New York Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Have you found yourself in a situation where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the New York Revocable Trust for Asset Protection, that are designed to comply with state and federal regulations.

Once you locate the correct form, click Purchase now.

Select the payment plan you prefer, provide the necessary information to create your account, and complete the purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New York Revocable Trust for Asset Protection template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct area/county.

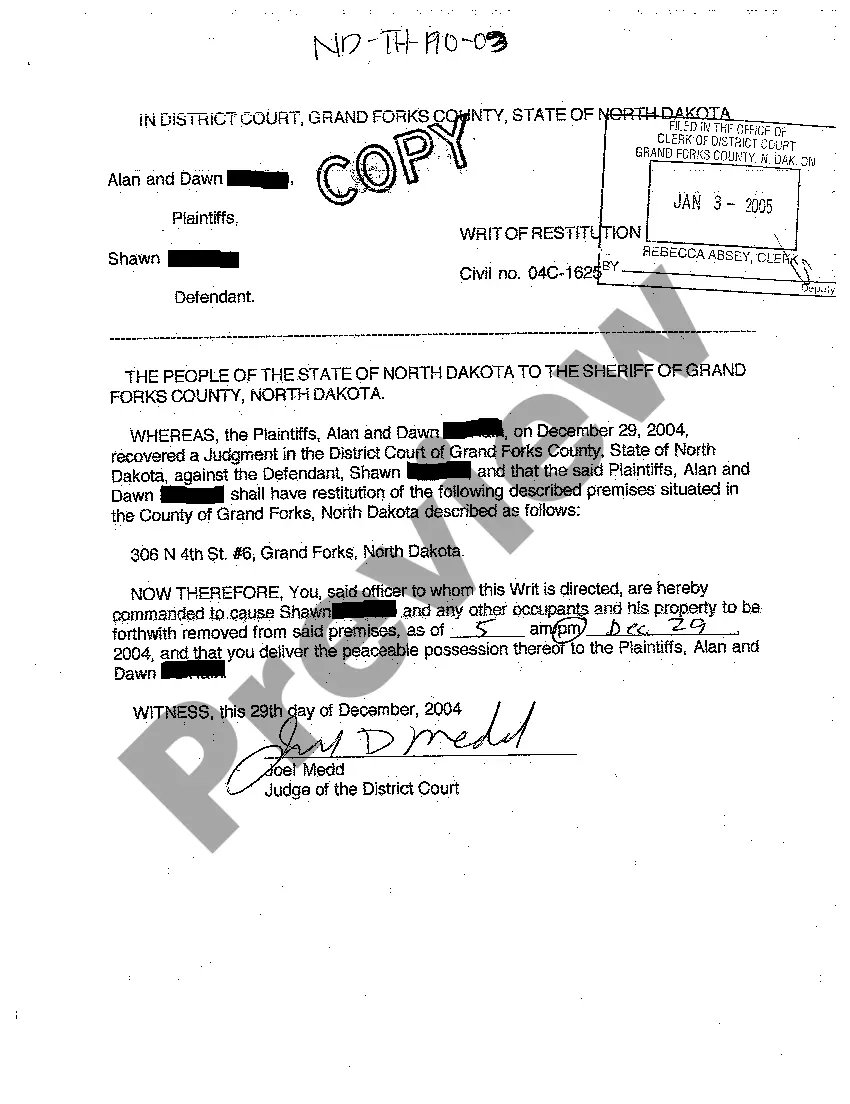

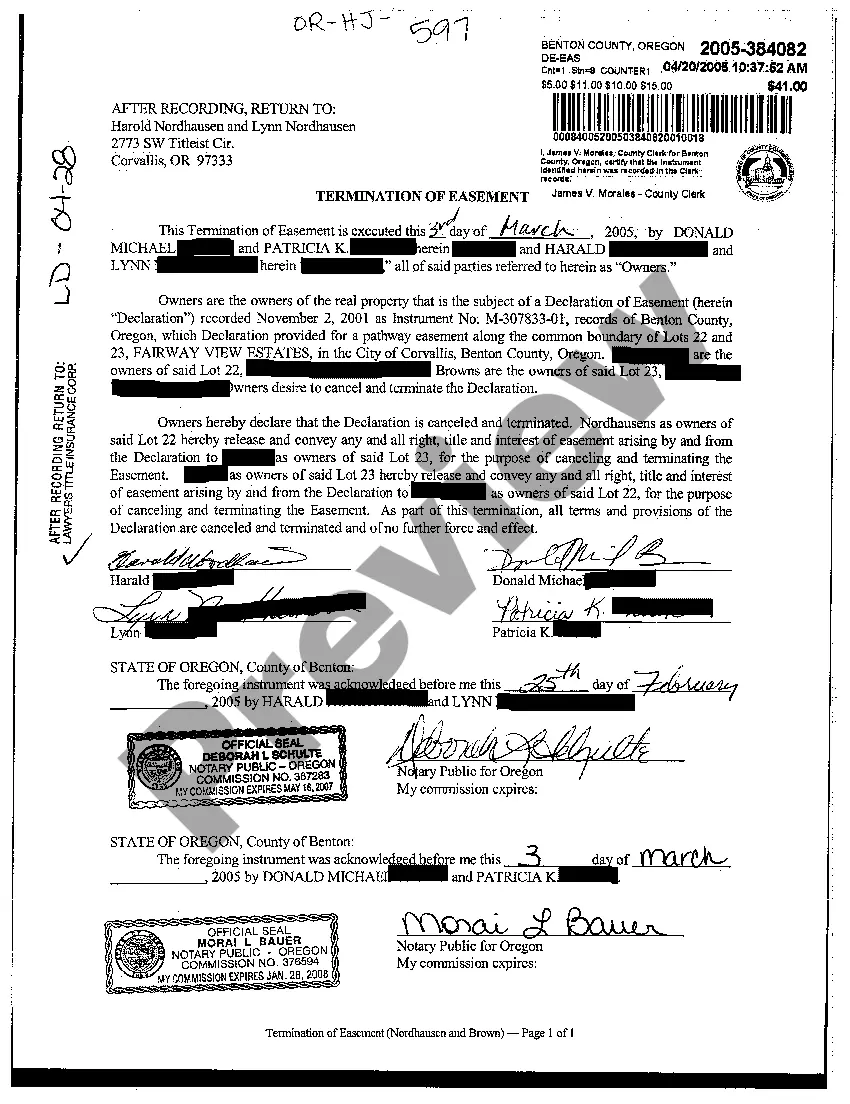

- Utilize the Preview button to review the form.

- Read the description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search feature to find the form that suits your requirements.

Form popularity

FAQ

While there are several states known for strong asset protection trusts, each state has unique rules and benefits. Many individuals consider jurisdictions like Nevada and South Dakota favorable. However, a New York Revocable Trust for Asset Protection can still be a robust option for those living in New York, providing flexibility and control over your assets.

Generally, revocable trusts do not offer significant asset protection from creditors during your lifetime. However, a New York Revocable Trust for Asset Protection can serve as a foundational step in your estate planning strategy. By establishing a comprehensive plan, including other protective measures, you can enhance your overall asset protection.

Certain assets typically do not fit well into a revocable trust, such as retirement accounts or life insurance policies. These assets often have designated beneficiaries that should remain outside the trust. It’s essential to review your asset list with a qualified advisor to determine the best strategy with your New York Revocable Trust for Asset Protection.

To protect your assets from Medicaid, you can create a trust that ensures your assets do not count against Medicaid eligibility. A New York Revocable Trust for Asset Protection can help you manage your assets strategically. It is advisable to plan early and seek guidance from a legal expert to navigate the complexities of Medicaid rules.

