an intitutional investor. For a company in need of financing, this a typical transaction arranged through an investment banker.

New York Bond placement agreement

Description

How to fill out Bond Placement Agreement?

Have you been in the place in which you require files for possibly organization or individual purposes virtually every time? There are tons of lawful file themes accessible on the Internet, but finding kinds you can rely isn`t easy. US Legal Forms delivers thousands of develop themes, such as the New York Bond placement agreement, that happen to be composed in order to meet state and federal specifications.

In case you are presently acquainted with US Legal Forms site and possess an account, simply log in. Next, you may down load the New York Bond placement agreement template.

Should you not offer an bank account and want to begin using US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for that proper metropolis/area.

- Make use of the Preview button to check the shape.

- Read the outline to ensure that you have chosen the correct develop.

- If the develop isn`t what you`re trying to find, use the Research discipline to discover the develop that meets your needs and specifications.

- If you find the proper develop, click on Get now.

- Pick the prices plan you need, submit the desired information to produce your bank account, and pay for your order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free data file file format and down load your backup.

Get each of the file themes you have purchased in the My Forms menu. You may get a additional backup of New York Bond placement agreement anytime, if possible. Just go through the required develop to down load or printing the file template.

Use US Legal Forms, probably the most substantial assortment of lawful kinds, in order to save efforts and steer clear of errors. The service delivers skillfully manufactured lawful file themes which can be used for a selection of purposes. Make an account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the issuer would send you a coupon (interest) payment of $40 every year. Most bonds pay twice a year, so you would receive two checks for $20 each.

New York, NY ? The City of New York (?the City?) announced the successful sale of approximately $1.56 billion of General Obligation Bonds, comprised of $1.41 billion of tax-exempt fixed rate bonds and $151 million of taxable fixed rate bonds.

Note: Municipal bonds issued in the State of New York are exempt from city and state income taxes. Municipal bond interest from bonds issued in the state may be triple tax-exempt from city, state, and federal income taxes.

When a company decides to issue its bonds to the public at large it is known as a Public Placement of Bonds. If a company goes for a Public Placement of Bonds, then it is open to more review from the public. Private placements have no review. These kinds of bonds are listed on the exchange.

Purpose of NYC bonds New York City sells bonds to finance the construction and repair of infrastructure projects such as roads, bridges, schools, water supply, and wastewater treatment systems. The City determines projects through the capital budgeting process.

A bond is simply a loan taken out by a company. Instead of going to a bank, the company gets the money from investors who buy its bonds. In exchange for the capital, the company pays an interest coupon, which is the annual interest rate paid on a bond expressed as a percentage of the face value.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

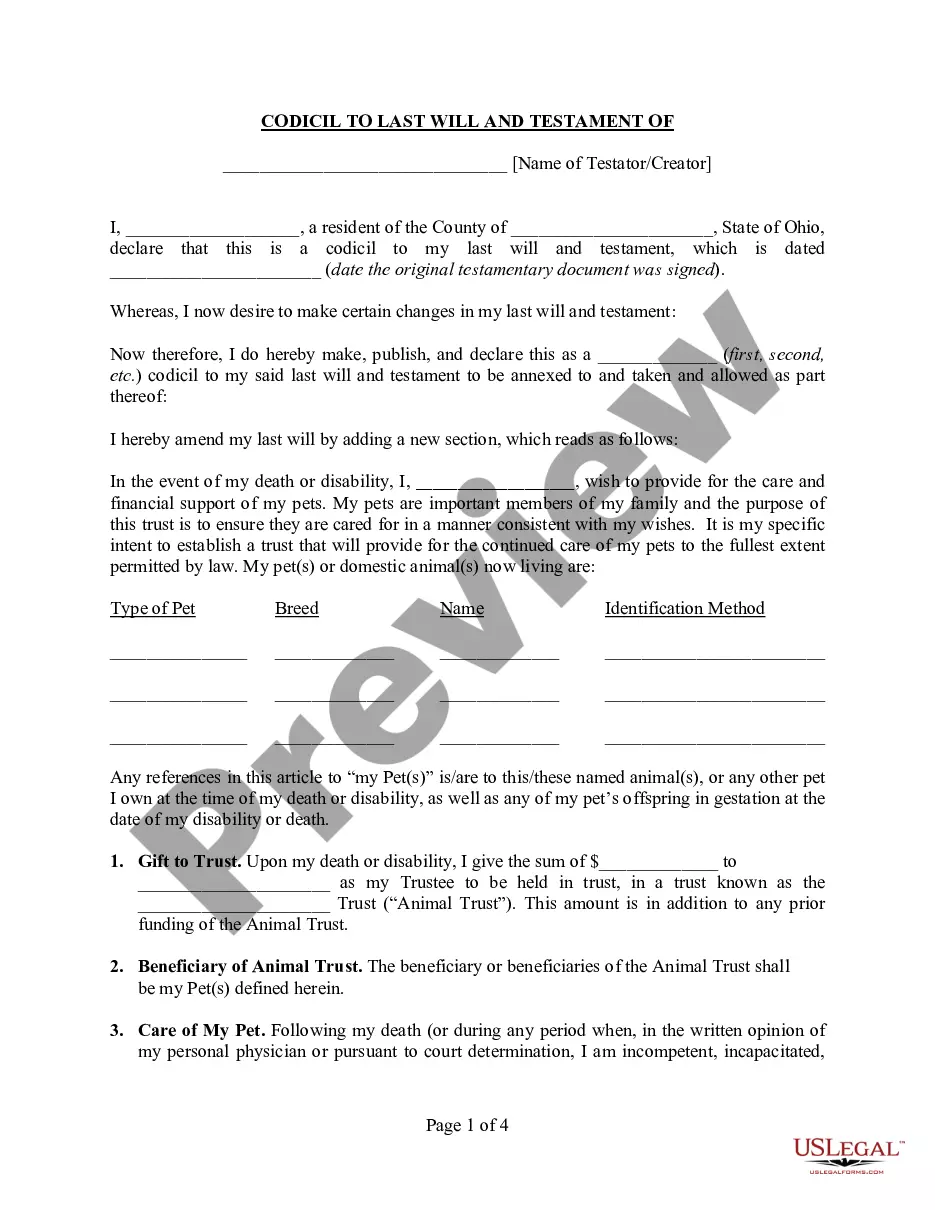

The terms of a bond purchase agreement will include sale conditions, among other things, such as sale price, bond interest rate, bond maturity, bond redemption provisions, sinking fund provisions, and conditions under which the agreement may be canceled.