New York Owner Financing Contract for Moblie Home

Description

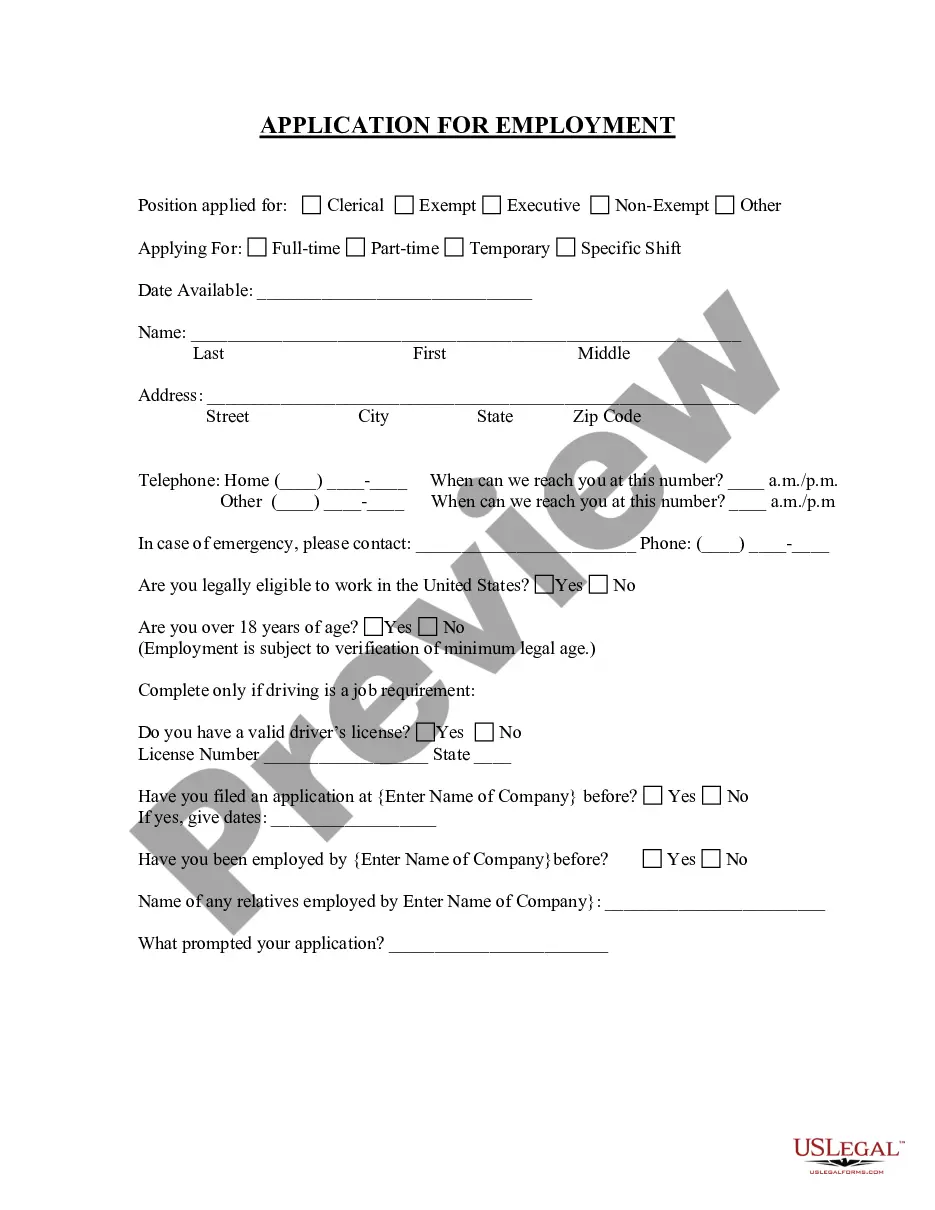

How to fill out Owner Financing Contract For Moblie Home?

If you require thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the leading repository of legal forms, accessible online.

Employ the site’s user-friendly and efficient search feature to locate the documents you require. A variety of templates for business and personal applications are categorized by types and states, or keywords.

Use US Legal Forms to find the New York Owner Financing Agreement for Mobile Home in just a few clicks.

Every legal document template you obtain is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the New York Owner Financing Agreement for Mobile Home with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Should you already be a US Legal Forms user, Log In to your account and click the Download button to acquire the New York Owner Financing Agreement for Mobile Home.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, adhere to the following guidelines.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review option to examine the form’s content. Make sure to read through the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the New York Owner Financing Agreement for Mobile Home.