Yes, you can establish a trust specifically designed to protect your assets. A New York Revocable Trust for Asset Protection allows you to maintain control while ensuring your assets are safeguarded. It is essential to consult with a legal professional to create a trust that meets your needs effectively.

A revocable trust in New York offers several key advantages, such as flexibility and control over your assets. You can modify or revoke the trust at any point during your lifetime. Additionally, a New York Revocable Trust for Asset Protection helps avoid probate, ensuring your assets are distributed quickly and privately.

Yes, New York permits the establishment of dynasty trusts, which can last for multiple generations. This type of trust allows you to protect your family's wealth over a long period. A New York Revocable Trust for Asset Protection can serve as a valuable tool within a dynasty trust by allowing easy management and potential future adjustments.

The main downside of a New York Revocable Trust for Asset Protection is that it does not provide protection from creditors. Since the trust remains revocable, the assets are still considered part of the grantor's estate. This means creditors can still make claims against them. Additionally, setting up a New York Revocable Trust involves legal fees, which can be a consideration, but balancing these costs against potential benefits is important.

Requirements for an asset protection trust typically include proper documentation, identification of assets, and discerning the beneficiaries. Additionally, laws may differ based on jurisdiction, making it crucial to be aware of specific regulations in New York. Establishing a New York Revocable Trust for Asset Protection is a strategic move that not only meets legal requirements but also offers peace of mind knowing your assets are secure. Seeking legal assistance will ensure all requirements are met efficiently.

Writing an asset protection trust requires careful consideration of your financial goals and family needs. Begin by outlining the terms of the trust, including the assets to be protected and the beneficiaries. Utilizing a New York Revocable Trust for Asset Protection can simplify this process, providing a clear structure for asset management. Professional guidance can be invaluable in drafting a trust that meets legal standards and effectively safeguards your assets.