Form popularity

FAQ

Many banks and credit unions offer financing for mobile homes in New York, but options may vary. You'll find that some lenders specialize in mobile home loans, especially those using a New York Owner Financing Contract for Mobile Home. It’s beneficial to shop around for the best rates and terms. Additionally, consider non-traditional lenders who may also provide financing solutions.

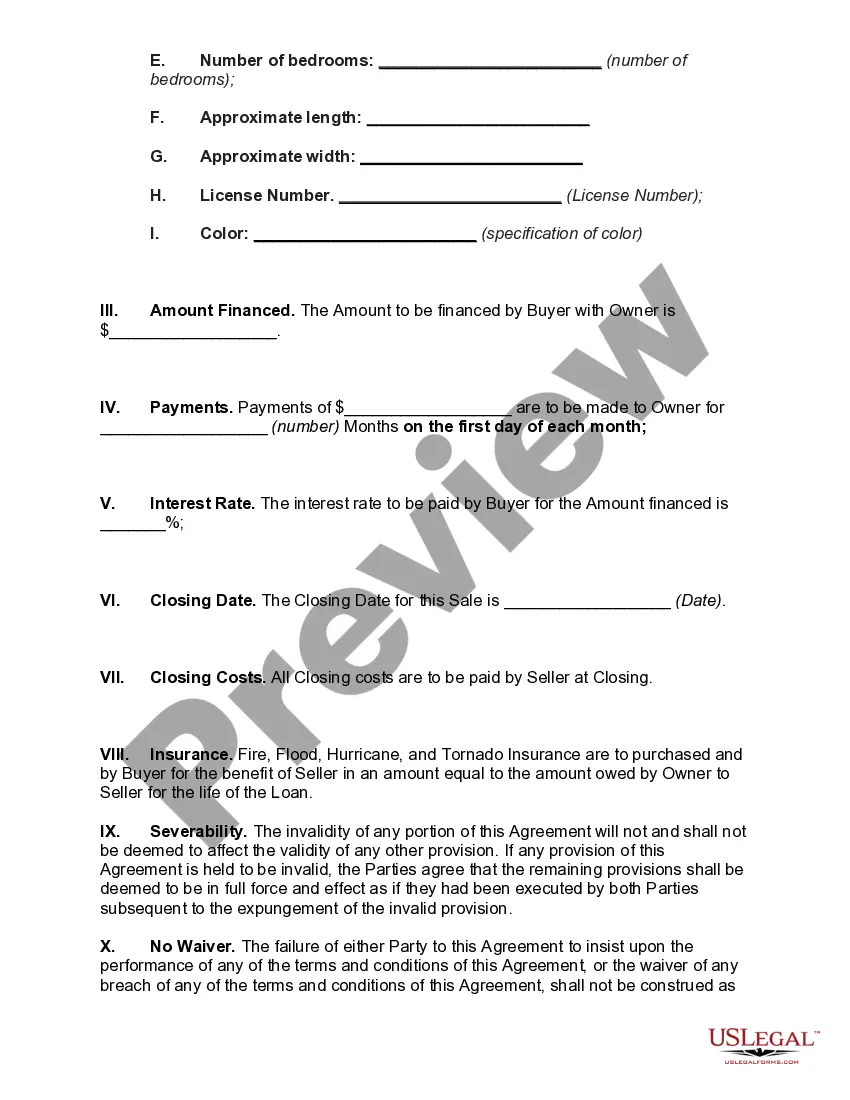

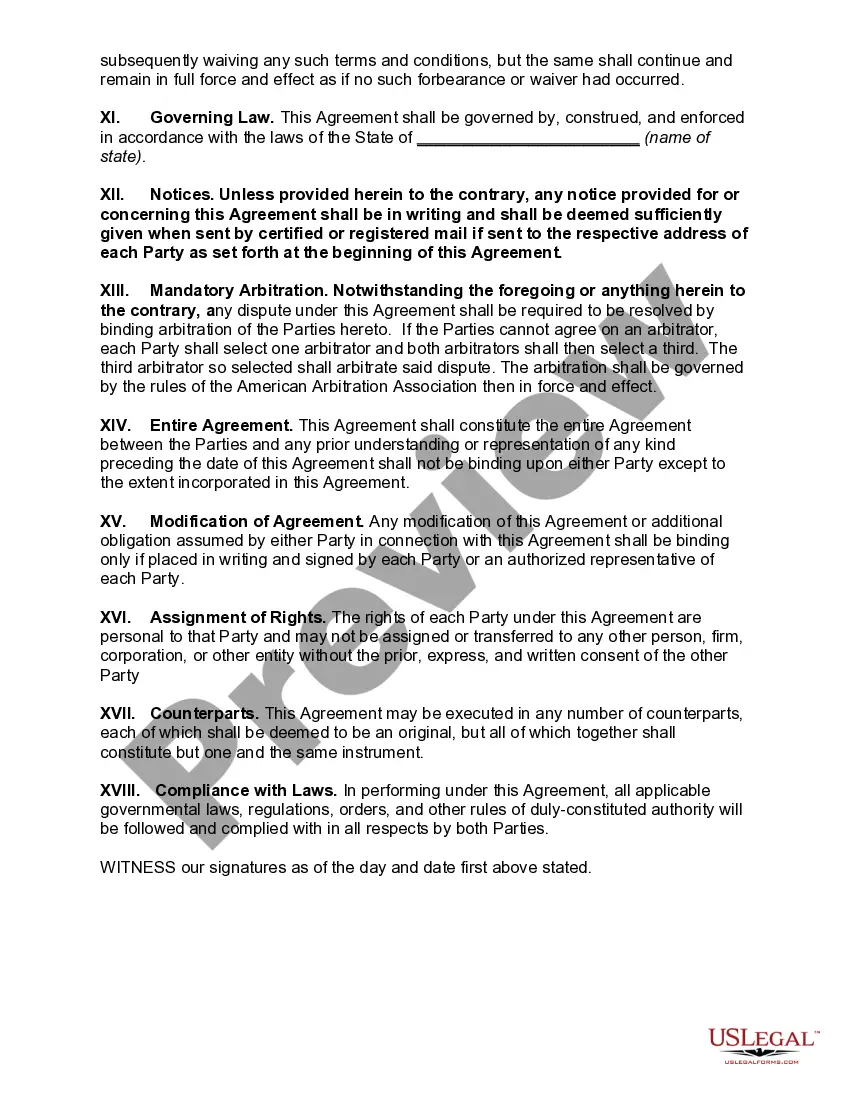

To write up an owner finance contract, start with clear identification of the property and the parties involved. Include the terms of payment, interest rate, and any contingencies. Using a template like the New York Owner Financing Contract for Mobile Home can streamline this process. It is also wise to have a legal professional review the contract to ensure compliance and protection for both you and the buyer.

Financing a mobile home can be more challenging compared to traditional homes due to stricter lender requirements. Many banks may view mobile homes as personal property rather than real estate. However, owner financing through a New York Owner Financing Contract for Mobile Home simplifies the process, allowing sellers to set their terms. This flexibility benefits buyers who might not qualify for conventional loans.

The average credit score needed to buy a mobile home typically ranges from 580 to 620 for conventional loans. However, with owner financing, such as a New York Owner Financing Contract for Mobile Home, buyers with lower credit scores may qualify. This flexible option can open doors for buyers who may struggle with traditional financing. Every seller may have different requirements, so discuss this openly.

Yes, you can owner finance a mobile home. This arrangement allows you to sell the home while providing financing directly to the buyer. Ensure you use a well-structured New York Owner Financing Contract for Mobile Home to protect your interests. This method can make home ownership more accessible for buyers, benefiting both parties.

The average length of seller financing arrangements generally ranges from 5 to 30 years. Sellers often prefer longer terms to secure steady income over time, while buyers may appreciate the flexibility and lower initial costs offered by shorter terms. It is vital to specify the duration clearly in a New York Owner Financing Contract for Mobile Home to avoid any misunderstandings between the parties involved.

Good terms for seller financing typically involve a fair down payment, manageable monthly payments, and a competitive interest rate. A common practice is setting an interest rate slightly above prevailing market rates, which can be beneficial for the seller while still remaining affordable for the buyer. Crafting a balanced New York Owner Financing Contract for Mobile Home is essential to ensure both parties feel satisfied with the arrangement.

Standard terms for owner financing may include a 30-year repayment period, a fixed interest rate, and an initial down payment ranging from 10% to 20%. However, these terms can be tailored to fit the specific needs of both the seller and the buyer, making negotiation key in a New York Owner Financing Contract for Mobile Home. Understanding these terms helps both parties reach a mutually beneficial agreement.

One downside of owner financing is the potential for higher interest rates compared to traditional bank loans. Additionally, if the buyer defaults on payments, the seller may face challenges in reclaiming the property. Careful consideration and a well-drafted New York Owner Financing Contract for Mobile Home can help minimize these risks and ensure a smoother transaction.

Many banks avoid financing mobile homes due to their classification as personal property rather than real estate. This distinction makes mobile homes riskier for lenders since they depreciate in value over time. Consequently, pursuing a New York Owner Financing Contract for Mobile Home becomes an appealing option for buyers seeking alternative financing methods.